SPXU: Speculators Only

Summary

- ProShares UltraPro Short S&P500 is a leveraged inverse ETF that aims to deliver triple the inverse return of the S&P 500 on a daily basis, making it suitable only for short-term speculators.

- Since its inception, SPXU's price has decreased by 99.96%, making it a dangerous vehicle to hold for the long term, but it can be used for hedging purposes if allocated correctly.

- KFA Mount Lucas Index Strategy ETF is a better alternative for long-term hedging, as it offers better risk-adjusted returns and lower volatility compared to SPXU.

Maximusnd

Thesis

ProShares UltraPro Short S&P500 (NYSEARCA:SPXU) may appeal to a speculator because it aims to deliver the returns that it targets in each trading session, as opposed to over multiple days. However, if you are looking for an equity hedge that you can hold for a long time, this is likely to be unfit.

Since the ETF was issued, it has experienced a dramatic decrease in its price. However, when it comes to inverse S&P 500 ETFs, it's not the exception; you can find some alternatives that experienced lower volatility, but they too have experienced great losses over the long run.

In this article, I want to explain why I don't prefer SPXU as an equity hedge and briefly talk about an alternative if you're looking to diversify.

What does SPXU do?

ProShares UltraPro Short S&P500 is a leveraged inverse ETF issued by ProShare Advisors LLC on 06/23/2009 and managed by the same. It currently manages about $1.35 billion.

Its goal is to deliver triple the inverse return of the S&P 500 on a daily basis through the use of futures and swaps. As an example, if the index decreases by 1% in a trading session, the fund would be successful if it delivered 3% during that day. And the reverse, if the index has its price increase in a day, the fund is supposed to mirror that percentage change multiplied by 3 as a loss.

Naturally, you would reasonably expect that if you hold this for a long enough time and the S&P 500 increases, you will lose a lot of money. And you would be right to expect that, as we will see in a minute. However, the issuer has made it clear that the fund's target is reset daily. It's not supposed to deliver such returns on a long-term basis. That is why it seems an appropriate vehicle for speculators.

That said, there's a case to be made about it when it comes to hedging a portfolio. And this is where this post comes in. I will not talk about how it can be used in trading, because I'm neither interested nor experienced in timing the market. This post will only explore the suitability of this ETF as an equity hedge. So bear that in mind before you continue reading.

Performance

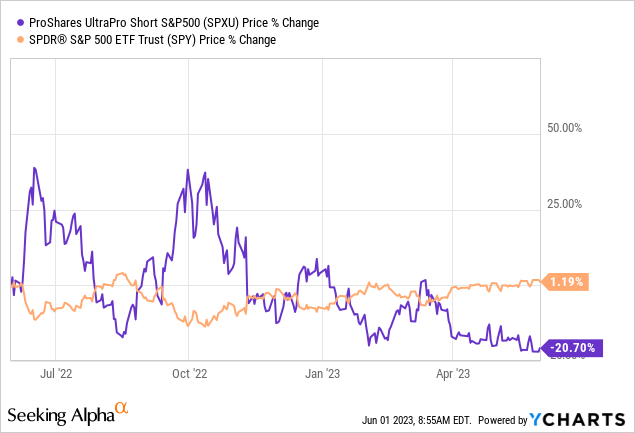

There is multiple past data I'd like to check with you, but to begin with, let's take a look at a chart that depicts the ETF's TTM price performance against SPY:

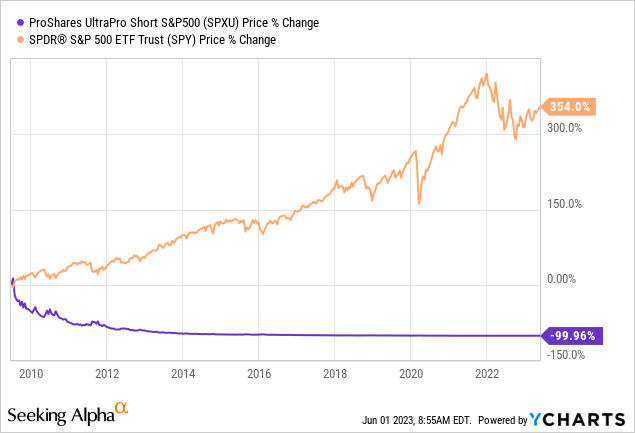

This illustrates well how SPXU is supposed to behave. Though you would suffer a big loss if you held it for the past 12 months, it would be more or less successful in what it was supposed to do. But of course, you can imagine what the result would be when it comes to a longer time frame in which the index experienced a decent return:

Since its inception date, SPXU's price decreased by 99.96%. Not shocking at all that you would suffer such a dramatic capital erosion, of course. This is a dangerous vehicle to hold for the long term. But to be fair, it's only dangerous if you're not careful how much to allocate to it; we'll come back to this in a minute.

