7% Yield - Main Street's Answer To The Retirement Crisis

Summary

- The retirement funding shortage crisis is growing, with many retirees and soon-to-be retirees requiring higher yields to sustain their livelihoods.

- Main Street Capital, a business development company, offers an attractive 7% yield and the potential to add high-quality long-term income to investors' portfolios.

- Despite its risks, Main Street Capital has demonstrated resilience and effective risk management, making it an appealing investment option for income-oriented investors.

takasuu

Introduction

In the title, I used the word Crisis, which isn't just attention-grabbing, but also highly appropriate given the severity of increasing retirement funding shortages.

This year, I started to focus more on investors requiring higher yields. Most of these investors are retirees or investors close to retirement.

Not only is this an important topic, in general, but it's increasingly important to address retirement funding shortages, which are becoming so bad that they could require significant intervention from the government.

Hence, this article is dedicated to shedding some light on these problems and presenting Main Street Capital (NYSE:MAIN), a business development company with a juicy 7% yield that has the ability to add income with an attractive risk/reward to investors' portfolios.

So, let's get to it!

How Bad Is It?

At the end of last month, I wrote an article titled Buy Alert: 3 Undervalued High-Yield Gems For Your Retirement.

I started the article by highlighting one of the reasons why I'm increasingly focused on income-oriented investors.

The number of retirees is now exponentially growing, which shifts demand to income-generating stocks. The same goes for my private clients. Most of them are now close to retirement.

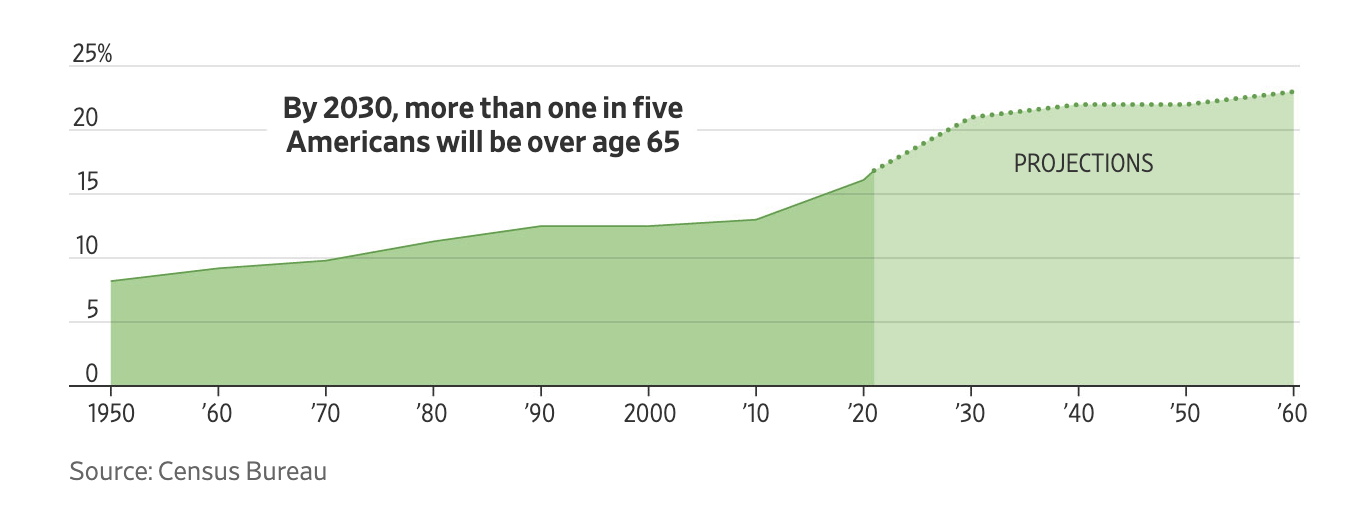

One of the charts I used to support my thesis can be seen below. We're currently in a very steep increase in the (projected) number of retirees. In 2010, roughly 13% of the population in the US was over 65. That number is soon to exceed 21%.

Wall Street Journal

The Wall Street Journal (which made this chart) noted that potential retirees have ambitious plans when it comes to saving for their old days. However, most are about to miss their targets by a mile.

Some aim to build nest eggs of $1 million, $2 million or more, though the majority of people have far less than that to work with. The recent bout of high inflation and market turmoil have added more anxiety to the challenge of making that money last.

