10 Dividend Aristocrats For The Ultimate 6% Yielding Retirement Portfolio

Summary

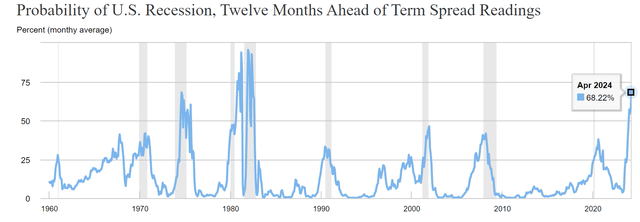

- The NY Fed estimates a 68% recession probability within the next 12 months, the highest risk in 42 years.

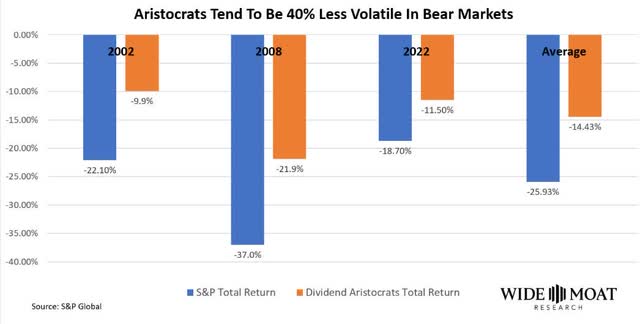

- Dividend aristocrats can provide a relatively safe investment option during a recession, with a history of raising dividends through economic downturns and much lower volatility.

- A diversified high-yield portfolio of dividend aristocrats can offer market-like returns with lower volatility and higher yield.

- These 10 high-yield aristocrats offer very safe yields, as proven by a 42-year dividend growth streak, BBB+ credit rating, and S&P 62nd percentile risk management.

- Together with two hedging ETFs, they create a 6% yielding Ultra SWAN aristocrat portfolio that averages 9% peak bear market declines, 72% less than the S&P. It fell just 19% during the Great Recession, is 98% likely never to fall 20+% in the next 75 years, and is 80% likely to outperform a 60/40 retirement portfolio over the next 50 years.

- Looking for a portfolio of ideas like this one? Members of The Dividend Kings get exclusive access to our subscriber-only portfolios. Learn More »

anyaberkut

This article was published on Dividend Kings on Wed, May 31st.

---------------------------------------------------------------------------------------

Here is part 1 of this 2-part series.

It's a very frustrating and frightening market for many investors.

The NY Fed estimates a 68% probability of recession within the next year. That's the highest in 42 years.

The bond market estimates a 100% risk of recession by the end of October 2024.

The blue-chip economist consensus expects a recession to begin in July, as does Ed Hyam, the most accurate economist of the last 42 years according to the Institutional Investor survey.

Mr. Hyam expects a 1.5% GDP recession, lasting nine months, to begin in July. That's 3X more severe than the mildest recession in history that economists expect.

Bank of America and JPMorgan agree with an average recession lasting nine months, beginning this year.

The good news is that a mild or average recession is no threat to most companies, especially not most dividend aristocrats.

The bad news? A lot of investors could be scared into painful and costly mistakes in the next few months.

S&P Bear Market Bottom Scenarios

| Earnings Decline | Historical Trough PE Of 14 (13 to 15 range) | Decline From Current Level | Peak Decline From Record Highs |

| 0% (blue-chip consensus, mildest recession in history) | 3224 | 23.3% | -33.1% |

| 5% (Morgan Stanley) | 3063 | 27.2% | -36.4% |

| 10% (bank lending data) | 2902 | 31.0% | -39.8% |

| 13% (average since WWII) | 2805 | 33.3% | -41.8% |

| 15% | 2741 | 34.8% | -43.1% |

| 20% | 2579 | 38.7% | -46.5% |

(Source: Dividend Kings S&P 500 Valuation Tool)

The recession hasn't even started yet, and Wall Street is completely unprepared for even a modest contraction in earnings.

Don't Panic: Dividend Aristocrats Can Be Your Port In The Storm

Dividend aristocrats by definition, have been raising their dividends every year since at least 1998 through:

- three recessions

- two economic crises

- inflation as high as 9.1%

- interest rates as high as 6.5%

There are no more dependable dividend stocks in the world than aristocrats, champions, and kings.

In part one of this series, we looked at all the aristocrats sorted by yield. But that ignores things like safety, quality, valuation, return potential, and many other factors.

Let me show you how to quickly and easily find the best high-yield aristocrats for this recession and other future downturns that might be coming in the future.

How To Find The Best Very Safe High-Yield Aristocrats For These Troubled Times... In 2 Minutes

Let me show you how to screen the Dividend Kings Zen Research Terminal, which runs off the DK 500 Master List, to find the best very safe high-yield aristocrats for this recession.

