PDD Holdings: Internal Competitive Culture Can Fend Off External Competitors

Summary

- PDD Holdings is poised for continued profitable growth due to its scale, operating leverage, and competitive company culture, with a strong cash balance and significant operating cash flow.

- The company's corporate structure poses risks related to its Variable Interest Entity (VIE) and restricted cash, but improving profitability is loosening those risks.

- PDD's highly competitive culture, driven by its founder-led team and PDD Partnership program, positions it for long-term success and potential expansion of its platforms.

- In all, PDD is a buy when it is selling for a compelling valuation and due to its superior margin profile compared to competitors.

xijian/E+ via Getty Images

Introduction

PDD Holdings (NASDAQ:PDD) has been a financial turnaround story since 2021, driven by its scale and operating leverage. I believe profitable growth is bound to continue due to the fiercely competitive and hard-working culture that is the backbone of the company's success. PDD generated $7 billion in operating cash flow during FY 2022 and has a cash balance of ~$22 billion as of the most recent quarter. When coupling a motivated management committed to high-quality growth and a favourable cash conversion cycle, I believe that PDD will be able to continue innovating the Pinduoduo Platform as well as successfully expanding its international business Temu. Furthermore, in the article, I explain why PDD's corporate structure poses a risk to shareholders, but also how profitability changes that risk profile. As PDD shifts to becoming a more profitable company, it will be able to unlock more 'restricted cash' from its Variable Interest Entity (VIE) in the People's Republic of China (PRC). This may give a way for share repurchases and potential dividends going forward.

The Business Model

PDD generates revenue in three ways, in which two are the primary drivers.

| Relevance | Revenue Model | FY 2022 Revenue ($Billions) |

| 1. | Online Marketing Services | 14.8 |

| 2. | Transaction Services | 4.0 |

| 3. | Merchandise Sales | 0.30 |

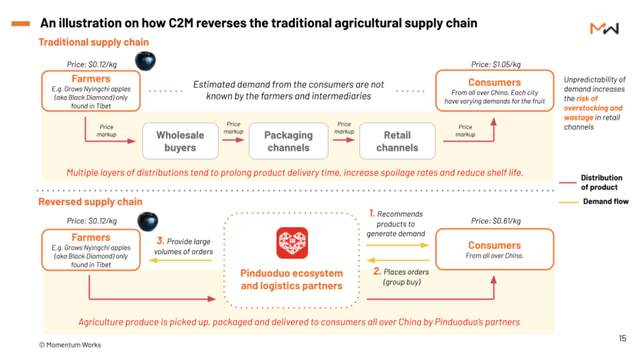

The company began by operating a platform ecosystem in China (Pinduoduo) and has recently expanded to the U.S. & Europe (Temu). The problem that the company is solving is the problem of an inefficient supply chain with high upstream costs. As seen below, the traditional supply chain involves five players which is two too many for PDD. In the PDD model, the manufacturer of goods (fresh fruit, various materials, consumer goods, clothing, etc.) is connected directly with the consumer on PDD's platform.

The implication of the PDD model is that the end consumer does not need to pay for the upstream costs that they would have otherwise incurred. Furthermore, the direct model simplifies the supply chain logistics and can be considered better for the environment, for shelf life, quality, and delivery time. If this is such a good model for the consumer, why hasn't it been done since the beginning? The difficulty with the PDD model, which the company has been so successful at, has two key components. First, PDD has managed to reach a scale of ~900 million cumulative users (Deep Tech Insights). Second, the company has created an intuitive and innovative purchasing model in which many unique consumers group together (pin) to buy more and do it in a fun way (duo duo). When PDD couples its scale and intuitive buying experience, merchants/manufacturers/sellers want to join the platform to increase their own sales. PDD capitalises on this two-sided ecosystem by charging transaction services for the products that merchants sell to consumers (by the way, PDD does not take responsibility for the inventory or logistics). PDD also capitalises on its large scale by providing merchants marketing services that place paying merchant's products most visibly on the platform. The pricing of this is done algorithmically, similar to that of Google (GOOG, GOOGL):

"The positioning of such listings and the price for such positioning are determined through an online auction system, which facilitates price discovery through a market-based mechanism."

