Gray Television: A Heavily Discounted Stock With Serious Headwinds

Summary

- Gray Television has demonstrated steady revenue and free cash flow growth over the past decade but faces challenges due to its high debt-to-equity ratio and a potential recession impacting advertising budgets.

- GTN's recent financial performance has been lackluster, with disappointing earnings in Q1 2023 and analysts projecting a loss per share in 2023, followed by a potential rebound in 2024.

- Despite its discounted share price, investors should carefully assess the risks associated with GTN, including its high debt, potential recession impact on advertising budgets, and the evolving industry landscape.

svetikd

Opening

Gray Television, Inc. (NYSE:GTN) is a prominent television broadcasting company in the United States. It possesses and/or manages television stations and digital assets throughout the country. The company broadcasts secondary digital channels that are affiliated with major networks such as ABC, CBS, NBC, and FOX. Additionally, it offers a diverse range of networks and program services, including CW Plus Network, MY Network, Telemundo, among others. Moreover, Gray Television operates local news/weather channels across various markets.

Within this article, we will perform a comprehensive evaluation of GTN's financial performance and its potential for future growth. Our assessment encompasses a detailed analysis of the company's revenue and profitability trends, its capacity to generate free cash flow, and the overall strength of its balance sheet. Furthermore, we will utilize a discounted cash flow analysis to estimate GTN's intrinsic value, offering valuable insights for investors seeking to evaluate the company as a potential investment opportunity in the current market.

Track Record

GTN has demonstrated steady revenue and free cash flow growth over the past decade and has maintained a solid return on equity (ROE). Let's delve deeper into the company's financial performance and explore its potential as an investment opportunity.

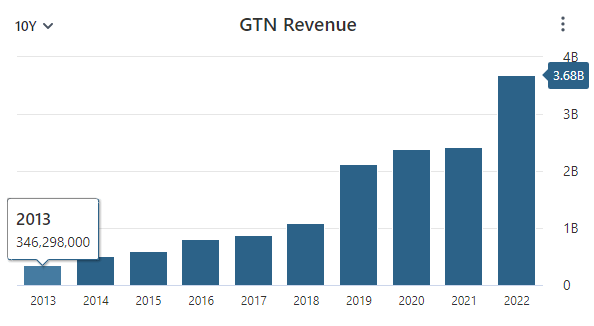

GTN has displayed impressive revenue growth over the past ten years, as the company has not experienced a year of revenue decline since 2013. In the past decade, GTN's revenue increased from $346 million to $3.68 billion last year, demonstrating the company's ability to expand its operations and capture market share. Additionally, the company has grown its revenue every year over the period.

Data by Stock Analysis

Another crucial metric to consider is the company's free cash flow, which measures the cash generated by the business that is available for investment, acquisitions, or shareholder payouts. Over the past ten years, GTN's free cash flow has increased by 10x from $36.1 million to $393 million of free cash flow in 2022, indicating that the company generates significant cash flows from its operations.

Data by Stock Analysis

Turning to GTN's profitability, ROE is a critical metric that investors use to assess a company's performance. GTN has maintained an average ROE of 17.3% over the past ten years. A high ROE suggests that the company effectively uses its resources to generate profits for its shareholders but benchmarking a company's return on equity (ROE) against its peers is crucial. In the case of GTN, its current ROE of 16% outshines the sector median of a mere 3.29%, indicating that the company is significantly more profitable than its competitors.

Let's take a look at GTN's balance sheet now and examine the health of the company. GTN's debt-to-equity ratio of 3.03 indicates is unusually high which is concerning because the company may not be able to manage this amount of debt on its balance sheet. In addition, the company's current ratio of 1.27 indicates that the company has the ability to meet its short-term obligations, such as paying bills and covering operational expenses, but not by a wide margin. This level of debt concerns me as an investor as the company's total debt has ballooned over the last decade from $842 million to $6.51 billion.

Data by Stock Analysis

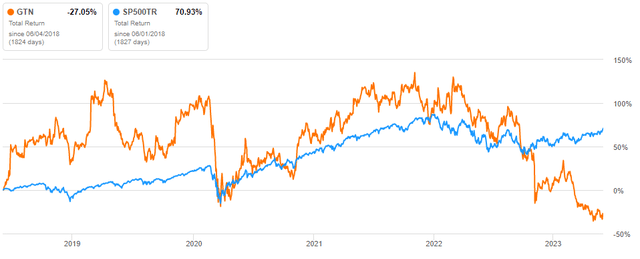

Additionally, GTN's total return has not kept pace with the S&P 500's total return over the past five years, delivering a total return of -27% compared to the S&P 500's return of 70.9% over the same period. Long term shareholders of GTN have been growing impatient with the stock, and the question on everyone's minds is whether GTN can turn things around.

Outlook

GTN's outlook appears uncertain for the next few years, as analysts predict a loss of $0.45 per share in 2023. However, there is a glimmer of hope for a sharp rebound in 2024, with projected earnings of $4.51 per share. Nevertheless, analysts anticipate fluctuating earnings until 2027 when the company is expected to earn $1.98 per share. It is important to note that GTN achieved earnings of $4.33 per share in 2022, highlighting the current bleak outlook. It is worth mentioning that predicting earnings several years ahead is exceptionally challenging, and these projections should be taken with caution.

