BDJ: Lagging Call-Write Peers Due To Mismatched Sector Exposures

Summary

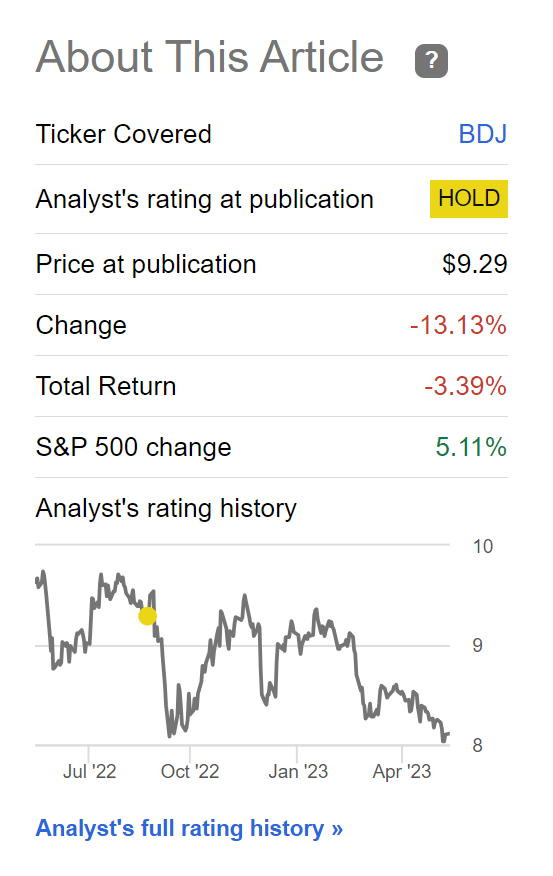

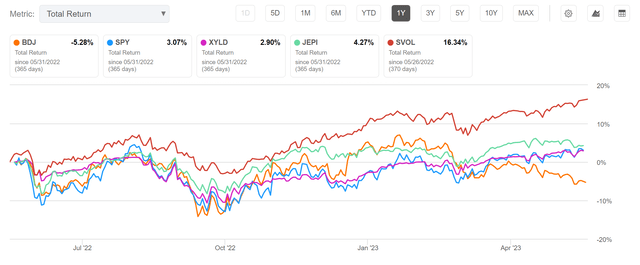

- The BlackRock Enhanced Equity Dividend Trust has underperformed the S&P 500 since we last covered it in September 2022, delivering -3.4% in total return compared to the S&P 500's 7.0% total returns.

- BDJ's recent performance lags peers, including the Global X S&P 500 Covered Call ETF and the JPMorgan Equity Premium Income ETF.

- BDJ's underperformance vs. call-write peers is due to the fund's sector allocation, which can tilt significantly away from market weights. This can lead to periods of over/underperformance.

- Looking forward, BDJ may continue to underperform as it's overweight sectors that tend to perform poorly during recessions.

MicroStockHub

Back in September, I wrote a cautious article on the BlackRock Enhanced Equity Dividend Trust (NYSE:NYSE:BDJ), suggesting that investors were trading away upside for premium income with BDJ's call writing strategy.

Since my article, the BDJ fund has delivered -3.4% in total returns compared to the S&P 500's 5.1% price return and 7.0% total returns, so my caution is justified (Figure 1).

Figure 1 - BDJ has lagged the markets (Seeking Alpha)

With 9 months gone by since my article, let us review why the BDJ fund has underperformed and my latest thoughts on the fund.

BDJ Is A Classic Call-Writing Fund

The BlackRock Enhanced Equity Dividend Trust owns a portfolio of dividend paying stocks and writes call options against its portfolio to enhance income. Rather than track an index like the S&P 500 Index, the BDJ fund is actively managed to own a portfolio of high quality large cap companies.