Source: PDD 2022, 20F Filing

The latter revenue model makes up for 77% of the company's revenue as of full year 2022, which makes it extremely important.

Favourable Cash Collection Cycle

Let us now look into the way in which PDD gets paid. Analysts often look at a metric called the Cash Conversion Ratio (CCR), which is the ratio between net income and operating cash flow for a given period. This is how 2022's CCR cycle looked for PDD ($millions):

| Net income | 4572 |

| Operating Cash Flow | 7032 |

| CCR (Cash Flow / Net Income) | 153.8% |

A CCR that is greater than 100% indicates that a company receives cash before providing the contractual service agreed and hence recognising revenue. And this makes complete sense given PDD's agreements with merchants.

"Merchants prepay for online marketing services that are primarily charged on a cost-per-click basis... The Group also provides display marketing services that allow the merchants to place advertisements on the platform primarily at fixed prices."

The timing of payments makes PDD incredibly balance sheet-light since it can support its running costs such as bandwidth, server costs, R&D, and payroll without taking with the cash received from customers. A direct result of this is that PDD has no debt on its balance sheet, save a ~$2.2 billion convertible bond liability.

In The People's Republic of China (PRC), it is important to run companies with low/no debt because the PRC can impose dividend restrictions on indebted companies. PDD states that

"If any of our PRC subsidiaries incur debt on its own behalf, the instruments governing the debt may restrict its ability to pay dividends or make other distributions to us. [The] wholly foreign-owned enterprise may pay dividends only out of its respective accumulated profits as determined in accordance with PRC accounting standards and regulations."

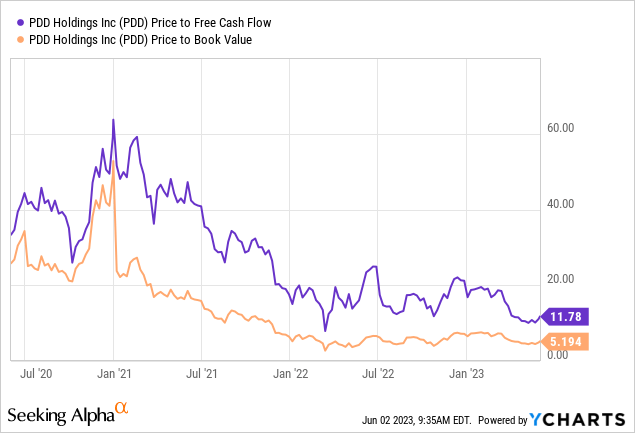

This is by no means a risk for PDD, but it should be worth bearing in mind when analysing foreign-owned companies' operating subsidiaries in the PRC. But, the bottom line is that PDD is a very cash-rich company and will likely continue generating large amounts of cash. As shown below, the company is trading for a historically low price to free cash flow and price to book value. As of Q1 2023, PDD had ~$2.8 billion in cash and cash equivalents and ~$20 billion in short-term investments. For a current valuation reference, at the time of me writing, PDD has a $91 billion market cap.

A Corporate Structure Risk that is Loosening

When you view PDD's balance sheet, you will notice that the company has an asset called 'Restricted cash', worth $7.4 billion as of the most recent quarter. You really won't find this large of an amount of cash locked up on a U.S. company's balance sheet. To proceed, I'm not going to talk about the general risks of investing in China, but rather a specific risk related to a common foreign company corporate structure in China, that is the use of variable interest entities (VIE).

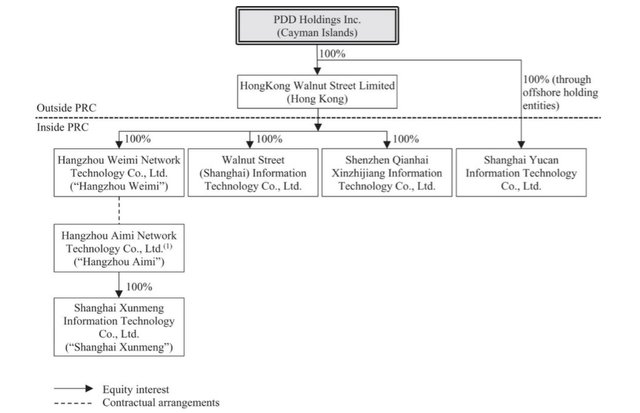

PDD Holdings is incorporated in the Cayman Islands, so although the majority of the company's revenue is generated in China, it is technically a foreign holding company. The corporate structure looks like the following:

