International Money Express: Huge Disconnection In Valuation

Summary

- There is a huge disconnection between International Money Express' fundamentals and valuation.

- IMXI has huge market opportunities, and it has been consistently gaining market share.

- The latest earnings continue to show great growth in both the top and the bottom lines.

- Current valuation is extremely compressed considering its growth.

- I rate the company as a buy.

Yana Tikhonova/iStock via Getty Images

Investment Thesis

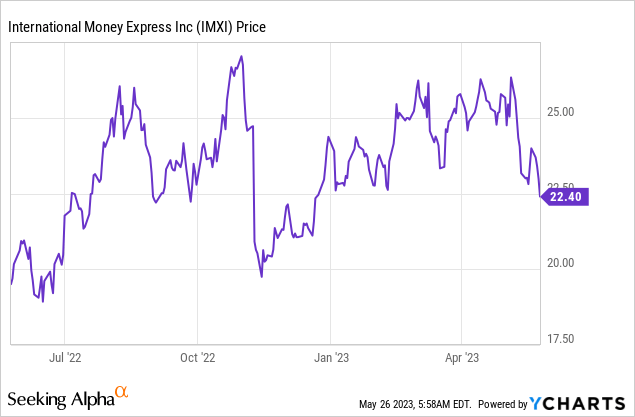

International Money Express (NASDAQ:IMXI) has declined nearly 15% in the past few weeks and I believe the drop presents a great buying opportunity for investors. The company operates in the massive and expanding remittance market, which should continue to provide ample growth opportunities. It has also been winning market shares rapidly in the past few years. Despite facing a tough macro backdrop, the company continues to show upbeat momentum in its latest earnings with double digits revenue growth.

However, the market seems to be overlooking its performance as the current valuation remains extremely compressed. I believe the massive disconnection between fundamentals and valuation should offer meaningful upside potential, therefore I rate the company as a buy.

Huge Market Opportunity

International Money Express is a US-based company that provides money movement services from the United States and Canada to 16 countries in Latin America, including Mexico and Guatemala, eight countries in Africa, and two countries in Asia. The company provides multiple remittance channels including its physical stores, mobile app, and website.

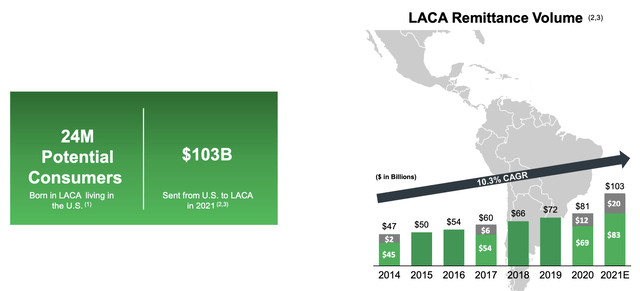

Remittance is an often overlooked industry but its market size is actually massive. According to Allied Market Research, its TAM (total addressable market) is forecasted to grow from $701.9 billion in 2020 to $1.23 trillion in 2030, representing a CAGR (compounded annual growth rate) of 5.7%. For instance, the LACA (Latin America & the Caribbean) market alone processed $103 billion in 2021, which presents ample growth opportunities for the company.

Digital remittance is the major driver of market expansion. Thanks to the rising availability of technology, the penetration rate of digital transactions is also increasing rapidly. A lot of customers also prefer digital channels due to vastly improved convenience and efficiency.

Winning Market Share

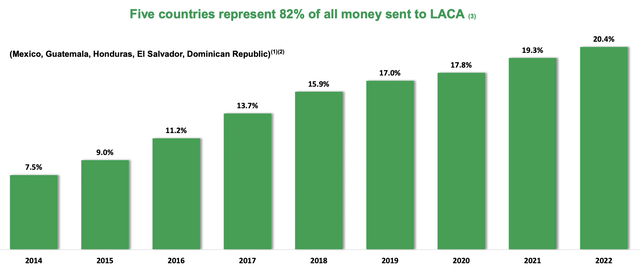

International Money Express has been consistently winning market share in the past few years thanks to its omnichannel approach. As shown in the chart below, the company's market share in the top 5 countries of LACA has grown from 7.5% in 2014 to 20.4% in 2022.

