Atlas Energy Solutions: Still The Province Of Insiders

Summary

- Atlas Energy Solutions, Inc., a frac sand and logistics company, just went public in March 2023. The company’s dividend of $0.60/Class A share yields 3.7%.

- Frac sand supply is a fraught business; many previous suppliers have gone bankrupt or gotten out of the sector.

- While Atlas had an excellent first quarter in 2023, its ownership structure is complex, with the result that public owners of Class A shares have little control.

- Looking for a portfolio of ideas like this one? Members of Econ-Based Energy Investing get exclusive access to our subscriber-only portfolios. Learn More »

James_Gabbert/iStock via Getty Images

Atlas Energy Solutions, Inc. (NYSE:AESI) is a company whose name refers to the book, Atlas Shrugged, by Ayn Rand. However, it may require more than an Atlas, or Hercules, to overcome the challenges inherent in the boom-and-bust frac sand business.

The company supplies sand for hydraulic fracturing from several Texas locations. Indeed, pre-IPO, the company was called Atlas Sand. In addition to its sand mines, Atlas is building a one-of-kind lengthy proppant conveyor, designed to take sand trucks off west Texas roads. Fracing requires literally tons of sand, which must be delivered by thousands of trucks on a very limited number of highways. This has led not just to congestion and time costs but, more significantly, to dangerous and deadly accidents.

Atlas was founded in 2017 by experienced exploration and production professionals and led by oilfield entrepreneur Bud Brigham. A portion of its equity was sold to the public in an IPO a few months ago. However, insiders still own nearly 70% of the company.

Ownership today is divided into Class A (public) shares and Atlas Sand Operating LLC units.

While the company has good backing and experienced leaders, frac sand supply is a highly volatile business that has bankrupted many prior companies. Long-term investors may want to wait for additional quarterly results, the successful operation of Dune Express, and a buying opportunity later, when equity ownership is not majority-controlled by insiders and a larger proportion of income can be attributed to Class A stockholders.

First Quarter 2023 Results and IPO

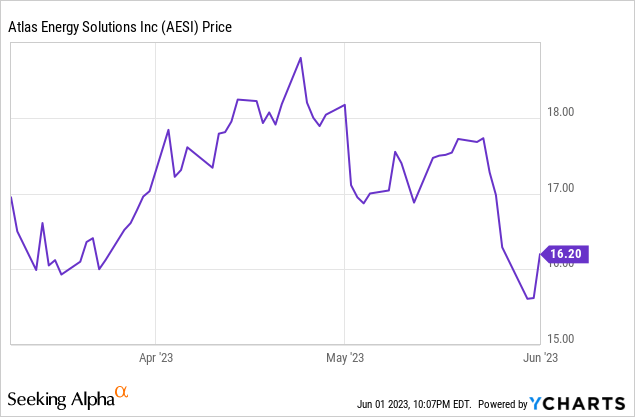

Atlas Energy Solutions, Inc. went public with an initial public offering in the first quarter of 2023. While initially targeting $20-$23/share, the IPO priced at $18.00/share (raising $324 million) and began trading Thursday, March 9, 2023, at slightly below that level.

On May 8, 2023, it reported first quarter 2023 sales of $153.4 million on 2.8 million tons of sand (or $55/ton, a higher price for sand than a few years ago when sand was oversupplied.) Income was $62.9 million (41% margin) and net cash flow from operations was $54.2 million.

However, even though Class A and Atlas Sand Operating unitholders received the same 1Q23 dividend, potential investors should be aware that only a fraction of Atlas' net income in 1Q23 is attributable to the Class A shareholders since the company was public for just a few weeks of 1Q23. To wit, while net income was $62.9 million, $54.6 million of that was pre-IPO net income attributable to Atlas Sand Company, LLC.

Also note that another $6.6 million was attributable to a redeemable noncontrolling interest, leaving $1.7 million, or $0.03/share, for Atlas Energy Solutions shareholders. (And most of those 57.4 million shares are held by insiders.)