As seen, the holding company in the Cayman Islands owns a Hong Kong limited corporation and Shanghai Yucan Information Technology Co., Ltd. Furthermore, HongKong Walnut Street Limited is the sole owner of three other subsidiaries in the PRC. This is standard holding - subsidiary corporate structure. This relationship deviates between Hangzhou Weimi Network Technology Co. and Hangzhou Aimi Network Technology Co., represented by the dotted 'Contractual arrangement' line.

Hangzhou Aimi is a variable-interest entity (VIE) of Hangzhou Weimi, which means that the company does not own any equity in the VIE whatsoever. Rather, Hangzhou Weimi receives service fees per contractual agreement from the VIE.

"We are a Cayman Islands holding company and we rely to a significant extent on dividends and other distributions on equity from our PRC subsidiaries, as well as service fees paid by the VIE and its subsidiaries pursuant to our contractual arrangements with them."

The reason why PDD has ~$7.4 billion in restricted cash is because "a wholly foreign-owned enterprise is required to set aside at least 10% of its after-tax profits each year, if any, to fund a certain statutory reserve fund, until the aggregate amount of such fund reaches 50% of its registered capital." From my understanding, then, PDD needs to fill up a statutory reserve fund in its VIE (which is where the restricted cash is located) before it can send dividends upstream to PDD Holding. In the 20F filing, the company speaks extensively about the risks of complying the PRC regulations regarding VIEs and the risk of not being able to extract cash from its VIE. This should be brought to mind to investors of PDD and investors in China in general. Qifu Technology (QFIN), a company I wrote about in China Is No Longer A Risk, operates with a similar corporate structure.

The logical follow-up question is then, why do foreign companies in China set up VIEs? The answer is that PRC regulations do not allow foreign businesses to own more than 50% equity interests in value-added telecommunication services ("VATS"). For this reason, PDD Holdings operates the Pinduoduo platform in the subsidiary of its VIE.

"currently [we] conduct the business activities of the Pinduoduo platform through Shanghai Xunmeng, a subsidiary of the VIE, which holds the VAT'S License for (I) online data processing and transaction processing business (operating e-commerce), (II) internet content-related services, (III) domestic call center business, and (IV) information services. Shanghai Xunmeng is wholly owned by the VIE, namely Hangzhou Aim, which has obtained a VATS License covering online data processing and transaction processing business (operating e-commerce) and internet content-related services."

Although the company does not comment on how much capital is required to be tied up in the VIE's reserve fund, I have noticed hints suggesting that capital requirements may be met.

| Report | Restricted Cash ($Billion) |

| Q4 2021 | 9.35 |

| Q4 2022 | 8.41 |

| Q1 2023 | 7.41 |

The restricted cash on the company's balance sheet is steadily declining which means that PDD Holdings can retain more dividends which it can later use to pay dividends to its shareholders or repurchase shares. This is a great sign to relieve investors of the corporate structure risk for Chinese VAT companies.

A Competitive Company Culture

Chris Mayer emphasizes in his book "100 Baggers" that culture is the most crucial factor for a company's long-term growth. In this discussion, I will now delve into PDD's unique company culture. The culture at PDD is highly competitive and led by its founders, with a three-layer hierarchical structure.

The company was established by Colin Huang, who currently owns approximately ~26% of the outstanding shares. However, he has stepped back from day-to-day operations since 2021. According to CNN Business, it is not uncommon for affluent and influential tech CEOs in China to take such a step, with Jack Ma, the founder of Alibaba (BABA), being a notable example. Nonetheless, the current Co-chief executives of PDD are Lei Chen and Jiazhen Zhao, both of whom were founding members of the company. Additionally, many other company leaders joined within a year of PDD's founding in 2015, indicating that the company is still driven by its founders and early executives.

