WESCO Remains Positioned In High-Growth, Consolidating Markets

Summary

- WESCO, a leading electrical distribution and services company, is currently undervalued by 36% with a fair value of $214.60, according to a weighted average of DCF and Alpha Spread's multiples-based relative valuation tool.

- The company's strategic positioning in macro growth sectors, operational capabilities, and disciplined capital allocation strategy make it a strong buy.

- Risks and challenges include continued supply chain duress, inflationary pressure, and potential difficulties in managing global operations.

imaginima

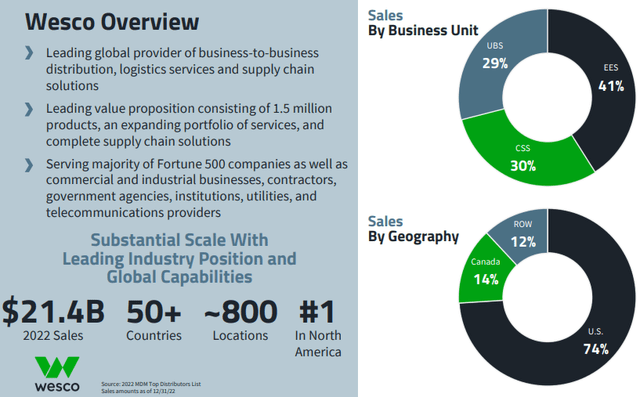

WESCO (NYSE:WCC) is a Pittsburgh, Pennsylvania-based electrical distribution and services company. The company's operations span electrical, industrial, communications, maintenance, repair and operating, and OEM products, in addition to construction materials and advanced logistics services.

Through a combination of these activities, WESCO has achieved >$21.4bn in 2022 sales, with operations across 800 locations in 50 nations.

WESCO's ability to generate scale through organic or inorganic means, its chronic undervaluation, and its positioning for long-run growth are why I rate WCC stock a 'strong buy'.

Introduction

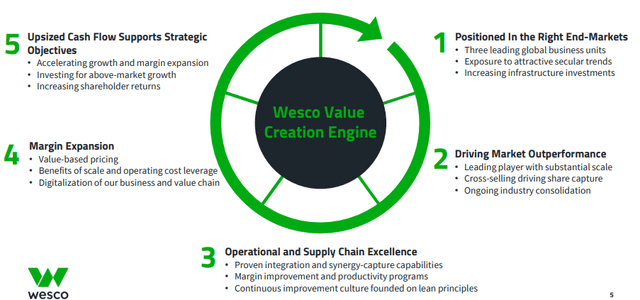

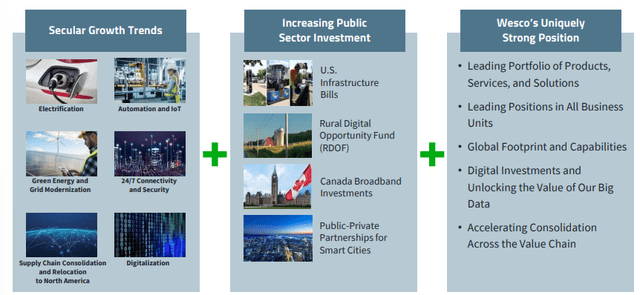

WESCO presents its value creation as five parts of a virtuous cycle, including the company's positioning in the appropriate end markets, aligning with macro growth sectors, utilizing scale advantage to outperform the market, integrating operational and supply chain performance to reduce costs and supporting productivity, expand margin through said efforts and digitalization and dynamic pricing efforts, and a disciplined capital allocation strategy which balances growth and shareholder returns.

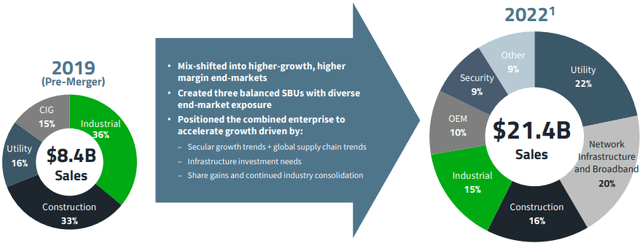

WESCO's 'value creation engine', through a combination of organic and inorganic growth- most notably the acquisition of Anixter- has supported significant scale growth and revenue diversification, in turn supporting greater resilience in the face of macro headwinds.

The company has thus been able to position itself to capture secular, organic growth trends, meet infrastructure investment needs, and lead an increasingly consolidated industry.