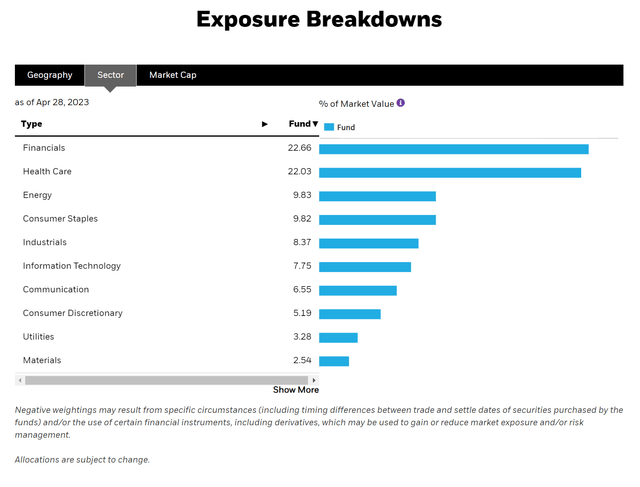

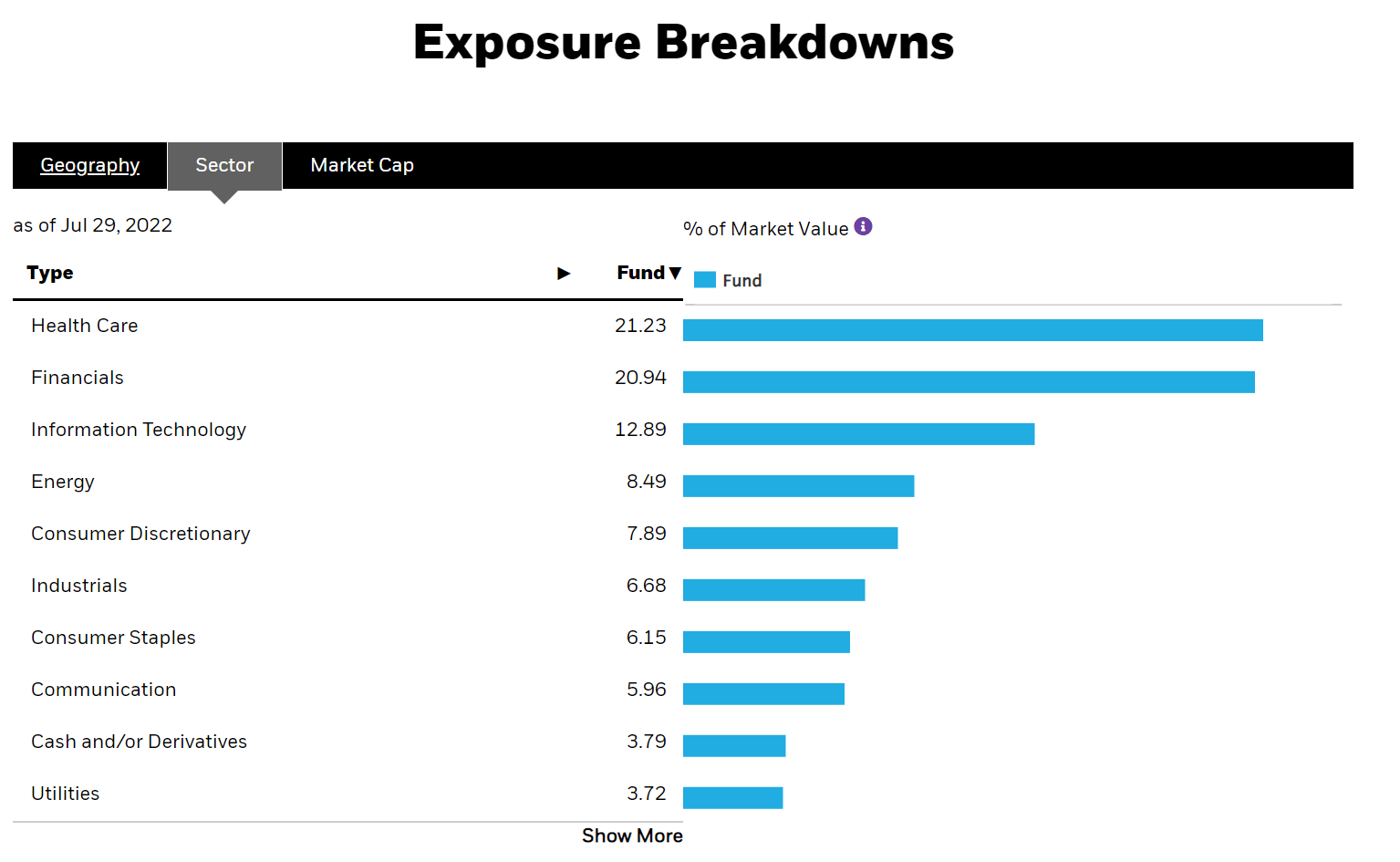

As of April 28, 2023, BDJ's portfolio is focused on Financials (22.7%), Health Care (22.0%), Energy (9.8%), Consumer Staples (9.8%), and Industrials (8.4%) (Figure 2).

Figure 2 - BDJ sector allocation (blackrock.com)

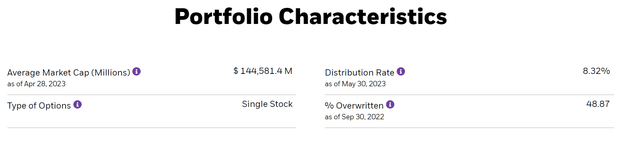

Approximately half of BDJ's portfolio is overwritten (i.e. have sold calls) (Figure 3).

