Taro Pharmaceutical: Potential Value In Sun Pharma Offer

Summary

- Taro received a $38/share offer from Sun Pharma last month.

- The deal represents a decent premium to the firm's market value at the time and a 12% premium to my estimate of fair value.

- Further insights reveal the deal could be valuable to Taro shareholders given all the contributing factors.

- With the new catalyst in place, I am revising the position to buy, not discounting the potential for a competing bid either.

Tero Vesalainen

Investment Summary

As it often does, the investment debate has swung on a dime for TARO Pharmaceutical Industries Ltd. (NYSE:TARO) after it received an offer from Sun Pharmaceutical Industries ("Sun Pharma"), the company's largest shareholder, to acquire the company for $38 per share. This is a welcomed turn in the story, given the firm's tremendous value erosion exhibited since 2015 (Figure 1a).

Previously, in February, I had written that TARO "ha(d) been an underwhelming performer versus key benchmarks over the last 6 years to date" given compressed earnings and erosion of return on existing capital. Here I extend the analysis further to show gross productivity and also provide unique insights into my views on the Sun Pharma acquisition.

Net-net, I am bullish following the announcement, as it suggests TARO is either mispriced or offering value, and I am not discounting the potential for another bid to come through from competing names. Revise to buy.

Figure 1 - Gap up off lows following Sun Pharma announcement (encircled). Now trading back at August 2022 highs

Figure 1a. - TARO long-term value erosion since 2015

Financials

I'll break the firm's most recent sets of numbers down in quarterly and annuals, as the major focus for me is on the acquisition (discussed below).

First turning to the Q4 FY'22 numbers, TARO exhibited a flat YoY growth in net sales, which increased by $3.3mm or 2.3% YoY. However, the gross on this fell to $75.7mm (51.6% of net sales) compared to $77.3mm (54.0% of net sales) in Q1 last year.

Notably, TARO's R&D investment increased by $1.4mm, and it booked another $9.0mm increase at the SG&A line. Consequently, the company's operating income declined to $9.3mm compared to $21.3mm in the previous year.

Looking at the full-year highlights, comparatively:

- Net sales increased by $11.6mm, indicating a modest growth trend.

- Again, the gross profit on this fell ~500bps YoY to $268.3mm (46.8% of net sales).

- Notably, settlements and loss contingencies of $61.4mm were booked for the year, concerning legal and antitrust matters. Excluding this impact, operating income for the year was $17.7mm compared to $63.5mm in FY'21.

Putting both periods into context, I've gone back to FY'20 using rolling TTM periods. In Figure 2, you'll note the firm's gross profit per unit of capital invested in productive assets. This has been trending lower over the past two years on a thinner asset base. This could be a strategic move by Sun therefore to snatch up a leaner TARO (discussed below), and therefore I believe the $38 could represent value for Sun given there's $45 in tangible book value per share. The question is, does this mean it is valuable for TARO shareholders?

Figure 2

Data: Author, TARO SEC Filings

Looking at it one way, given the financials above, the Sun deal could be a blessing in disguise for TARO shareholders. Consider the following points:

- Marginal growth with declining profitability

- The firm comes in with a 46% trailing gross margin after the last quarter, below the sector's 55% median.

- Top-line growth of 230bps YoY opens a question on opportunity cost as well. Hence, Sun undoubtedly observes mispriced value in TARO's assets in my view, which is unsurprising given the $1.7Bn in net asset value.

- Expense/Investment impact on GAAP operating income

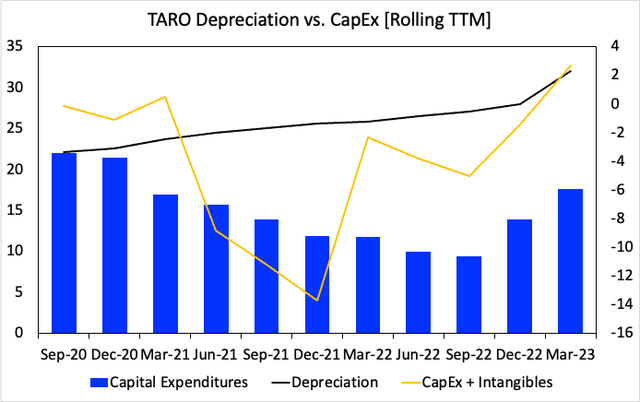

- The haircut to operating income is noted, yet, this stems from a combination of CapEx and more R&D and SG&A investment. Looking at Figure 3, this is exemplified well.

- The chart shows the total capital investment (tangible and intangible, not including NWC) over the last two years on a rolling TTM basis.

- The data shows TARO paring back its growth investments over the previous 2-years, only to pick this back up in the last few periods. This is only true when factoring in all uses of capital, however.

- Still, both CapEx and additional investment have only just begun to pick up again in 2023 for the firm.

Figure 3

Data: Author, TARO SEC Filings

Acquisition Proposal by Sun Pharma

Breaking down the deal into its sub-components helps to understand where the value is to be made. Here's the critical facts:

- Sun presented a proposal to acquire all outstanding shares of TARO through a reverse triangular merger.

- The proposed transaction structure involves Sun Pharma establishing a wholly-owned subsidiary (it will just be an SPV) that will merge with TARO, resulting in TARO becoming a wholly-owned subsidiary of Sun Pharma.