Related to the quote above, not only has consumer sentiment gone down the drain, but we also see that a big part of the population in the US is now living paycheck to paycheck - even people with relatively high incomes!

CNBC

Based on that context, I just read an interesting article in the German WELT newspaper, which is one of my favorites with a no-nonsense view of the big picture. In this case, it elaborated on some of these retirement issues.

Their research found that over 40% of Baby Boomers have no retirement savings, and many work for small companies that do not offer employer-sponsored retirement plans.

These people are left to fend for themselves, while others are self-employed or live paycheck to paycheck due to low income.

During retirement, they rely solely on the Social Security system, which poses a problem. The average monthly benefit for a retired worker is approximately $1,800, while the average household of a person over 65 spends over $4,000 per month on expenses such as rent, groceries, and healthcare.

According to the article, an average 45-year-old American expects to need around $1.1 million by the time they retire. That's for a moderately comfortable retirement.

Furthermore, the Social Security system, which already has limited funds, is facing significant solvency problems. By 2033, accumulated reserves and surpluses may be exhausted due to the rapidly increasing demand. According to the Center for Retirement Research at Boston College, public pension plans had an average of only $0.75 for every dollar owed to future retirees in the previous year.

Now, policymakers are considering slowly shifting the retirement age to 70. Needless to say, that's cause for dissatisfaction.

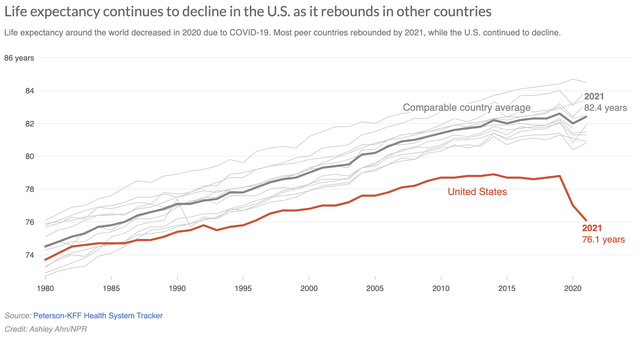

Also, looking at the life expectancy numbers below, this seems to be a calculation that somewhat incorporates an increasingly narrow window where people depend on social security.

NRP

While this article won't solve these issues, I am increasingly providing investors with stocks that come with higher income without exposing them to significant risks - after all, the risk/reward in the high-yield space is often misjudged - in my opinion.

That's where the MAIN ticker comes in.

High-Quality BDC Income

Based in Houston-Texas, Main Street Capital is a business development company ("BDC") that specializes in debt and equity funding to small and lower middle-market companies in the United States.

The company is a monthly dividend stock, which - as the name already suggests - distributes a monthly dividend instead of a quarterly dividend.

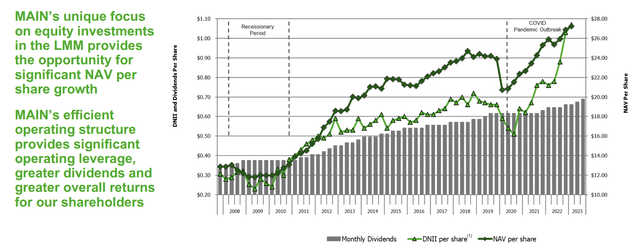

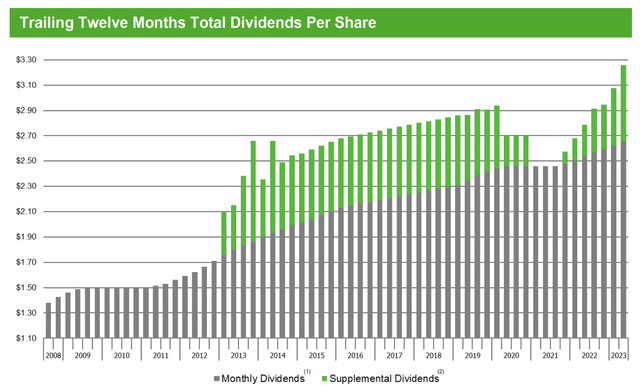

This monthly dividend has NEVER been cut, despite MAIN going through at least two major recessions since its IPO. Since 4Q07, its dividend has been hiked by 109%. The company uses supplemental (special) dividends to distribute excess cash.

