U Power Limited: Significantly More Speculation Than I'm Comfortable With

Summary

- U Power Limited, a Chinese company focused on electric vehicle battery swapping technology, has experienced extreme share price volatility, with its stock potentially being overvalued.

- The company has limited revenue, is losing money, and has limited capital to work with, even after its IPO.

- U Power Limited faces risks associated with standardization, an opaque balance sheet, and the political environment in China.

- Looking for a helping hand in the market? Members of Crude Value Insights get exclusive ideas and guidance to navigate any climate. Learn More »

Teamjackson/iStock via Getty Images

One of the most volatile companies, from a share price perspective, on the market recently is U Power Limited (NASDAQ:UCAR). On June 2nd of this year alone, shares of the company closed up 18.7%. But this was after rising as much as 101.4% for the day. This has not been the only time that the company has been volatile. Since coming public earlier this year, shares have ranged from a low point of $2.89 to a high point of $75. Some of this move is being caused by actual developments that the company is announcing. But the vast majority of the price change seems to be random fluctuations caused by speculators. When you dig down into the fundamentals of the company and the space it operates in, there does not seem to be a good reason for the stock experiencing the fluctuations that it has. In fact, I would even go so far as to say that the stock might very well be overvalued at this time.

A look at recent volatility

The extreme volatility that shares of U Power Limited experienced on June 2nd seems to be related to a development announced on June 1st. In a press release, the company said that it entered into a framework strategic cooperation agreement with a company called Quantum Solutions. For those who don't know, Quantum Solutions is the first and only independent electric vehicle company that is currently listed on the Tokyo Stock Exchange. It focuses on a variety of electric vehicle-oriented activities.

According to the press release, the arrangement between it and U Power Limited, the former will advise U Power Limited on topics regarding the selection and development of suitable electric vehicle models. As part of the arrangement, U Power Limited has agreed to provide battery swapping technology, products, and compatible cloud service platforms that fit the requirements of Quantum Solutions to that firm. Both companies will do this with the understanding that either one may recruit other strategic partners in fields associated with the electric vehicle market for the purposes of working together.

There weren't any financial terms associated with this development. And right now, it is quite unclear the degree to which either party might benefit financially, either in the short term or in the long term, from this relationship. But when you look at the overall fundamental condition of U Power Limited, it's not surprising that there would be more of an emphasis from the perspective of investors on what could be rather than what is.

To see what I mean by this, I think it would be helpful to dig into exactly what U Power Limited is and what its plans are moving forward. Up until very recently, U Power Limited has been focused on the business of vehicle sourcing. In short, the company basically brokers sales of vehicles between automobile wholesalers and buyers. Its biggest emphasis along the way has been lower tier cities in China because they are smaller and less developed than larger cities are. This network eventually grew to consist of roughly 100 wholesalers and 30 small and medium vehicle dealers.

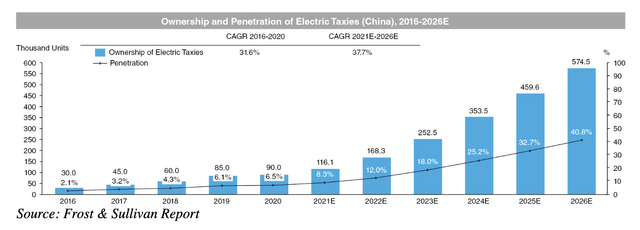

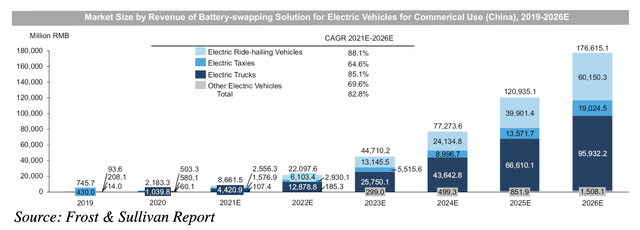

Recognizing that there might be a bigger opportunity available, the company started making its way into the electric vehicle market in 2020. For multiple reasons, it is expected that the sales volume of electric commercial vehicles will grow over the next few years from 164.7 thousand units per year in China in 2021 to 431,000 units per year in 2026. That's a roughly 21.2% annualized growth rate. At this stage in the game, there is still plenty of growth opportunity for companies that actually focus on the manufacture of electric vehicles. But this is an expensive market to get into and it's plagued with competition. Instead, U Power Limited decided to focus on what it calls UOTTA, or battery swapping technology.