The Dividend Kings 500 Master List includes some of the world's best companies, including:

- Every dividend champion (25+ year dividend growth streaks, including foreign aristocrats)

- Every dividend aristocrat

- Every dividend king (50+ year dividend growth streaks)

- Every Ultra SWAN (as close to perfect quality companies as exist)

- The 20% highest quality REITs, according to iREIT

- 40 of the world's best-growth blue chips.

The key with any screen is to remember that whatever metric you're targeting is never enough on its own.

Valuation always matters, and even some A-rated aristocrats like IBM are speculative due to their turnarounds.

| Step | Screening Criteria | Companies Remaining | % Of Master List |

| 1 | Dividend Champions List | 133 | 26.60% |

| 2 | Reasonable Buy or better (nothing overvalued) | 89 | 17.80% |

| 3 | Non-Speculative (No Turnaround Stocks, investment grade) | 76 | 15.20% |

| 4 | 81+% safety score (very safe) | 61 | 12.20% |

| 5 | 10+% LT return potential | 38 | 7.60% |

| 6 | Sort By Yield | 0.00% | |

| 7 | Select Top 10 Yielders | 10 | 2.00% |

| 8 | Use "build your watchlist" to get just those ten aristocrats | 10 | 2.00% |

| Total Time | 2 Minute |

And in just two minutes now, we have a portfolio of very safe non-speculative aristocrats with the highest possible yield.

10 Dividend Aristocrats For The Ultimate 6% Yielding Retirement Portfolio

I've linked to articles with more information about each company.

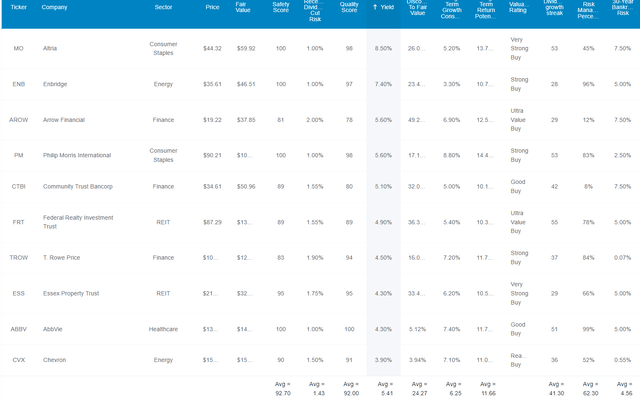

Dividend Kings Zen Research Terminal

Here they are in order of highest yield.

- Altria (MO)

- Enbridge (ENB)

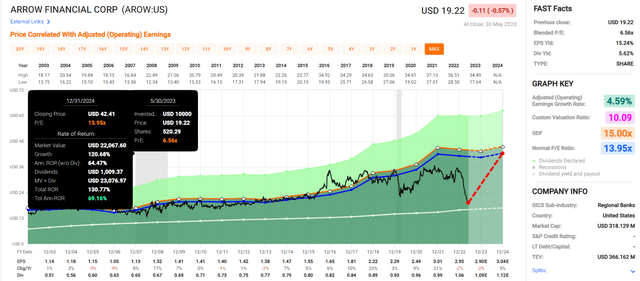

- Arrow Financial (AROW)

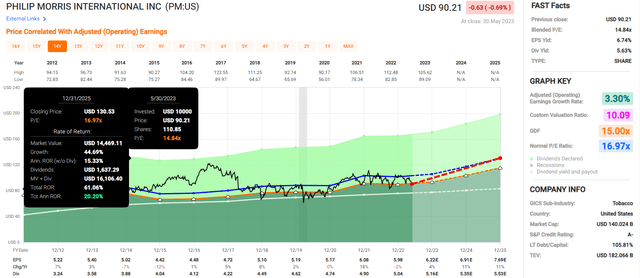

- Philip Morris International (PM)

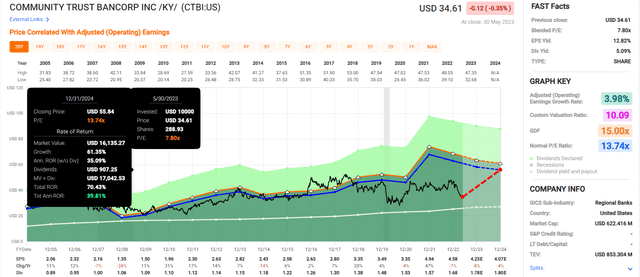

- Community Trust Bancorp (CTBI)

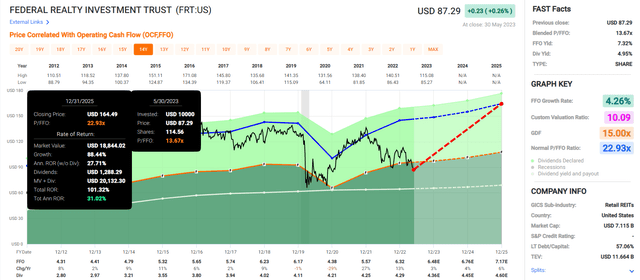

- Federal Realty Investment Trust (FRT)

- T. Rowe Price (TROW)

- Essex Property Trust (ESS)

- AbbVie (ABBV)

- Chevron (CVX)

Tax Implications

Enbridge Is a Canadian company.