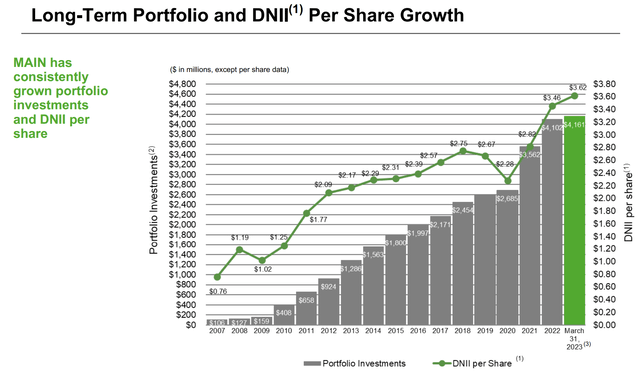

Looking at the chart below, we see that the company's monthly dividend is almost always covered by distributable income ("DNII" per share), except during steep recessions.

Main Street Capital

The following chart shows the company's total dividend, including its special dividend.

Main Street Capital

On May 2, MAIN hiked its regular dividend by 2.2% to $0.23, which implies a yield of 6.9%. The board also declared a supplemental dividend of $0.225 per share payable in June, representing its largest and seventh consecutive quarterly supplemental dividend.

Over the past ten years, the regular dividend has been hiked by 5.0% per year, which protects income against inflation.

With that said, MAIN's IPO was in 2007. Since then, it has grown into a company with $6.6 billion in capital under management. $5.0 billion of this is managed internally.

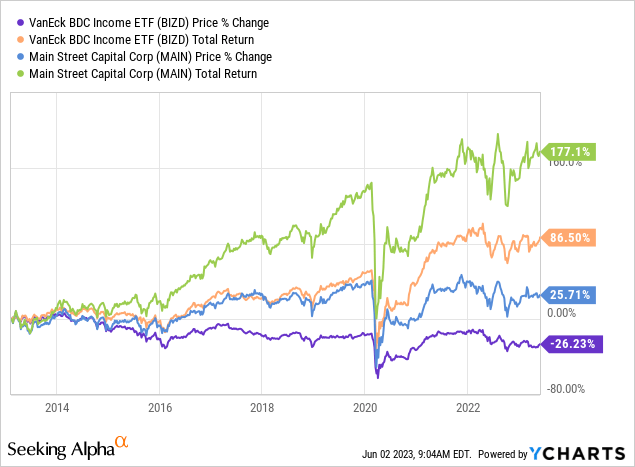

Since 2013, the MAIN stock had 26% capital gains. That is not a lot. However, we're dealing with yield vehicles here. Most of these high-yielding investments have no positive long-term capital gains at all. For example, the VanEck BDC Income ETF (BIZD) had 26% capital losses during this period.

Including reinvested dividends (total return), MAIN has returned 178% since 2013.

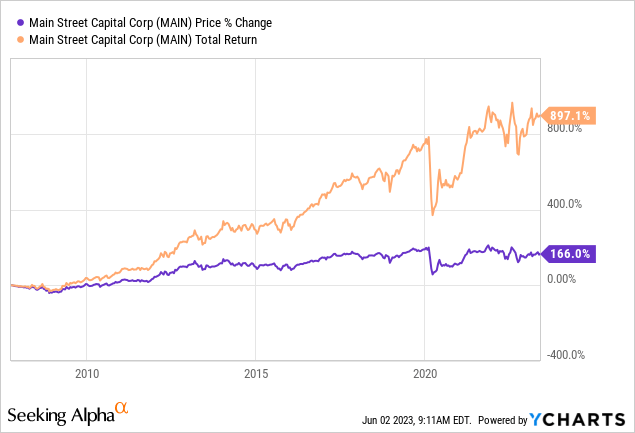

Since its IPO, MAIN has returned close to 900%. Its stock price has risen by 166%.

However, the most important takeaway here is the stability of its stock price (excluding dividends). Up until this day, MAIN investors did not have to sacrifice their hard-earned money just to get access to a steady cash flow of dividends. Most of the time, they were able to sell their position at a profit.

Needless to say, MAIN isn't risk-free. The opposite is true. While MAIN holds a portfolio of high-quality debt, it is prone to steep sell-offs during recessions.

After all, its business is highly cyclical and prone to credit risks.

MAIN shares regularly sell off 25% with steeper drawdowns during severe recessions like the Great Financial Crisis or the brief pandemic recession in 2020.

The good news is that MAIN always quickly recovers, which is due to its management and prudent lending strategy.

