VICI Properties: Bet On Casinos, Not In Them

Summary

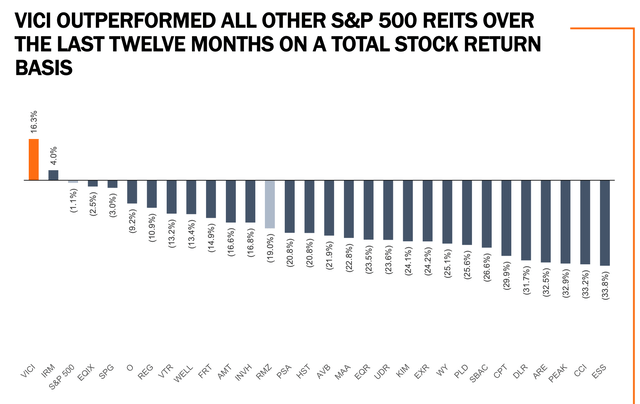

- VICI is a casino/entertainment landlord and one of only a handful of REITs whose stock price increased last year.

- This wasn't a coincidence as VICI has arguably the best lease terms of any net lease REIT, with extremely long terms and above standard rent escalators.

- I present my outlook for this recession resilient buy.

LeBright/iStock via Getty Images

Dear readers/followers,

The time has come to cover VICI Properties (NYSE:VICI), one of very few REITs that posted positive results last year (returning about 8%). This wasn't a coincidence because as you'll see VICI is a pretty special company with some really good characteristics which make it a good pick in the current high rate environment and a potential economic slowdown.

Why VICI?

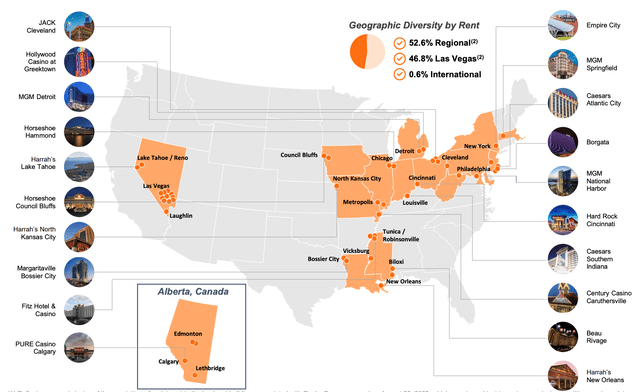

VICI is a specialized REIT focused on gaming and entertainment properties. The REIT owns just 50 properties, 46 in the US and 4 in Canada. Unsurprisingly a large portion of the portfolio (47%) is concentrated in the casino capital of the world Las Vegas, where VICI completely dominates as it owns about half of the trophy assets located on the Strip. These include some of the best casinos and hotels such as Caesars Palace, The Venetian, Mandalay Bay, MGM Grand and many others. In total the company owns almost 700 acres across the Strip and over 40,000 hotel rooms.

Even though the real estate market appears to be quite frozen in terms of transactions, VICI is continuing to expand its portfolio quite aggressively. In Q1 2023 the company completed their first international transaction, a sale-leaseback of four PURE Canadian Gaming assets. In addition to this they also acquired the remaining 49.9% stakes in MGM Grand and Mandalay Bay, which they previously owned via a JV with Blackstone. Beyond straight forward acquisitions, VICI also announced investments with Hard Rock Ottawa ($85 Million of senior secured notes purchased from Hard Rock with proceeds to be used for redevelopment) and with Great Wolf Lodge ($290 Million construction loan). These acquisitions are a testament to VICI's good relationships with its tenants which enable them to grow in many different ways.

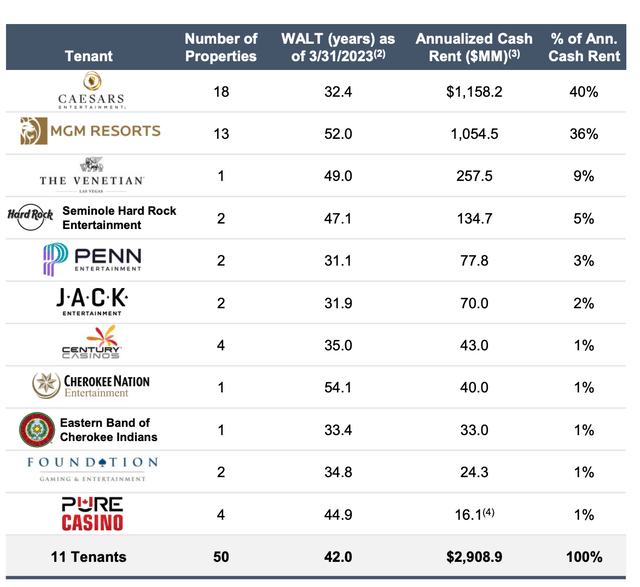

VICI's lease terms are amongst the best I've seen (honestly probably the best). With an average asset size of nearly $60 Million, VICI's tenants are all large reputable companies. The REIT has only 11 tenants in total, and 76% of all rent comes from S&P 500 tenants. Not only that but 81% of rent is covered by a master lease and 91% has parent company guarantees. What this means, is that the company doesn't have to worry about rent collection at all. Moreover with the average remaining lease term of a staggering 42 years (inclusive of all tenant renewal options), it doesn't have to worry about occupancy either as it's currently fully occupied.