- NO K1 tax form

- qualified dividends

- 15% dividend withholding for US investors in taxable accounts

- none in retirement accounts

- tax credit available for taxable accounts

- own in retirement accounts to minimize tax paperwork

Fundamental Summary

- Yield: 5.4%

- dividend safety: 93% (1.43% severe recession cut risk)

- dividend streak: 42 years (1981)

- quality: 92% (Ultra SWAN)

- credit rating: BBB+ stable (4.56% 30-year bankruptcy risk)

- S&P long-term risk management: 62% global percentile, low risk, good risk management

- discount to fair value: 24% (potential strong buy)

- growth consensus: 6.3%

- long-term return potential: 11.7%

- 5-year consensus total return potential: 17.1% CAGR = 120% vs. 50% S&P

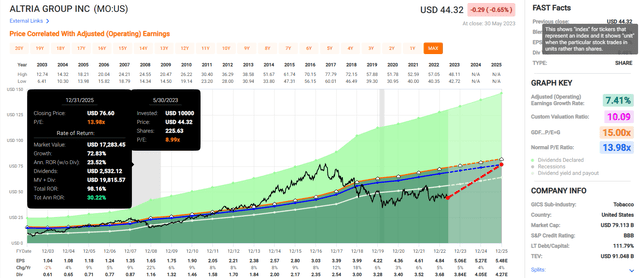

Altria 2025 Consensus Total Return Potential

(Source: FAST Graphs, FactSet)

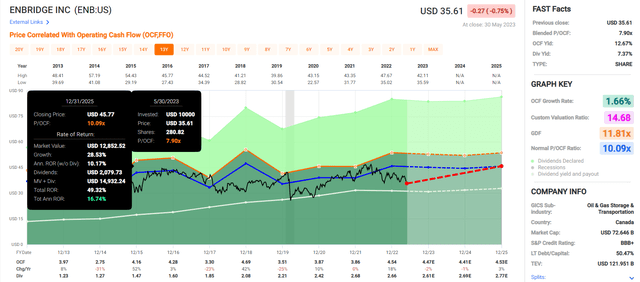

Enbridge 2025 Consensus Total Return Potential

(Source: FAST Graphs, FactSet)

Arrow Financial 2025 Consensus Total Return Potential

(Source: FAST Graphs, FactSet)

Philip Morris International 2025 Consensus Total Return Potential

(Source: FAST Graphs, FactSet)

Community Trust Bancorp 2025 Consensus Total Return Potential

(Source: FAST Graphs, FactSet)

Federal Realty 2025 Consensus Total Return Potential

(Source: FAST Graphs, FactSet)

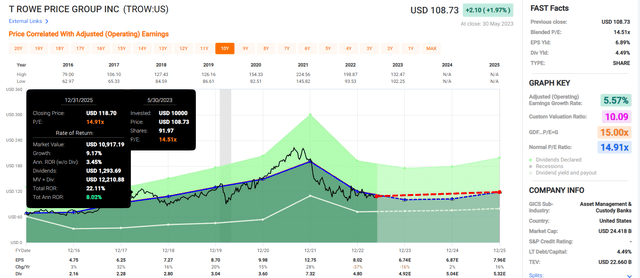

T. Rowe Price 2025 Consensus Total Return Potential

(Source: FAST Graphs, FactSet)

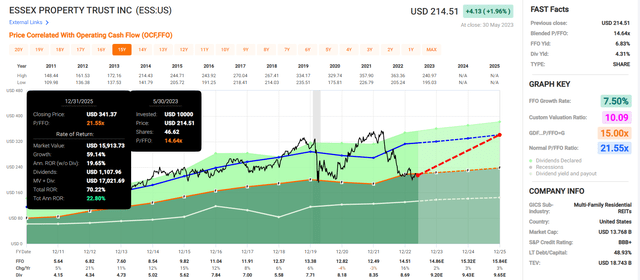

Essex Property Trust 2025 Consensus Total Return Potential

(Source: FAST Graphs, FactSet)

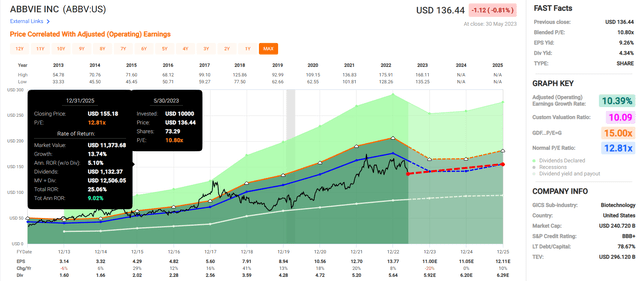

AbbVie 2025 Consensus Total Return Potential

(Source: FAST Graphs, FactSet)

Chevron 2025 Consensus Total Return Potential

(Source: FAST Graphs, FactSet)

Ten blue-chips in 5 sectors.

