Rising Tech Tide Supports Market

Summary

- Tech stocks continued to drive the market in May, with AI-focused companies such as Nvidia and Marvell Technology posting strong earnings and forward guidance.

- The US economy showed resilience with a higher revised first-quarter GDP, tight labor market, and consumer spending, but inflation may be more ingrained than previously thought.

- The market may expect an economic soft landing, but higher interest rates and labor market pain may be necessary to combat inflation.

CHUNYIP WONG/E+ via Getty Images

While investors nervously monitored the debt-ceiling showdown in May, tech continued to separate itself from the rest of the market—especially toward the end of the month, when earnings beats and bullish forward guidance from AI-focused companies such as Nvidia and Marvell Technology underscored the recent momentum in the space.

While the rising tech tide helped lift many boats last month, it also highlighted a potential vulnerability: A “narrow market” driven by a handful of stocks with highly elevated valuations is susceptible to volatility, if and when the momentum bubble bursts.

If last month’s tech surge surprised many market participants, so did the US economy’s resilience. First-quarter GDP was revised higher, the labor market remained tight, and consumers continued to spend. The catch is that inflation appeared to be even stickier than previously thought—it may have peaked, but it also may be more ingrained in the economy than many people had hoped.

As they have for more than a year, all roads appear to lead back to interest rates. In May, consensus expectations shifted from “the Fed is done hiking rates” to “the Fed may need to hike a couple more times.” So, while the market may continue to expect an economic soft landing, it may be difficult to break the back of inflation without higher rates and some pain in the labor market.

US equities

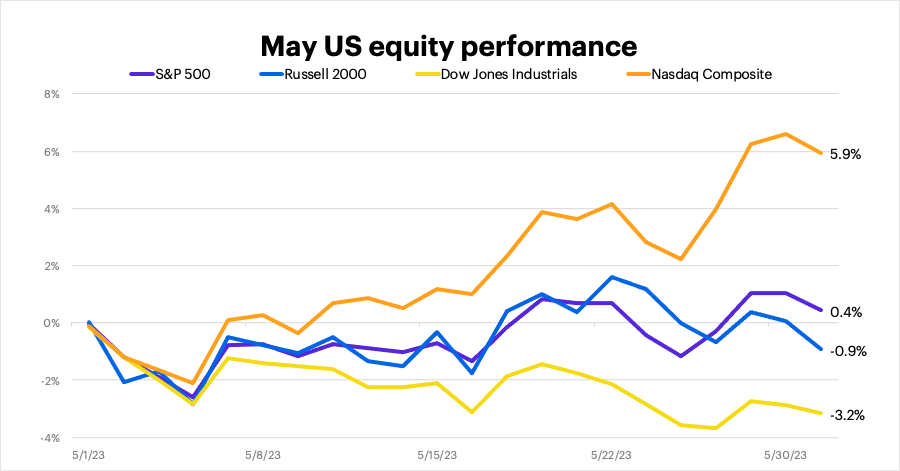

What was shaping up to be a negative May for US stocks was transformed by the accelerated tech rally toward the end of the month. Returns were still mixed, though. The tech-heavy Nasdaq Composite led the market by a wide margin, while the S&P 500 gained a marginal 0.4% for the month. The Dow Jones Industrial Average was the weakest performer, while the Russell 2000 small cap index ended the month slightly lower:

FactSet Research Systems

(It is not possible to invest in an index.)

Sectors

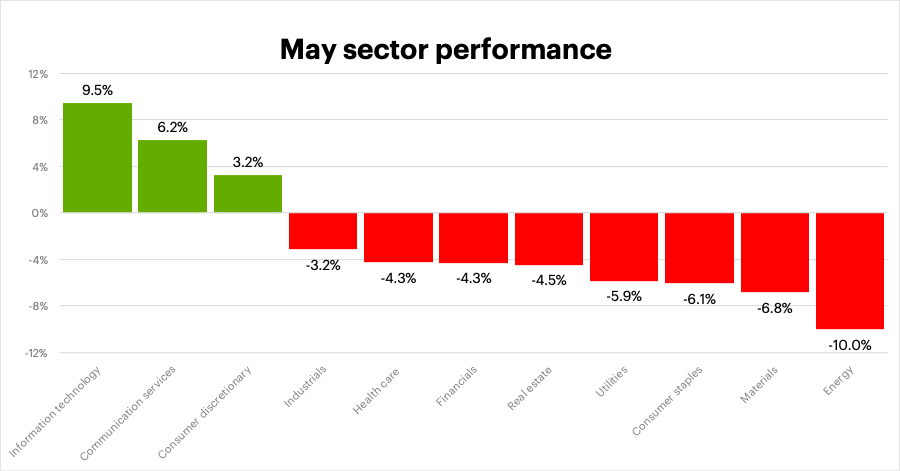

Only three S&P 500 sectors were positive in May, but the two strongest—tech and communication services—both posted outsized gains. Energy was the weakest sector, as oil prices spent most of May toward the lower end of their multi-month trading range:

FactSet Research Systems

International equities

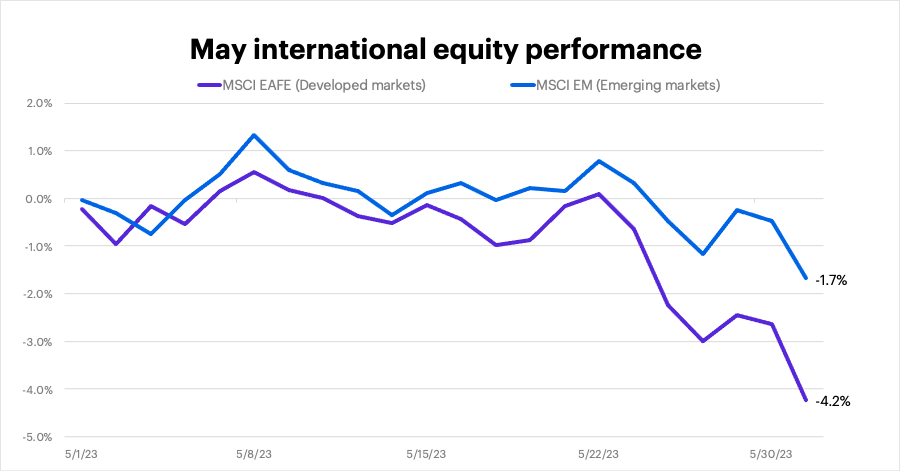

International stocks mostly underperformed the US in May, but there was a big difference between developed and emerging markets. The MSCI EAFE Index of developed markets fell more than 4% (Europe pulled back after a strong April), while the MSCI EM Index of emerging markets declined only 1.7%:

FactSet Research Systems

Fixed income

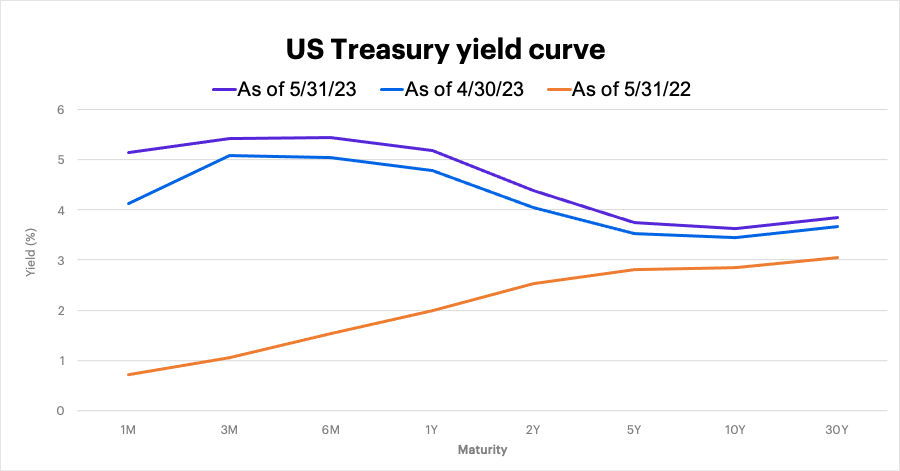

Bond prices declined last month as yields, which move in the opposite direction of prices, hit their highest levels in more than two months. The 3-month Treasury yield jumped above 5%, while the benchmark 10-year Treasury yield closed May at 3.64%, up from 3.45% at the end of April:

FactSet Research Systems

Looking ahead

With the debt ceiling off the table, here are some themes to focus on as we head toward mid-year:

- Rates poised to rise. Morgan Stanley & Co. analysts noted the recent shift in expectations for interest rates: With core inflation still high and US unemployment at its lowest levels since 1968, hopes the Fed was done hiking rates this year have waned,1 even if there’s no increase this month.

- Risks of narrow market leadership. The tech sector’s eye-popping returns may be enticing but, as noted, narrow markets potentially translate into continued market volatility. Excessively priced pockets of the market are always vulnerable to correction, which can weigh on the broad market.

- Stormy weather calls for a diversified, balanced portfolio. A high-rate environment with attractive fixed-income yields continues to argue in favor of maintaining a broad, balanced portfolio of quality stocks and bonds.

There were more than a couple of surprising market development last month—there usually are. Because such shifts are unpredictable, investors are wise to concentrate on stability over short-term momentum. As always, stay disciplined, diversified, and focused on the long term.

This article was written by

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it. I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.