Finally, management really tries to show how well protected they are against inflation. They have an entire slide in their presentation dedicated to the percentage of CPI-linked leases. In particular, they show that 50% of rents are currently CPI-linked and that this percentage will increase to 96% by 2035. Since the company only has a handful of tenants, I've gone through the lease terms for each one of them in the supplement and unfortunately I find this misleading. This is because a large percentage of leases, although CPI-linked, have caps at 3% annual increases. I wouldn't call that inflation protected. If we consider only truly CPI-linked leases then these account for 43% of total rent and this number won't really change going forward. Still with an average minimum annual contractual rent escalation of 1.9% for the whole portfolio and over a third of leases CPI-linked without caps, VICI's inflation protection is amongst the best of any net lease REIT I've seen.

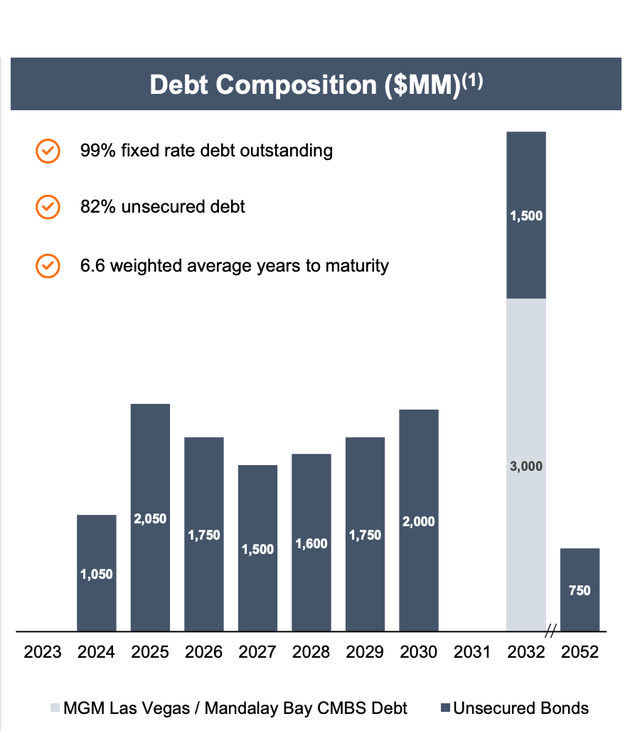

Solid balance sheet with abundant liquidity

In terms of leverage, the company has roughly $17 Billion in debt, which is 5.7x adjusted EBITDA. That's relatively high and has likely been reflected in a BBB- rating, but given their extremely long leases with above market terms, I don't mind. Their debt is all fixed (99%) at a weighted average interest rate of 4.34%. Maturities are reasonably spread over time, and the company has abundant liquidity of $4 Billion - $650 Million in cash, $2.4 Billion available on their credit facility and $860 Million of net proceeds from January forward sale agreements (raised through the sale of 30.3 Million shares).

Good growth prospects

Total AFFO reached $530 Million in Q1 2023 (up 73% YoY), while AFFO per share totaled $0.53 per share (up 18.6%). The difference between AFFO growth and per share growth is of course due to an increase in the number of shares, which has been quite significant (680 Million in Q1 2022 and 1 Billion in Q1 2023). This sharp increase was explained by management on the earnings call as follows:

share count increased primarily from equity raise and shares issued to fund our acquisition of the MGM Grand and Mandalay Bay JV this quarter and to consummate our acquisitions of MGP during Q2 and the Venetian Resort during Q1 of last year.

Normally I would find such a sharp increase in the number of shares worrying, but since the share price has done quite well over the period, the market has clearly recognized that the company is able to create value by investing the newly raised capital.

In terms of growth, management has reaffirmed their 2023 guidance for AFFO per share of $2.10-2.13, which would represent a 10% increase YoY. They also noted that they're basically done with new share offerings for the year (only expecting an extra 0.5% until the end of the year), as all planned acquisitions are covered by already available liquidity. Beyond this year, the general consensus is for growth to slow to a more modest 4-5% per year.

The company currently pays a dividend of $0.39 per share which represents a yield of 5%. That's pretty standard for a net lease REIT. The yield is also quite well covered with AFFO per share of $0.53 in line with the target 75% AFFO payout. If AFFO growth by 10% this year as expected, it's likely that the board will increase the dividend, as they have in the past.

Valuation

VICI is in a league of its own so peers are very difficult to find, still I think a comparison to other established net lease REITs is useful, because although the properties may be completely different, the lease terms can be quite similar. Agree Realty Corporation (ADC) in particular, which I've covered recently, also has a large percentage of CPI-linked leases and the majority of its tenants are investment grade companies. That makes for a pretty good comparison.

VICI stock currently trades at 15x AFFO which is roughly where it has traded historically since its IPO in 2018. ADC trades at 16.4x which suggests that VICI's price is reasonable. When we consider that ADC is only expected to grow by 3-5%, it's not farfetched to value VICI at 16.5x.

So what can we expect from VICI for the next couple of years?

- 5% dividend yield growing in line AFFO

- 10% AFFO growth this year and 4-5% beyond

- slight 10% upside from multiple expansion

- total expected annual return of 10-12%

That's a solid return and one that I consider to be amongst the safest in REIT, which is why I issue a "BUY" rating for VICI here at $31 per share with a PT of about $40 per share.

This article was written by

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.