Atlas also reported that it had begun construction of Dune Express, due to be operable in 2024. Dune Express is a 42-mile-long proppant (or sand) delivery system-the world's first long-haul conveyor-- that originates at Atlas' Kermit (Texas) sand facility. Dune Express has 75,000 tons of storage and is designed to take thousands of sand trucks off the few roads in the Delaware Basin, thereby making those roads safer. Atlas already has a contract with BPX Energy, a subsidiary of BP (BP).

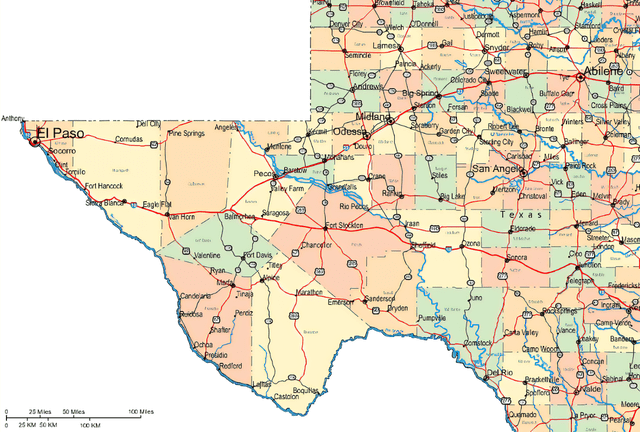

On the map below, many of the Permian sand mines are in a rough line from Monahans (the Monahans Sand Hills are illustrated at the top of this article) northwest through Kermit to the border with New Mexico.

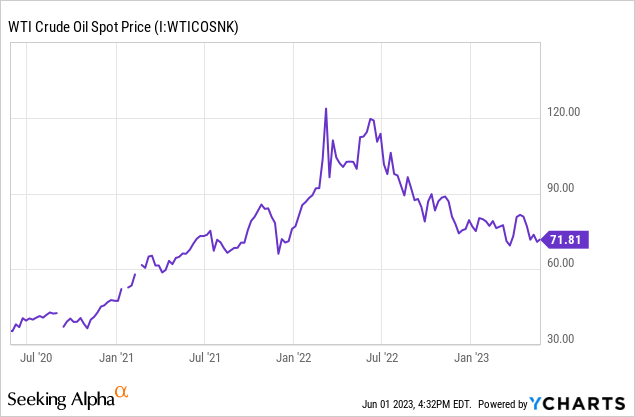

West Texas Intermediate (WTI) Crude Oil, $/bbl

Oil Prices and Production

The WTI closing price on the NYMEX futures market for delivery at Cushing, Oklahoma in July 2023 on Thursday, June 1, 2023, was $70.07/barrel. The Brent futures market, which now factors in the price of (effectively) WTI at Midland, Texas, was $74.24/barrel for August 2023 delivery.

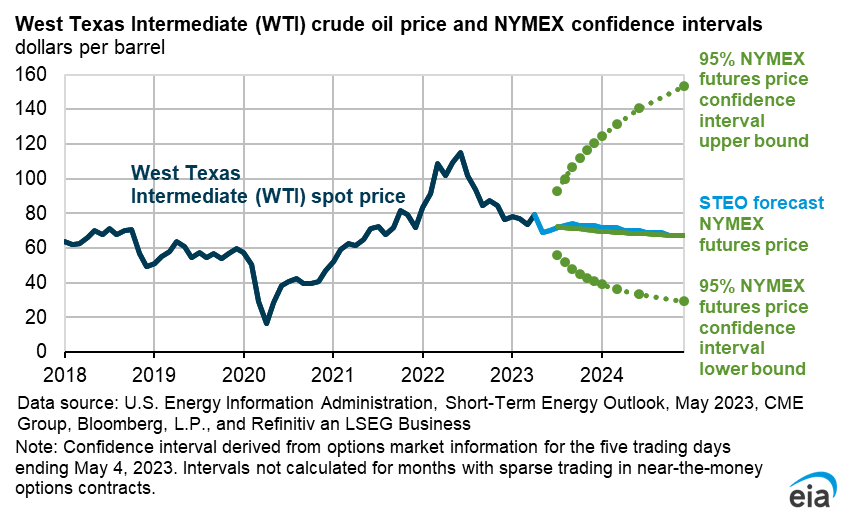

The 5-95 confidence interval through the end of 2024 shows a range of about $30/barrel to $155/barrel.