What Makes Main Street Capital So Special

While MAIN deals with risky debt, it does a great job managing risks.

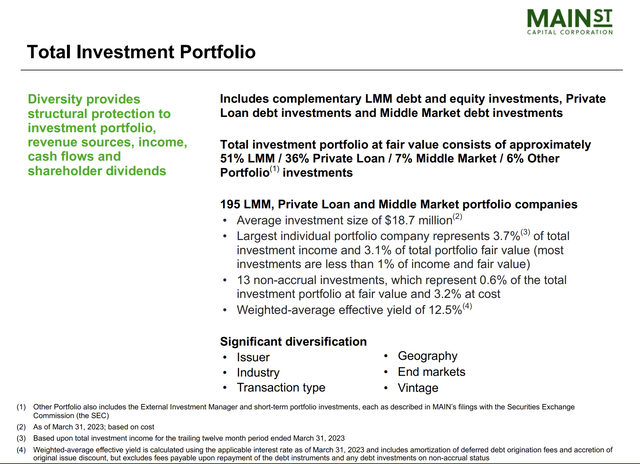

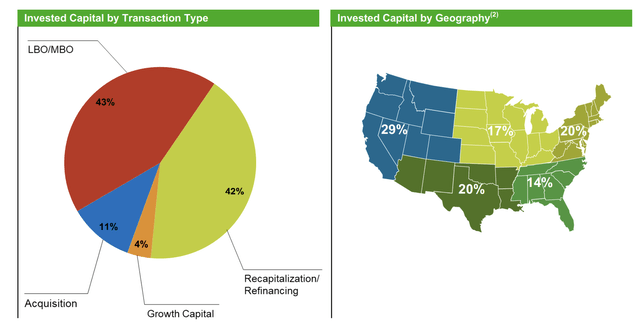

The company maintains a highly diversified portfolio with investments in 195 companies spanning over 50 different industries across their lower middle market, private loan, and middle market portfolios.

Main Street Capital

The largest portfolio company represents a small percentage of the total investment portfolio, while the majority of investments contribute less than 1% of income and assets.

Main Street Capital

Furthermore, while economic growth is weakening, MAIN is doing just fine.

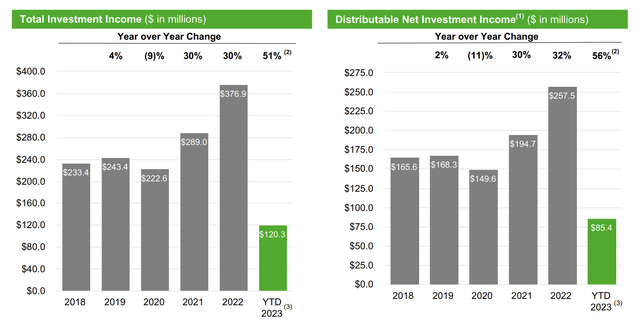

In the first quarter earnings call, the company expressed satisfaction with its operating results, highlighting several quarterly records achieved. These records included total investment income, NII (Net Investment Income) per share, DNII (Distributable Net Investment Income) per share, and NAV (Net Asset Value) per share.

- Total investment income for the first quarter increased by $40.9 million or 51% compared to the same period in 2022, reaching $120.3 million.

- Interest income saw a significant increase of $34 million from a year ago and $7.1 million from the previous quarter.

- Dividend income also rose by $7.6 million compared to the previous year and $1.8 million compared to the fourth quarter.

Main Street Capital

The growth in investment income was primarily attributed to the continued increase in benchmark index rates, contributing to more than half of the increases in both interest and dividend income.

Additionally, the expansion of the company's debt investments played a significant role in driving investment income growth.

However, it should be noted that the first-quarter investment income included elevated dividends and accelerated pre-payment and other activities, amounting to approximately $7.1 million or $0.06 per share above the average of the prior four quarters.

Main Street Capital

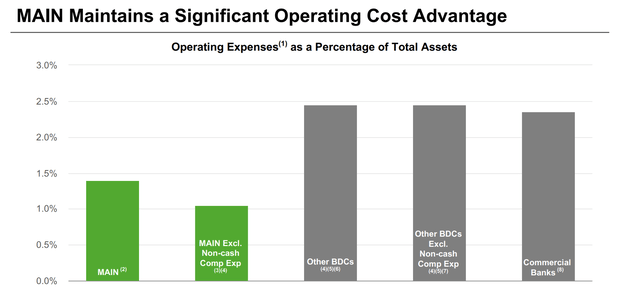

The company also shines when it comes to operating efficiencies. In the first quarter, operating expenses experienced a $12.1 million increase compared to the first quarter of 2022. This increase was mainly driven by higher interest expenses and compensation-related expenses.