The foundation of PDD's company culture lies in its values and drive. Rather than following the common corporate governance practice of having the board of directors select management, PDD has established a structure known as the PDD Partnership, which holds authority over all aspects of leadership governance. The purpose of this partnership is to ensure the sustainability of governance and promote individuals with diverse skill sets who share the partnership's core values. The PDD Partnership possesses the right to elect new members and nominate the CEO. Its power is so significant that it even has the ability to replace the board of directors if the board does not vote in favour of the partnership's election. The election process unfolds as follows:

"Prior to each election that takes place once every three years, the Partnership Committee will nominate a number of partners equal to the number of Partnership Committee members plus three additional nominees. After voting, all except the three nominees who receive the least votes from the partners are elected to the Partnership Committee."

This process promotes the addition of new ideas through new members and eliminates the lowest performers, which constantly keeps management alert to meet their objectives.

PDD is known for setting two or more teams on the same project and based on the final results of each team, the loser gets eliminated. Outstanding performers are then promoted into higher positions, while the poorest performers are continually demoted until their project succeeds. The internal competition is fierce and with the expansion to new markets with Temu, employees with low performance are not spared. "Temu also follows Pinduoduo’s 721 elimination system. This means that 10% of employees in each project are eliminated, and 20% of employees do not receive the full bonuses." (TLD by MW). The article referenced also notes cases in which seven or eight different teams compete to price-press the same merchant into receiving the best contracts for PDD.

Overall, the company's focus on internal competitiveness and thoughtful management control systems can bode well for long-term success. But, the incessant focus on monetary rewards to keep employees as well as unsustainable price pressuring towards suppliers may foster short-term thinking within the company and weaken customer relationships. Although it is difficult to get a feeling for the culture from behind a computer screen, the rhetoric was directed purely towards increased investment for further growth in the prior quarter, which I believe is encouraging. Lei Chen stated that "We will channel more resources to R&D as it is the key catalyst in driving efficiency and uncovering opportunities." This is positive since the company has a great amount of cash that it can use to generate higher returns going forward, which is something that I will be looking for personally as I continue to follow PDD. It is important to remember that the company is still quite young, despite the $90 billion market cap! The CFO stated that "We are still in the investment stage, and we plan to step up our investment to further support quality growth", in which the new growth opportunities will most likely be geared toward generating the best possible outcomes for quality merchants through the so-called '10 Billion Ecosystem Initiative'. (Q1 2023, Earnings Release)

External Competitors

PDD's two largest competitors are Alibaba (BABA) & JD.com (JD) in China. In regards to the U.S. and international markets, Amazon (AMZN) has a large presence. But rather than competing with Amazon - PDD is competing with low-cost players that sell cheap products online. Some examples of these companies are Shein, Alibaba, and several smaller e-commerce players in China (Daxue Consulting). Nevertheless, PDD is the 3rd largest e-commerce and shopping marketplace in China based on traffic according to similarweb.

The reason why PDD's international business Temu doesn't compete with Amazon directly is because "Amazon is busy raising its average order value, letting go of the vast ‘sinking markets’ 下沉市场 (i.e.: lower-income-segments of the population) with an average order value of less than $40. For Chinese cross-border e-commerce players, this is a rare opportunity." (TLD by MW) The article states that this has created an "Amazon e-commerce siege war" between SHEIN, Alibaba, TikTok, and Shopee where Temu is currently leading. For this reason, I'm going to focus my relative valuation comparing Alibaba, JD.com, and PDD.

