ICL Group: Remarkable Dividend That Seems Solid

Summary

- ICL Group Ltd, a fertilizer company, maintains a strong financial position with a solid dividend yield of over 15% despite a decline in fertilizer prices.

- The company's dividend is expected to be sustainable at a 7-10% yield, with potential for growth in revenue and bottom line.

- ICL faces risks such as debt management and production chain disruptions, but its robust financial state and strategic management can help mitigate these challenges.

Eloi_Omella

Investment Summary

ICL Group Ltd (NYSE:ICL) is a company in the fertilizer market offering a broad array of products and solutions to industries like agriculture, food, and engineered materials. With operations in more than 30 countries, ICL provides a diverse range of products, including fertilizers, potash, and bromine compounds.

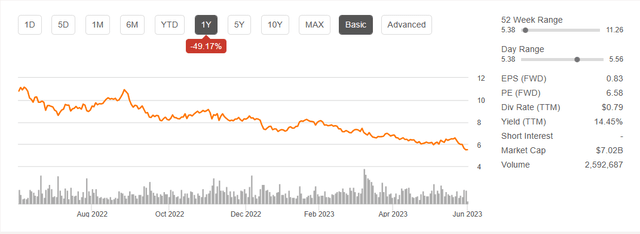

Many companies in the fertilizer market are not seeing the same levels of revenues as they did a year ago as the prices have gone down significantly. The war in Ukraine helped push prices to new highs and companies like ICL were able to benefit greatly and build up their balance sheet and provide value to shareholders through dividends and buybacks. The company managed to generate record operating cash flows of $382 million in the last quarter which certainly makes them able to keep up the solid dividend yield, which is above 15% right now. Financially the company is sound and they have room to grow. The high yield doesn't scare me and ICL is a buy for me right now, meaning I am keeping the same rating as last time despite the share decline.

Is The Dividend Sustainable

One of the factors about investing in ICL is perhaps the dividend. It sits at a TTM yield of around 15% right now. The company announced a dividend of $0.11 per share in the last report. I think we need to be realistic here and realize that the dividend of 15% right now is not likely to remain in my opinion. The company has seen steady growth over the last few years, but as the prices of fertilizers are much less favorable than a year ago I don't see the same yield being possible.

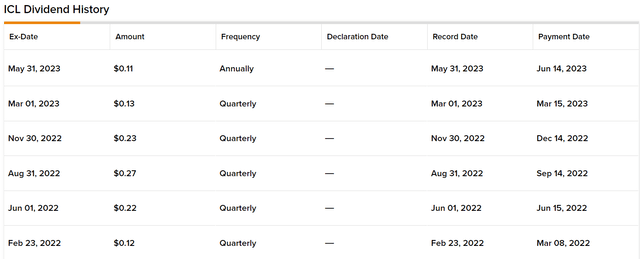

Dividend History (Market Screener)

At least not the 15% we have in the last 12 months. But a quarterly dividend of $0.11 for 2023 would be $0.44 in total, or around 7 - 8% if the share prices stay around the $6 mark. That is not a bad dividend at all. Where I think there is further value to be had is that ICL will continue growing its revenues and that in turn should help the bottom line grow. The forward p/e being around 7 presents little risk here in my opinion. The company is estimated to generate between $2.2 billion and $2.4 billion of adjusted EBITDA for 2023, a notable decrease from 2022 which had it come it at just under $4 billion. But as mentioned, prices are much less favorable now and are likely to continue going in cycles like these. But the overall trend seems clear, and that is fertilizers will play a major role for decades in our food systems across the globe.

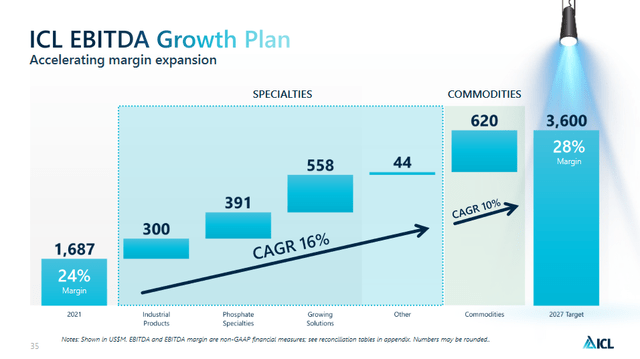

ICL Growth Plan (Investor Presentation)

The company is targeting an EBITDA margin in 2027 of 28%, which is far from the 2022 margins which were at 40% at their highs. I don't think it's likely we see margins like that again in the near term, but a 28% margin, and close to $13 billion in projected sales would mean around $3 billion in operating cash flows if the margins sustain. With if the company gets to a dividend of around $0.44 for the full year of 2023, that would be just under $600 million in capital disturbed if the shares remain the same. I find it likely the company can continue with the dividend and perhaps raise it going into 2027 as well. Growth seems to be strong and with the low valuation, there seems to be little downside getting in at these prices. The dividend in my mind can be sustained around the 7 - 10% yield without risking the company having to dilute shares or defaulting on any debt.

