WTMF: May Not Provide The Hedge Investors Expect

Summary

- The WisdomTree Managed Futures Strategy Fund (WTMF ETF) is an actively managed ETF aiming to achieve positive returns in various market conditions.

- The fund utilizes a quantitative, rules-based strategy to capture trends in equity, commodity, currency, and U.S. treasury futures, and may invest up to 5% in bitcoin futures.

- While the WTMF ETF has returned an impressive 9.6% YTD, its historical performance suggests it may not offer diversification benefits that investors expect from managed futures funds.

asbe

Investors looking to build long-term diversified portfolios often look to add a 'managed futures' strategy to their portfolios. In theory, managed futures funds simply follow price trends and can make money in both up and down markets. Unfortunately, for retail investors, there are not many good managed futures funds to choose from.

While many investors have flocked to the iMGP DBi Managed Futures Strategy ETF (DBMF), giving the fund almost $750 million in assets, I have written several cautious articles on the DBMF ETF's strategy, as I see a serious flaw in its design. Simply put, the DBMF ETF operates at a significant lag, as it uses regression analysis on top performing managed futures funds to build a replicating portfolio. In volatile markets, the DBMF ETF end up 'zigging' when it should be 'zagging'.

So I was pleasantly surprised to see that the WisdomTree Managed Futures Strategy Fund ETF (NYSEARCA:WTMF) has delivered a strong 9.6% total return YTD, outperforming peers like the DBMF ETF who were caught flat footed in the recent March bout of fixed income volatility. Could WTMF be the 'positive carry hedge' I have been searching for?

Unfortunately, WTMF's historical performance suggest it is not. Historically, when the market performs poorly, the WTMF ETF also performs poorly. This is not the desired behaviour from a managed futures strategy.

While WTMF's short term returns are impressive, I worry it may be a flash in the pan and WTMF may not deliver when it counts (when equities re-enter a bear market, for example). I would not recommend investors add the WTMF ETF to their portfolios.

Fund Overview

The WisdomTree Managed Futures Strategy Fund is an actively managed ETF pursuing a managed futures strategy that aims to achieve positive returns in both rising or falling markets that are not correlated to broad equity or fixed income returns.

The WTMF ETF is managed using a quantitative, rules-based strategy designed to capture both rising and falling price trends on listed equity, commodity, currency, and U.S. treasury futures. The ETF may also invest up to 5% of net assets into bitcoin futures. The WTMF ETF is rebalanced monthly.

The WTMF ETF is one of the longest-operating managed futures funds in the ETF space with an inception date of January 5, 2011. The WTMF ETF currently has $140 million in assets and charges a 0.65% expense ratio.

Portfolio Holdings

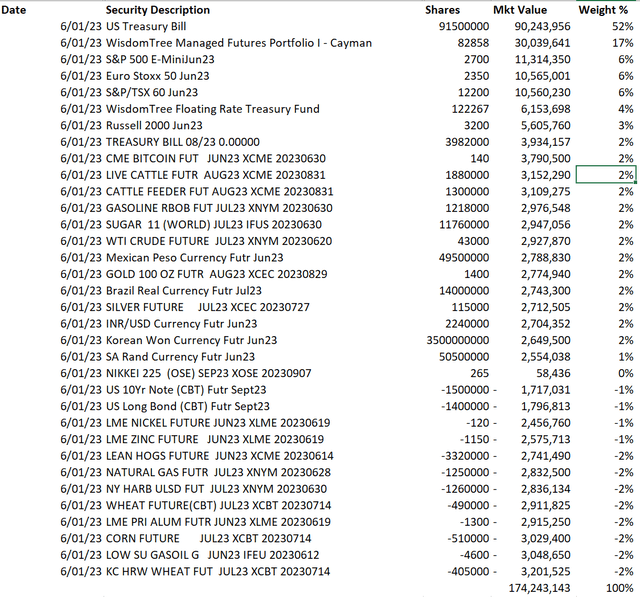

Figure 1 shows the current portfolio holdings of the WTMF ETF. As a managed futures strategy, it is normal for the WTMF ETF to hold lots of cash and treasury bills, as any excess cash is invested in short-term treasuries to earn a yield.

