BST: Expect Impressive Performance To Continue

Summary

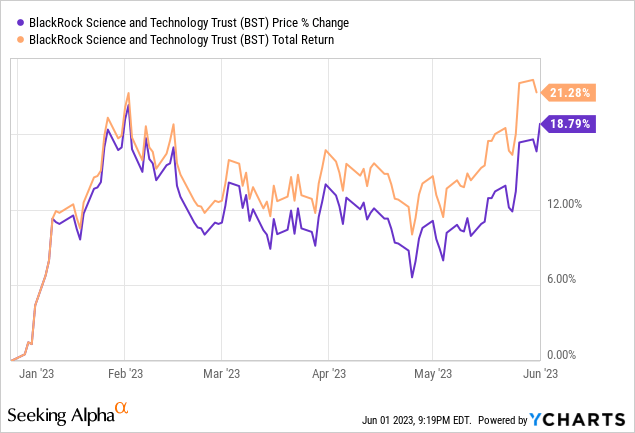

- BlackRock Science and Technology Trust has defied the typical covered call fund performance, with a 20% year-to-date price appreciation and a history of raising dividends.

- BST writes covered calls against individual stocks, generating richer premiums, and only writes calls against a portion of its portfolio, allowing for price appreciation.

- The fund has a high beta and volatility, making it suitable for investors who feel bullish or neutral about the overall market, while risk-averse investors may prefer an index fund approach.

Andrew Burton

When people think about covered call funds, they typically think about funds that give up all share price appreciation in favor of call premiums but BlackRock Science and Technology Trust (NYSE:BST) continues to defy odds as it is up almost 20% year to date (21% counting the dividend). The fund is basically telling its investors that they can have their cake and eat it too.

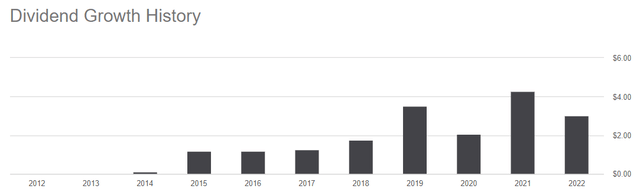

The fund not only has a high dividend yield but a history of actually raising dividends which is very rare in covered call funds with high yields. Typically these funds tend to see their NAV decline over time which means dividends will also get cut but BST continues to raise its dividends year after year while the share price continues to appreciate as well.

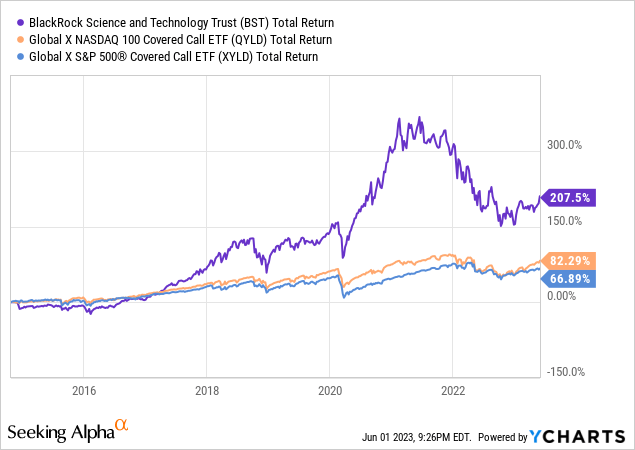

How does the fund do it? First, unlike most other covered call funds, it doesn't write covered calls against the whole index. It writes calls against individual stocks. Since IVs in individual stocks (especially tech stocks and growth stocks) tend to be much higher than index funds, you can generate much richer premiums from them. Second, the fund writes calls against only a portion of its portfolio, allowing the rest of its portfolio grow and appreciate in value so its upside potential is not capped. As a result, the fund enjoys much better total returns than most other covered call funds, especially some of the highly popular ones such as QYLD and XYLD.