- Average 2025 consensus return potential: 70%

- average annual return potential: 27%

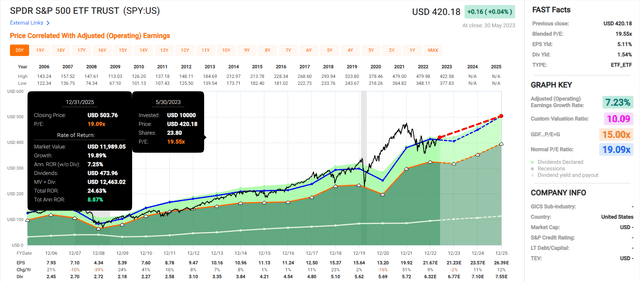

S&P 2025 Consensus Total Return Potential

(Source: FAST Graphs, FactSet)

Aristocrats with more than 3X the yield of the S&P also offer 3X the short-term return potential of the market.

Long-term, these aristocrats offer an 18% better return potential.

3X higher yield, higher quality, better safety, BBB+ balance sheet, and a 42-year dividend growth streak, and better returns than the market.

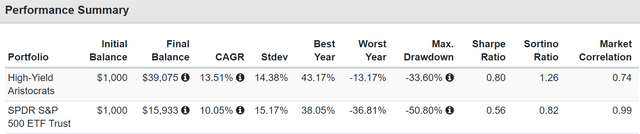

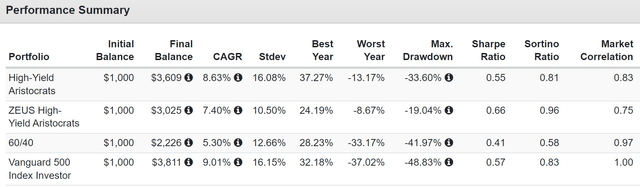

Total Returns Since 1994

(Source: Portfolio Visualizer Premium)

Fantastic market-beating returns with lower volatility despite having 50X fewer companies. And a 33% smaller peak decline in the Great Recession.

(Source: Portfolio Visualizer Premium)

Consistently market-crushing returns and with far fewer bear markets.

14.4% Annual Income Growth For 27 Years

(Source: Portfolio Visualizer Premium)

S&P dividend growth was 8.1% CAGR since 1995.

The yield on cost for the ten aristocrats is now 200% and for the S&P, 23.6%.

Ok, this is some impressive stuff. But here's how to make this portfolio even better.

ZEUS High-Yield Aristocrat: Crank Up The Yield And Low Volatility To 11

Do you know why Warren Buffett never worries about 30%, 40%, or even 50% market crashes? Because Berkshire Hathaway Inc. (BRK.A) generates $25 billion per year in free cash flow, and it's sitting on $138 billion in cash.

Buffett owns the world's best companies... and always has money to buy more in bear markets.

You probably don't own insurance companies and thus might think that you need cash set aside for bear market blue-chip buying.

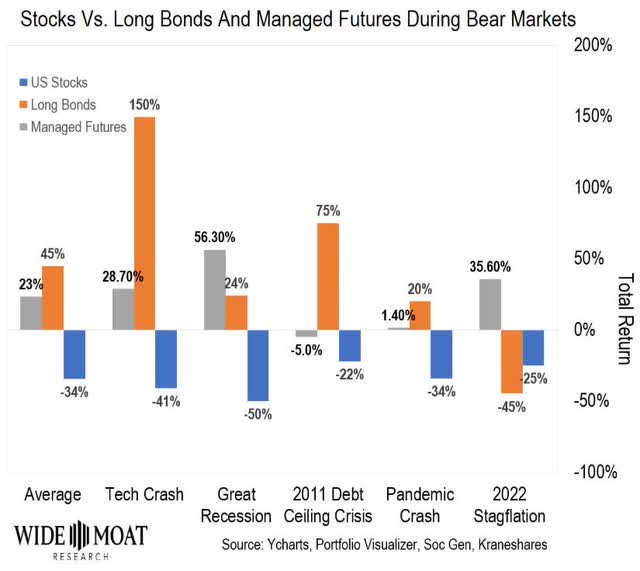

Actually, you need non-correlated blue-chip assets that zag when the market zigs.

Consider the DK ZEUS strategy: Zen Extraordinary Ultra Sleep-Well-At-Night

Consider adding a 16.67% allocation to long-duration bonds like Vanguard Extended Duration Treasury Index Fund ETF Shares (EDV).