Battery swapping is an interesting concept that may have some utility as electric vehicles take hold. One of the downsides to traditional electric vehicles is that they can take time to charge. And with charging infrastructure still sparse throughout many markets, including China, one alternative approach that has been explored involves taking a depleted battery out of the vehicle in question and replacing it with a newly charged vehicle. This can significantly reduce the time needed for an electric vehicle that has been depleted to get back onto the road. Management believes that this is a truly high growth market opportunity. The estimated revenue for battery swapping solutions for electric commercial vehicles is expected to grow at an annualized rate of about 82.8% between 2021 and 2026. Given where the US dollar is compared to the Chinese wand, this would take the industry up to nearly $25 billion by the end of the forecast period.

In some respects, U Power Limited has done well to carve out for itself a little niche in this space. Even though the company only began working on this in 2020, it already has established in-house capabilities centered around electric vehicle battery swapping technology. This has led to 14 issued patents and 24 pending patent applications in China. But recognizing that it can be better to work together, the firm began cooperating with major automobile manufacturers in 2021 with the goal of jointly developing UOTTA-powered electric vehicles, all by adapting selected electric vehicle models with its technology. Although there are multiple market segments that the company could focus on, it has chosen to really emphasize developing commercial use UOTTA-powered electric vehicles like those dedicated to passenger ride hailing, small logistics, light electric trucks, heavy electric trucks, and more. So this is not the first rodeo for the company in terms of partnering up with some other enterprise that has more experience than it does.

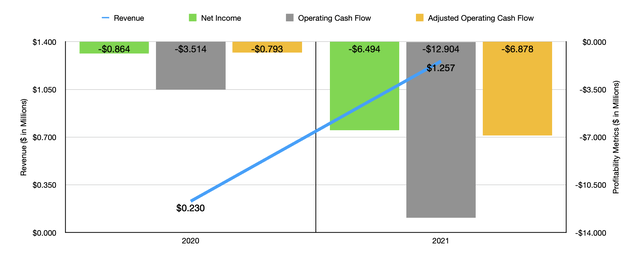

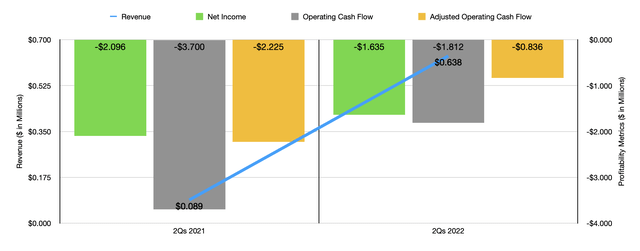

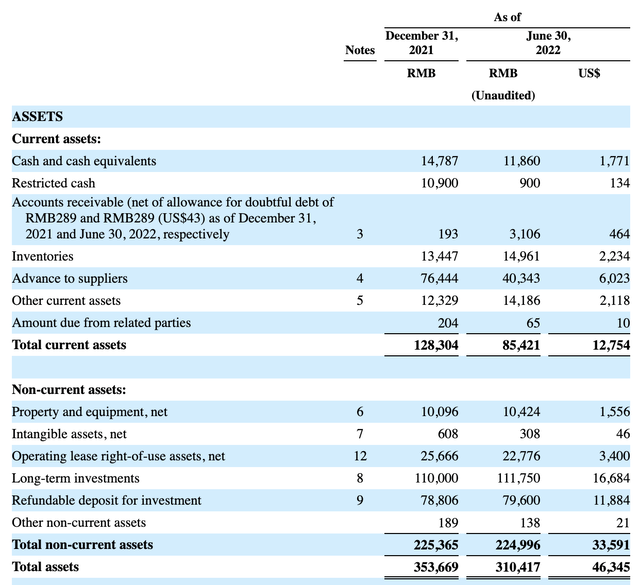

At first glance, all of this looks fantastic. But there are multiple problems that I see when I dig deeper. For starters, the company is currently incredibly small from a revenue perspective. Using a constant currency approach to translating the one to US dollars, I looked at the revenue, profit, and cash flow picture the company for 2020 and 2021. These results can be seen in the chart above. In the chart below, meanwhile, you can see the same thing for the first six months of the 2022 fiscal year compared to the same time one year earlier. Because the company has not yet filed its annual report, we don't have anything more recent than this. But clearly, you have a company that is generating just north of $1 million a year in revenue and that is hemorrhaging cash.

The problems are deeper than this though. As of this writing, the firm has a market capitalization of $472.3 million. Prior to its IPO earlier this year, the company had cash and cash equivalents of only $1.9 million. That compares to the $2.5 million worth of debt on its books. But even with the IPO, the firm does not have a tremendous amount of capital to work with. After all, excluding the underwriters option on shares, the company brought in gross proceeds of only $14.5 million from its IPO, with net proceeds there coming in at about $1.49 million.

So what we have here is a business that has very little revenue, that's losing money left and right, and that frankly doesn't have that much capital to work with even after going public. It is true that the firm is focusing more on its battery swapping activities. But even there we have some problems. For starters, revenue in the first half of the 2022 fiscal year that was associated with this set of operations totaled only $51,000. And second, management makes very clear that one of the problems in the space is the absence of standardization.