EIA

The Energy Information Administration (EIA) estimates US oil production will average 12.5 million barrels per day (BPD) in 2023 and 12.7 million BPD in 2024.

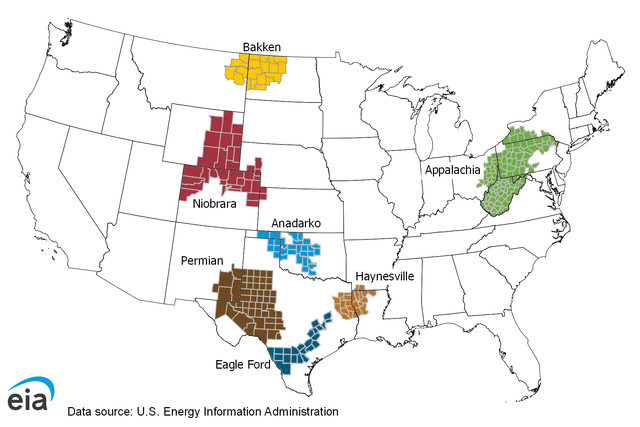

For June 2023, the EIA predicts Permian basin oil production will be 5.7 million BPD, or a bit less than half of the total. Key onshore basins (excluding Alaska and offshore US) are shown in the map below. The Haynesville and Appalachia are mostly natural gas; the Anadarko and Eagle Ford are gas and liquids, and the Bakken, Niobrara, and Permian are more liquids, including oil, with some gas.

Sand and Proppant Market Factors

Despite the bigger footprint in the U.S. shale business from international producers such as Exxon Mobil (XOM), Chevron (CVX), and ConocoPhillips (COP), reduced drilling budgets to maintenance levels mean markets for and prices of services like frac sand can be depressed, although they did see post-Covid and inflationary bounces. Within horizontal drilling practices, lateral lengths have increased (positive for sand use), intensity or pounds of sand per foot appears to be reaching an inflection point (neutral) although companies are always aiming technologies toward higher initial production rates (positive). However, producers now steer away from tight downspacing because of well-to-well interference (negative for sand use).

The frac sand industry experiences volatility from three directions: a) big oil and natural gas price changes, b) pressure on completion costs (like sand) with reduced numbers of wells drilled in the down-cycles, and c) the commodity nature of sand itself, separate from the commodity behavior of oil and gas. This last is the "siren" nature of sand: it can appear deceptively easy to read the frac sand business from a mining and real estate perspective.

Texas sand is the low-cost choice for the Permian and Eagle Ford basins, and the west Texas Permian basin is where the most US drilling is occurring.

Competitors

Atlas Energy Solutions is headquartered in Austin, Texas; the primary Texas drilling basins are in the west and south.

A drive through Monahans, Texas in west Texas-with sand whipping up from piles on both sides of the interstate-illustrates just one of the operational challenges of mining and supplying sand: keeping it from blowing away.

And perhaps it is this above-ground visibility, somewhat like real estate, that seems to make sand mining a bigger boom-bust business than oil itself.

A few public companies - Smart Sand (SND) and U.S. Silica (SLCA) - have survived the forays into frac sand supply. Other public companies, like Covia and Hi-Crush, have not. Similarly, Black Mountain Sand is a large private sand supplier; many private companies have also come and gone.

It is also the case that sand suppliers both compete with and cooperate with much larger multi-line oilfield service companies and proppant managers. Some producers also have their own sand supplies.

Governance

Insiders own about 70% of the company's Class A shares. Thus, out of 57.15 million shares outstanding, only 17.71 million are floated, or available for sale and trade by public investors.

Shorts were 8.8% of floated shares at May 15, 2023.

Moreover, ownership of the company is shared with Atlas Sand Company, LLC, which appears to be represented on the March 31, 2023, balance sheet as a $778 million redeemable noncontrolling interest.

At March 30, 2023, the top four institutional holders were Janus Henderson (3.5%), Adage Capital Partners (3.2%), ClearBridge Investments (3.0%), and Vanguard (2.4%). Some institutional fund holdings represent index fund investments that match the overall market.

