Vicor: Modular Power Architecture Positioned For Growth

Summary

- Vicor Corporation's modular power architecture and effective use of free cash flow make it a hold due to overvaluation according to DCF figures.

- The company's Power-on-Package technology and Power System Designer software enable efficient power system design and management.

- Vicor's growth trajectory and commitment to innovation make it a strong contender in the long term, despite short-term risks such as dependence on key customers and supply chain disruptions.

Marco_de_Benedictis/iStock via Getty Images

Vicor Corporation (NASDAQ:VICR) has displayed large price volatility in the past few years, primarily due to the expansion of use for CPUs and GPUs in the long term. I believe the company is currently a hold due to its effective use of FCF, its modular power architecture's positioning, and overvaluation assuming my DCF figures.

Business Overview

Vicor Corporation, along with its subsidiary companies, is engaged in the design, development, manufacturing, and global marketing of modular power components and systems for converting electrical power. The company operates both in the United States and internationally, catering to a wide range of industries.

Vicor offers a diverse portfolio of brick-format DC-DC converters that enable efficient power conversion. These converters are complemented by various components that provide functions such as AC line rectification, input filtering, power factor correction, and transient protection. The company also provides a comprehensive range of products for managing input and output voltage levels, as well as output power, along with associated electrical and mechanical accessories. Furthermore, Vicor offers customized power system solutions to address specific customer requirements.

The company's customer base primarily consists of independent manufacturers of electronic devices, original equipment manufacturers (OEMs), and their contract manufacturers. Vicor serves a wide array of industries, including aerospace and aviation, defense electronics, industrial automation and equipment, instrumentation, test equipment, solid-state lighting, telecommunications and networking infrastructure, and vehicles and transportation.

EEJournal

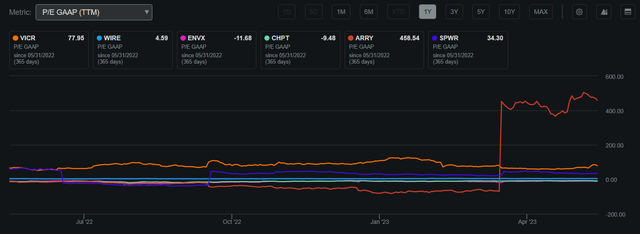

With a market capitalization of $2.67 billion, a 10% return on invested capital, and a P/E GAAP of 77.95, Vicor Corporation's stock is currently priced at $55.35. This price is in proximity to its 200-day moving average of $54.73. In terms of valuation, the company's P/E GAAP ratio is considerably higher compared to its peers.

Vicor P/E GAAP Compared to Peers (Seeking Alpha)

Despite not paying a dividend, Vicor Corporation leverages its strong return on invested capital to utilize free cash flow for the expansion of its core business. This strategic approach allows the company to prioritize profitability and competitiveness in the market. I believe that this prudent course of action will continue to benefit Vicor as it focuses on stabilizing growth and maximizing its profitability through the effective allocation of FCF resources.

Seeking Alpha

Despite reporting mixed results in Q1 2023, with earnings per share beating expectations by $0.07 at $0.25, but revenue falling short by $6.33 million at $97.8 million, Vicor Corporation has showcased commendable growth in a challenging economic climate. The company's ability to navigate these headwinds and exceed profitability projections while achieving double-digit growth highlights its resilience. Vicor's success can be attributed to its commitment to innovative solutions that cater to consumer needs. Moreover, the company's backlog of $271.3 million in the first quarter ensures financial stability and predictable cash flows for the foreseeable future.

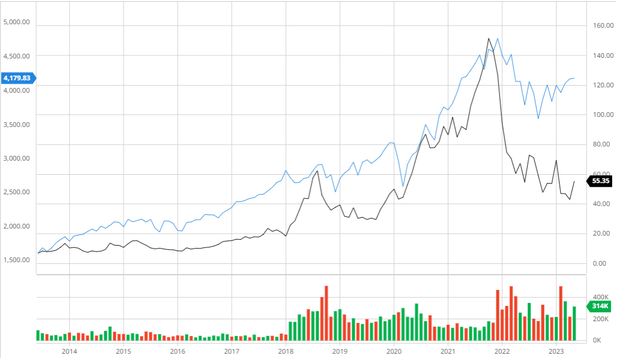

Vicor Compared to the Broader Market

Over the last decade, Vicor has experienced relative underperformance compared to the S&P 500, primarily driven by the decline in its share price in 2022. This serves as a clear indication of Vicor's recognition of the need to prioritize the development of innovative solutions and implement effective strategies to sustain long-term growth.

Vicor Compared to the S&P 500 10Y (Created by author using Bar Charts)

Modular Power Architecture Technology Fostering Growth

A crucial part of Vicor Corporation's entire business strategy is its modular power architecture plan. Offering consumers across diverse industries modular power solutions that enable flexibility, scalability, and efficiency is part of this goal. The modular design makes it simple to integrate, customize, and expand power systems, allowing clients to efficiently fulfill their unique power needs.

Vicor's Power-on-Package (PoP) technology is one illustration of how its modular power architecture is put to use. PoP enables effective power supply and management at the chip level by directly integrating power components onto outstanding performance semiconductor chips such as CPUs and GPUs. In terms of reducing space, managing heat, and improving system performance, this modular approach offers substantial benefits.

