XPeng Vs. NIO: Which Is The Best Auto Stock To Buy?

Summary

- XPeng and NIO have both struggled amid the ongoing price war in the Chinese EV market.

- Strong fundamentals make XPeng a better long-term speculative EV play.

- XPeng's valuation is lower when compared to NIO.

- Looking for more investing ideas like this one? Get them exclusively at Outsider Growth Investing. Learn More »

sarawuth702

XPeng (NYSE:XPEV) has better fundamentals than NIO (NIO) over the long term, and a more attractive valuation right now, making it a better long-term speculative play in the global electric vehicles investment theme.

Background

As I’ve analyzed in previous articles, I invest across several secular growth themes including semiconductors, 5G, digital payments, and electric vehicles (EVs), beyond other themes. In the EV theme, one stock that I have been bullish over the past couple of years has been XPeng, while I’ve also owned Tesla (TSLA) in the past and currently also own lithium producers Albemarle (ALB) and Livent (LTHM) in my portfolio.

While I consider XPeng to be a good play on the growing Chinese EV market over the long term, competition has been quite fierce in recent months, and the company, and some of its closest peers, have struggled over the past few quarters to grow and remain profitable as investors were expecting some time ago.

Given this background, XPeng’s share price has been on a downtrend over the past year (white line in the next graph), being an underperformer compared to other potential plays on the Chinese EV theme for U.S. investors, namely NIO and Li Auto (LI).

Share performance (Bloomberg)

Given that both XPeng and NIO have declined significantly over the past year, in this article I compare which one is a better buy right now for long-term investors, while personally I’m willing to allocate more capital in this growth theme and may increase my position on XPeng, or diversify and also buy some NIO stock.

Business Strategy

As a long-term investor, one factor that I think is critical to invest in a company is its business strategy over the medium term. XPeng and NIO have a similar business profile and strategy, as both companies are EV focused and have strong technological capabilities, even though in my opinion XPeng’s autonomous driving technology is more advanced than NIO and is closer to Tesla’s capabilities.

This means that XPeng’s and NIO's business models can be considered to be similar to Tesla to a large extent, showing that Chinese EV start-ups were clearly inspired by Tesla’s success story and have replicated its business model to a large extent.

However, XPeng has developed more advanced in-house technology compared to NIO, being a key reason why I have preferred XPeng in the past, a profile that has not changed much in the past few months. Beyond that, both companies have expanded their sales and services network in China in recent years, plus have an internationalization strategy to expand in European countries and potentially other regions in the future.

While there aren’t many differences between the two companies in several aspects, two important reasons why I prefer XPeng is its charging network and its own production facilities, while NIO has a battery-as-a-service strategy and outsources most of its production.

NIO has tried to distinguish itself from its competitors through its battery swap stations, offering a convenient and fast way of having the battery fully charged compared to other alternatives. NIO also offers a rechargeable network like other competitors do, but the battery-as-a-service model is quite unique to its business model. Nevertheless, this approach has been tried by other companies in the past, including Tesla which also had a battery swap option in the past, but scrapped this service due to lack of customer interest and focused instead on the development of its supercharging network.

As I’ve covered in a previous article, I don’t like the battery-as-service (BaaS) approach due to its large capex requirements and some specific operating costs, which makes the financial profitability of this service highly questionable.

Additionally, there was a short seller report from Grizzly Research LLC one year ago that raised several questions about NIO’s battery service, namely how it's organized between different group companies and if NIO is under-reporting costs associated to its BaaS offering, which the company has refuted and performed an internal review and found no evidence of wrongdoing, but this will remain a question mark for investors for some time, in my opinion.

Moreover, NIO has an arrangement with Jianghuai Automobile Group for the production of its models, which means that NIO does not have full control over the production of its cars while, on the other hand, XPeng has invested in recent years in the development of its own factories.

I think this is another competitive advantage of XPeng over NIO, because it allows XPeng to have better cost control and achieve higher efficiency, while NIO has to compensate its manufacturing partner for potential operating losses, making it more difficult to achieve breakeven in the next few years.

This has become more important since Q4 2022, when a price war began in China among EV companies and led to much lower business margins for all companies in the market, putting further pressure on NIO’s business model sustainability.

Regarding both companies model line-up, NIO has positioned itself more on the premium segment while XPeng was more present in the mid-market segment. Nevertheless, XPeng has recently released some more upscale models, such as the G9 SUV, but both companies have expanded their model line-up and offer now several SUVs and sedans to a broad range of potential customers, thus I don’t think there is any edge here comparing the two companies.

Recent Developments and Earnings

While I consider the long-term growth prospects of both companies to be quite good, as EV penetration in China and Europe is growing rapidly, boding well for EV-focused companies like XPeng and NIO, on the other hand competition is quite fierce and the auto industry is quite challenging for new entrants to become profitable.

This happens because there are a lot of fixed costs, related to production, logistics, sales, and repair services, that make the auto industry highly dependent on economies of scale. This means that auto manufacturers need to reach some size to become profitable, and usually profitability is only achieved if annual production reaches thousands of cars.

Taking this into account, recent developments in the EV segment have been negative for both companies, due to supply-chain bottlenecks that were affecting the production and sales of new cars in China and abroad, China’s zero-COVID policy, and more recently an EV price war in China triggered by Tesla last October.

