SPSB: Should You Ditch It For Treasury Bills?

Summary

- SPDR® Portfolio Short Term Corporate Bond ETF has a very low expense ratio and passes you almost the underlying yield.

- The fund won't make you rich, but offers a solid yield since we exited ZIRP.

- The yield does make you wonder though whether you should just sit it out in Treasury bills.

- I do much more than just articles at Conservative Income Portfolio: Members get access to model portfolios, regular updates, a chat room, and more. Learn More »

richcano

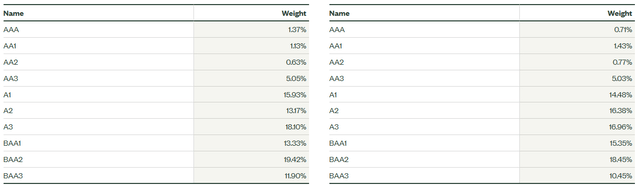

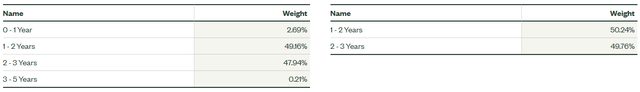

SPDR® Portfolio Short Term Corporate Bond ETF (NYSEARCA:SPSB) invests in investment grade, fixed rate, US corporate bonds with maturities between 1-3 years. Additionally, the bond has to have an outstanding face value of at least $300 million and should be non convertible to be included in the ETF's portfolio. It is a passive exchange traded fund pursuing the performance of the Bloomberg U.S. 1-3 Year Corporate Bond Index. SPSB uses sampling to select the index securities to hold. The aim is to have a portfolio that represents, at a broader level, the same risk and return characteristics of the index. The ETF is pretty closely matched with its benchmark when we look at the most recent numbers indicating the quality and maturity schedule of the respective holdings.

Fund Website [index data on your right hand side]

Fund Website [index data on your right hand side]

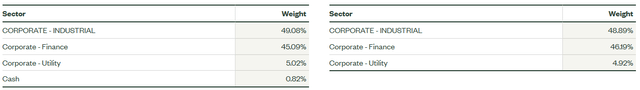

The same story ensues in case of sector allocations, made up primarily of issuers from the industrial and financial belt.

Fund Website [index data on the right hand side]

Let's see if this close tracking has translated into a historically equivalent performance to the benchmark.

Performance

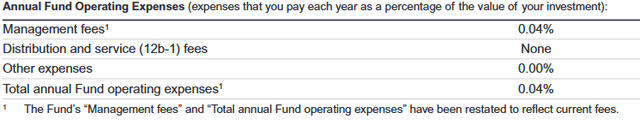

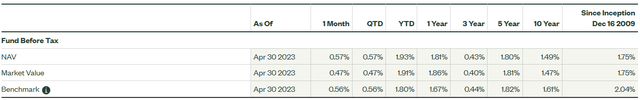

The ETF unlike the index has expenses, which can serve as a handicap in replicating the results of the benchmark index. Being a passive fund, SPSB's annual expenses are a negligible 0.04%, removing any significant hurdle on that front.

Summary Prospectus

On the flip side, having a passive investment strategy also removes any attempt by the management to outperform the index. After all, the 0.04% which is great for investors of this fund, is meagre from the management's perspective. Irrespective, the sampling method has worked for the ETF and it has kept up with the index over the long run, net of expenses. SPSB's NAV has even consistently beat the benchmark over the shorter time frames.

Fund Website

Distributions

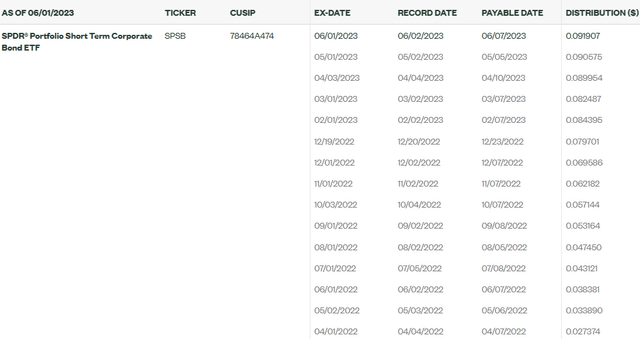

The ETF's last monthly distribution was $0.091907, which at the current price of $29.46 gives its incoming investors a yield of 3.74%. We can see that the monthly distributions are not static in amount, and have been on the rise.

