Starbucks Stock: Slowly Approaching An Attractive Entry Point

Summary

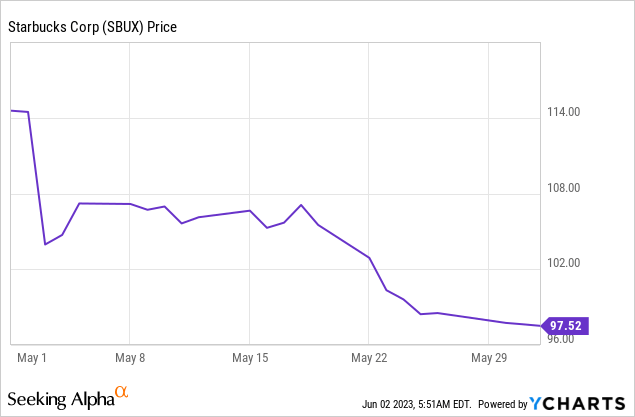

- The Starbucks Corporation Q2 2023 earnings report showed robust growth, but since then the stock price has dropped around 15% due to falling short of 2023 guidance.

- The company's expansion into international markets, particularly China, is crucial for growth, but geopolitical tensions and potential recession pose risks.

- When factoring in management's high-end guidance for 2025, our valuation model suggests that Starbucks is currently slightly overvalued, making it a Hold for investors.

jetcityimage

Starbucks Corporation (NASDAQ:SBUX) announced their Q2 2023 earnings report on May 2, 2023. Although their overall earnings appeared robust, the 2023 guidance fell short of investor expectations. After the earnings release, the company's stock price tanked around 15%.

When considering the most optimistic scenario of their just reaffirmed guidance for 2023 and 2025, the company seems to be trading at a fair valuation. This could suggest the company approaches attractive entry levels.

Business

Most of us are probably pretty familiar with Starbucks and its operations. However, before we get into specifics, let's make sure we all agree on this:

Starbucks Corporation, headquartered in Seattle, Washington, is a large global coffeehouse chain and roastery reserve. Since its inception in 1971, the company has grown to become one of the world's most famous brands. Starbucks owns and operates retail locations, sells coffee and tea through different distribution methods, and provides other consumer goods and services.

Starbucks is the world's largest coffee company, and its brand is linked with quality and consistency. Its significant market presence and ongoing development into foreign markets such as China and other Asian countries contribute to its potential for growth. The following map depicts their geographic presence:

Geographic Diversification of Starbucks in 2021 (Data: STARBUCKS CORPORATION : Shareholders Board Members Managers and Company Profile | US8552441094 | MarketScreener)

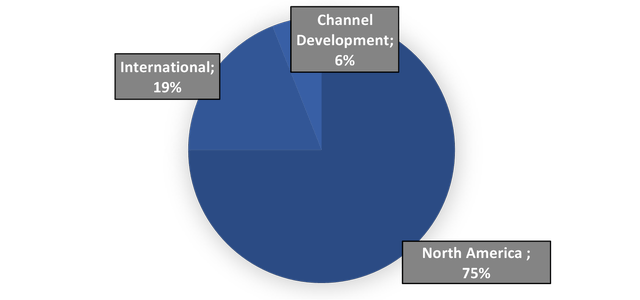

It's intriguing to observe that between 2021 and 2022, their most promising segment with the highest growth potential – the International segment – appeared to experience a contraction:

Geographic Diversification of Starbucks in 2022 (Data: https://s22.q4cdn.com/869488222/files/doc_financials/2022/q4/Q4-and-Fiscal-2022-Earnings-at-a-Glance.pdf)

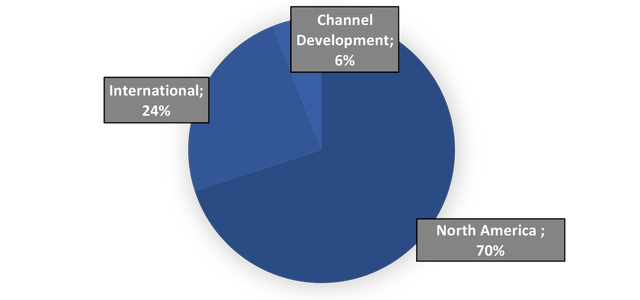

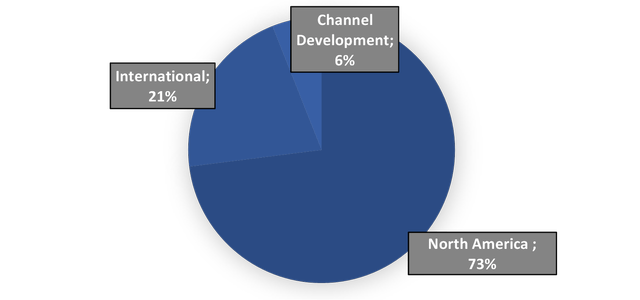

In the first quarter of 2023, it appears that reliance on the North American market has further intensified.

