KOLD: Still A Buy After The Above 200% Upside

Summary

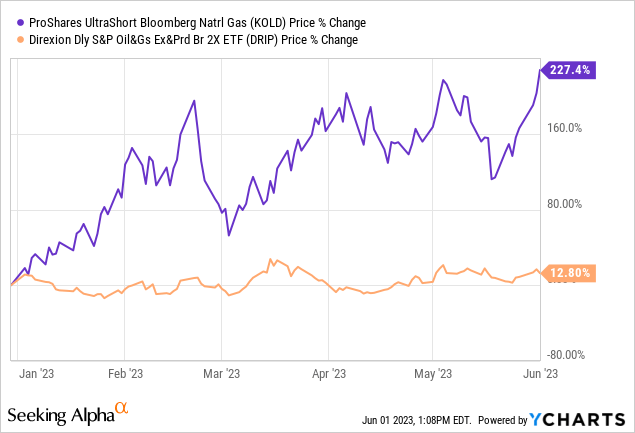

- The prices of oil and natural gas have been moving in opposite directions, with the ProShares UltraShort Bloomberg Natural Gas ETF performing well compared to the Direxion Daily S&P Oil and Gas Exploration and Production Bear 2X ETF.

- KOLD tracks the Bloomberg Natural Gas Index inversely at an accelerated rate, meaning that when the index loses value, KOLD gains, making it a useful tool for shorting.

- Short-term trading strategies and monitoring of demand and supply conditions are recommended for investing in KOLD, as its leveraged nature can lead to abrupt moves in either direction.

Eleganza/E+ via Getty Images

The prices of oil and natural gas have been moving in opposite directions. This is illustrated in the year-to-date performance of the ProShares UltraShort Bloomberg Natural Gas (NYSEARCA:KOLD) has been nothing short of spectacular, especially compared to the Direxion Daily S&P Oil and Gas Exploration and Production Bear 2X ETF (DRIP) as shown in the chart below.

Both ETFs are used for shorting purposes, but KOLD's stellar rise despite the advent of the winter season which is normally synonymous with an increase in demand for gas, shows that natural prices have gone inexorably lower, making it difficult to call a bottom.

Thus, my aim with this thesis is to assess whether a new bottom in prices has been attained which would mean that it is time to short the ETF, and for this purpose, I will go through the demand-supply equation, but, I start by cautioning investors as these whopping gains made possible using leverage can quickly make people become oblivious of the risks.

Using KOLD for Shorting

First in order to understand how KOLD makes possible such gains, it tracks the Bloomberg Natural Gas Subindex, but, inversely at an accelerated rate of two times as pictured below.

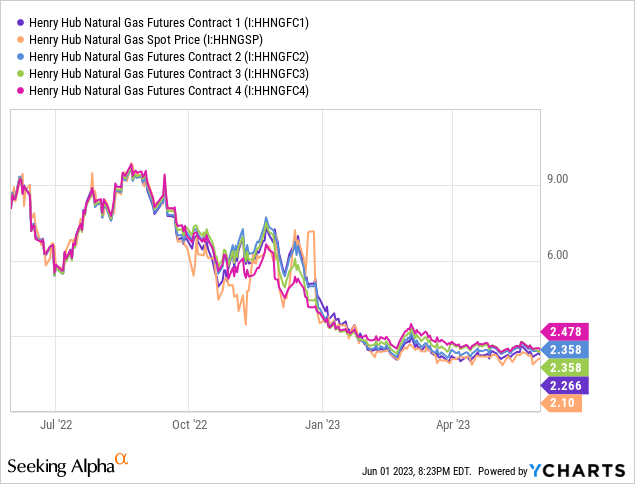

This means that when the index loses $2 on the back of falling natural gas futures, KOLD gains $4. This implies that the reverse is also true and when natural gas futures rise by $2, the ProShares ETF loses $4. I specifically mention futures as the index consists of natural gas futures contracts, not the spot price of natural gas.

To differentiate between these two, a look at the price action over the last one-year period shows that both the spot and future prices tend to move in tandem, as pictured below. However, as seen by the orange chart, spot prices tend to be more volatile, but, on an overall basis, they are correlated to futures.

The example trades I provided above using $2 seem so simple, but, in practice, things can get complicated and can quickly translate into losses for the uninitiated eager to make money on the back of news updates about energy. Along the same lines, the strategy used by this ETF to make money is also different from what most of us are used to as "conventional" investors who look to buy into a fund and keep it for a period of time of at least one year either for the income (dividends) or the capital appreciation. This approach does not work for KOLD, and to minimize the possibility of incurring losses, it is better to abide by the Securities and Exchange Commission's guidelines and avoid a buy-and-hold strategy.

In this case, one of the risks involved when putting money into the ProShares UltraShort ETF is the compounding of daily returns, due to its highly leveraged nature. This comes into play when it loses some of its gains when experiencing a high degree of volatility during the period it is held. Referring to the $2 example I mentioned earlier, it means that gains can be reduced to $3 or even $2.5, instead of the $4 expected. Thus, to minimize compounding risks, the issuers advise against holding the ETF for periods exceeding one day.

Taking into consideration the above, I will elaborate on a short-term trading strategy, or one where depending upon certain demand and supply conditions, a bet is placed at the most favorable moment, while bearing in mind that one should constantly monitor and be ready to exit in case losses mount.