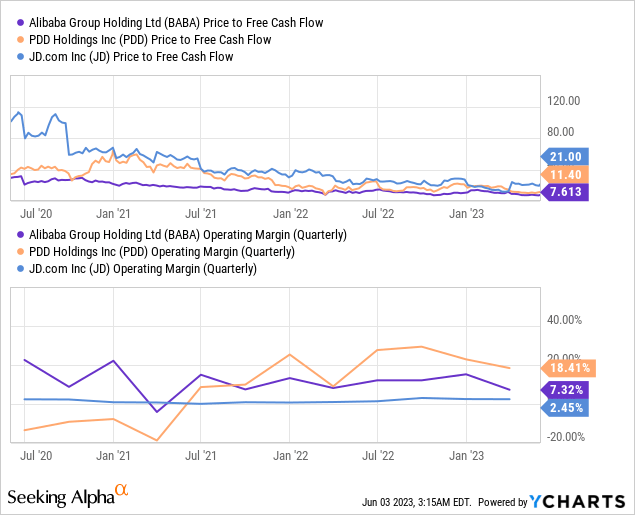

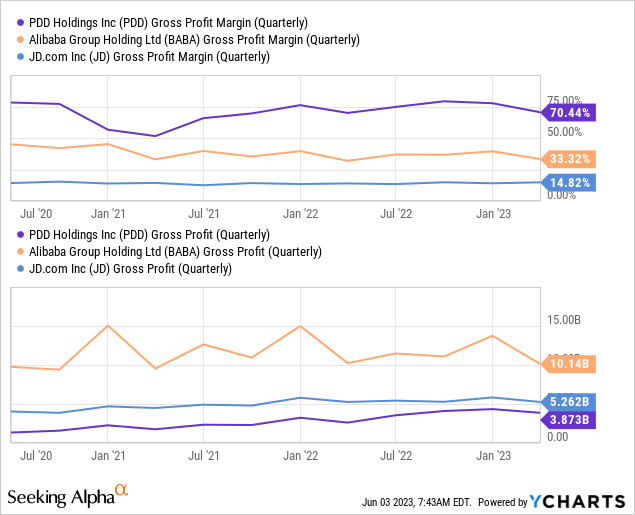

Below is an overview of relative company valuation and operating margins. PDD has seen margins far surpass its two peers since the middle of 2021 and it is trading at a relatively cheap price to free cash flow. Alibaba has the lowest valuation premium, which is most likely due to its low/no growth during the past few quarters. Considering that PDD grew revenues at a 58% rate YoY in the prior quarter, the 11.4 price to free cash flow is certainly warranted.

The vastly differing margin profiles between the companies can be explained by the business models that they employ. JD.com purchases products from suppliers and then re-sells them to consumers (JD 20F, 2022). Alibaba has a mixture of both directly selling products to consumers, similar to JD.com, (30% of revenue, 2022), and of deriving fees from marketing services to merchants (37% of revenue, 2022) (BABA 20F, 2022). The direct sales business that these companies are involved in draws margins down already at the COGS. As seen below, PDD's gross profit margin is dramatically larger than that of its two peers. However, JD & BABA have been able to reach incredible scale with their direct sales and logistics businesses, which are reflected in the companies' absolute quarterly profits.

PDD has a business model solely focused on advertising for its merchants. In my opinion, this means that the company isn't weighed down by managing bulk purchases and logistics. We can see that this pleased investors of Shopify (SHOP) as its stock rushed upwards after the company announced it would be selling its logistics business. This is a good sign for PDD as well, but the question will be whether they need to expand to direct sales as they pursue international expansion. Currently, 1.57% of the company's revenue is generated from direct sales and this will be a number to look for going forward as an investor. I would like to see the company keep this percentage low.

Conclusion

To conclude, the big question is: will PDD be able to fend off competitors with its strong competitive internal culture? From my understanding, I think the answer is yes. This strong culture is reflected in the company's strong margin profile which has been acquired through tough negotiation, large scale, and its direct selling model. Therefore, PDD Holdings is poised for continued profitable growth. With impressive financials, including a significant operating cash flow and a strong cash balance, PDD has the resources to innovate and expand its platforms. A true test of this will be the level of success PDD experiences with Temu abroad, especially since the international markets are markedly different in comparison to the Chinese market. Further, while PDD's corporate structure poses risks related to its VIE and restricted cash, the company's improving profitability is loosening those risks. In all, PDD's highly competitive culture, driven by its founder-led team and PDD Partnership program, positions it for long-term success against the backdrop of competitive pressures.

Editor's Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

This article was written by

Analyst’s Disclosure: I/we have a beneficial long position in the shares of PDD, QFIN either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.