Geographic Diversification of Starbucks Q1 2023 (Data: https://s22.q4cdn.com/869488222/files/doc_financials/2023/q1/INFOGRAPHIC-1Q23.pdf)

Q2 2023 And Guidance

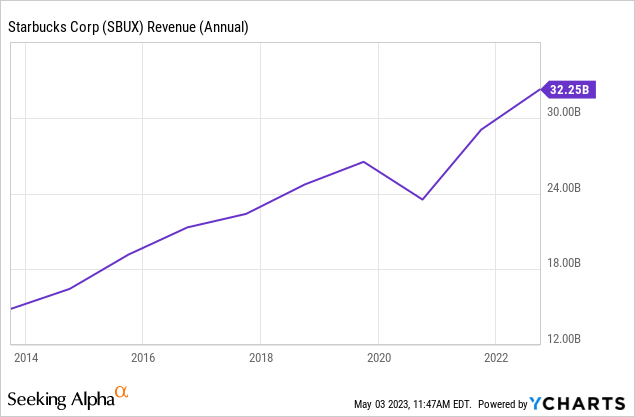

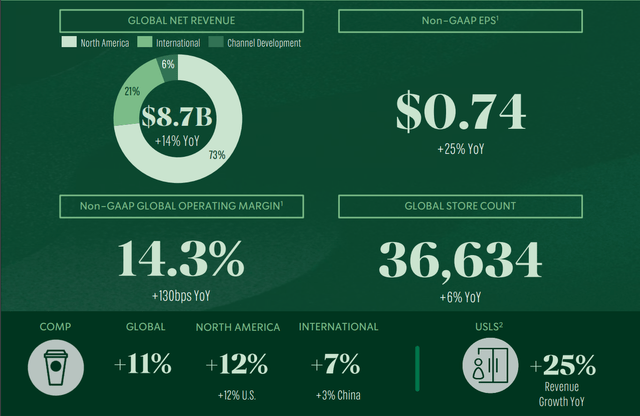

In Starbucks' Q2 2023 quarterly financial release, they announced revenue of $8.7 billion, indicating a 14% YoY growth. This expansion can be ascribed to a number of things, including the opening of new stores around the world, which led to a 6% YoY increase and a 12% increase in worldwide comparable store sales.

Comparable store sales in North America increased by 12%, while growth in the overseas market was more moderate. The international growth rate was 7%, with China, one of Starbucks' important markets, experiencing only a 3% increase.

However, with the construction of additional overseas stores, Starbucks appears to be resuming its path toward greater global variety. North America generated "only" 73% of sales in Q2 2023, indicating a more balanced global presence:

Geographic Diversification of Starbucks Q2 2023 (Data: https://s22.q4cdn.com/869488222/files/doc_financials/2023/q2/Q2-Fiscal-2023-Earnings-at-a-Glance_Final.pdf)

Most of the points mentioned can be also seen here at the Q2 2023 Earnings At A Glance:

Starbucks Q2 2023 Earnings At A Glance

Starbucks launched a net total of 464 new locations in the second quarter, after accounting for closures in North America and overseas markets, for a total of 36,634 global stores, 51% of which are company-operated and 49% are licensed. By the conclusion of the second quarter, the United States and China accounted for 61% of the global portfolio, with 16,044 and 6,243 outlets, respectively.