Interest expense grew by $8.3 million due to higher interest rates on debt obligations, increased benchmark index rates, and higher average outstanding borrowings. Cash compensation expenses increased by $3.1 million, driven by favorable operating performance and increased investment activity.

Looking at the overview below, we see that MAIN's operations are much cheaper than comparable BDCs or commercial banks - without compromising on quality.

Main Street Capital

Even better, the company expects another strong quarter in the second quarter of 2023, with an expected DNII per share of at least $0.95. The level of dividend income and portfolio investment activities during the quarter could potentially exceed this target.

MAIN remains optimistic about its underlying portfolio's strength and believes that conservative leverage, strong liquidity, and continued access to capital will position them well for the future.

These comments are based on a favorable investment environment. Due to high rates, BDCs have become attractive sources of funding.

Despite the current broad economic uncertainty, we expect to continue to be active in our lower middle market strategy. Consistent with our experience in prior periods of broad economic uncertainty, we believe that the unique and flexible financing solutions we can provide to lower middle market companies and their owners and management teams should be an even more attractive solution today and should result in very attractive investment opportunities for us.

During the first quarter, the company remained active on the capital front. It added a new lender to its corporate revolving credit facility, increasing the total commitments by $60 million to $980 million.

Adding to that, the company executed an additional $50 million in unsecured private placement notes and raised a net amount of $41 million through the issuance of equity under their ATM program.

Furthermore, the company remains in great financial shape.

The company's regulatory debt-to-equity leverage, calculated by dividing total debt (excluding SBIC debentures) by net asset value, was 0.77 at the end of the quarter. This ratio indicates a slightly more conservative approach compared to the target range of 0.8x to 0.9x. Additionally, the regulatory asset coverage ratio stood at 2.3x, exceeding the target range of 2.1x to 2.25x.

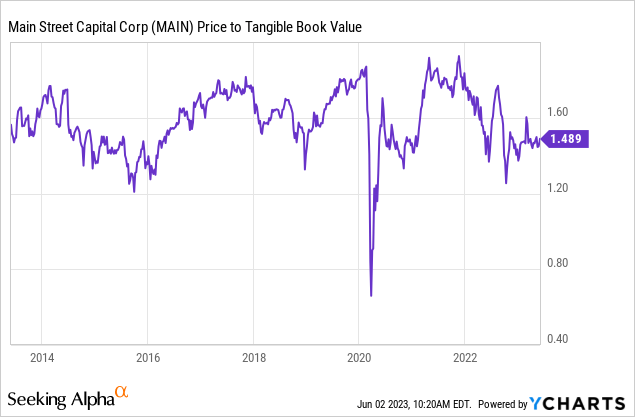

Please note that the company's valuation reflects its quality. Shares are trading at a premium to the (tangible) book value.

With that said, if I were in the market for MAIN shares, I would start by buying small and add gradually over time. I do not believe that it is wise to invest large sums into MAIN at current levels.

I believe we could see more downside if prolonged above-average rates hurt commercial credit. While I believe that MAIN has high-quality loans, I believe that investors will likely get a shot at averaging down in the months ahead.

So, buying gradually is how I would approach this high-yield vehicle.

In general, I would be a gradual buyer to somewhat spread entry risks.

Approaching this investment conservatively is one of the best ways to build high income through high-quality business development loans.

Takeaway

The retirement funding shortage is a growing crisis that requires urgent attention. Many retirees and soon-to-be retirees are in need of higher yields to sustain their livelihoods.

Main Street Capital is a business development company offering a compelling solution with its attractive 7% yield (excluding special dividends) and the potential to add high-quality long-term income to investor portfolios.

While the retirement funding situation is dire, MAIN provides stability and consistent dividends, making it an appealing investment option.

However, it's important to note that MAIN is not without risks, as it can experience sell-offs during recessions due to its cyclical and credit risk-prone nature.

Nonetheless, MAIN has demonstrated resilience and effective risk management, which has led to consistent outperformance versus its peers.

As the number of retirees continues to rise, addressing the retirement funding crisis requires careful investment choices, and MAIN presents a viable opportunity for income-oriented investors.

This article was written by

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.