Valuation & Financials

General Overview

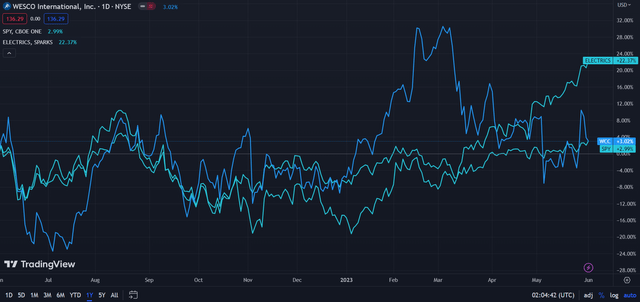

In the TTM period, WESCO- up 3.02%- has experienced growth similar to the broad market, represented by the S&P 500 (SPY)- up 2.99%- but significantly poorer than TradingView's Electrical Production Index- up 22.37%.

WESCO (Dark Blue) vs Industry & Market (TradingView)

This likely reflects lingering anxieties about the impact of the supply chain turmoil through the past few years as well as cost-push inflation, which continues to increase labour costs.

Comparable Companies

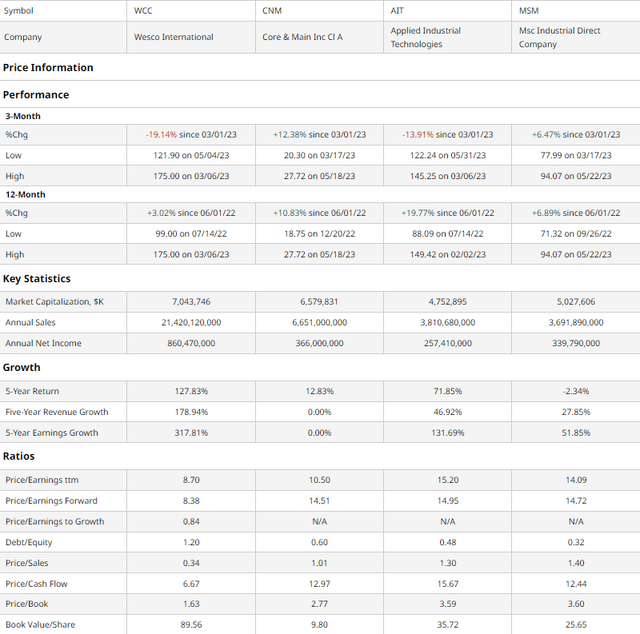

Since WESCO operates across a broad range of verticals and leads its market, it makes more sense to compare the company with similar-sized firms with similar operations but across different segments. For instance, Core & Main (CNM) functions analogously to WESCO, but with water and wastewater products rather than electricals. Similarly, Applied Industrial Technologies (AIT) works with transmission and engineered power system products and MSC Industrial Direct (MSM) works with metals.

As demonstrated above, WESCO has experienced poorer quarterly and TTM price action than peer companies. This comes in spite of superior growth and multiples-based value metrics.

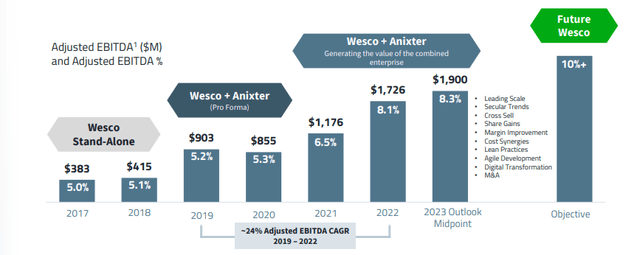

For instance, WESCO has seen the greatest five-year revenue and earnings growth. Although much of this growth is a product of M&A- chiefly Anixter- WESCO has seen commendable margin expansion, with earnings growing at almost double the rate of revenue.

In the same vein, WESCO sees much lower- thus higher value- multiples; the firm maintains the lowest trailing and forward P/E, PEG, P/CF, and P/B, all the while sustaining the highest BV/share.

Although this comes at the cost of a higher debt/equity, WESCO has demonstrated its capacity to generate more than sufficient free cash flow to address increased debt costs.

Valuation

According to my discounted cash flow analysis, at its base case, the fair value of WESCO should be $185.32, meaning the stock's current price of $136.29 is undervalued by 26%.

Calculated over a 5-year period without perpetual growth, my model assumes a discount rate of 10%, in line with the company's debt-heavy cap structure, and growth at 6%, significantly lower than the 5-year CAGR. I do this to remain conservative in my estimates and incorporate potential recessionary impacts.