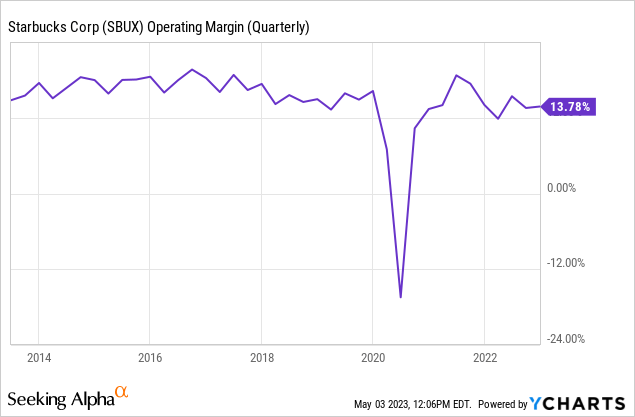

GAAP operating margin grew to 15.2%, owing mostly to sales leverage, pricing, productivity improvement, and benefits from the sale of the Seattle's Best Coffee brand. This growth was offset in part by personnel investments, greater general and administrative expenditures, and inflationary pressures. The non-GAAP operating margin rose to 14.3%.

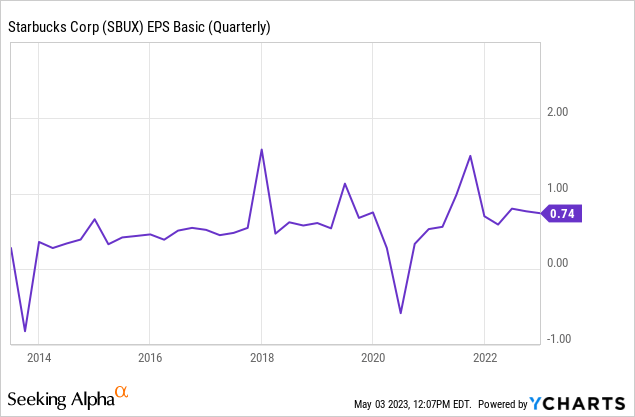

GAAP earnings per share grew by 36% to $0.79, while non-GAAP earnings per share increased by 25% to $0.74.

Starbucks Rewards is a customer loyalty program developed by Starbucks to incentivize and reward its consumers for their business. Members can earn stars (points) for their purchases by participating in the program, which can subsequently be redeemed for free food, drinks, or goods at Starbucks shops. This program is intended to improve the customer experience and encourage repeat business by providing concrete rewards to the company's most devoted customers. Starbucks Rewards loyalty program 90-day active members in the United States surpassed 30.8 million, a 15% increase year on year.

Guidance

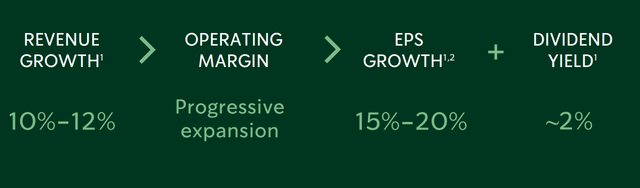

In the latest earnings call, management reaffirmed their latest guidance for fiscal 2023. The most important points from this Fiscal Year 2023 Guidance are:

- Global Comparable Store Sales Growth: 7% - 9%

- Global Store Growth ~7% with China growing ~13%

- Global Revenue Growth: 10% - 12%

- Global Operating Margin: "Solid margin expansion"

- EPS Growth: 15% - 20%.

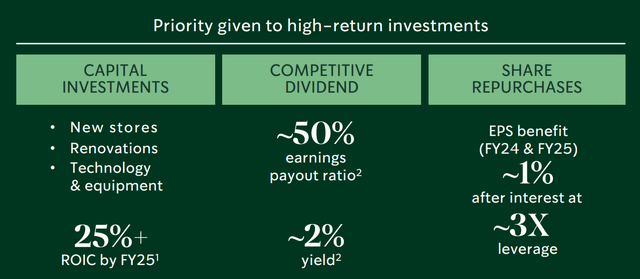

This guidance appears to be very similar to what Starbucks' management gave during their Investor Day in 2022. The company's leadership discussed their strategic vision and growth ambitions during that event, which appear to be consistent with the current guidance provided.

Starbucks' management also placed a strong emphasis on capital allocation throughout the event, emphasizing crucial parts of their strategic approach in this area. They discussed how the company intends to invest resources effectively in order to support growth, increase shareholder value, and reinforce the brand's market position.

Outlook

Now that we have an understanding of Starbucks' performance over the past few quarters, as well as management's long-term guidance and strategic plan, I would like to highlight several critical aspects in this Outlook segment that I believe will significantly impact the company's future success. These factors are essential for Starbucks to achieve or even surpass its management's expectations and goals.