Figure 3 - BDJ writes call options on approximately half its portfolio (blackrock.com)

Recent Performance Lagging Peers

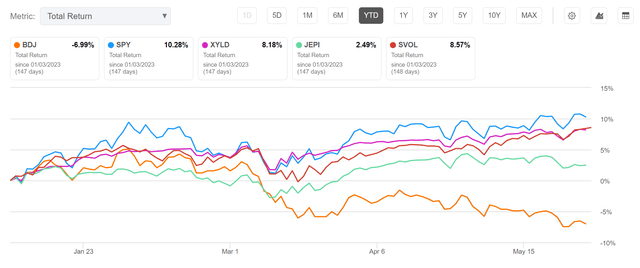

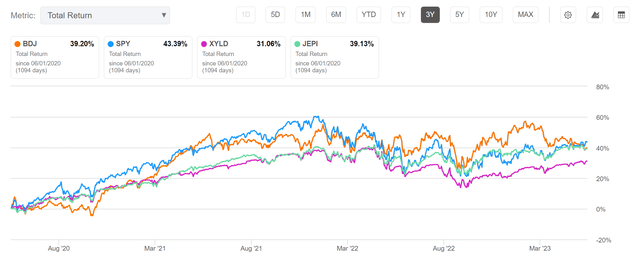

Comparing the BDJ fund against the SPDR S&P 500 Trust ETF (SPY), the Simplify Volatility Premium ETF (SVOL), and popular call-writing ETFs like the Global X S&P 500 Covered Call ETF (XYLD) and the JPMorgan Equity Premium Income ETF (JEPI), we find that the BDJ fund has significantly underperformed its peers in the short term.

Figure 4, 5, and 6 shows the total returns comparison between BDJ and its peers on a YTD, 1Yr, and 3Yr basis.

Figure 4 - BDJ vs. peers, YTD (Seeking Alpha) Figure 5 - BDJ vs. peers, 1Yr (Seeking Alpha) Figure 6 - BDJ vs. peers, 3Yr (Seeking Alpha)

What could be the cause of BDJ's recent underperformance?

Call-writing Trades Away Upside

As we explained in our prior article, we believe there's a risk with call-writing strategies in that they trade away 'upside' for premium income. This is can be problematic after sharp declines like in 2022, when the S&P 500 Index returned -18%. Typically, stocks 'snap back' after sharp declines, and calls sold near the market bottom may get triggered quickly, stunting a portfolio's recovery.

In fact, from Figure 4 above, we can see that most call-writing strategies underperformed the SPY ETF YTD because of this reason.

Recent Security Selection Also Questionable

I believe the bigger issue for the BDJ fund may be the portfolio's security selection. Judging from Figure 2 above, the portfolio manager has significant latitude to tilt the sector weights of the BDJ fund.

Currently, we can see that the fund's portfolio is heavily weighted towards the Financial, Health Care, Energy, and Consumer Staples sectors. The weights are fairly consistent with the fund's sector weights at the end of July 2022, with the exception of a further decline in Information Technology (Figure 7). This suggests the portfolio manager does not change their views quickly.

Figure - BDJ sector allocation, July 2022 (blackrock.com)

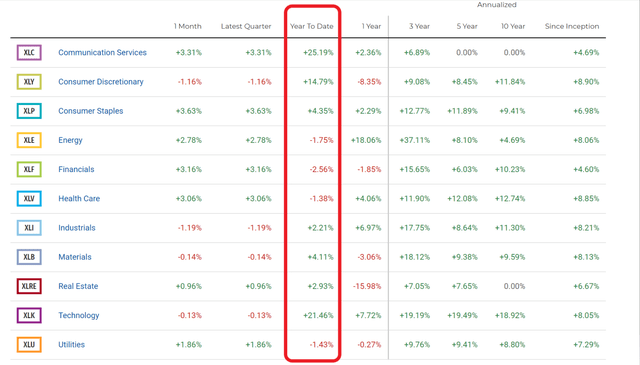

Unfortunately, YTD, equity markets have been driven by strong rallies in Communications, Technology, and Consumer Discretionary stocks (Figure 8).

Figure 8 - YTD Equity rally led by Communications, Technology, and Consumer Discretionary stocks (sectorspdr.com)

The mismatch between sector performance and BDJ's sector allocation is likely the main cause of BDJ's recent underperformance against the market and peer call-writing strategies like the XYLD and JEPI ETF.

For investors, giving the portfolio manager the latitude to tilt the portfolio to the extent that the BDJ fund does can be a double-edged sword. It can lead to periods of strong outperformance when the heavily weighted sectors are in favour, and underperformance when they are not. Currently, it seems the portfolio manager is on a 'cold streak'.

