Target: 'Five Finger Discount' Is Just 1 Of 3 Key Concerns

Summary

- The stock of this well-known retailer has been under pressure lately due to several key investor concerns about Target Corporation.

- Challenges faced by Target include a recent and ongoing marketing fiasco, a significant increase in losses from theft, and deteriorating conditions for consumers.

- Should investors buy the nearly 20% dip in Target Corporation stock over the past couple of weeks? An investment analysis follows below.

- Looking for a portfolio of ideas like this one? Members of The Insiders Forum get exclusive access to our subscriber-only portfolios. Learn More »

GoodLifeStudio/iStock via Getty Images

When plunder becomes a way of life for a group of men in a society, over the course of time they create for themselves a legal system that authorizes it and a moral code that glorifies it.”― Frédéric Bastiat.

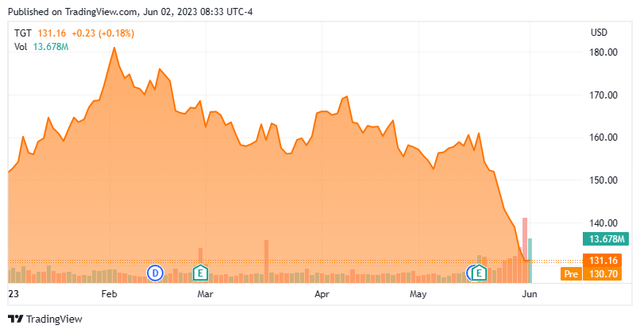

Today, we put Target Corporation (NYSE:TGT) in the spotlight for the first time. The stock of this well-known retailer has been under pressure this spring both from headwinds affecting most of the retailing sector as well as some of its own unforced errors. The stock lost more than 15% of its market value in May. We discuss some of the key challenges Target faces and whether the stock in sufficiently "on sale" to buy the dip in the shares via the analysis below.

Company Overview:

This retailing behemoth Target Corporation is headquartered in Minneapolis, MN. The company offers just about every household good imaginable from apparel, kitchen items, groceries and even luggage, both online and through over 1,900 stores in the U.S. With the pullback in the stock, TGT shares trade for just north of $130.00 a share and sport an approximate market capitalization of $60 billion.

Google Search

Marketing Fiasco:

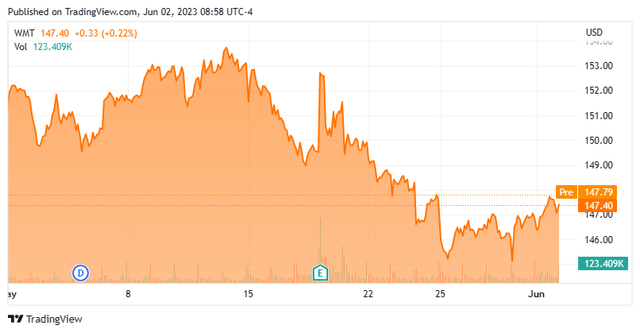

Target Corporation stock has had ten straight down sessions in the market since May 18th, accumulating 18.5% in losses in the process. This sharp pullback is due primarily to the extremely negative backlash from the merchandise and marketing campaign associated with the company’s Pride month event this year. In way of comparison, archrival Walmart Inc. (WMT) is down just 2.7% over that time.

Marketing executives at Target stepped in the same ideological morass that The Walt Disney Company (DIS) and Bud Light seller Anheuser-Busch InBev SA/NV (BUD) have found themselves stuck within via pushing a marketing message that is offensive to some of their core constituents. This has subjected these companies to significant boycotts.

I am not going to get into a discussion around ideology. Suffice it to say all of these companies could learn from the timeless business wisdom of the greatest NBA player of all time, Michael Jordan (sorry, Lebron fans). When famously asked on why he doesn't take public political stances, MJ simply quipped, "Republicans wear sneakers, too."

Theft or "Shrink"

Target's marketing missteps have been all over the news and social media over the past couple of weeks. Those headlines have overshadowed one of the company's growing problems that is impacting more and more retailers these days. That of the "five-finger discount," also known as shoplifting. As some jurisdictions have refused to now prosecute shop lifters, theft has spiked in places like San Francisco and New York City. A good portion of this shoplifting is now being facilitated by organized gangs.

Management noted in its first quarter earnings report that it was increasing its provision for this kind of theft, also known as "shrink." Specifically, the company's CEO stated:

As we look ahead, we now expect shrink will reduce this year's profitability by more than $500 million compared with last year. While there are many potential sources of inventory shrink, theft and organized retail crime are increasingly important drivers of the issue."

He also articulated that the company is making 'significant investments in strategies to prevent this from happening in our stores and protect our guests and our team'.

Target is hardly alone in the sector facing this headwind. The National Retail Federation recently noted that organized retail crime has risen sharply since 2020. Many of these stolen items are now fenced through online sales and flea markets. The organization said these coordinated attacks cost the industry nearly $95 billion in 2021. A figure that is sure to rise when numbers from 2022 are known.