Risks

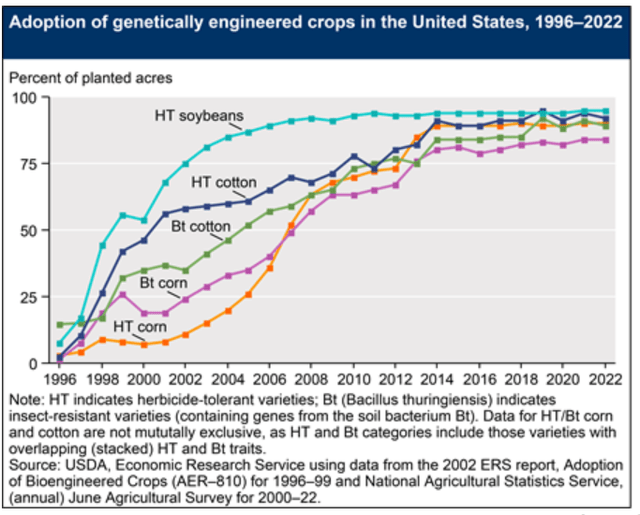

The seed protection industry faces a potential risk due to the growing popularity of genetically modified [GM] crops, which possess built-in resistance against pests and diseases. While this trend may reduce the demand for seed protection products, it also presents challenges for the industry. Developing new GM crop varieties that can effectively combat emerging pests and diseases requires substantial investment in research and development. However, the widespread adoption of GM crops is still in the future, and in the meantime, there is a pressing demand for fertilizers, presenting an opportunity for companies like ICL Group to meet this need.

Examining ICL Group more closely, it's important to consider the company's long-term debt, which stands at around $2.3 billion. Managing this debt burden will remain a challenge for the company. However, I believe that ICL Group is taking proactive measures to stay ahead by capitalizing on the significant cash flows it currently generates. On the other hand, there is a higher risk of share dilution if any disruptions occur in the production chain, leading to increased costs. In order to secure its cash position, the company may resort to diluting shares, which could negatively impact investment in the company.

Overall, while there are certain risks to be mindful of, ICL Group has the opportunity to leverage its strengths in meeting the immediate demand for fertilizers and capitalize on its strong cash flows. By strategically managing its debt and production chain, the company can mitigate potential challenges and continue to thrive in the industry.

Financials

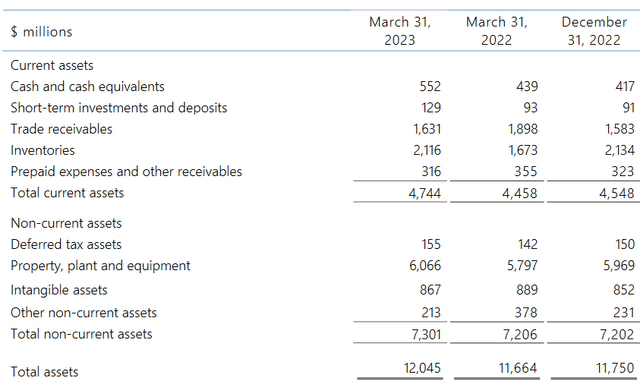

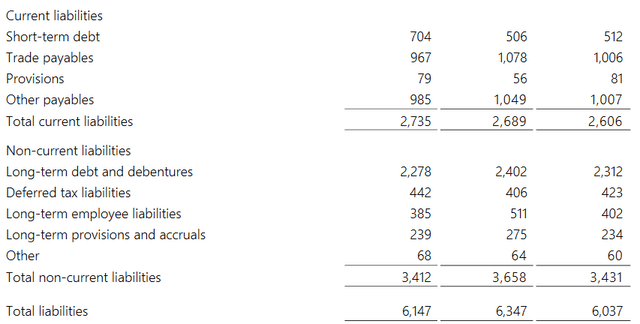

Moving over to the financials of the company they have made some moves that I particularly like to see. The cash position has risen by 32% on a QoQ basis, reaching $552 million in total. It's not enough to pay off all the short-term debt, but with the cash flows to back it up the $704 million in short-term debt is making the company risky right now.

Assets (Balance Sheet) Liabilities (Balance Sheet)

In fact, the company has nearly 2x as many total assets as total liabilities and with strong cash flows the financial state seems very robust and places the company in a position where they can both invest heavily and also continue distributing a dividend, or enter into important partnerships. The long-term debts are sitting at $2.2 billion right now and with the projected operating FCF I had of $3 billion in 2027 that seems very manageable. Shares outstanding have risen slowly over the years, but I think as prices stabilize and the same happens to the margins in the business the likelihood of dilution speeding up is low in my view.

All in all, I don't see any alarming signs on the balance sheet, in fact, I think they are in a strong position to continue growing leveraging their flexible state. The cash position increase is a major bonus and going forward I will keep an eye on the decrease of current liabilities and look so it doesn't result in increased share dilution.

Valuation & Wrap Up

With a forward P/E of around 7, I don't see ICL as a risky investment here. The yield might make ICL look like a very risky investment and the chart would tell the same story. But as we know, the fertilizer prices that were seen in 2022 just weren’t sustainable and that creates uncertainty about the company's forward earnings of course. With ICL I think they are in a strong position to grow both their top and bottom line efficiently over the coming years. The 2027 target of nearly $13 billion in sales seems very much within reach. Leading up until then I think the company can offer investors a lot of value, most notably the dividend, which I think can stay around a 7 - 10% yield sustainable if the share price doesn't rise from here. The cash flows are strong and so is the balance sheet.

I see the fertilizer market experiencing a lot of growth in the coming years and I would want to be in a solid company like ICL then to benefit from it. ICL is like the last time I wrote about them still a buy for me.

This article was written by

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.