Outlook Not Favourable In The Face Of A Recession

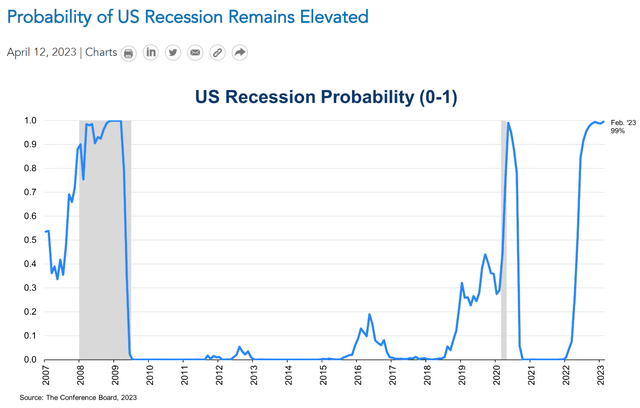

Looking forward, I fear the BDJ fund may continue to underperform due to a high risk of an impending recession (Figure 9).

Figure 9 - High risk of impending recession (Conference Board)

During recessions, cyclical sectors like Financials and Energy that the BDJ fund is overweight tend to lag the markets. In fact, we may already be seeing signs of those sectors pricing in a recession, as several regional banks failed recently and oil prices have retreated to multi-year lows.

On the other hand, current equity markets continue to be propped up by a handful of mega-cap technology stocks benefiting from the 'artificial intelligence' secular trend.

The end result is that traditional 'stock pickers' like the BDJ fund are having a tough time delivering positive returns while the overall markets like the S&P 500 Index continues to grind higher, with a 10% YTD gain.

Shorting VIX May Be The Better Strategy

Sharp-eyed readers may notice that in Figure 4 and 5 above, the Simplify Volatility Premium ETF has significantly outperformed both the BDJ fund and peer call-writing ETFs. In fact, on a 1-Yr basis, the SVOL ETF has significantly outperformed even the SPY ETF.

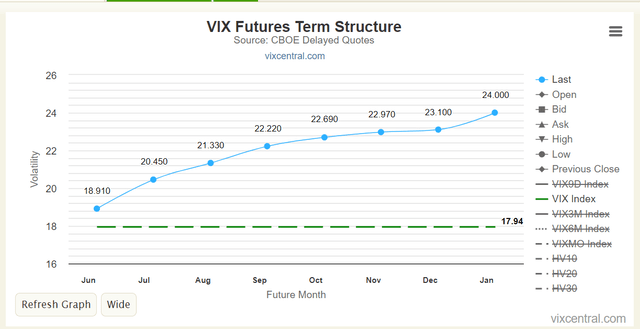

We wrote about the SVOL ETF in our prior article, noting that it may be a viable alternative to call-writing strategies like the BDJ fund. The fundamental idea behind SVOL is to short moderate amounts of VIX futures, relying on the fact that VIX futures curves are usually in contango. As the shorted futures mature and converge to spot, they tend to decline in price. Figure 9 shows the current VIX futures curve.

Figure 9 - VIX futures curve tends to be in contango, benefiting shorts (vixcentral.com)

The benefit of shorting VIX futures compared to writing calls on stocks and stock indices is that 'right tail' returns are not capped. In other words, during sharp equity rallies, the VIX curve usually steepens even further (short-term VIX collapses), and SVOL's strategy can continue to generate attractive yields and returns whereas call-writing strategies tend to have their returns 'capped' by the strike of the written calls.

The risk of shorting VIX futures is on the 'left tail', i.e. during market crashes, VIX futures can rally more than equity market declines. For example, many short volatility strategies blew up in early 2018 when the VIX index doubled overnight. SVOL claims to hedge against this risk by owning deep out of the money ("OTM") calls on the VIX index or something equivalent. However, this hedge has not been tested since the fund's inception in 2021.

Judging by Figure 4 and 5 above, so far, the SVOL ETF appears to be a better mousetrap compared to call-writing strategies in generating high yield and delivering strong total returns. I wrote a detailed review of the SVOL ETF compared to call-writing strategies here.

Conclusion

While the BDJ fund pays an attractive 8.3% forward distribution yield, investors should be mindful that the fund has delivered -7.0% total returns YTD, significantly underperforming the market and peers.

There are two main reasons for this underperformance. First, call-writing strategies like BDJ trades 'upside' for premium income, so when markets rally sharply like they have done YTD (the S&P 500 Index has returned more than 10% YTD), call-writing strategies lag.

Furthermore, the BDJ fund is currently overweight sectors that are underperforming the market. Looking forward, with a high risk of an impending recession, I fear BDJ's underperformance may continue as cyclical sectors like Financials and Energy that BDJ is overweight tends to perform poorly during recessions.

I recommend investors avoid the BDJ fund and seek yield elsewhere.

This article was written by

Analyst’s Disclosure: I/we have a beneficial long position in the shares of SVOL either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.