The founder, CEO, and executive chair of Atlas Energy, Bud Brigham, is a known quantity: he has successfully started and sold other oilfield companies.

Financial and Stock Highlights

Atlas Energy Solutions' June 1, 2023, closing stock price was $16.20/share, compared to the (narrow) three-month post-IPO range of $15.06-$18.95/share. This gives a market capitalization of $926 million from the outstanding shares (including the 70% insiders' shares). Taken together with the $778 million redeemable noncontrolling interest gives an overall market capitalization of $1.7 billion.

This price was 85% of the high and 67% of its one-year target price of $24.20/share. (Or, the upside to the one-year target price is 49%.)

Earnings per share (EPS) for the prior twelve months was $1.37, resulting in a trailing price/earnings ratio of 12. Analysts' average estimates of 2023 and 2024 EPS are earnings per share are $2.56 and $3.50, respectively, for a forward price/earnings ratio range of 4.6 to 6.3.

Trailing twelve months' (TTM) return on assets is 21% and return on equity is 43%.

TTM operating cash flow was $237 million and levered cash flow was $28 million.

At March 31, 2023, Atlas Energy Solutions had $269 million in liabilities, including $114 million of long-term debt, and $1.1 billion of assets for a good liability-to-asset ratio of 24%.

However, separate from the liabilities and the $57 million of stockholders' equity on the balance sheet, the company also has in its ownership obligations the $778 million redeemable noncontrolling interest noted above.

A forward annual dividend on the Class A shares of $0.60/share yields 3.7%.

As noted above, Atlas ownership is divided into Class A (public) shares and Atlas Sand Operating LLC units. For 1Q23 Class A shareholders received $0.15/share dividend and unitholders received the same $0.15/unit distribution.

Mean analyst rating is 1.6, or approximately right between "strong buy" and "buy," from ten analysts. At least one analyst considers it significantly undervalued.

Atlas' next earnings conference call is August 1, 2023.

Notes on Valuation

Atlas' book value per share is $0.99, below its market price, indicating positive investor sentiment.

Enterprise value is $751 million and the company's ratio of enterprise value to EBITDA is 2.4, suggesting an extreme bargain.

Positive and Negative Risks

Although companies have reduced their drilling budgets to closer to maintenance levels, they are doing all possible to improve efficiency-which can include more sand per foot-and drill longer laterals-which means more sand overall.

Mining and selling frac sand is tricky business because it is easy to enter. It attracts real-estate professionals (one can see above-ground sand mines) as well as commodity experts. Frac sand demand operates as a second-order derivative commodity: the supply-demand balance for sand depends (but not only) on the supply-demand balance for crude oil.

Potential investors should consider their oil price expectations as the factor most likely to affect Atlas Energy Solutions' business.

Recommendations for Atlas Energy Solutions

While Atlas Energy Solutions pays a dividend and has upside to its one-year target, long-term investors will want to wait until insiders no longer hold the majority of shares and the company has a cleaner balance sheet: it is likely insiders' interests and that of the $778 million redeemable noncontrolling interest that would not fully align with those of individual outside, public shareholders.

Atlas may appeal to speculative investors who think it could become an acquisition target for a larger company.

Atlas Energy Solutions

Editor's Note: This article covers one or more microcap stocks. Please be aware of the risks associated with these stocks.

I hope you enjoyed this piece. I run a Marketplace service, Econ-Based Energy Investing, featuring my best ideas from the energy space, a group of over 400 public companies. Each month I offer:

*3 different portfolios for your consideration, summarized in 3 articles, with portfolio tables available 24/7 to subscribers

*3 additional in-depth articles = 6 EBEI-only articles;

*3 public SA articles, for a total of 9 energy-related articles monthly;

*EBEI-only chat room;

*my experience from decades in the industry.

Econ-Based Energy Investing is designed to help investors deal with energy sector volatility. Interested? Start here with an initial discount.

This article was written by

Do you want to understand and invest in volatile energy markets? We bring fundamentals-based insights to oil, gas, utilities, renewables, and gasoline companies for real-world investors.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of XOM, CVX, COP either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.