Starbucks Rewards

Starbucks Rewards, as previously stated, is a customer loyalty program meant to encourage repeat business and increase customer engagement with the Starbucks brand. Customers who join the program can earn "stars" every time they make a purchase at participating Starbucks shops or through the Starbucks app.

Members can then redeem these stars for free food, beverages, or items, as well as enjoy exclusive program offers and promotions. Starbucks Rewards offers customized deals and recommendations based on a member's interests and purchasing history. Members also get free in-store refills, birthday rewards, and the ability to purchase and pay ahead of time using the Starbucks app.

By providing value-added advantages and a personalized experience to its members, the Starbucks Rewards Program strives to encourage brand loyalty, boost customer retention, and drive revenue development.

Additionally, the app streamlines payment processes, allowing transactions to be done without the use of cash or credit cards, thus reducing time in-store.

Another important factor is that consumers who "preload" money into the app receive twice as many "stars" as those who pay regularly through the app. As a result, habitual customers are more inclined to deposit money that they would have spent regardless on Starbucks. This results into improved financial planning security and interest-free credit secured directly from clients for the organization.

This program was already responsible for 50%+ of U.S. income in 2022 and is fast expanding - 15% in the last year. This appears to distinguish Starbucks from its competitors and to solidify the consumer's status within the Starbucks ecosystem.

Chinese Market

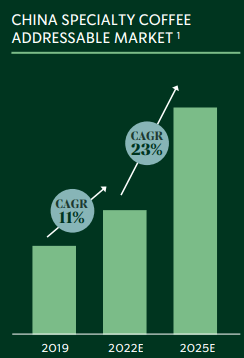

The Chinese market remains critical for Starbucks, with the country's rapidly expanding middle class acting as a big motivator for the country's Total Addressable Market (TAM) for coffee. Starbucks forecasts rapid growth rates ranging from 11% to 23% in the coming years:

TAM Coffee China (Starbucks Investor Day 2022)

As a result, Starbucks intends to focus extensively on China and set lofty goals for the region. By 2025, the company hopes to have doubled its revenue, quadrupled its net income, and increased its store presence in China by 50%. This will be accomplished, among other things, by increasing use of the previously described rewards scheme.

Starbucks' significant development opportunity in the Chinese market comes with its own set of obstacles. With the possible escalation of hostilities between the United States and China, as well as the ongoing Trade War, a U.S.-based corporation such as Starbucks could face trade restrictions or other regulatory measures imposed by the Chinese government.

Furthermore, these geopolitical difficulties may influence Chinese consumers' shopping habits, which could harm Starbucks' success in the region. Customers, for example, may prefer to support local brands over international ones, or the impression of US-based enterprises may suffer, resulting in a drop in patronage. Starbucks must keep aware of these potential dangers and devise contingency plans to mitigate any negative repercussions on their operations in China.

Recession

According to experts’ average forecast, there is a 64% risk of a recession by the end of 2023. This begs the question of how a hypothetical recession may affect Starbucks. During a recession, Starbucks, like many other firms, may suffer difficulties when the economy deteriorates. A prolonged recession lasting several years could worsen these issues. Starbucks may face the following challenges during a recession:

Reduced consumer spending: During a recession, people often limit their discretionary spending as a result of job losses, lower income, or economic uncertainty. Because Starbucks sells non-essential beverages and products, customers may opt to spend less on these items, resulting in fewer sales and revenue.

Margin pressures: Economic downturns can result in higher raw material, labor, or other operating costs. Starbucks may need to cut costs, raise prices, or make other changes in order to sustain profitability, which may have an influence on its brand image or consumer happiness.

Store closures or slower expansion: To maintain financial stability in a difficult economic environment, Starbucks may need to rethink its expansion plans or possibly close underperforming stores. This may jeopardize the company's long-term growth goal.

Increased competition: Competitors may aggressively target customers with lower-cost alternatives or incentives, escalating the competitive environment and putting additional pressure on Starbucks' sales and profits.

While Starbucks may encounter these issues during the current recession, it is vital to remember that the company has a strong brand, a dedicated customer base, and a global presence. These elements, together with an effective management approach, can assist the organization in navigating economic downturns and recovering once conditions improve.

Valuation

I believe we can all agree that Starbucks is a world-class company known for its superior quality and performance. It is important to note, however, that companies of this level rarely sell at fair or even low prices.