Unlike many companies that solely focus on digital channels, the company's heavy emphasis on retail channels is one of the keys to its success. Due to the company's exposure to emerging countries, most of its customers have relatively limited education while some do not have exposure to technology. According to the company, 60% of them also get paid in cash. Therefore retail channels are often able to better accommodate the needs of these customers and provide a much more comfortable experience. This alongside their complementary digital channels continues to help the company win over customers.

Andras Bende, CFO, on their omnichannel approach

We're executing a differentiated omnichannel business strategy for expanding our ecosystem productive and profitable retail agents with a laser focus on efficiency, engaging in only the right partnerships in the right geographies.

Strong Growth

International Money Express announced its first-quarter earnings last week and the results were pretty strong, especially the top line. The company reported revenue of $145.4 million, up 26.8% YoY (year over year) compared to $114.7 million. The number of transactions increased by 28.6% from 10 million to 12.9 million, with the total payment volume being $5.3 billion.

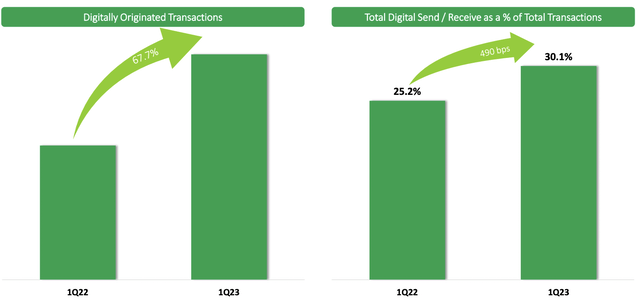

The growth was mostly driven by the increase in active customers, which grew 37.4% from 2.6 million to 3.6 million. Digital channels continue to see strong traction, with the number of transactions up 67.7%. Digital transactions now account for 30.1% of total transactions, up from just 25.2% in the prior year.

The bottom line was less impressive but still very solid. The adjusted EBITDA increased 16.4% YoY from $20.7 million to $24.1 million, or 16.6% of revenue. The adjusted net income grew 6% YoY from $13.4 million to $14.2 million. The slower bottom-line growth was mostly due to the increase in salaries and benefits, which grew 43.3% from $11.3 million to $16.2 million. The adjusted diluted EPS was $0.38 compared to $0.34, up 11.8%.

The company's balance sheet remains very healthy with $85.5 million in cash and only $99.2 million in debt. The guidance for FY24 was also very upbeat. Revenue growth is expected to be between 22% and 26% while adjusted EBITDA growth is expected to be between 14% and 18%.

Cheap Valuation

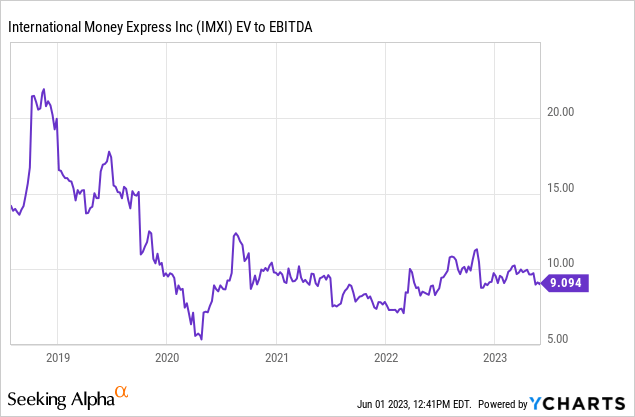

International Money Express' valuation is extremely attractive in my opinion. The company is currently trading at an EV/EBITDA ratio of just 9.1x, which is extremely cheap for a company growing both the top and the bottom line at double digits. For instance, you mostly only see such valuations appearing in late-stage companies with stagnant or minimal growth.

As shown in the chart below, the current multiple is near the lower end of its historical range. The company is also significantly discounted compared to other money movement companies with similar growth rates. For context, Block (SQ) reported revenue growth of 26% in the latest quarter, but its EV/EBITDA ratio of 23.5x represents a whopping 158% premium compared to the company.

Investors Takeaway

I believe there is currently a huge disconnection between International Money Express' fundamentals and valuation. Some investors are worried about the company's sole presence in the LACA region but a TAM of over $103 billion should be more than enough for significant expansion in the long run. The company has been winning market shares and the progress is shown in its latest earnings, with strong revenue and customer growth.

On the other hand, the market is pricing the company like a value stock with minimal growth, as the current multiples are extremely discounted. As long as the company continues to execute, I believe the market will eventually recognize its potential and revise its multiples, which should present a huge upside.

This article was written by

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.