In terms of exposures, the WTMF ETF is currently long modest amounts of futures on equity indices like the S&P 500, the Euro Stoxx 50, and the S&P/TSX 60. It is short various commodities like Zinc, Wheat, and Natural Gas. The WTMF ETF does not appear to take any big bets, as its position sizes are relatively small at 1 to 6%.

Figure 1 - WTMF portfolio holdings (Author created from WTMF holdings report)

Distribution & Yield

The WTMF ETF pays an annual nominal distribution with trailing 12 month distribution of $0.22 or 0.6%.

Returns Have Been Modest

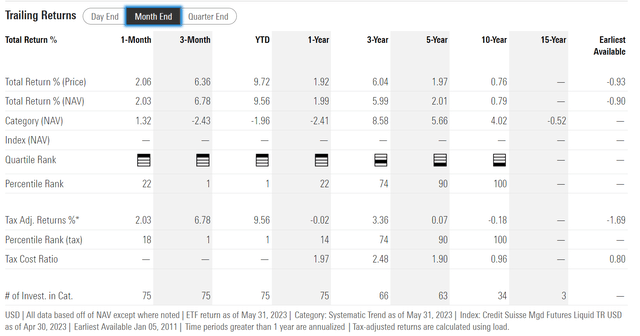

Overall, despite the strong YTD gains, the WTMF ETF has delivered very modest total returns, with 3/5/10Yr average annual returns of 6.0%/2.0%/0.8% respectively to May 31, 2023 (Figure 2).

Figure 2 - WTMF historical returns have been very modest (morningstar.com)

However, the main purpose of a managed futures strategy is not to deliver high absolute returns. Instead, investors allocate to the strategy in order to benefit from diversification.

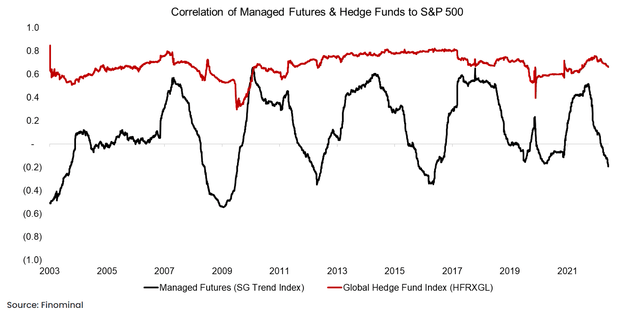

For example, according to data from finominal.com, managed futures strategies tend to have very low correlations with the S&P 500 (Figure 3).

Figure 3 - Managed Futures tend to have low correlation with the S&P 500 (finominal.com)

Adding a managed futures strategy to a diversified portfolio may enhance overall risk-adjusted returns if the managed futures strategy is able to deliver positive returns when equity markets suffer pullbacks.

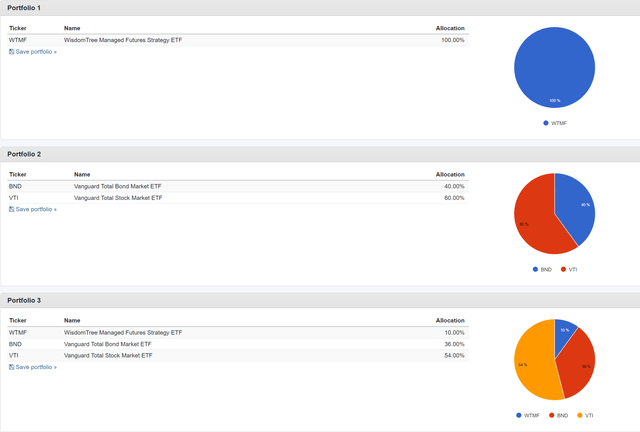

Unfortunately, based on WTMF's historical performance data, I do not see any meaningful diversification benefits from adding WTMF to a traditional 60/40 portfolio of equity and bonds (Figure 4).

