Tracking Stanley Druckenmiller's Duquesne Family Office Portfolio - Q1 2023 Update

Summary

- Duquesne Family Office's 13F portfolio value increased by 14% to $2.31B in Q1 2023, with 29 securities significantly large.

- Microsoft, Alphabet, Amazon, IQVIA Holdings, News Corp, and Taiwan Semi were among the new stakes established during the quarter.

- Cenovus Energy, Lennar Corp, Deere & Co, and Datadog were among the stake disposals in Q1 2023.

Neilson Barnard

This article is part of a series that provides an ongoing analysis of the changes made to Duquesne Family Office's 13F stock portfolio on a quarterly basis. It is based on Stanley Druckenmiller's regulatory 13F Form filed on 5/15/2023. The 13F portfolio value increased ~14% from $2.02B to $2.31B this quarter. The holdings are concentrated with recent 13F reports showing around 55 positions, many of which are very small. There are 29 securities that are significantly large (more than ~0.5% of the portfolio each) and they are the focus of this article. The largest five stakes are Coupang, Nvidia, Microsoft, Eli Lilly, and Lamb Weston Holdings. They add up to ~50% of the portfolio. Please visit our Tracking Stanley Druckenmiller's Duquesne Portfolio series to get an idea of their investment philosophy and our previous update for the fund's moves during Q4 2022.

Stanley Druckenmiller started the family office in Q4 2011 after closing his hedge fund Duquesne Capital in 2010. Prior to that, he managed George Soros's Quantum Fund between 1988 and 2000. He follows a trend following trading style that is similar to George Soros. To know more about Druckenmiller's trading style check out Trend Following: Learn to Make Millions in Up or Down Markets.

New Stakes:

Microsoft Corp. (MSFT): MSFT is a large (top three) 9.11% of the portfolio position established this quarter at prices between ~$222 and ~$288 and the stock currently trades well above that range at ~$333.

Note: MSFT is back in the portfolio after a quarter's gap. It was a 2.56% of the portfolio position built in 2017 at prices between ~$60 and ~$90. Q1 2021 saw a ~20% stake increase at prices between ~$213 and ~$245. There was a ~63% reduction over the next two quarters at prices between ~$236 and ~$305. That was followed with a ~75% selling during Q3 2022 at prices between ~$233 and ~$294. The elimination last quarter was at prices between ~$214 and ~$257.

Alphabet (GOOG), Amazon.com (AMZN), IQVIA Holdings (IQV), News Corp. (NWS), and Taiwan Semi (TSM): GOOG is a ~4% of the portfolio position purchased this quarter at prices between ~$87 and ~$109 and the stock currently trades above that range at ~$124. The 3.62% AMZN stake was established at prices between ~$83 and ~$113 and the stock is now above that range at ~$123. IQV is a ~4% of the portfolio position established this quarter at prices between ~$188 and ~$241 and the stock currently trades at ~$199. The 2.53% NWS stake was purchased at prices between ~$16 and ~$22 and it is now at ~$19. TSM is a 2.33% of the portfolio position established at prices between ~$74 and ~$98 and it currently trades at ~$99.

Note: AMZN is back in the portfolio after a quarter's gap. It was a top three 5.81% of the portfolio stake established during Q3 2022 at prices between ~$106 and ~$145. The disposal last quarter was at prices between ~$82 and ~$121.

Skechers U.S.A. (SKX), Illumina, Inc. (ILMN), Marvell Technology (MRVL), and Barrick Gold (GOLD): These very small (less than ~1.10% of the portfolio each) stakes were established during the quarter.

Stake Disposals:

Cenovus Energy (CVE): CVE was a 2.60% of the portfolio position that saw a ~220% stake increase last quarter at prices between ~$15.50 and ~$21.50. The disposal this quarter was at prices between ~$15.50 and ~$20.40. The stock currently trades at $16.50.

Lennar Corp. (LEN) and Deere & Co. (DE): The ~2% LEN stake was purchased last quarter at prices between ~$71 and ~$94. The elimination this quarter was at prices between ~$92 and ~$108. It is now at ~$108. DE was a 1.55% of the portfolio position established last quarter at prices between ~$334 and ~$446. The stake was sold this quarter at prices between ~$386 and ~$440. The stock currently trades at ~$353.