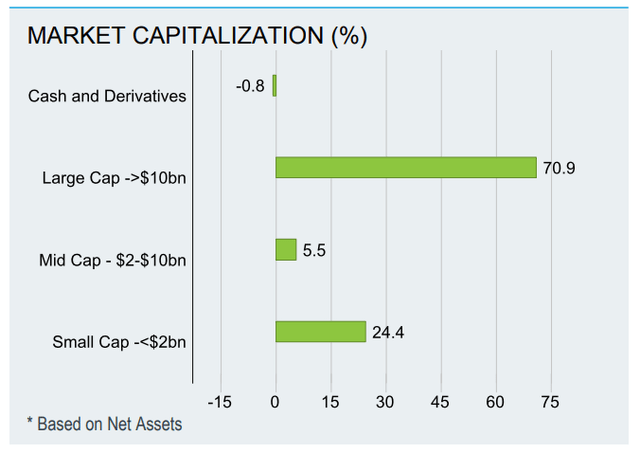

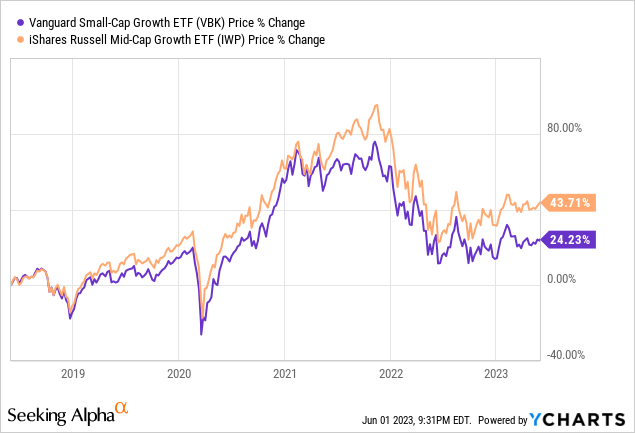

As you can see in the chart above, the fund was actually performing much better until mid-2021. At one point its total return level as high as 350%. Then came the bear market of 2022 which wreaked havoc on growth and technology stocks. Small and medium cap stocks were hit especially hard and many of them still haven't recovered even though mega cap technology stocks such as FAANGs are already back to all-time highs. Below you can see how small cap and mid-cap growth stocks have been performing for the last 5 years. Notice that they topped and started dropping in second half of 2021 even though bear market in major indices such as S&P 500 and Nasdaq didn't start until 2022. This is very typical in bear markets where small caps and mid-caps start falling first, large caps and mega caps are typically the last dominoes to fall, and also small caps and mid-caps recover last even though they started falling first.

BST has a good mix of small cap, mid-cap and large cap growth in its portfolio. The fund has 30% exposure to companies with market caps below $10 billion but it also has good exposure to companies like Microsoft (MSFT), Apple (AAPL) and Nvidia (NVDA). To be honest, the fund used to have a higher exposure to small and mid-cap stocks but large cap stocks have been vastly outperforming lately which increased the weight of large caps in this fund's total assets. For example, when Nvidia's price more than doubled in the last 6 months, it increased the fund's weight of this stock from about 2% to almost 5%.

I don't expect this to last long though because the fund is actively managed and its managers tend to do a good job of striking a good balance. I expect them to trim some overbought positions and reallocated funds to positions that haven't been performing as good which should bring more balance to its total portfolio and increase rate of small and mid-caps while reducing its allocation of mega caps.

Even though the fund tells us that it writes covered calls against some of its positions, it doesn't specify which ones. If investors expect 100% transparency from their funds, they might be disappointed in this but most investors aren't looking into that much detail and they trust their fund managers to run their funds the best way they can. Otherwise they would be running their own portfolios and doing their own options plays. After all, one of the goals of investing in a fund (whether it be a mutual fund, ETF, CEF or ETN) is to have a peace of mind and not worry about day-to-day details of running things. Fund managers are paid to worry about details so that we won't have to. While I would like to know more details about this fund's options plays, I am not too bothered by their lack of transparency as long as they continue to deliver good results.

