SoFi Strikes Back With A Punishing Blow

Summary

- SoFi investors celebrated the battering of bearish investors as SOFI surged almost 65% from its May lows.

- CEO Anthony Noto reassured investors that SoFi remains in control of its loan sales. As such, investors shouldn't be swayed by false narratives causing them to panic unnecessarily.

- SOFI's May bottom saw dip buyers returning to defend against the pessimism, likely sending short-sellers scurrying for cover this week.

- With the impending resumption of student loan repayments after the conclusion of the debt ceiling saga, SoFi has another tailwind in the second half.

- SOFI buyers should consider buying the next dip more aggressively, as it's no longer in a medium-term downtrend.

- Ultimate Growth Investing members get exclusive access to our real-world portfolio. See all our investments here »

Justin Sullivan

SoFi Technologies, Inc. (NASDAQ:SOFI) investors have received a significant boost from the conclusion of the debt ceiling saga, which provided clarity to restarting the leading digital finance company's stalled student loans business.

As such, the student loan pause "is set to end on August 30, 2023," which could help to rejuvenate refinancing originations in that segment. Keen investors should recall that student loan originations fell from "$2.4 billion in Q4 2019 to $525 million in Q1."

As such, I assessed that the market likely priced in the near-term optimism with the impending commencement of repayments, providing SoFi with another critical support toward its year-end guidance.

Therefore, SOFI dip buyers who braved the extreme pessimism in May to buy the steep pullback have been rewarded, as SOFI surged toward its March 2023 highs. Weak SOFI short-sellers who loaded more bets in mid-May likely saw their positions scorched as SOFI rose nearly 65% through this week's highs.

I presented before that SOFI is a highly volatile stock, given its unprofitability and short-selling interest. However, the company is also tracking toward GAAP net income profitability exiting 2023.

As such, I parsed that it should provide more confidence for dip buyers to pounce on significant pullbacks like the ones we saw in May, as I highlighted "another fantastic dip-buying opportunity" after its first-quarter earnings release.

The extreme pessimism in May likely centered on SoFi's personal loans business, as bearish investors pointed out the lack of personal loan sales to investors. Bears see it as a worrying trend of potentially weaker underlying demand for SoFi's loans, worsened by the intensifying macroeconomic headwinds.

However, SoFi CEO Anthony Noto rebutted that thesis in a recent conference in May, indicating why the company decided to hold the loans on its balance sheet. Noto stressed that SoFi could earn a more attractive return, considering several factors, including the current market dynamics.

As such, he assured investors that SoFi remains in control of its opportunities, implying that SOFI holders should not be swayed by false narratives. Noto articulated:

The company's primary focus is to maximize returns on equity and invested capital. The decision to hold or sell loans is based on assessing the return on equity and considering the balance sheet risk management. By holding loans, the company expects a higher return on assets (6% ROA) compared to selling them (4% ROA). From an ROE perspective, holding loans can result in a higher ROE (approximately 43%) compared to selling (high 20%). - 51st Annual JPMorgan Global Technology, Media, and Communications Conference 2023

As such, I assessed that Noto's reassuring commentary helped allay unnecessary fears about SoFi's ability to maintain its profitability guidance and balance sheet capacity.

Moreover, I think SoFi's more than $10B in deposits in Q1 (up from $7.34B in Q4) demonstrated that it wasn't caught in the deposit flight, underpinning a stabilizing influence on its lending activities.

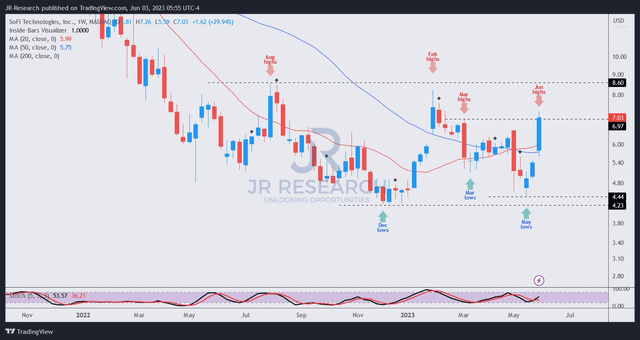

SOFI price chart (weekly) (TradingView)

SOFI dip buyers who braved the storm in May have been rewarded, as SOFI surged toward highs last seen in March 2023.

However, I assessed that SOFI's price action is no longer constructive, and dip buyers are also not likely to participate at the current levels.

Chasing momentum at these levels could be perilous, even as some investors might anticipate a breakout to catch more short-sellers unaware.

Moreover, SOFI's balanced valuation (rated "C-" by Seeking Alpha Quant) indicates that there isn't a highly attractive valuation dislocation for investors to capitalize on.

Still, I think investors must consider that SOFI is no longer in a medium-term downtrend, as it has reversed decisively in May. Therefore, the subsequent pullback from the recent momentum surge could be telling, indicating where dip buyers could be attracted to return to support the nascent uptrend recovery.

As such, SOFI holders might not need to worry too much about catching falling knives at the next pullback, bolstering more confidence in dip buyers to add more aggressively.

Rating: Hold (Revised from Speculative Buy). See additional disclosure below for important notes accompanying the thesis presented.

We Want To Hear From You

Have additional commentary to improve our thesis? Spotted a critical gap in our thesis? Saw something important that we didn't? Agree or disagree? Comment below and let us know why, and help everyone in the community to learn better!

A Unique Price Action-based Growth Investing Service

- We believe price action is a leading indicator.

- We called the TSLA top in late 2021.

- We then picked TSLA's bottom in December 2022.

- We updated members that the NASDAQ had long-term bearish price action signals in November 2021.

- We told members that the S&P 500 likely bottomed in October 2022.

- Members navigated the turning points of the market confidently in our service.

- Members tuned out the noise in the financial media and focused on what really matters: Price Action.

Sign up now for a Risk-Free 14-Day free trial!

This article was written by

Ultimate Growth Investing, led by founder JR Research, helps investors better understand a range of investment sectors with a focus on technology. JR specializes in growth investments, utilizing a price action-based approach backed by actionable fundamental analysis. With a powerful toolkit, JR also provides insights into market sentiments, generating actionable market-leading indicators. In addition to tech and growth, JR also offers general stock analysis across a wide range of sectors and industries, with short- to medium-term stock analysis that includes a combination of long and short setups. Join the community today to improve your investment strategy and start experiencing the quality of our service.

Seeking Alpha features JR Research as one of its Top Analysts to Follow for the Technology, Software, and the Internet category, as well as for the Growth and GARP categories.

JR Research was featured as one of Seeking Alpha's leading contributors in 2022.

About JR: He was previously an Executive Director with a global financial services corporation and led company-wide, award-winning wealth management teams consistently ranked among the best in the company. He graduated with an Economics Degree from Asia's top-ranked National University of Singapore and currently holds the rank of Major as a Commissioned Officer (Reservist) with the Singapore Armed Forces.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Important note: Investors are reminded to do their own due diligence and not rely on the information provided as financial advice. Our cautious/speculative ratings carry a higher risk profile. They are only intended for sophisticated investors/traders. We urge new or inexperienced investors to avoid relying on such ratings. The rating is also not intended to time a specific entry/exit at the point of writing unless otherwise specified. Moreover, investors must exercise prudence and devise appropriate risk management strategies, such as pre-defined stop-loss/profit-taking targets, within a suitable risk exposure.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.