Ford Envy Coming Soon In Tesla Superchargers

Summary

- The opening of Tesla's superchargers may prove to be Ford's tailwinds, in our opinion, significantly aided by the latter's diversified strategy across sedan/truck/commercial EVs.

- While it remains to be seen if Ford may achieve its ambitious 2023 production targets, it has taken great steps to strengthen its lithium supply for over 3M EVs.

- Combined with its high-margin and high-growth BlueCruise, we may see Ford's top and bottom lines recover from these depressed levels as more embrace its EV and SaaS offerings.

Wirestock

The F Investment Thesis Continues To Grow

Ford Motor Company (NYSE:F) has dramatically raised its stock prices with the surprising announcement of the Supercharger collaboration with Tesla (TSLA). While the eventual opening up has been expected for the latter to access federal funding, F's early deal suggests that the management has bought into the "large, reliable, and efficient charging system" offered by the EV leader.

We suppose this cadence is great for F as well, due to its lower battery capacity of between 226 miles for the standard range and up to 320 miles for the extended range, compared to TSLA's current offerings of between 267 and 375 miles.

Tesla Superchargers also offer a faster charging option of up to 200 miles within 15 minutes, compared to F's existing BlueOval Charging Network at 54 miles within 10 minutes or those offered by ChargePoint (CHPT) at 100+ miles within 30 minutes.

As a result of the Supercharging, we believe F's drivers may be better assured of their driving and towing range, the latter of which has been a teething problem for many F-150 Lightning users, as opposed to the more expensive and longer-ranged battery options.

This optimistic cadence may have been part of the reason why the F stock has similarly rallied after the news release, potentially boosting EV adoption at a time of elevated interest rate environment. However, we believe there are also many other positive developments from this opening up, beyond the obvious collaborative tailwinds between both CEOs.

Ford's Mach-E VS Tesla's Model Y

Firstly, F may receive "free exposure" to the largest group of EV users, namely TSLA drivers, potentially attracting new buyers, since over 60% of Mach E customers are new to the brand, significantly aided by the lowered prices. By early May 2023, the automaker has further cut prices by up to $4K, triggering lower entry points of $42.99K for Mach-E, compared to the $48.88K for TSLA's Model Y.

With Mach-E boasting a more attractive price from $39.24K onwards (after deducting the $3.75K tax credit) compared to Model Y at $41.38K (deducting the $7.5K), we suppose F's EV demand may continue to grow ahead, significantly aided by the model's handsome features.

With TSLA's superchargers to be open to F's user base by early 2024, we may see more comparisons between the two automakers' sedan/ SUV offerings then, potentially shifting the balance in demand.

Ford's F-150 Lightning VS Tesla's Cybertruck

Secondly, while it is unknown how things may develop moving forward, we are cautiously optimistic about F-150's long-standing reputation as America's best-selling truck for 46 consecutive years.

With 653.95K units of F-150 delivered in 2022 (-9.9% YoY) and 239.97K already delivered by April 2023 (+24.8% YoY), it is not overly bullish to project nearly 719.91K of sales for FY2023 (+10% YoY). Despite the mishaps in Q1'23, F still delivered 5.62K units of F-150 Lightning by April 2023, up tremendously from the 258 units reported a year ago.

With TSLA's Cybertruck only to start production by mid-2023 and reach volume output by 2024, it remains to be seen how the two truck models may compare, with some analysts already likening the Cybertruck to "enthusiast/ cult status" with a speculative limited volume of 50K units annually.

Assuming so, we may see F remain the undisputed leader in the truck market, bolstered by its projected annual run rate of 150K for F-150 Lightning by September 2023 and speculatively up to 600K by 2026, matching the output for its ICE equivalent.

The automaker has also been putting great efforts into securing its lithium supply for more than 3M EVs, further demonstrating its determination to achieve at least 2M in EV output by H2'26.

Thirdly, F has guided profitability for its first-generation electric vehicles on a pretax basis by the end of 2024, significantly aided by its robust COGS efficiency of -$5K for the Mach-E by the end of 2023.

This is on top of its growing success in the Ford Pro SaaS, BlueCruise, with the miles-driven expanding tremendously to 70M (+66.6% QoQ) by the latest quarter, similarly triggering the expansion in its subscription revenues (+64% QoQ) and total subscriptions to 600K.

Given the early success of its high-margin software business across fleet management, telematics, and charging, we remain confident in F's resilience ahead, significantly aided by its market-leading position in the Active Driving Assistance System segment by early 2023.

The Consumer Report has placed F's BlueCruise ADAS firmly at the top, scoring 84 points, topping General Motors' (GM) Cruise at 75 points and TSLA's Autopilot at 61 points. With such a promising development, we will not be surprised if the former's SaaS proves to be a tremendous top and bottom-line driver moving forward, with it already obtaining regulatory approval in the UK and EU thus far.

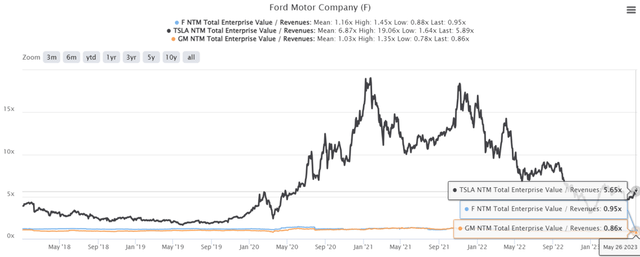

F YTD EV/Revenue and P/E Valuations

Unfortunately, the same optimism was not reflected in F's valuations, which continue to be moderated to NTM EV/ Revenues of 0.95x, compared to its 5Y mean of 1.16x. Then again, we suppose this is linked to its legacy automaker status, since General Motors' (GM) valuation is similarly impacted to 0.86x, with TSLA remaining highly buoyant at 5.89x thus far.

This is despite the supposed expansion in F's top line at a CAGR of 5.5% through FY2025, compared to its historical cadence of 0.5% pre-pandemic and 1.2% during the pandemic. The same was observed with GM at -4.4% pre-pandemic/ 4.5% pandemic/ 3.6% through FY2025, with TSLA already expected to decelerate (albeit still with an excellent growth rate) from 52% pre-pandemic and 49.1% pandemic to 25.3% through FY2025.

F 1Y Stock Price

Then again, we are not overly concerned for now, since F has already successfully rebounded from its previous October and December 2022 support levels of $11s. As a result, we continue to rate the stock as a Buy here, if the exercise consequently lowers long-term investors' dollar cost averages.

Otherwise, bottom-fishing investors may consider waiting for another retest to the $11s for an improved margin of safety, since the macroeconomic outlook remains uncertain over the next few quarters. There is no need to chase this rally yet.

This article was written by

Analyst’s Disclosure: I/we have a beneficial long position in the shares of TSLA either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

The analysis is provided exclusively for informational purposes and should not be considered professional investment advice. Before investing, please conduct personal in-depth research and utmost due diligence, as there are many risks associated with the trade, including capital loss.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.