And a 16.67% allocation to managed futures like KFA Mount Lucas Index Strategy ETF (KMLM).

Take a look at what this balanced Zen Extraordinary Ultra Sleep Well At Night or ZEUS Wide Moat aristocrat portfolio does.

- 16.66% EDV

- 16.66% KMLM

- 6.66% each of the ten high-yield aristocrats.

Take a look at what adding this hedging bucket does to the fundamentals.

ZEUS High-Yield Aristocrat Vs. 60/40

| Metric | 60/40 | ZEUS High-Yield Aristocrat | X Better Than 60/40 |

| Yield | 2.1% | 5.8% | 2.76 |

| Growth Consensus | 5.1% | 4.0% | 0.78 |

| LT Consensus Total Return Potential | 7.2% | 9.8% | 1.36 |

| Risk-Adjusted Expected Return | 5.0% | 6.9% | 1.36 |

| Safe Withdrawal Rate (Risk And Inflation-Adjusted Expected Returns) | 2.8% | 4.6% | 1.66 |

| Conservative Time To Double (Years) | 26.0 | 15.7 | 1.66 |

(Source: DK Research Terminal, FactSet)

That's almost market-like 10% long-term return potential with triple the yield of a 60/40 and far better long-term return potential.

- 116% better inflation-adjusted returns over 30 years

And volatility so low it's like riding over the worst market potholes in a Rolls Royce.

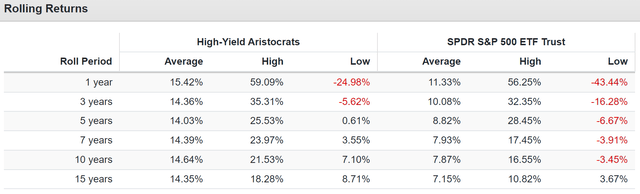

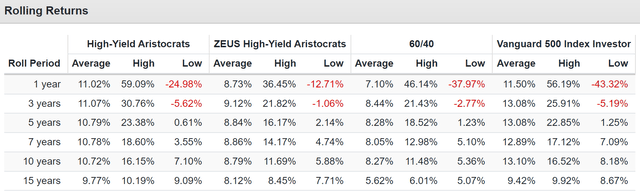

Total Returns Since December 2007 (Start of The Great Recession)

(Source: Portfolio Visualizer Premium)

2.1% better returns than a 60/40 with lower volatility and a peak decline during the Great Recession of just 19%.

(Source: Portfolio Visualizer Premium)

And now, take a look at how ZEUS High-Yield Aristocrat has performed during the bear markets since 2007.

| Bear Market | ZEUS High-Yield Aristocrat | 60/40 | S&P | Nasdaq |

| 2022 Stagflation | -17% | -21% | -28% | -35% |

| Pandemic Crash | -13% | -13% | -34% | -13% |

| 2018 | -7% | -9% | -21% | -17% |

| 2011 | -2% | -16% | -22% | -11% |

| Great Recession | -19% | -44% | -58% | -59% |

| 2008 | 4% | -33% | -37% | -42% |

| Average | -9% | -23% | -33% | -30% |

| Median Decline | -10% | -19% | -31% | -26% |

(Source: Portfolio Visualizer Premium)

60% smaller peak declines than a 60/40 in bear markets, 73% smaller declines than the S&P, and 69% smaller than the Nasdaq.