Figure 4 - Adding WTMF to a 60/40 portfolio (Author created with Portfolio Visualizer)

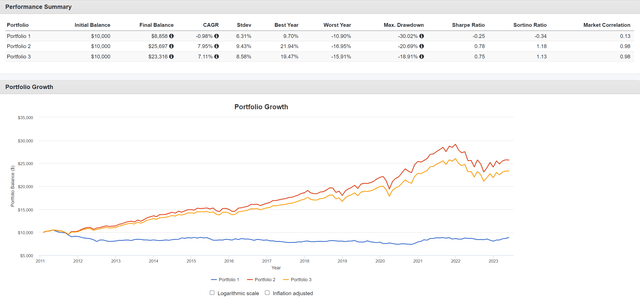

Using Portfolio Visualizer, we can see that the addition of a 10% allocation to the WTMF ETF combined with a 54/36 allocation between the Vanguard Total Stock Market Index Fund (VTI) and the Vanguard Total Bond Market Index Fund (BND) reduced CAGR returns without improving Sharpe and Sortino ratios (Figure 5).

Figure 5 - Adding WTMF to a 60/40 portfolio did not improve risk-adjusted returns (Author created with Portfolio Visualizer)

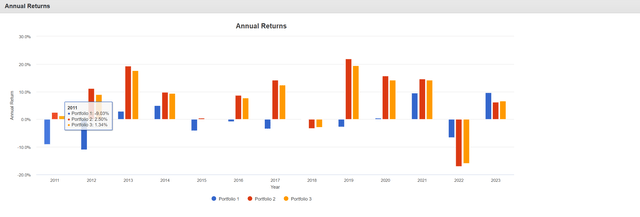

The problem appears to be, when the 60/40 portfolio performs poorly, like in 2015, 2018 and 2020, the WTMF ETF also performs poorly, offering no diversification benefits at all (Figure 6).

Figure 6 - WTMF did not offset poor 60/40 returns in 2015, 2018, and 2020 (Author created with Portfolio Visualizer)

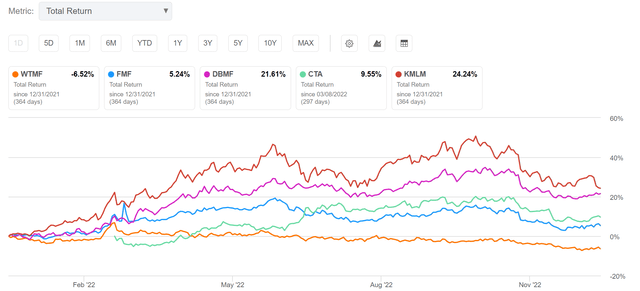

In fact, in 2022, when peer managed futures ETFs like the DBMF and the KFA Mount Lucas Index Strategy ETF (KMLM) delivered positive returns to help investors offset their poor performance in bonds and stocks, WTMF actually returned a disappointing -6.5% (Figure 7).

Figure 7 - WTMF returned -6.5% in 2022 while peers delivered positive returns (Seeking Alpha)

Conclusion

Although WTMF's 9.6% YTD return appears promising at first glance, upon further analysis, I am worried that the WTMF ETF does not offer the diversification benefits that managed futures funds should provide. For example, when a 60/40 portfolio performed poorly in 2015, 2018, and 2020, the WTMF ETF also performed poorly.

Furthermore, in 2022, when peer managed futures funds delivered positive returns to offset poor bond and equity returns, the WTMF delivered a disappointing -6.5% return.

While strong-short term returns are nice, I am more interested in a managed futures fund that can deliver modest absolute returns while significantly outperforming during market drawdowns; the proverbial 'positive carry hedge'. In my opinion, the WTMF is not such a fund.

This article was written by

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.