BIT: Revisiting A Multi-Asset CEF, 10% Yield

Summary

- BlackRock Multi-Sector Income Trust has successfully navigated rising interest rates, outperforming its peers by using interest rate swaps and creating a flat duration profile.

- The fund is now transitioning to taking duration risk again as rates peak, with a bar-belled approach to its collateral, including a significant amount of 'AAA', 'B', and 'CCC' assets.

- The main risk for BIT is corporate credit spread risk going forward, mitigated by a large bucket of AAA assets.

- The fund has had a healthy positive total return during the past year, outperforming most peers in the HY and IG space.

gorodenkoff/iStock via Getty Images

Thesis

We have covered BlackRock Multi-Sector Income Trust (NYSE:BIT) before here, and we have been quite impressed on how this CEF has navigated the rise in interest rates. The fund outperformed by layering in interest rate swaps and creating a flat duration profile in 2022. The fund is dynamic, and is now expressing a view on peak rates by starting to take duration risk:

Duration (Fund Website)

We expect this figure to keep increasing as it becomes more obvious to all market players that we are set for lower rates in the coming years. We are going to take a renewed look in this article at the CEF's collateral and what is in store for this name in the future.

Firstly, let us look again at the investment objective for this multi-asset CEF:

BlackRock Multi-Sector Income Trust’s (the 'Trust') primary investment objective is to seek high current income, with a secondary objective of capital appreciation. The Trust seeks to achieve its investment objectives by investing, under normal market conditions, at least 80% of its assets in loan and debt instruments and other investments with similar economic characteristics. The Trust may invest directly in such securities or synthetically through the use of derivatives.

The fund has a very wide investment mandate, and we consider it a multi-asset CEF given its current and historic composition. Around half of the assets are corporate bonds (both investment grade and high yield), with the rest composed of MBS bonds and securitized products.

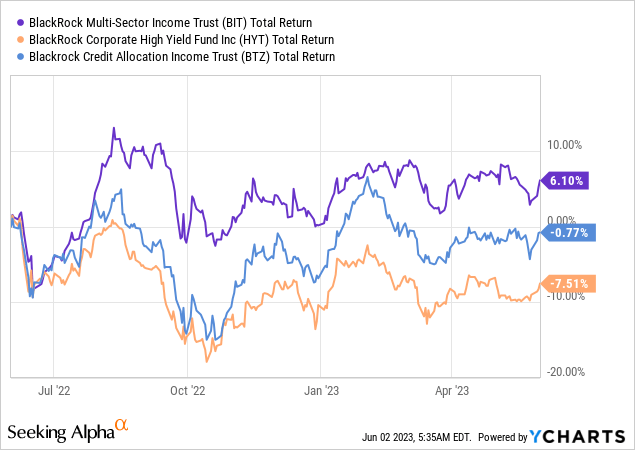

The fund has had a tremendous performance in the past year, being up over 6% on a total return basis:

We are comparing BIT with a pure high yield CEF from BlackRock, namely BlackRock Corporate High Yield Fund (HYT), and with an investment grade CEF from the same fund family, namely BlackRock Credit Allocation Income Trust (BTZ). BIT outperforms significantly. The fund was able to manage its duration very, very well, and due to its securitization holding which have a floating rate, was able to get a boost from higher rates.

The fund did suffer from higher rates via its leverage profile. The CEF is running a 34% leverage ratio achieved via Repo facilities, meaning it pays floating rates on its debt. As rates have gone up, the cost of funding for the CEF has gone up as well. This is reflected in a poor coverage for its distribution.

BIT Holdings

The fund is now equally split between investment grade and high yield instruments:

Products (Fund Fact Sheet)

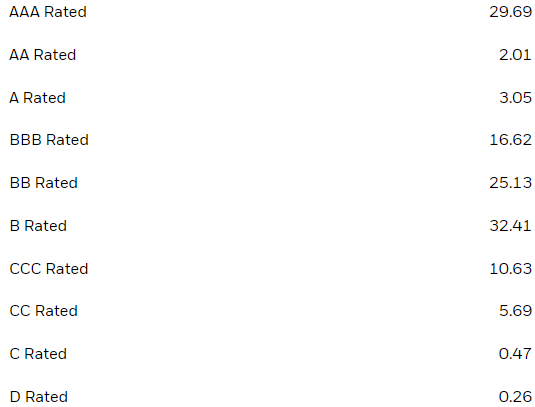

Most of the holdings in the 'Securitized Products' bucket above are rated investment grade. Let us have a look at the ratings distribution as well:

Ratings (Fund Fact Sheet)

We observe again the bar-belled approach we identified before - a significant amount of AAA assets (Agency MBS bonds and senior AAA securitizations), offset by 'B" and 'CCC' rated high yield bonds.