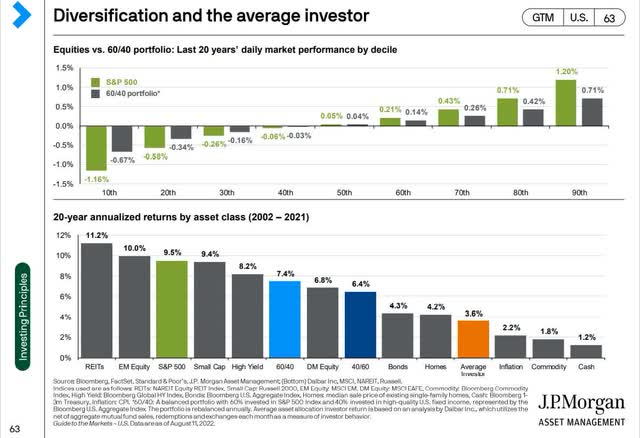

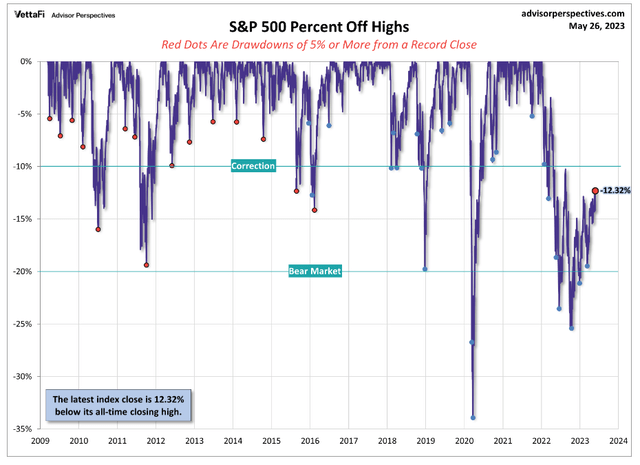

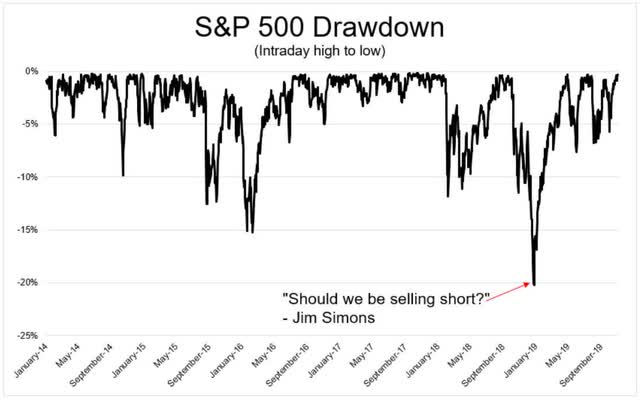

Why does volatility matter? Because most people can't stomach the normal volatility of the market.

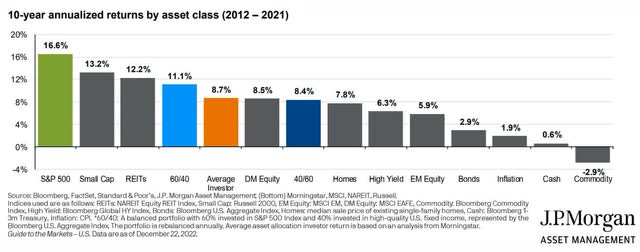

The average investor probably was trying to beat the S&P in the last 20 years. But through terrible market timing they achieved half the returns of a 60/40 portfolio.

In a roaring bull market, the average investor, again thanks to terrible market timing created by normal market volatility, also lost to the 60/40 by a significant amount. Why?

Because even in a raging bull market, stocks don't go straight up.

In other words, by owning a diversified high-yield hedge fund like ZEUS or even a 60/40, the average investor ends up richer because the lower volatility lets them sleep well at night and thus buy and hold.

It's better to be 80% perfect 100% of the time than 100% perfect 80% of the time.

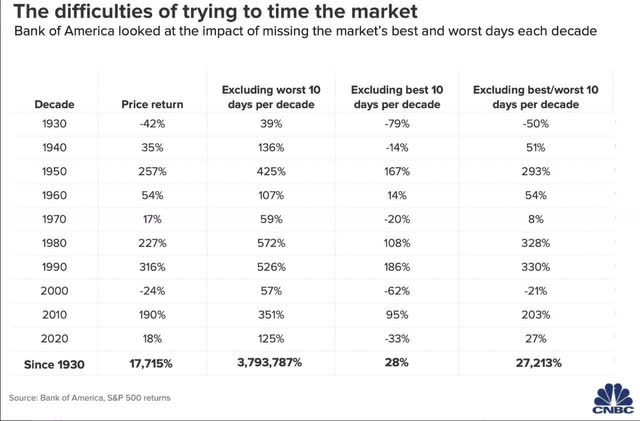

Why? Because the 20% of the time when investors try to time the market is when market timing is most costly.

Miss just the best market day of each year; you might as well not invest in stocks.

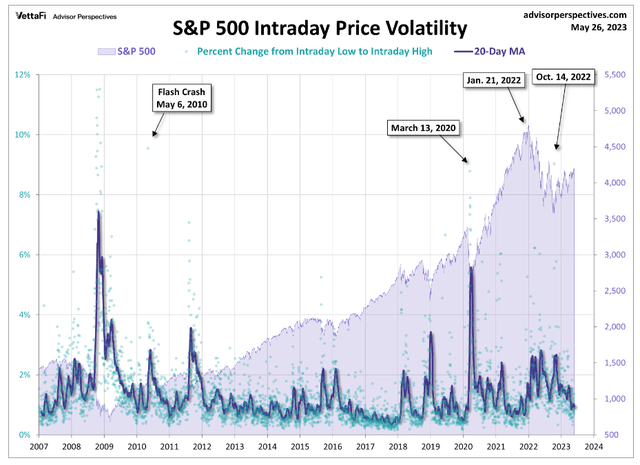

Guess when the market's best days happen? 80% of them occur within two weeks of the market's worst days.

Good luck if you think you can time the market's best intra-day swings.

