AT&T's Capital Structure Signals No Problem At All For The Common Stock

Summary

- Heavy pressure on the AT&T Inc. common stock and zero pressure on the debt and preferred stock.

- Significant credit spread narrowing that is absolutely surprising.

- The AT&T Inc. preferred stock yield is comparable to fed funds rate.

- Long the AT&T Inc. common stock or short the preferred stock is the question.

- Looking for a portfolio of ideas like this one? Members of Trade With Beta get exclusive access to our subscriber-only portfolios. Learn More »

themacx/iStock via Getty Images

We usually post our articles to members of our service 1 week before we publish them to the public. This article was first published on May 29, 2023.

In our investment group, we monitor on a daily basis all the exchange-traded fixed-income vehicles in an attempt to be most adequately diversified in our portfolios. Choosing the best in our opinion picks is only half of the job done, the other half being getting rid of the securities that no longer offer us some "alpha." From time to time we find ourselves in a situation when everything we monitor for some products is telling us "sell."

We believe that under the current market conditions, this is the case with AT&T Inc. (NYSE:T) perpetual fixed-rate preferred stocks (T-A) and (T-C). With this article, we will try to defend the thesis why, in our opinion, an investor should consider closing their long positions in these products. It is not only the fact that these investment vehicles have nothing to offer, on a relative basis, as upside potential. Everything we considered about them is showing us that they are way overvalued in the fixed-income universe and have huge depreciation potential.

Moreover, it is bizarre for T-A and T-C (Ba1 by Moody's) to trade at yields similar to the yield of the safest exchange-traded preferred stock GDV-H (Aa3 by Moody's) when there is obvious distress for the common stock of the company. We strongly believe that words have meaning and that "high-yielder" should yield way higher than the top credit-rated investment-grade preferred stock. So let us dive into the analysis that follows.

The common stock of AT&T

AT&T is one of the world's largest telecommunications companies by revenue and one of the three largest providers of mobile telephone services in the United States. The company is providing services for quite a long time and has established itself as one of the trustworthy names in the industry.

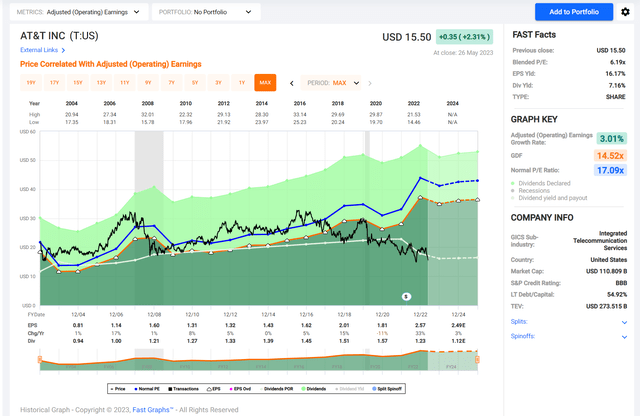

No matter how big, old, or well-renowned a company is, it is not insured against a hard time. The downtrend in the price of the common stock T for the last couple of years is obvious from the trading graph posted. We accept that the market could be wrong in pricing a stock from time to time but such a long-term depreciation usually is an indicator of a steady decline in the interest of the general public.

Another indicator besides the price action that we monitor is the Price to Earnings ratio for the common stock of the company. AT&T's P/E ratio as of May 25, 2023, is 6.47. Now this is a rather low number that can be interpreted by the investors in two different ways, depending on their personal understanding of the situation:

- In combination with the trading graph above one can expect such a small value for the P/E ratio to indicate a troubled company with a common stock that cannot attract investors despite the very attractive earnings it offers them. That, in our opinion, means bad news for the preferred stocks holders. There is really no logical financial reason for such preferred stocks to be priced at similar yields to the best credit-rated investment-grade securities traded on the exchange.

- Another way to look at AT&T's P/E ratio is to regard it as a great mispricing and an opportunity to go long the common stock. A company that can finance its debt with investment-grade bonds (BBB rated by S&P) should trade with a rather higher value for its P/E ratio. This type of interpretation has its own merits, but it means nothing for the preferred stocks. Again, there is no sound explanation for the 5.7% CY of T-A and T-C.