Deteriorating Consumer Conditions:

I think Target's marketing debacle will gradually fade to the background and it will not suffer the same boycott impacts of Bud Light, which has seen sales drop nearly 30% since its own social media marketing fiasco. Increased shoplifting losses are probably here to stay, although hopefully the measures the company is now taking decrease the pace of the rise.

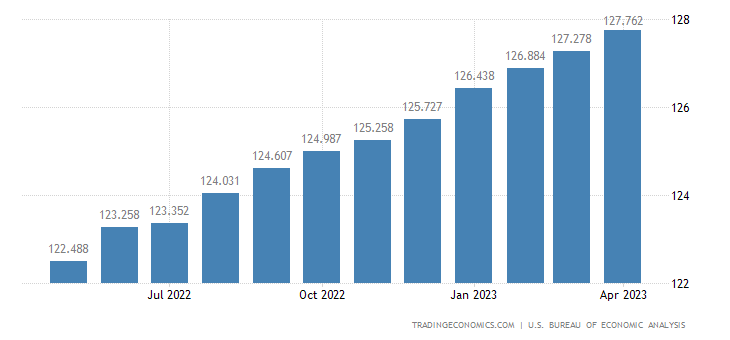

The biggest challenge facing Target and the majority of the retail industry, is the deterioration of consumer health across most segments of society. The average consumer has lost buying power to inflation for 24 straight months now and counting. With the central bank’s favorite measure of inflation, the core Personal Consumption Expenditures Price Index, or core PCE, not budging (4.7%) so far in 2023, that headwind to consumer spending and confidence is likely to remain in place for the foreseeable future.

U.S. Bureau of Economics

While the jobs market remains strong, there are myriad signs the country is heading into a recession. Manufacturing has been in recessionary territory for six straight months now after thirty straight months of expansionary readings. In addition, the treasury yield curve is as inverted as it has been since before the major recession of the early '80s, and the Leading Economic Indicators have been pointing to a pending economic contraction for some time now. This last factor is why I started to short Target stock in March in the mid-$170s along with several other retailer names. I have recently closed out those bear put spreads for a nice profit.

Target is hardly alone in facing these headwinds, as retailers like Macy's, Inc. (M), Best Buy Co., Inc. (BBY), Costco Wholesale Corporation (COST), and numerous others in the sector have all lowered guidance and/or noted the poor condition of the consumer in their first quarter earnings calls during earnings season.

Valuation/Verdict:

The current analyst consensus has Target earning $8.35 a share in FY2023 on the slightest of revenue growth to $110.6 billion. They see brighter times ahead in FY2024 with profits coming in above ten bucks a share even as sales growth remains tepid in the low single digits.

That leaves TGT trading at 15.7 times this year's consensus earnings and 55% of revenues. This compares to WMT, which trades at 23.8 times earnings and 62.5% of sales. TGT has a 3.3% dividend yield compared to Walmart's 1.55%, for what it is worth as well.

I would start to accumulate shares of Target Corporation when the dividend yield hits four percent, as that should put a floor under the stock. Outside of that, I would like to see some combination of the following before buying the dip in Target:

1) Signs Target is putting this marketing miscue fully behind it.

2) Significant insider buying by management*

3) Substantial decreases in core inflation

4) Consistent signs the economy is on the uptrend.

*Insiders have sold just over $1.2 million worth of shares so far this first quarter. It has been years since the last insider purchase in this equity.

Looters become looted, while time and tide make us mercenaries all.”― Patrick Rothfuss.

Author's note: This is your chance to try us out – without any strings attached. Activate your two-week free trial period now and see if The Insiders Forum is right for you.

This article was written by

Our Model portfolio's return has more than TRIPLED the return of our benchmark since its launch!

The Insiders Forum's focus is on small and mid-cap stocks that insiders are buying. Some studies have shown that equities with heavy insider purchases outperform the overall market over time. The portfolio managed by Bret Jensen consists of 15-25 top stocks in different sectors of the market that not only are attractively valued but have had some significant insider purchases in recent months. Our goal is to outperform the Russell 2000 (the benchmark) over time. Since its launch in the summer of 2016, the Insiders Forum's model portfolio has generated an overall return of 162.75% as of 05/19/2023. This is more than triple the 46.10% return from the Russell 2000 over that time frame.

• • •

Specializing in profiling high beta sectors, Bret Jensen founded and also manages The Biotech Forum, Insiders Forum, and the Busted IPO Forum model portfolios. Finding “gems” in the biotech and small-cap stock sectors, these highly volatile spaces proven hugely successful have empowered Bret Jensen's own investing portfolio.

• • •

Learn more about Bret Jensen's Marketplace Offerings:

The Insiders Forum | The Biotech Forum | Busted IPO Forum

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.