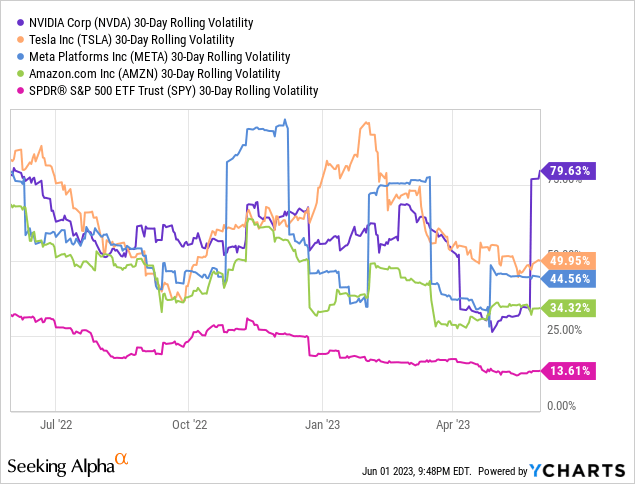

As of March 31st, the fund had a 31% rate of coverage which means it was writing covered calls against 31% of its stock holdings. I find it impressive that it is able to generate 9-10% dividend yield by selling covered calls against only one third of its total position when other funds get similar yields by selling calls against 100% of their position. This is because individual stocks (especially tech stocks) have much higher volatility than indices and thus they command much higher option premiums. In the below chart you will see an example of this where S&P 500 index (SPY) recently had a volatility of 13% whereas Nvidia had a volatility of 79%, Tesla (TSLA) had a volatility of 50%, Meta (META) had a volatility of 44% and Amazon had a relatively "low" volatility of 34% which was still more than twice that of the index.

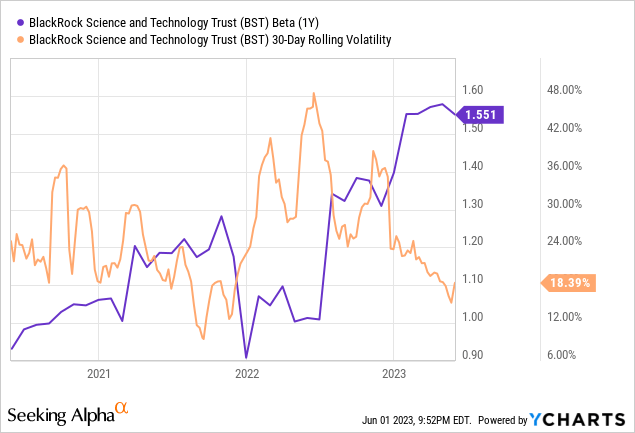

Investors should still understand that there is no free lunch and no fund is risk free. The fund itself has a high beta and high volatility. Currently the fund's beta sits at 1.55 which means it is 55% more volatile than the market. For example if S&P 500 was to fall by 10%, this fund would be expected to fall by 15.5%. If S&P 500 was to fall by 20%, this fund would be expected to fall by 31% and so on. Similarly, the fund's volatility is currently at low ends of its 3-year range but it's still higher than market's average at 18.39%. Investors should invest in this fund if they feel bullish or at least neutral about the overall market. If they feel bearish, they should wait for a better entry point but this could also mean missing out on rich dividend payments.

I bought some BST in my 401(k) portfolio and I keep adding a little bit every month. This is one of those positions I don't plan on ever liquidating unless I absolutely have to. Since I am prepared to hold and add to this position (and reinvest my dividends) for many years to come, I am not too bothered by its price fluctuations. If you feel the same way, this is a good place to start accumulating. If you are particularly risk-aversive, you might want to stay away from this fund and perhaps go for an index fund approach.

Alternatively investors who feel even more adventurous can also invest into this fund's "sister" fund BSTZ (BSTZ). In addition to tech and growth stocks, this particular fund also allocates about 25% of its assets into private companies that haven't yet had an IPO. That fund also happens to trade at a deep discount to its NAV as I've explained in a previous article. I have positions in both funds and I expect both to perform well in the long run.

This article was written by

Analyst’s Disclosure: I/we have a beneficial long position in the shares of BST, BSTZ either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.