Another illustration is the software program called Power System Designer (PSD) from Vicor, which enables users to create and manage modular power systems according to their requirements. Vicor's power components, converters, and other control components can be easily chosen and integrated thanks to the PSD tool, which offers a seamless and effective approach to power system design.

Vicor's modular power architecture approach has achieved success in a number of different fields. Vicor's modular solutions, for instance, offer a flexible and adaptive approach to power distribution in the data center industry, where high power density and energy efficiency are critical. Data center operators may effectively manage power demands, optimize energy use, and streamline their infrastructure by utilizing Vicor's modular power components.

I firmly believe that Vicor's positioning in modular power solutions will serve as a catalyst for the company's continued expansion across various key industries in the long run. This enhanced utility for customers will not only enable Vicor to expand its profit margins but also generate greater cash flows for reinvestment into its core business. By leveraging these efficiency improvements, Vicor will outperform its competitors while capitalizing on long-term trends such as the increasing demand for GPU technology.

Analyst Consensus

In the past three months, three analysts have assigned a "buy" rating to Vicor. Despite the average one-year price target of $53.33, which suggests a slight downside of 3.64%, analysts acknowledge the company's excellence while expressing some concern about its valuation.

Trading View

Valuation

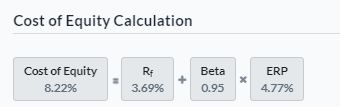

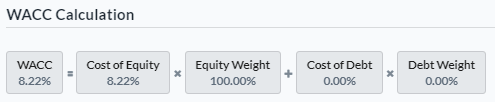

Prior to developing my assumptions and conducting my discounted cash flow analysis, I will determine the Cost of Equity and Weighted Average Cost of Capital for Vicor by utilizing the Capital Asset Pricing Model. Based on the current risk-free rate of 3.69%, derived from the 10-year treasury yield, I have determined that the Cost of Equity for Vicor is 8.22%, as demonstrated below.

Created by author using Alpha Spread

Based on the aforementioned Cost of Equity value, I have computed the Weighted Average Cost of Capital for Vicor to be 8.22%, as illustrated below. This figure falls below the industry average of 11.68%, indicating that Vicor is effectively managing its capital costs and potentially enjoying a competitive advantage in terms of cost of capital.

Created by author using Alpha Spread

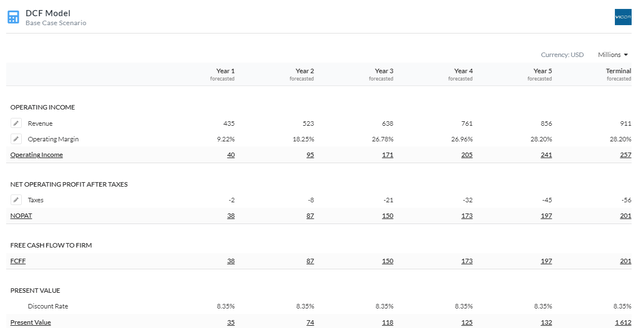

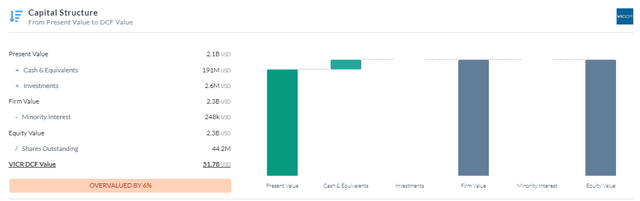

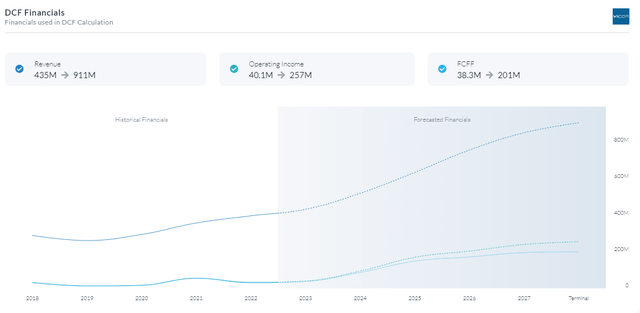

After conducting a comprehensive Firm Model DCF analysis using FCFF excluding Capital Expenditures, I have determined that Vicor is currently overvalued by approximately 6%. This conclusion is based on a fair value estimation of approximately $51.78. In arriving at this valuation, I applied a discount rate of 8.35% over a 5-year time horizon.

Additionally, my analysis suggests that Vicor has the potential to improve its margins in the long term. This projection takes into account anticipated enhancements in operational efficiencies and recovery from margin declines experienced in the previous year. These factors contribute to the overall outlook for Vicor's profitability and support the notion of long-term value creation.

5Y Firm Model DCF Using FCFF Without CapEX (Created by author using Alpha Spread)

Created by author using Alpha Spread

Created by author using Alpha Spread

Risks

Dependence on Key Customers: Vicor's revenue may be largely derived from a small number of important clients or sectors. The financial health of the business can suffer from any large customer losses or a drop in demand from important industries.

Supply Chain Disruptions: Vicor sources basic supplies and components through a global supply chain. Production delays or higher prices could result from supply chain disruptions like shortages, logistical problems, or geopolitical conflicts.

Conclusion

In summary, I believe it is prudent to maintain a hold on Vicor at present. This decision is based on the company's impressive growth trajectory, its commitment to the use of modular power architecture, and the consideration of its overvaluation as per my DCF analysis.

This article was written by

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.