One really good book I read last year is called The Box. It focuses on the history of the shipping container. In it, the company dedicates a great deal of time discussing the pains that various firms went through during the standardization process for that industry. Mostly throughout the 1950s and 1960s, domestic and international committees labored over shipping container standards. Topics included how long shipping containers should or should not be, how wide they should or should not be, and even involved minute details like the size and shape of corner fittings and locks.

If this sounds like a small detail, consider that in 1964 Grace Line, a major shipping company dedicated to containerized shipping, estimated that if standards dictated, the cost of replacing corner fittings on its containers and lifting frames would come out to $750,000 alone. That works out to roughly $7.4 million today. In 1967, container shipping giant Sea-Land, which was controlled by Malcom McClean, the father of containerized shipping, calculated that it could add five feet to each of its 25,000 containers and 9,000 chassis, and alter all of its ships and cranes, for a combined cost of $35 million. Matson, which was much smaller but also a major player in the market at the time, figured that it could switch from 24-foot containers to 20-foot containers at a cost of about $9 million. Adjusted for inflation, these numbers came out to $322.7 million and $83 million, respectively, and were all because of standard-setting initiatives.

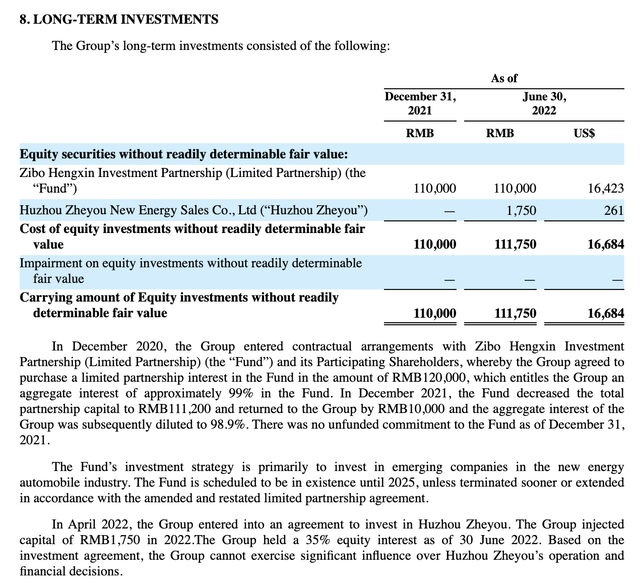

Obviously, every industry is different and every company in every industry is different. So we don't know if standardization will truly come to bite U Power Limited. But it most certainly is a risk. On top of this, one other issue that I noticed is that the company's balance sheet is rather opaque. On its books, it has about $11.88 million worth of refundable deposits listed as assets. These are deposits made for investments to companies like Shanghai Lingneng Electricity Selling Co. But there is no way of knowing just how healthy or valuable this asset might be. The company also has another $16.68 million worth of long-term investments, much of which we know little to nothing about. I don't like to see large amounts of assets on a company's books that I can't understand the significance of and the potential value of. The long-term investments are a true black box because they were essentially put into a fund to invest in privately held companies. I view it as a large red flag when you have a small company that's trying to grow into a new market that is investing in other businesses that shareholders know nothing about when the company could and should be using that capital to grow its core operations. This is the kind of stuff they write case studies about years later.

U Power Limited U Power Limited

Takeaway

From all that I can see, U Power Limited is an interesting company. The business could very well go on to capture a nice chunk of the market it wants to play in. But beyond that, all I see is risk. The firm does not have a tremendous amount of capital to work with. It has only dipped its toes into the market that investors are buying it for. On top of this, the company's balance sheet looks problematic and it faces unknown risks associated with standardization. All of this, combined with the fact that the company is a Chinese based firm, which to me brings a heightened amount of risk because of that political environment, and I cannot say that the company is a solid opportunity for investors at this time. In fact, given how high the market capitalization of the firm is, I would even go so far as to rate the business a "sell".

Crude Value Insights offers you an investing service and community focused on oil and natural gas. We focus on cash flow and the companies that generate it, leading to value and growth prospects with real potential.

Subscribers get to use a 50+ stock model account, in-depth cash flow analyses of E&P firms, and live chat discussion of the sector.

Sign up today for your two-week free trial and get a new lease on oil & gas!

This article was written by

Daniel is an avid and active professional investor. He runs Crude Value Insights, a value-oriented newsletter aimed at analyzing the cash flows and assessing the value of companies in the oil and gas space. His primary focus is on finding businesses that are trading at a significant discount to their intrinsic value by employing a combination of Benjamin Graham's investment philosophy and a contrarian approach to the market and the securities therein.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.