T-A and T-C

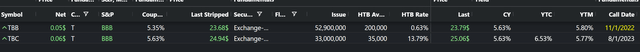

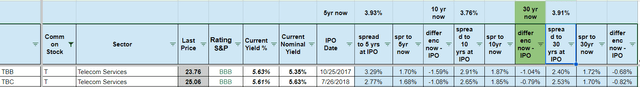

As mentioned above, AT&T has two fixed-rate perpetual exchange-traded preferred stocks - T-A and T-C:

Preferred stock info (proprietary software)

The preferred stocks of AT&T are rated two notches lower than its exchange-traded notes ("ETNs") TBB and TBC and have a credit rating of BB+ from S&P. This is a pretty standard credit evaluation of the preferred stocks compared to the unsecured debt of a company. So, according to S&P the debt of AT&T is investment-grade, but the prefs are high-yielders. As a general rule, two notches difference in the credit rating means around 0,5% yield difference. Yet T-A and T-C trade at CY similar to the YTM of TBB and TBC. It is beyond our comprehension why the market loves equally the preferred stocks and the debt of a troubled company.

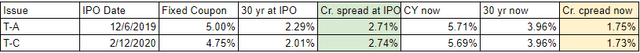

A standard procedure when evaluating a fixed-income security yield is to compare it to its benchmark bond yield and check if there are some deviations. For perpetuity, this is the 30-years Treasury bonds. The logic behind this is that security is fairly priced at its IPO. In the process of IPO, the security is evaluated thoroughly by top-tier professionals, and the credit spread it receives to its corresponding benchmark at that moment is of key importance for future evaluations.

credit spread dynamics (proprietary spreadsheet)

In the table above, we have calculated the credit spread at IPO and at the current moment for the two preferred stocks that are of interest to us today - T-A and T-C. These are rather simple calculations that give us a clear result - the credit spread for both income vehicles has narrowed by 1%. For the 3+ years since the IPOs of these securities, the benchmark rate has a double increase in value. If everything related to the company remains the same for that period of time, the credit spread of its securities should widen. Well, obviously not everything has been the same with the company - its common stock currently is trading at half the price it did at the time of the IPOs. So for these 3 years, something happened to AT&T that wiped out half of its value, and simultaneously with this made its preferred stocks safer securities.

At this point, I can hear you asking "What kind of sorcery is this?" and let me tell you - it is a just question. For us, there is an evident market mistake in the current pricing of T-A and T-C and they should trade at way higher yields. According to our understanding, the credit spread narrowing alone is an indication that T-A and T-C are not priced right. That in combination with AT&T's common stock behavior and a P/E ratio of 6.5 is giving us a powerful "sell"/"go short" signal on its preferred stocks.

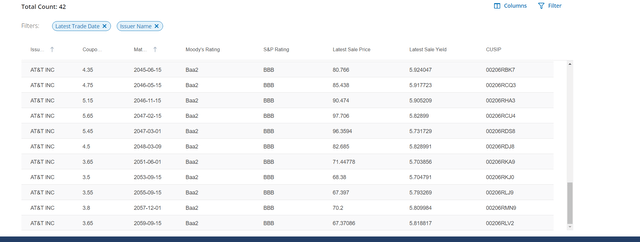

The Bonds

These are the long-term bonds of the company that are rated BBB and have yields in the range of 5.7% - 5.9%. Very similar to the exchange-traded: Baby bonds:

Baby Bonds of AT&T (proprietary software)

In line with the preferred stocks, the baby bonds have also narrowed their spreads:

Baby Bonds credit spread dynamics (proprietary spreadsheet)

New ALL IPO

At the end of this short analysis, we would like to turn your attention, for comparison purposes only, toward the new Allstate Corporation IPO. ALL-J (ALL.PJ) will be BBB rated by S&P perpetual preferred stock with a 7.375% fixed nominal yield. Allstate has always been a prime issuer and if it cannot finance its operations at lower costs at the moment that means no way AT&T can. We believe that T-A and T-C sooner rather than later will have a reality check and adjust their yields to more adequate, higher levels.

How to take advantage of the situation

It all depends on the perspective and on your personal understanding of the situation. If one believes the fixed income market is correct about AT&T, then the T common stock has never presented such an obvious mispricing as a multiple to the operating earnings:

T stock historical performance (Fastgraphs)