Premium/Discount to NAV

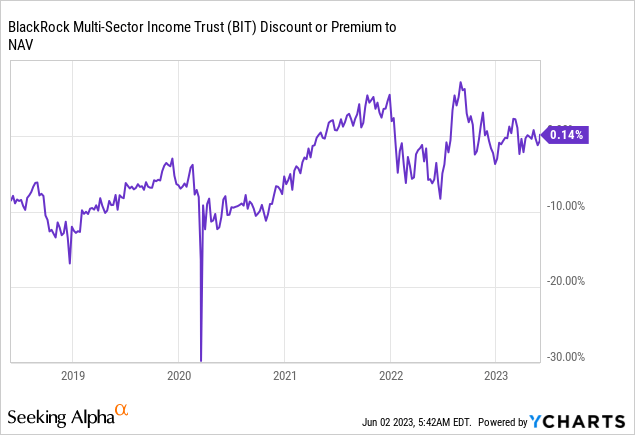

As it has outperformed, the CEF has seen its discount to NAV narrow:

We can see a very different trend here for this CEF as opposed to some of its HY peers. BIT is now trading at the top of its historic range for a premium/discount to NAV, while other pure HY CEFs are trading at historic wide discounts to NAV. We attribute this occurrence to the elegant way the CEF was able to deal with higher rates, and general robust performance. This fund has delivered strong positive results in a very tough year for fixed income.

Distribution Coverage

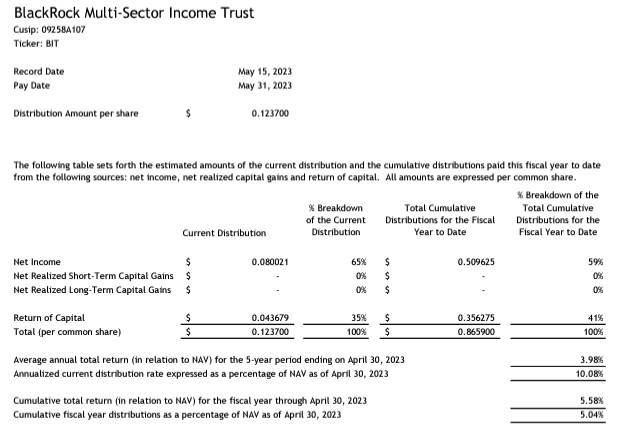

This area is the only weak spot here for this CEF:

Distribution (Section 19a)

Due to the floating rate nature of its leverage facilities, the fund has been negatively affected by higher rates. That translates into an uncovered distribution yield. We can see the CEF is using around 41% in ROC, which brings its true yield to a figure closer to 6%. That is actually the total return it has posted in the past year.

Conclusion

BIT is a multi-asset CEF from BlackRock. The fund was able to navigate higher rates very well via a flat duration profile, obtained via interest rate swaps. The fund is now transitioning to taking duration risk again as rates peak. The vehicle has a bar-belled approach to its collateral, with a significant amount of 'AAA', 'B' and 'CCC' assets. The main risk in this fund now is corporate credit spread risk. Only half of the fund's assets are high yield bonds though, so it will likely outperform its HY CEF peers. The only negative impact to the fund from higher rates has been felt via its higher cost of leverage, which makes the current distribution un-sustained. The market has rewarded the CEF with a very tight discount to NAV. We expect this fund to keep outperforming its HY and IG peers this year, especially during the next leg down in the market. We believe the CEF will however lag during a strong bull market for risky assets. That is reserved for 2024 in our view. We own this CEF and continue to Hold.

This article was written by

Analyst’s Disclosure: I/we have a beneficial long position in the shares of BIT either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.