The Demand Vs Supply Equation

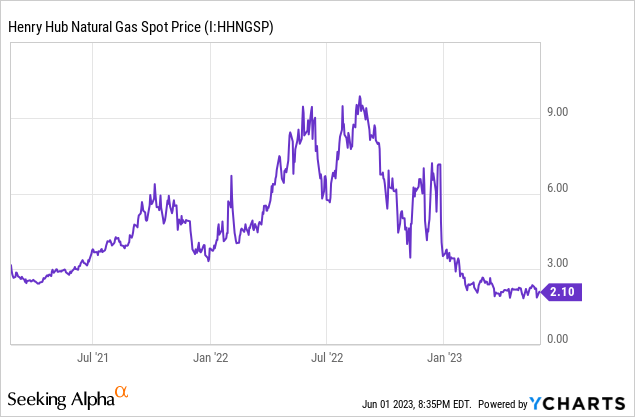

First, to put things into perspective, the price of natural gas attained a high of $10 in August 2022, a level last attained only in 2008.

The rise came in the aftermath of the Ukrainian conflict which started in February last year, prompting a surge to the $7 level, but it was only when the flow of gas from Russia to Europe was cut off in September that prices skyrocketed to $10. To provide investors with a sense of dependency, Germany relied on Russia for half of its natural gas, and with these supplies in jeopardy, authorities braced for the worst with traders looking to profit from the surge in demand.

Subsequently, prices did surge but were not sustained mainly due to winter in Europe being milder than usual but also due to the fact that in anticipation of the Russian move, Europe had already started diversifying its supplier base to include the Middle East and the U.S. Furthermore, in Europe’s industrial heartland, many factories were able to switch from gas to heavy oil or even coal in order to keep production. To make things worse for energy bulls, the weather was also milder in North America, with the warmest February ever in New York City.

Switching to supply, according to natural gas producer EQT Corporation (EQT) CEO Toby Rice, there has been a production cut which augurs well for prices in the second half of the year. This is further confirmed by the number of drilling gas rigs having been taken offline by more than 16 to 241 in April, or the highest rate since February 2016. Because of the difficulty to raise finances.

However, this reduction in supply is likely to be offset to some extent by the increase in storage facilities. In this case, working gas lying in underground storage on May 26 represented an increase of 557 Bcf or Billion cubic feet over the amount last year and 349 Bcf above the five-year average of 2,097 Bcf. At the same time, the advent of summer does not augur well for consumption in general unless there is a spike in temperatures over a sustained period, which implies additional demand for office and home cooling purposes.

In these circumstances, the next step is to look at the price action.

The Price Action and Trading Opportunity

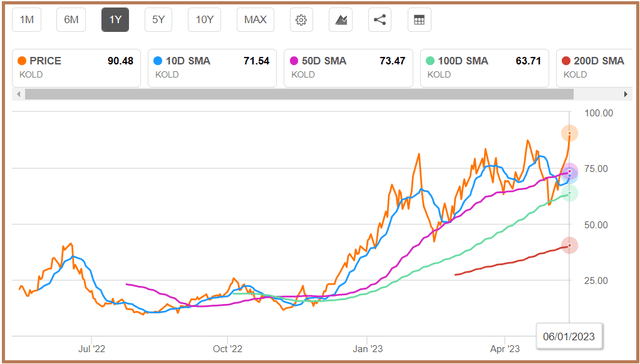

In this case, natural gas prices, which fluctuated in the $2.05 to $2.8 range during the last three months, appear to have slightly fallen as per the latest update. This has caused KOLD which inversely tracks gas futures to surge by 8.35% as at the time of writing, as shown in the orange chart below. As a result, its share price of $90.48 is now significantly above the 50-day SMA's value of $73.47 (purple chart). This is an indicator of an uptrend, which means it is now time to go long KOLD, which also concurs with Quant's Ratings of a "Strong Buy".

KOLD's Momentum and Performance (seekingalpha.com)

As for possible gains, the ETF could rise at least to the $100 level, a level it crossed back in March 2022, that time on a downtrend. This bullishness is also based on its RSI of 64.59 which tends to be in the 40 to 90 range during an uptrend. This is actually the case for KOLD and, on top, it is already passed the 40-50 support zone.

I also support this optimism using two demand/supply factors.

First, coming back to the weather, on average summer temperatures are likely to be "near to above normal" over the major part of North America, which does not leave room for increased cooling-related demand as production cuts take time to impact on prices.

Second, with the price of crude oil or WTI hovering around $70 or more than $50 below its June 2022 highs, there may be no further impetus for power generation companies to switch to natural gas, again impacting demand. However, looking at the longer term, as a cleaner source of energy (compared to oil), demand for natural gas for power generation in flexi-fuel thermal power stations in order to push coal or crude out should be sustained.

Finally, do note that there are many levers that can impact demand and supply, but short trend indicators point to further weakness in natural gas prices, which augurs well for KOLD. This said, this is a levered ETF and as such its price actions can be abrupt in any direction this is the reason, one must have a clear objective as to intended gains and be ready to exit with a loss.

This article was written by

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, but may initiate a beneficial Long position through a purchase of the stock, or the purchase of call options or similar derivatives in KOLD over the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

This is an investment thesis and is intended for informational purposes. Investors are kindly requested to do additional research before investing.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.