- The offer price is $38 per ordinary share, offering a premium of 31.2% over TARO's closing price on May 25, 2023, when the deal was announced.

- For Sun, this deal represents an absolute gift in my opinion, as with TARO's $850mm in cash on the balance sheet, its $1.43Bn market valuation equates to a vastly different c.$180mm enterprise valuation at the time of writing.

- Hence, it has Sun trading at ~3.6x forward EBITDA at the time of writing and this is good value, in my view.

Notably, the onset of this deal has changed my forward-looking assumptions on the outlook for investors. This is one clear example of where special situations, in this case, a potential merger or acquisition, can be played on the strategic side to unlock medium-term alpha. My specific thoughts on the acquisition proposal are as follows.

One, there's no doubt the proposal presents a clear liquidity opportunity for TARO's shareholders. At the offer, the purchase price represented a significant premium over the company's stock price, providing shareholders with an attractive valuation and the ability to realize 12% return from my estimate of intrinsic value. Longer-term holders will likely be appreciative of the $38 offer too. If you're a buyer of TARO in the long account, then $38 is the exit point for now.

The proposal by Sun presents a clear liquidity opportunity for Taro's shareholders. At the offer, the purchase price represented a significant premium over the company's stock price, providing shareholders with an attractive valuation and the ability to realize their investment. If you're a buyer of TARO in the long account, then $38 is the exit point for now.

Two, there is merit in the swift and sure transaction structure. The proposed reverse triangular merger structure aligns with standard practices in multiple jurisdictions and is expected to benefit all stakeholders (we'll wait and see the outcome on this, however). The formation of the SPV typically enables a swift and particular transaction, minimizing uncertainties and potential disruptions during the acquisition process. This must be considered, as frictional costs are often associated with a) intermediaries and b) unforeseen headaches, thereby reducing the value to be extracted from the potential buyout.

Three, my eyes had to read thrice to absorb that the proposed transaction was not subject to any financing contingency. Sun and TARO are well engaged in my view, and look to achieve a signing and closing of the deal in an expedited manner. No exact word on timings just yet, however. There's equal merit in this because the cost of capital is still volatile as all get out at the moment, forcing companies to re-think where to park money. Further, it makes taking on risks for corporations even less attractive. Consider that:

- Cash is now an attractive alternative at the moment, at c.4-5% starting yields in short-dated bills and notes (and some corporate accounts); hence, there is another hurdle to overcome with those returns on cash in place;

- The true cost of obtaining capital is also at multi-year highs, with tight money, 5-6% borrowing rates, and equity investors/seed rounds demanding higher required rates of return (15-30%) to compensate for the market risk.

Therefore the transaction makes sense to me for both parties to unlock risk capital in the future. This is further supported in findings on the valuation below.

Valuation

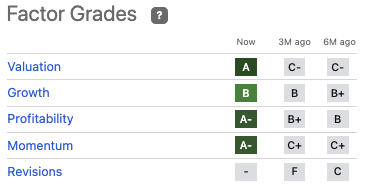

The market has TARO valued at 3.6x trailing EBITDA, and if this is the asking price for Sun, it will be paying this as well. That's a tidy multiple if you ask me. It is more than a 75% discount to the sector, and the market is probably using EV/EBITDA to value the stock, given the lack of earnings and the industry trades rich at 4x sales. You can see the positive rating to valuation in the quant factor grading system below.

Figure 4

Data: Seeking Alpha

The firm's book value is $1.7Bn, and thus, TARO trades at a discount to book deals on the market. But, as I write, this is also interesting - it is higher than the $1.43Bn market valuation, indicating the market expects the firm's steady-state value to compress further.

To illustrate:

- At a 12% hurdle rate and TARO's current market valuation of $1.43Bn, the market is expecting $172mm in forward EBITDA from the firm, a reversion towards the historical range (172/0/12 = $1,433). A 12% discount rate is fair and represents the long-term market averages.

- From its FY'22 numbers, this is a big step - 28% CAGR over the coming 5-year period. Is that too much of an ask?

Perhaps so, which is why the premium Sun is paying represents potentially good value for TARO shareholders. My numbers allow the company to do $158mm in pre-tax income over the coming years, below the $172mm the market expects. So I get to $1.3Bn or $34 per share on that valuation, a validating point of view. In that vein, current TARO shareholders may find tremendous value in this proposition, adding another $4/share or c.12% to my estimates of intrinsic valuation. And, there's a clear buyer in step ready to pay that 12% premium, not a bad offer.

I wouldn't rule out the possibility of a late competing bid, either. As is typically the case, M&A markets heat up around mid-year in various jurisdictions, and plenty of competing names will look for a bargain, in my opinion.

Conclusion

In conclusion, TARO showed mixed results, with net sales growth offset by gross profit and operating income declines.

The insights derived from this analysis emphasize the importance of maintaining profitability in order to attract a premium to valuation, as in my view Sun is getting a good deal here. This extends to TARO shareholders too, who, on my valuation estimate of $34/share, are getting 12% fixed upside on this with the acquisition. This is potentially an attractive proposition. Further, I wouldn't be ruling out the possibility of competing bids, given the compressed valuations with TARO also trading at a discount to book value. Net-net, I revise my position to a bullish one, and rate TARO a buy.

This article was written by

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, but may initiate a beneficial Short position through short-selling of the stock, or purchase of put options or similar derivatives in TARO over the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.