When the greatest trader in history can't time market bottoms, and even almost shorts the exact bottom, it's useless for the rest of us even to try.

10,000 75-Year Monte Carlo Simulations: Stress Testing The Future With Statistics

By simulating 10,000 75-year future periods using historical returns, we can get a statistically significant idea of what kinds of returns are most likely and what kind of volatility we must be prepared for.

(Source: Portfolio Visualizer Premium)

The base-case (most common) long-term return was 8.8% vs. 7.2% for a 60/40.

Adjusted for inflation, 6% real returns turn $1,000 into $82,000 over 75 years.

The most common safe withdrawal rate was 6%, far more than the 60/40's 2.7%.

(Source: Portfolio Visualizer Premium)

The probability of beating a 60/40's consensus of 7.2% in the next 50 years is over 78%.

In fact, this portfolio has a 22% probability of even beating the S&P in the long-term.

- Analyst consensus 9.8% vs. 10.2% S&P 500

Almost the same returns as the market, a 22% chance of better returns, and 73% smaller peak declines in bear markets.

Speaking of bear markets.

(Source: Portfolio Visualizer Premium)

This portfolio has such high quality and low volatility that it fell to a peak of 19% when the market crashed 57% in the 2nd worst market crash in US history, the Great Recession.

The probability of it suffering a 20+% bear market in the next 75 years is just 1.92%.

The probability of a 40+% market crash, which the 60/40 suffered in the GFC, is 0.02%.

Probability Of Future Bear Markets

| Bear Market Severity | Statistical Probability Over 75 Years | 1 In X Probability | Expected Every X Years | S&P More Likely To Suffer X% Decline In Any Given Year |

| 20+% | 1.92% | 52 | 3,906 | 651 |

| 25+% | 0.61% | 164 | 12,295 | |

| 30+% | 0.19% | 526 | 39,474 | |

| 35+% | 0.06% | 1667 | 125,000 | |

| 40+% | 0.02% | 5000 | 375,000 | 7,500 |

(Source: Portfolio Visualizer)

This is a portfolio with such low volatility that you should expect a bear market once every 3,906 years.

- The S&P 500 is 651X more likely to suffer a bear market in any given year

A 40% crash, like the 60/40 suffered in the Great Recession, is expected once every 375,000 years.

- The S&P is 7,500X more likely to suffer a bear market in any given year

Bottom Line: High-Yield Aristocrats Can Be Just What You Need To Survive And Thrive What's Coming

I can't tell you when the market bottom is coming or even exactly where it will be. I can give you the latest facts, probabilities, and most likely ranges.

But here is what I can say with near certainty.

If the market leaves the ground and you haven't bought some blue-chip bargains, you'll regret it. Maybe not today, maybe not tomorrow, but soon and for the rest of your life." - Paraphrase of Casablanca

A face-ripping bull market is going to start when this bear market hits bottom. One of those years where if you're not in the market, you're giving up about 50% of the market's long-term gains.

A diversified recession-optimized high-yield portfolio like ZEUS High-Yield Aristocrats is potentially the best way for you to avoid the disastrous temptation to time the market and likely miss out on the 50% historical rally that is likely starting later this year.

Start with a core stock position consisting of the safest high-yield aristocrats you can buy today.

- Altria

- Enbridge

- Arrow Financial

- Philip Morris International

- Community Trust Bancorp

- Federal Realty Investment Trust

- T. Rowe Price

- Essex Property Trust

- AbbVie

- Chevron

These ten aristocrats offer potentially life-changing fundamentals and phenomenal safety and quality for this and any future recession.

Fundamental Summary

- Yield: 5.4%

- dividend safety: 93% (1.43% severe recession cut risk)

- dividend streak: 42 years (1981)

- quality: 92% (Ultra SWAN)

- credit rating: BBB+ stable (4.56% 30-year bankruptcy risk)

- S&P long-term risk management: 62% global percentile, low risk, good risk management

- discount to fair value: 24% (potential strong buy)

- growth consensus: 6.3%

- long-term return potential: 11.7%

- 5-year consensus total return potential: 17.1% CAGR = 120% vs. 50% S&P

70% return potential in the next 2.5 years and 120% in the next five years, 2.5X more than then S&P.

While you enjoy a yield that's 3X higher.

And if you can't stand the idea of 20+% portfolio drops, then turn these aristocrats into a ZEUS portfolio with long bonds like EDV and managed futures like KMLM.