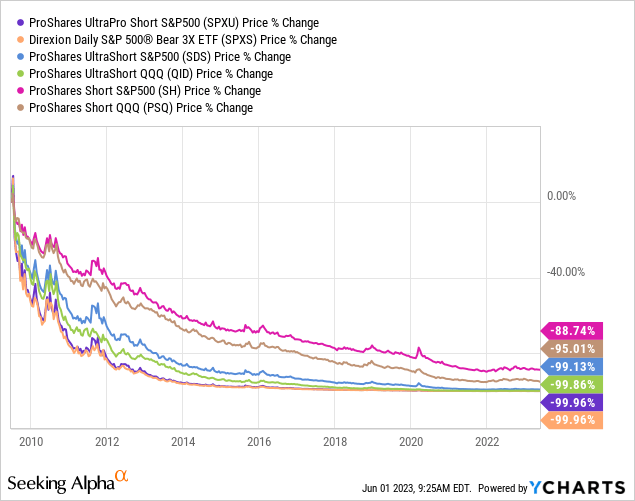

Now, are there similar alternatives out there for those who want to hedge without seeing their capital vanish in such a dramatic fashion? The answer is no if such alternatives are as "successful" as SPXU. Even those that aim for -2x and -1x returns would perform similarly, and the chart below has a mixture of both:

For speculators, it all comes down to the level of risk they are willing to take during the time they place their bets. For investors looking to diversify, the difference in performance is not as significant. Your best bet at hedging equities could be SPXU. But I wouldn't make that bet because leveraged inverse ETFs are clearly not appropriate for buy/hold portfolios.

So, I wouldn't use SPXU to hedge. Currently, I think that KFA Mount Lucas Index Strategy ETF (KMLM) is the best fund to hedge with if you're looking to buy and hold.

Based on a backtest from January 2010 to May 2023, a portfolio consisting of 90% in SPY and 10% in SPXU would have a less severe maximum drawdown and a lower standard deviation than SPY; at the cost of a lower compound return, naturally.

| Portfolio | CAGR | Maximum Drawdown | Standard Deviation Annualized | Sharpe |

| SPY/SPXU (90/10) | 7.93% | -15.42% | 9.71% | 0.76 |

| SPY | 12.45% | -23.93% | 14.71% | 0.82 |

Now, since January 2021, KMLM delivered better risk-adjusted returns while keeping volatility low when compared to SPXU:

| Portfolio | CAGR | Maximum Drawdown | Standard Deviation Annualized | Sharpe |

| SPY/SPXU (90/10) | 4.60% | -13.53% | 9.39% | 0.36 |

| SPY/KMLM (90/10) | 7.67% | -17.06% | 14.70% | 0.47 |

| SPY | 6.16% | -23.93% | 17.74% | 0.34 |

This is a much shorter time frame, I know. But because KMLM is supposed to hedge equities without necessarily having to realize inversely correlated returns, it's a better bet in my opinion. I would like to take a stab at hedging while protecting my hedge allocation and not choose almost certain capital erosion in order to hedge in the long run.

But that is me. You may find value in buying SPXU because of its "promise" at a chance of lower portfolio volatility. However, if you want to learn more about KMLM, you can check a review of it that I've written in the past.

Fees

| Ticker | Expense Ratio | AUM | Inception Date |

| SPXU | 0.90% | 1.37 B | 06/23/2009 |

| SPXS | 1.08% | 1.24 B | 11/05/2008 |

| SDS | 0.90% | 1.10 B | 07/11/2006 |

| QID | 0.95% | 508.49 M | 07/11/2006 |

| SH | 0.89% | 2.29 B | 06/19/2006 |

| PSQ | 0.95% | 1.40 B | 06/19/2006 |

Unsurprisingly, this ETF is expensive to hold, charging a 0.9% expense ratio. But this is more or less in line with what inverse S&P 500 ETFs charge, which are similar in size, track record length, and performance. Additionally, the fund seems to be successful in delivering the returns it's supposed to. So, I believe it's a reasonable fee.

Risks

Here are some important risks associated with investing in SPXU that you should be aware of:

- Long-Term Capital Loss: As we already demonstrated, being exposed to an inverse S&P 500 ETF is likely to erode your capital in the long run if it's successful because the index is most likely going to experience long-term growth.

- Derivatives Risk: SPXU uses futures and swaps to deliver its leveraged inverse returns and is therefore subject to derivatives risk.

- Counterparty Risk: By using derivatives, such as futures, the fund is also subject to the possibility the other party in a transaction will become unable to fulfill its obligation, negatively affecting the value of the contract.

- Leverage Risk: Because the ETF uses leverage to achieve its returns, it may experience greater losses than it would otherwise.

Regardless of why you might be interested in a leveraged ETF like SPXU, I strongly advise you to read this short article by the SEC about leveraged and inverse ETFs. These short-term, tactical vehicles have inherent risks that are distinct from what you may have been used to coming across within the ETF space.

Verdict

There is definitely a case to be made for using SPXU as a speculative vehicle to bet against the S&P 500. Buying and holding for long-term hedging? That's trickier. If you can accept that your allocation to that fund is very likely to be eroded in time, but you appreciate the hedging quality of this fund, then it might be useful to you short term. But to be safer, I'd prefer to go with KMLM instead.

Before you go, I would like to know your opinion. Did you like this post? Did I leave something out? Leave a comment below and let me know. Thank you for reading.

This article was written by

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.