While China’s EV average selling price is lower than compared to other markets, recent price cuts have failed to materially lead to growing deliveries across the market, being an important headwind for the profitability of automakers, including XPeng and NIO, but also BYD (OTCPK:BYDDF) or Tesla. Nevertheless, the EV market is expected to reach 8.5 million units in 2023, an increase of 35% YoY.

Due to the challenging backdrop, not surprisingly, both XPeng and NIO delivered somewhat underwhelming numbers last year, both regarding deliveries and profitability.

Indeed, XPeng delivered 120,757 cars during 2022 (+23% YoY) and NIO delivered 122,486 units (+34% YoY), representing a significant decline in growth rates compared to the previous year. Total revenues amounted to $3.6 billion for XPeng (+24% YoY), while NIO’s revenues were above $7.1 billion due to a much higher average selling price per unit.

Despite higher deliveries and revenues, gross margins declined due to the price war, especially in Q4. For the full year, XPeng’s gross margin was 11.5% and NIO's gross margin was 10.4%, but related to Q4 XPeng reported a gross margin of 8.7% and NIO of only 6.8%. This clearly shows the negative impact of lower prices on the company’s profitability, a situation that is not expected to reverse soon. For the full years, XPeng’s net loss was $1.3 billion and NIO reported a net loss above $2 billion.

While operating trends were not particularly strong in Q4 2022, during the first few months of 2023 the background has not improved much, with both companies struggling to grow deliveries and margins.

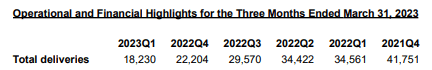

During the first three months of 2023, XPeng reported 18,230 units, a decrease of 17.9% YoY, or a monthly average of only about 6,000 units. In April the company delivered slightly above 7,000 units and 7,500 units in May, thus in Q2 the company should deliver some 22,000 units, which will represent a decline of 36% YoY. This clearly shows that the ongoing price war in China is taking a strong toll on the company’s growth, especially considering that the first half of 2022 was quite weak due to several lockdowns in China and supply-chain issues.

Deliveries (XPeng)

NIO also is struggling to grow in recent months, considering that while during Q1 its total deliveries amounted to 31,000 units (+20.5% YoY), its delivery pace has clearly slowed over the past couple of months as the company only delivered 6,600 units in April and 6,155 in May. Therefore, at this pace, its quarterly deliveries should be below 20,000 units, or a quarterly decline of 35%.

Lower quarterly deliveries for XPeng already has a strong effect on revenues, given that is reported Q1 revenues of only $590 million, a decline of 45.9% YoY, while NIO will only report its quarterly results next week, but current consensus is to report revenues of $1.65 billion (+5% YoY), a more resilient performance during the period even though in Q2 its drop should be more similar to XPeng taking into account its weak deliveries in the first two months of the quarter.

More worrisome than declining deliveries and revenues is the negative impact that the ongoing EV price war in China is taking on the company’s gross margins. XPeng reported a quarterly gross margin of only 1.7% in Q1 (vs. 12.2% in Q1 2022) and vehicle margin was negative 2.5% in Q1. This means that XPeng is now losing money on each car its sells, which is not a good position to be in. NIO is expected to report a gross margin of 7.5% in Q1, but considering the decline in deliveries during Q2, it’s quite likely that gross margin will also decline to a very low number in Q2, not boding well for profitability.

This shows that competition in the EV market is quite strong in China, while Tesla’s cost advantage and pricing strategy is taking a great impact on competitors. While Tesla’s gross margin also declined considerably, from 29% in Q1 2022 to about 19% in the last quarter, the company stopped to cut prices during Q2, thus its gross margin is not likely to compress further and Tesla can easily maintain prices and remain profitable, while pushing other competitors into a difficult position.

XPeng has recently presented a new vehicle platform that should allow it to reduce costs and be more competitive, plus a new mid-market SUV called G6, which should help it to be more competitive in the short term.

However, XPeng in a recent event acknowledged that an automaker needs to sell some 3 million units annually if it wants to survive over the long term, which may not be easy to achieve both for XPeng and NIO. This means that many EV start-ups will go bust in the future, or will be acquired or combine with other competitors, as the auto industry is not easy for new entrants to become profitable in a sustainable way over the long term. Moreover, Tesla clearly has a first-mover advantage in this segment, which will not be easy to challenge both for legacy automakers and EV start-ups over the coming years.

Conclusion

The ongoing EV price war in China has taken a great impact on both XPeng and NIO, and the business prospects of both companies are currently quite uncertain given that business margins have collapsed and deliveries have been quite week in recent months. Despite that, I believe XPeng has better prospects of becoming as relevant global automaker over the long term due to its stronger business model and better technological capabilities, which are quite important for its long-term success.

Moreover, XPeng is currently trading at some 1.4x EV/revenues, while NIO is trading at more than 2x EV/revenues, thus from a valuation perspective XPeng also seems to be a better choice, even though investors should consider an investment on these companies as highly speculative and have a relatively small weight in their stock portfolio.

Editor's Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

If you are a long-term investor and want to be exposed to several secular growth trends, check out my marketplace service focused on different secular growth themes, namely: Digital Payments / FinTech, Semiconductors, 5G / IoT / Big Data, Electric Vehicles, and the Metaverse. If this is something that you may be interested in sign up today.

This article was written by

I invest with a long-term perspective in industries/themes that have secular growth prospects and should deliver strong returns in a time frame of 10-15 years. Currently, I'm invested in Digital Payments/Fintech, Semiconductors, 5G/IoT/Big Data, Electric Vehicles, and the Metaverse.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of XPEV either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.