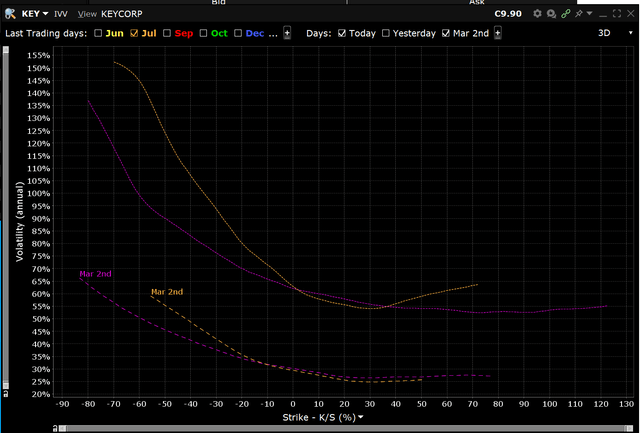

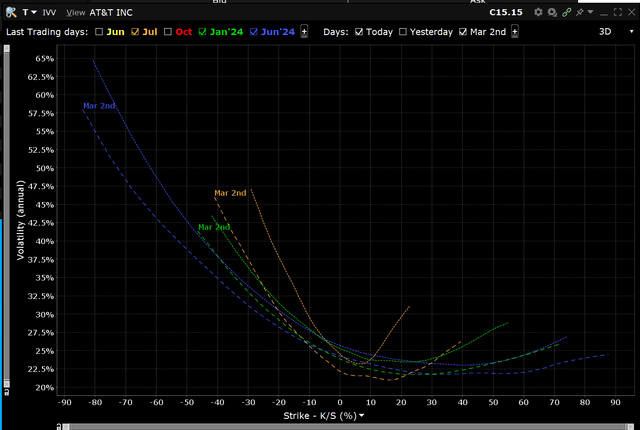

If the analysts are correct in their prognosis for the future, you have the rare chance to invest in such an iconic company at close to 16% earnings yield. This is a number one would expect from a distressed company. One further positive for the investor in AT&T is the fact that the implied volatility for the common stock has been pretty stable in spite of the terrible stock performance. Here is how the Implied volatility changes when there is a problem:

Implied volatility example (Interactive Brokers)

Here is the same chart but for T

AT&T implied volatility (Interactive Brokers)

It seems that the market has not risen its expectation for a sharp decline in the company's price. While the preferred stocks, the bonds, and the IV of the company are not signaling any problem. one has to be very tempted to buy the common stock because it is very rare to be able to buy these Buffet-like companies cheaply. Of course, as traders of mis-pricings, we prefer the less obvious trade. As mentioned earlier, the credit spread of the preferred stocks is at historical lows and we see a lot of value in trading its widening. The easiest way to do that is to bet on the widening via some exotic CDS product on the preferred stock. We do not have such a product available for trading and the only trade we can make out of this is to be long a similar duration treasury bond while shorting the preferred stock. To some extent, this trade is similar to what Bill Ackman did in 2020.

Summary

Based on the preferred stocks, baby bonds, implied volatility, and the whole yield curve of AT&T Inc., we can conclude that this is a sound investment-grade company with no significant credibility issues ahead. The narrowing of the credit spreads, suggests improved credibility and a market willing to finance the underlying business at a lower-than-usual credit premium.

As it is hard for us to know the future, we only highlight the obvious convergence between the AT&T Inc. common stock price behavior and how the risk premiums have narrowed. It is one of the very few situations where the company's common stock seems to be undervalued in comparison to the preferred stock, all else being equal.

This article was written by

Day trader whose strategy is based on arbitrages in preferred stocks and closed-end funds. I have been trading the markets since I started my education in Finance. My professional trading career started right before the big financial crisis of 2008-2009 and I clearly understand what are the risks the average investor faces. Being a very competitive trader I have always worked hard on improving my research and knowledge. All my bets are heavily leveraged(up to 25 times) so there is very little room for mistakes. Through the years my approach has been constantly changing. I started as a pure day trader. Later I added pair trades. At the moment most of my profits come from leveraging my fixed income picks. I find myself somewhere in between a trader and an investor. I am always invested in the markets but constantly replace my normally valued constituents with undervalued ones. This approach is similar to rebalancing your portfolio and I just do this any time there is some better value in the markets. I separate my trading results from my trading/investment results. I target 40% ROE on my investment account and since inception in 2015, I am very close to this target.

My main activity is running a group of traders. Currently, I have around 40 traders on my team. We share our research and make sure not to miss anything. If there is something going on in the markets it is impossible not to participate somehow. Some of my traders are involved in writing the articles in SA. As such Ilia Iliev is writing all fixed-income IPO articles. This is part of their development as successful traders.

My thoughts about the market in general:

*If it is on the exchange it is overvalued and our job is to find the least overvalued.

*Never trust gurus - they are clueless.

*Work hard - this is the only way to convince yourself you deserve success.

*If you take the risk it is you who has to do the research.

*High yield is always too expensive.

We are running a service here on SA. It is a great community with very knowledgable people inside. Even though we are not in the spotlight as often as we would like to our articles' results are among the strongest on SA. You can always contact me to share some of our articles and best picks so far.

Analyst’s Disclosure: I/we have a beneficial short position in the shares of T.PA either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

I am short T-C and have a small long position in T

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.