Fund Website

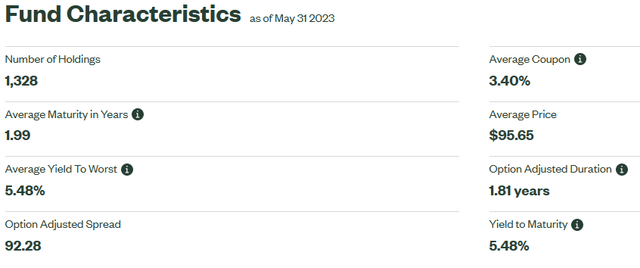

That is simply a function of the increase in earnings of its underlying holdings since the federal reserve started raising rates. We can see below that while the average coupon of the portfolio is 3.40%, the yield to maturity or YTM is more than 200 basis points higher at 5.48%.

Fund Website

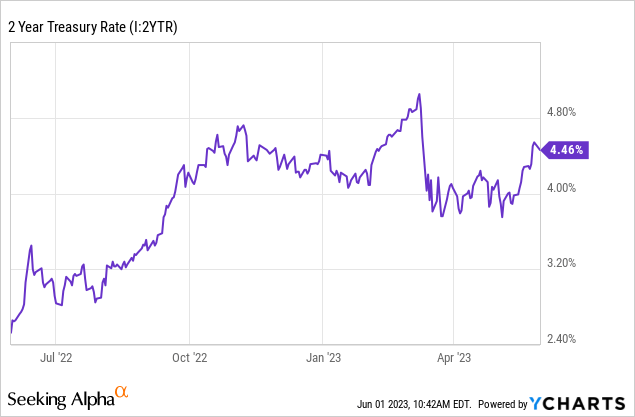

The distributions take time to catch up to the income earned by the fund, and we should continue to see the higher monthly trend in distributions paid to the unitholders. Of course, some of the earnings go towards paying the expenses, but as we have seen those are nominal in this SPSB's case. The average portfolio maturity noted above is 2 years. We can see that the equivalent risk free rate yields 4.46%.

The current spread between the risk free and investment grade issues is around 92 basis points, bringing us close to 5.5% in YTM.

Verdict

The ETF invests in quality giving its investors peace of mind from the credit risk perspective. While investment grade bonds can go down, defaults (not downgrades, those can happen) in a 2 year time horizon are exceptionally rare and would certainly not be material to the NAV of a diversified fund. One area where such risk has been recently, has been in the regional bank arena, but the vast majority of that appears played out too.

The fund's duration risk of 1.18 years is also not substantial to cause sleepless nights. All in all, there is not much risk you are taking here and the return reflects that. One interesting aspect here is that investors are getting better yields than the 2 Year Treasury with this fund, but almost exactly the same as Treasury bills. This of course comes with the fact that the market is pricing in big rate cuts in the next 12 months. This creates a rather unusual setup where investors may feel that Treasury bills are the best option here. If the Federal Reserve's "higher for longer" turns out not to be a bluff, they will be correct and best served in Treasury bills. If the futures market is right and big rate cuts are coming, then it still becomes debatable as to whether you want to hold even investment grade bonds before spreads really blow out. In our approach we take it on a case by case basis and our buying investment grade bonds where the yields are far superior to average yield of this fund and the credit risk is actually lower in our opinion. We rate this fund a hold and think it probably does deliver positive 10% total returns over the next 2 years despite the recession risks.

Please note that this is not financial advice. It may seem like it, sound like it, but surprisingly, it is not. Investors are expected to do their own due diligence and consult with a professional who knows their objectives and constraints.

Are you looking for Real Yields which reduce portfolio volatility? Conservative Income Portfolio targets the best value stocks with the highest margins of safety. The volatility of these investments is further lowered using the best priced options. Our Enhanced Equity Income Solutions Portfolio is designed to reduce volatility while generating 7-9% yields.

Give us a try and as a bonus check out our Fixed Income Portfolios.

Explore our method & why options may be right for your retirement goals.

This article was written by

Conservative Income Portfolio is designed for investors who want reliable income with the lowest volatility.

High Valuations have distorted the investing landscape and investors are poised for exceptionally low forward returns. Using cash secured puts and covered calls to harvest income off value income stocks is the best way forward. We "lock-in" high yields when volatility is high and capture multiple years of dividends in advance to reach the goal of producing 7-9% yields with the lowest volatility.

Preferred Stock Trader is Comanager of Conservative Income Portfolio and shares research and resources with author. He manages our fixed income side looking for opportunistic investments with 12% plus potential returns.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.