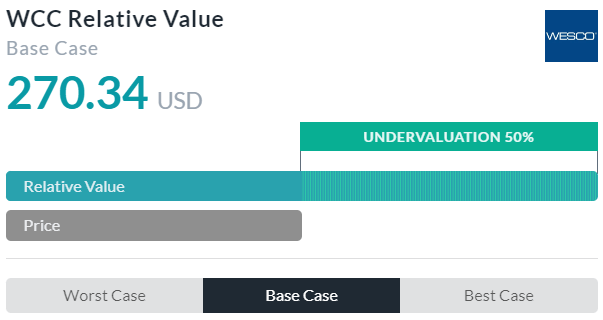

Alpha Spread

Alpha Spread's multiples-based relative valuation tool more than corroborates my theory on the stock's undervaluation, calculating, at its base case, an undervaluation of ~50%, with WESCO's fair price being $270.34.

However, I believe Alpha Spread may be overvaluing the stock due to its inability to account for WESCO's disproportionate debt/equity ratio relative to peers.

Thus, using a weighted average skewed towards my DCF, the fair value of WESCO is $214.60, with the company currently undervalued by 36%.

Operational & Macro Events + Capital Deployment Strategy Conducive to Growth

Above all else, WESCO aims to position itself to capture maximal secular growth, following macro trends. For instance, WESCO has invested in organic capability to address the electrification of vehicles and homes, green energy and grid modernization, and increasing digitalization- increasing accessibility and reducing costs along the way. Elsewhere, through the acquisition of Anixter, the company has accelerated its foray into communications and networking, thus being able to adequately address Internet-of-Things growth, 24/7 connectivity needs, and automation.

Such activities have enabled WESCO to operate in coordination with significant public and private investment opportunities, from multi-trillion dollar investments led by the US among many others to the rise of the infrastructure asset class amongst insurers and private equity groups. This has ultimately led to widening EBITDA margins with the propensity for significant cost synergies to segue into 10%+ future EBITDA margins.

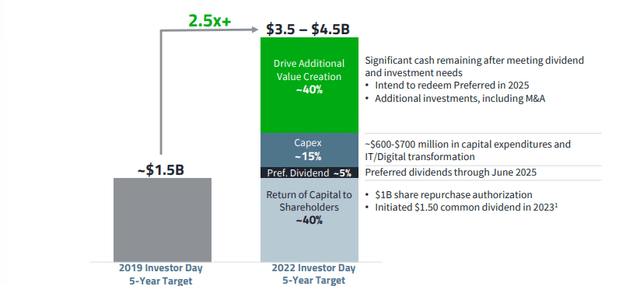

Beyond establishing its capability to achieve scale and margin growth, WESCO has demonstrated a marked ability to return value to shareholders, with a strategic blend of capital expenditures, inorganic growth through M&A, dividend provisions, and a $1bn share repurchase commitment.

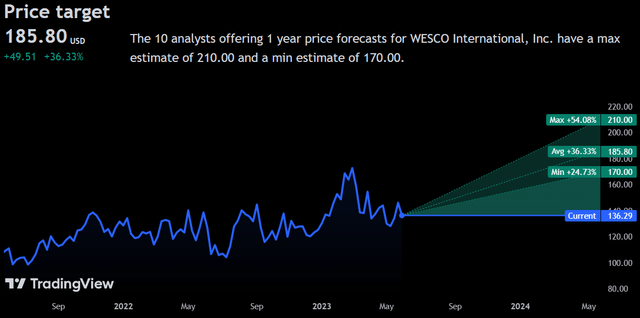

Wall Street Consensus

Analysts support my highly positive sentiment, projecting an average 1Y price increase of 36.33%, to a price of $185.80.

Even at its minimum projected price of $170.00, analysts project a 24.73% price increase. This reflects a shared opinion of WESCO's chronic undervaluation given its strong operational capabilities and financial results.

Risks & Challenges

Continued Supply Chain Duress

As a materials and distribution company, WESCO is exposed to stressors across global supply chains. Sustained supply chain concerns may lead to an inability for the company to fulfill its activities, reducing cash flow generation capabilities in addition to growth ability.

Inflationary Pressure May Reduce Profitability

Although WESCO generally does not manufacture its products, it is nonetheless susceptible to pass-through inflation. Continued inflation can not only increase WESCO's expenses but additionally lead to a decreased demand for the company's products.

Global Operations May Inhibit Core Growth

WESCO has aggressively been pursuing growth across geographic regions in addition to vertical expansion. Though this promotes greater revenue growth, the regulatory complexities, foreign exchange risk, and additional supply chain capabilities involved in global operations may reduce profitability for WESCO while simultaneously reducing the company's focus on its core markets.

Conclusion

In the short term, I expect WESCO to revert to its fair price and continue to judiciously deploy capital.

In the long term, I project WESCO's ability to position itself for macro growth opportunities will lead to increased capabilities for scale and margin growth.

This article was written by

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, but may initiate a beneficial Long position through a purchase of the stock, or the purchase of call options or similar derivatives in WCC over the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.