Datadog (DDOG): The 1.21% DDOG stake was established during Q2 2022 at prices between ~$82 and ~$157. The next quarter saw a ~165% stake increase at prices between ~$86 and ~$118 while in the last quarter there was a ~58% selling at prices between ~$67 and ~$95. The disposal this quarter was at prices between ~$63.50 and ~$89. The stock is now at ~$95.

Alnylam Pharma (ALNY), AT&T Inc. (T), Cameco Corp. (CCJ), Caterpillar Inc. (CAT), D.R. Horton (DHI), Las Vegas Sands (LVS) Calls, Occidental Petroleum (OXY), Ovintiv Inc. (OVV), Parker-Hannifin (PH), Pioneer Natural Resources (PXD), Samsara Inc. (IOT), and Vale S.A. (VALE): These small (less than ~1.3% of the portfolio each) stakes were disposed during the quarter.

Stake Increases:

NVIDIA Corp (NVDA): NVDA is a large (top three) 9.53% of the portfolio stake purchased last quarter at prices between ~$112 and ~$181. There was a ~35% stake increase this quarter at prices between ~$143 and ~$280. The stock currently trades well above those ranges at ~$398.

Lamb Weston Holdings (LW): The large (top five) ~9% LW position was built during the last two quarters at prices between ~$73 and ~$90 and it is now at ~$112. There was a ~20% increase this quarter at prices between ~$87 and ~$105.

Teck Resources (TECK): TECK is a 5.12% of the portfolio stake purchased in Q1 2022 at prices between ~$29 and ~$42. The next quarter saw a ~55% reduction at prices between ~$26 and ~$46. There was a ~200% stake increase in the last three quarters at prices between ~$26 and ~$44. The stock currently trades at $40.96.

Note: TECK has seen a previous recent roundtrip. It was a 2.47% of the portfolio position built in Q4 2020 at prices between ~$12.25 and ~$18.85. The bulk of it was sold in Q3 2021 at prices between ~$19.50 and ~$26.80.

KBR, Inc. (KBR): The 4.29% KBR position saw a ~110% stake increase over the four quarters through Q3 2022 at prices between ~$40 and ~$57. The stock is now at $59.45. The last two quarters saw only minor adjustments.

T-Mobile US (TMUS) & rights: The ~3% TMUS stake was established in Q2 2020 at prices between ~$82 and ~$107. Next quarter saw a ~20% stake increase while in Q4 2020 there was a similar reduction. There was a ~63% selling over the next three quarters at prices between ~$118 and ~$149. That was followed with a ~25% reduction during Q2 2022 at prices between ~$122 and ~$139. The last quarter saw another ~37% selling at prices between ~$132 and ~$152. The stock currently trades at ~$139. There was a ~10% increase this quarter.

Natera Inc. (NTRA): The 2.15% NTRA stake was established over the last three quarters at prices between ~$32 and ~$58 and it is now at $49.29.

Advanced Micro Devices (AMD): The small 1.40% AMD stake saw a minor ~7% stake increase this quarter.

Stake Decreases:

Eli Lilly (LLY): LLY is a large (top five) ~9% of the portfolio position purchased during Q2 2022 at prices between ~$279 and ~$327. There was a ~150% stake increase in the last two quarters at prices between ~$296 and ~$375. The stock currently trades at ~$437. This quarter saw a ~18% trimming.

Meta Platforms (META): The 2.20% stake in META was primarily built last quarter at prices between ~$89 and ~$140. There was a ~75% reduction this quarter at prices between ~$125 and ~$213. The stock is now at ~$273.

Chevron Inc. (CVX): A large CVX stake was purchased during the two quarters through Q1 2022 at prices between ~$102 and ~$171. There was a ~28% selling in the two quarters through Q3 2022 at prices between ~$136 and ~$181 while the last quarter saw a ~42% stake increase at prices between ~$144 and ~$188. This quarter saw the position sold down by 75% to a small 1.58% portfolio stake at prices between ~$152 and ~$188. The stock currently trades at ~$152.