Moreover, GTN faced a challenging earnings report in the first quarter of 2023, with earnings per share of -$0.48, falling short of estimates by $0.17. Although the company exceeded analysts' revenue expectations for the quarter, reporting $801 million, it experienced a year-on-year revenue decline of 3.14%. Additionally, GTN provided full-year guidance of $3.3 billion in revenue for 2023, indicating an 8.33% decrease compared to the previous year's revenue. Furthermore, the company anticipates a significant decline in free cash flow this year, projecting a range of $160 - $170 million, which is a substantial drop from the $393 million in free cash flow generated in 2022.

The poor guidance and bleak analyst outlook for GTN in the coming years can be attributed to a number of factors. First and foremost, GTN has a substantial amount of debt which continues to get larger year after year. The company's interest coverage ratio is currently just 2.29 which means the company may not be able to cover its interest obligations.

Furthermore, most of the GTN's debt is at variable rates of interest which exposes the company to interest rate risk. Therefore, if interest rates rise the company will have a larger debt obligation to pay despite not borrowing any more money. Unfortunately, this is GTN's current reality with interest rates rising up to 5% in the just the past year which is the highest interest rates seen since 2007. This large amount of debt makes it difficult for GTN to reward shareholders with dividend raises or share repurchases, two things that the company already doesn't have a strong track record of.

Other aspect weighing on GTN is that majority of its revenues come from advertising. As fears of a recession press on, declines in consumer spending become more likely as individuals become more cautious with their finances. In such circumstances, businesses may scale back their advertising budgets to align with lower demand and avoid spending resources on campaigns that may have a diminished impact.

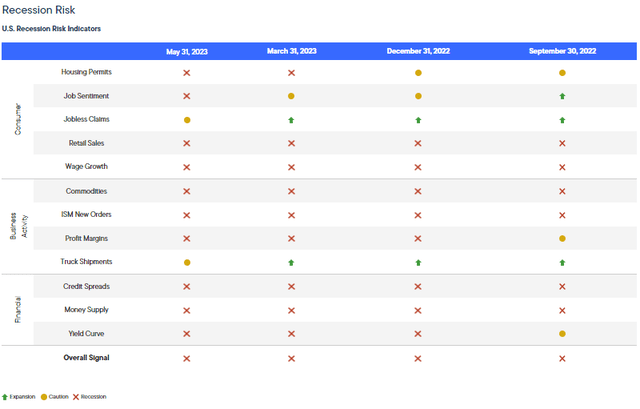

Current macroeconomic factors are not favoring GTN in this regard, Franklin Templeton offers a highly informative program called "Anatomy of a Recession" that provides a monthly overview of the current state of the US economy. However, the recent outcomes of the program have been disheartening as nearly every recession risk indicator point to an impending recession which is bad news for GTN.

But it's not just macroeconomic factors that are affecting GTN, what's even more concerning are the industry trends that affecting the company's business. GTN is in the business of competing for audiences, the bigger the audience the greater the company's ad revenue. New technologies that have contributed to the increased alternatives to television, like websites, apps, and direct to consumer streaming platforms, have made it so that people have more choices for what to watch on TV. This has caused TV viewers to split into smaller groups, and it's become more difficult for companies like GTN to make money.

Intrinsic Value

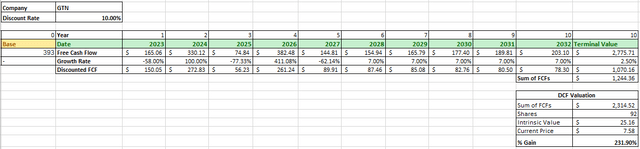

We will employ the discounted cash flow (DCF) analysis to assess GTN's intrinsic value, which is my preferred method for valuation. It evaluates a company's intrinsic worth by calculating the present value of its anticipated future cash flows.

To begin, we will start with GTN's free cash flow from the previous year, which amounted to $393 million. In line with the guidance provided by GTN's management during the company's most recent earnings call, we will apply a growth rate of -58% in the first year. For 2024, we will use a growth rate of 100% to account for the optimistic estimate of an earnings rebound by analysts. Subsequently, based on average analyst earnings estimates, we will utilize growth rates of -77.33%, 411.08%, and -62.14% for the following three years. However, predicting GTN's free cash flows beyond this point becomes increasingly challenging. Therefore, we will adopt a growth rate of 7% for the next five years, considering the company's strong history of growth.

In order to determine the terminal value, we will apply a more conservative perpetual growth rate of 2.5%. Additionally, employing a discount rate of 10%, which considers the S&P 500's long-term return rate with dividends reinvested, GTN's intrinsic value can be calculated as $25.16. This suggests that GTN might be significantly undervalued, indicating a remarkable potential return of 231.90% for investors compared to the company's current market price.

Closing

GTN is a prominent television broadcasting company in the United States and despite a track record of steady revenue and free cash flow growth, GTN faces numerous red flags that raise concerns about its future prospects.

The company carries a substantial amount of debt, and its debt-to-equity ratio is notably high. This poses challenges for managing the debt burden and raises questions about the company's ability to reward shareholders with dividend raises or share repurchases. Additionally, fears of a recession affecting advertising budgets and the shifting industry landscape, which has increased competition for television audiences, are creating further headwinds for GTN.

While GTN has demonstrated revenue growth and profitability over the past decade, its recent financial performance has been lackluster. The company reported disappointing earnings in the first quarter of 2023, falling short of estimates. Analysts project a loss per share in 2023, followed by a potential rebound in 2024. However, the outlook remains uncertain, and predicting earnings several years ahead is challenging.

Considering these red flags, I advise readers to hold the company despite its current discounted share price. Investors should carefully assess the risks associated with GTN, including its high debt, potential recession impact on advertising budgets, and the evolving industry landscape.

This article was written by

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.