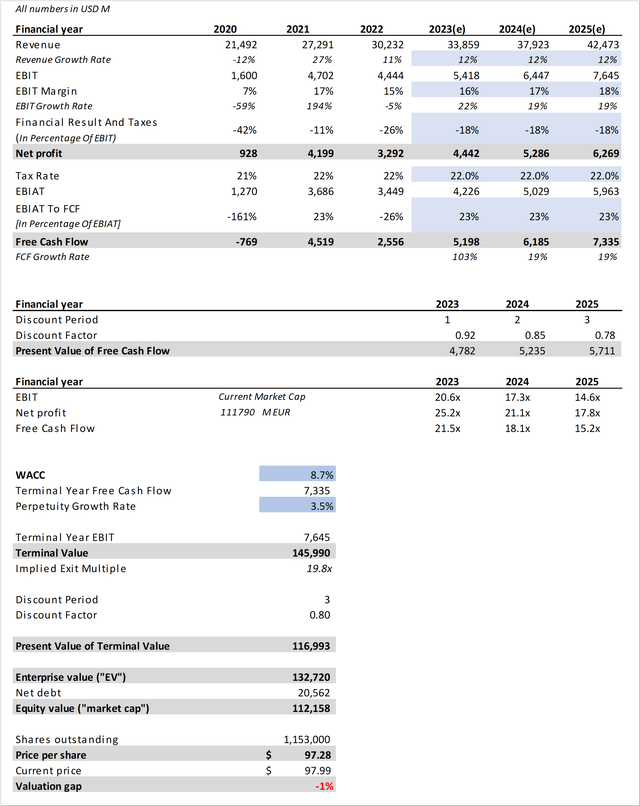

Given this context, it's critical to examine Starbucks' current valuation to acquire a better grasp of the price offered by Wall Street for this priceless treasure. As a result, I devised a Discounted Cash Flow Analysis (DCF). The assumptions used to evaluate Starbucks are shown by the blue cells in the study. The following are the assumptions I used to evaluate Starbucks:

- Revenue: For the period between 2023 and 2025, the revenue growth projection was derived using the upper limit of management's guidance, which was set at 12%.

- EBIT-Margin: For the EBIT-margin, it was assumed that Starbucks would begin at the 2022 levels and, as planned by management, improve their margins annually. To maintain a conservative approach, an anticipated increase of 1% each year was factored into the calculations.

- Financial Result And Taxes: To calculate the Net Profit for the years 2023 to 2025, I used an average of the values from the last two years, arriving at 18%. I intentionally excluded 2020 data from the calculation, as the Covid-19 pandemic represents an extraordinary scenario that deviates from typical business conditions.

- Tax Rate: I assumed a tax rate of 22% right in line with the last years.

- Free Cash Flow: Using the Tax Rate above, I calculated the EBIAT and afterwards tried to determine a suitable EBIAT to FCF ratio. In that case I think 23% the high end of 2020 to 2022 seems optimistic but achievable.

- WACC: I assumed a, in my opinion conservative, WACC of 8.7%.

- Perpetuity Growth Rate: The perpetuity growth rate assumed for the analysis is 3.5%.

Data: seekingalpha.com; investor.starbucks.com

This analysis gives us a target share price of $97.28. Given this target price and assuming the company will continue to grow at an optimistic rate, it appears that Starbucks is currently - even after the sharp decline after earnings - trading at a fair valuation.

However, it's important to keep in mind that this scenario assumes the high-end estimates provided by management come to fruition.

Conclusion

Based on the 2025 scenario provided by Starbucks management, our DCF yields a price estimate of $97. With this and the preceding considerations in mind, and despite Starbucks' strong reputation as a market leader, the company's present valuation appears to be still slightly overinflated.

According to the most optimistic scenario - used in the DCF - the current Starbucks Corporation pricing seems appropriate. The actual result, however, is likely to fall somewhere between the upper and lower boundaries of management's projections and expectations. This means that Starbucks is currently priced for perfection, or at least for the more optimistic scenario presented by management, which is why I am currently rating the company as a Hold.

However, if the Starbucks Corporation stock price were to fall to a more attractive level, or if management revised their guidance upwards for 2025/the future, I would not hesitate to consider expanding my already existing investment in the company. I would probably start to add to my Starbucks Corporation position in the range of $85 to $90.

This article was written by

Analyst’s Disclosure: I/we have a beneficial long position in the shares of SBUX either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.