Vertiv Holdings (VRT): VRT is a 1.26% of the portfolio stake established during Q3 2022 at prices between ~$8.25 and ~$13.50 and it now goes for ~$19.40. There was a ~20% stake increase last quarter at prices between ~$10 and ~$15. This quarter saw a two-thirds reduction at prices between ~$13 and ~$16.50.

Option Care Health (OPCH): OPCH is a 1.11% of the portfolio position established last quarter at prices between ~$28 and ~$35 and the stock currently trades at $27.73. There was a ~50% reduction this quarter at prices between ~$28 and ~$33.

Arch Resources (ARCH), Palo Alto Networks (PANW), Phillips 66 (PSX), and WillScot Mobile Mini (WSC): These small (less than ~1% of the portfolio each) stakes were reduced during the quarter.

Kept Steady:

Coupang Inc. (CPNG): CPNG had an IPO last March. Shares started trading at ~$49 and currently goes for $16.11. Druckenmiller had a 10.5M share stake that went back to funding rounds prior to the IPO. There was a ~50% stake increase in Q3 2021 at prices between ~$28 and ~$44.50. Q4 2021 saw another ~15% stake increase at prices between ~$26 and ~$31. It is currently their largest stake at ~13% of the portfolio.

Freeport-McMoRan (FCX): FCX is a 1.48% of the portfolio position purchased in Q4 2019 at prices between ~$10 and ~$13.50. Next quarter saw a ~70% selling at prices between ~$5.50 and ~$12.90. Q2 2020 saw the stake rebuilt at prices between ~$6.25 and ~$10.90. The two quarters through Q3 2021 had seen a ~25% selling at prices between ~$30 and ~$45. That was followed with a one-third reduction during Q2 2022 at prices between ~$29 and ~$51. The last two quarters saw another ~75% selling at prices between ~$25 and ~$40. The stock currently trades at $35.47.

Recursion Pharma (RXRX): The very small 0.40% stake in RXRX was kept steady this quarter.

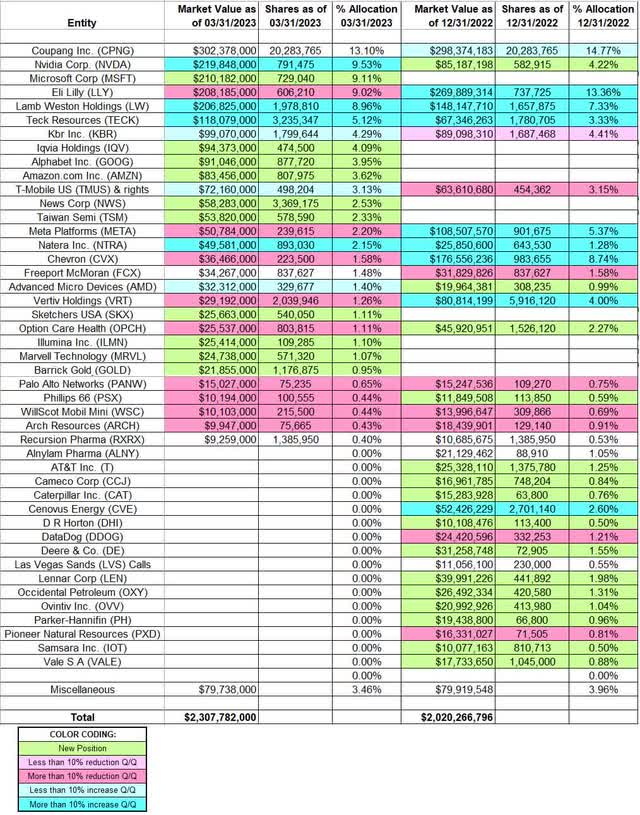

Below is a spreadsheet that highlights the changes to Stanley Druckenmiller's Duquesne Family Office 13F stock portfolio as of Q1 2023:

Stanley Druckenmiller - Duquesne Family Office's Q1 2023 13F Report Q/Q Comparison (John Vincent (author))

This article was written by

Analyst’s Disclosure: I/we have a beneficial long position in the shares of CPNG, AMZN, GOOGL, META either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.