ZEUS High-Yield Aristocrat Vs. 60/40

| Metric | 60/40 | ZEUS High-Yield Aristocrat | X Better Than 60/40 |

| Yield | 2.1% | 5.8% | 2.76 |

| Growth Consensus | 5.1% | 4.0% | 0.78 |

| LT Consensus Total Return Potential | 7.2% | 9.8% | 1.36 |

| Risk-Adjusted Expected Return | 5.0% | 6.9% | 1.36 |

| Safe Withdrawal Rate (Risk And Inflation-Adjusted Expected Returns) | 2.8% | 4.6% | 1.66 |

| Conservative Time To Double (Years) | 26.0 | 15.7 | 1.66 |

(Source: DK Research Terminal, FactSet)

Market-like returns, but a 6% safe yield and with 73% smaller peak declines in bear markets.

| Bear Market | ZEUS High-Yield Aristocrat | 60/40 | S&P | Nasdaq |

| 2022 Stagflation | -17% | -21% | -28% | -35% |

| Pandemic Crash | -13% | -13% | -34% | -13% |

| 2018 | -7% | -9% | -21% | -17% |

| 2011 | -2% | -16% | -22% | -11% |

| Great Recession | -19% | -44% | -58% | -59% |

| 2008 | 4% | -33% | -37% | -42% |

| Average | -9% | -23% | -33% | -30% |

| Median Decline | -10% | -19% | -31% | -26% |

(Source: Portfolio Visualizer Premium)

A portfolio that has a 98% chance of never experiencing a bear market in the next 75 years.

Now this is what I call the ultimate 6% yielding dividend aristocrat Ultra Sleep-Well At Night retirement portfolio!

This is the power of always putting safety and quality first and prudent valuation and risk management.

This is the power of asset allocation and world-beater blue-chips.

This is the power of ZEUS, the king of sleep-well-at-night retirement portfolios.

Did you know that hedge funds charge an average of 5% per year to try to maximize volatility-adjusted returns?

They promise you good returns, and low volatility, and when the market is crashing hardest, that's when they shine brightest.

Do you know what the expense ratio is for ZEUS High-Yield aristocrat?

- 0.33% or 15X less than the average hedge fund

And here's how ZEUS High-Yield compares to David Swenson and Ray Dalio, two legendary hedge fund managers.

ZEUS High-Yield Aristocrat Vs. Hedge Funds

Portfolio Visualizer Premium Portfolio Visualizer Premium

Better returns, much smaller peak declines in even the most ferocious bear markets, and superior volatility-adjusted returns (Sharpe and Sortino ratio).

Better than a 60/40, better than two of the world's most famous hedge fund managers.

And for 15X lower cost and with much higher yield to boot.

This is the power of trusting the world's highest quality and most dependable companies to work hard for you so that one day you won't have to.

Market trends are like the ocean's tides; they ebb and flow. The wise investor builds his castle on the rock, not the sand.

And there are few rocks studied in this coming recession than these 10 high-yield dividend aristocrats and the best hedging strategy of the last 53 years.

Money doesn't grow on trees, but patient investments can sow the seeds. A skilled investor is like a wise gardener, nurturing seeds into mighty dividend oaks.

With time and patience, these 10 high-yield aristocrats can turn modest savings into a safe and prosperous retirement.

----------------------------------------------------------------------------------------

Dividend Kings helps you determine the best safe dividend stocks to buy via our Automated Investment Decision Tool, Zen Research Terminal, Correction Planning Tool, and Daily Blue-Chip Deal Videos.

Membership also includes

Access to our 13 model portfolios (all of which are beating the market in this correction)

my correction watchlist

- my $2.5 million family hedge fund

50% discount to iREIT (our REIT-focused sister service)

real-time chatroom support

real-time email notifications of all my retirement portfolio buys

numerous valuable investing tools

Click here for a two-week free trial, so we can help you achieve better long-term total returns and your financial dreams.

This article was written by

Adam Galas is a co-founder of Wide Moat Research ("WMR"), a subscription-based publisher of financial information, serving over 5,000 investors around the world. WMR has a team of experienced multi-disciplined analysts covering all dividend categories, including REITs, MLPs, BDCs, and traditional C-Corps.

The WMR brands include: (1) The Intelligent REIT Investor (newsletter), (2) The Intelligent Dividend Investor (newsletter), (3) iREIT on Alpha (Seeking Alpha), and (4) The Dividend Kings (Seeking Alpha).

I'm a proud Army veteran and have seven years of experience as an analyst/investment writer for Dividend Kings, iREIT, The Intelligent Dividend Investor, The Motley Fool, Simply Safe Dividends, Seeking Alpha, and the Adam Mesh Trading Group. I'm proud to be one of the founders of The Dividend Kings, joining forces with Brad Thomas, Chuck Carnevale, and other leading income writers to offer the best premium service on Seeking Alpha's Market Place.

My goal is to help all people learn how to harness the awesome power of dividend growth investing to achieve their financial dreams and enrich their lives.

With 24 years of investing experience, I've learned what works and more importantly, what doesn't, when it comes to building long-term wealth and safe and dependable income streams in all economic and market conditions.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of PM either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

I own almost all of these via ETFs.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.