Commodity Supercycles And The Role Of Luck (One Year Later)

Summary

- This article is a look back at my Commodity Supercyles warning, from April 25, 2022.

- Since then, most spot commodity prices have crashed. Depending on the specific commodity and company, many of the producers have experienced dramatic declines in their stock prices.

- This piece also shares lessons learned and perspective for readers.

- This idea was discussed in more depth with members of my private investing community, Second Wind Capital . Learn More »

audioundwerbung/iStock via Getty Images

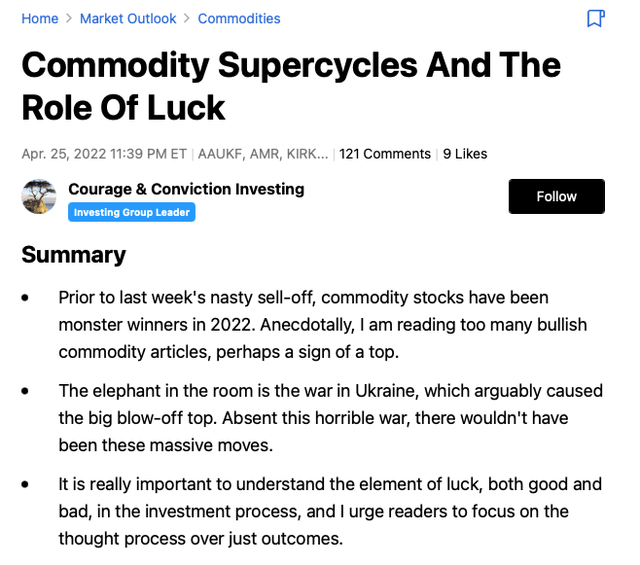

On April 25, 2022, right here on Seeking Alpha, I wrote Commodity Supercycles And The Role Of Luck. As it turns out, this was perhaps one of my most timely macro calls written on Seeking Alpha. Had readers been closely following my work, and acted on this call, which at the time was very contrarian call and even bold, they would've saved themselves and their portfolios the avoidance of material losses or they would've locked in major gains. Generally speaking, it is really hard to try and call tops and bottoms, and I'm not a macro analyst. The inflection points are so tricky and timing matters. Because of this very high difficulty level, of trying to separate signals from the noise, on most days, I try to keep it simple and stick to my bailiwick, which is stock picking and focusing on small cap value investing. I leave the macro forecasting to the Phd's from the University of Chicago and all the 'top strategists' on Wall Street that routinely pull down 7-figure annual compensation programs.

That said, I've been at this game, formally and informally for close to twenty years now, and back in late April 2022, the euphoria to invest in commodities and commodity stocks was palpable. Back then, my spidey sense, just a clever phrase for investing intuition, was tingling, so I felt compelled to write the Paul Revere April 25, 2022 article.

Seeking Alpha

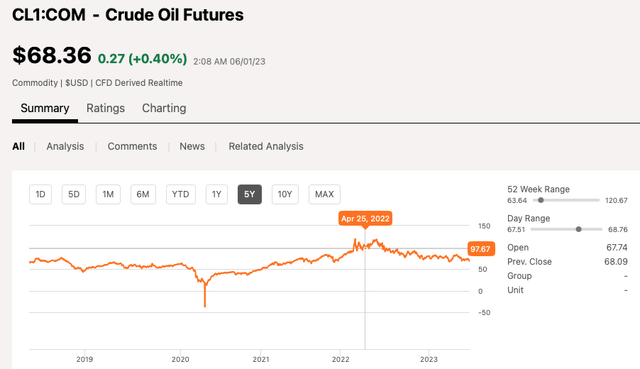

For perspective, let's take a look at how major commodities have moved from late April 2022 through May 31, 2023.

Let's start with crude oil (USO) (XLE). Oil has gone from $98 to $68. Back in Q2 FY 2022, a number of very highly paid and well known sell side analysts, from Tier 1 shops, were all over CNBC, Bloomberg, and throughout the financial media making their clarion calls that oil would remain around $100 per barrel and $150 was a real possibility. What a difference a year makes!

Forecasting commodity prices is like being a weather forecaster. You have good near term visibility, but the crystal ball gets a lot foggier in the intermediate time intervals.

As a broad proxy for the dramatic decline in so many commodities, since April 2022, keep in mind that spot natural gas (UNG) is down 65%. Turning to a proxy for fertilizer prices, UREA is down 71%! Rounding out the list, global ocean freight container rates are down 78%, steel rebar is down 30%, corn futures are down 26%, wheat futures down 43%, seaborne thermal coal is down 61%, and finally, lumber is down 46%. (Please see the Appendix section for specific charts).

Next, let's turn to the stock prices of a few (now formerly) highly popular commodity stocks.

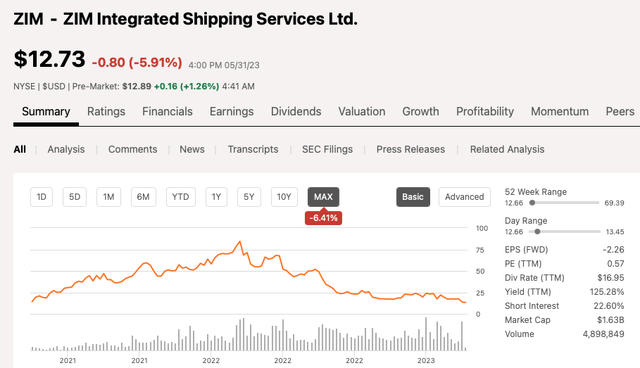

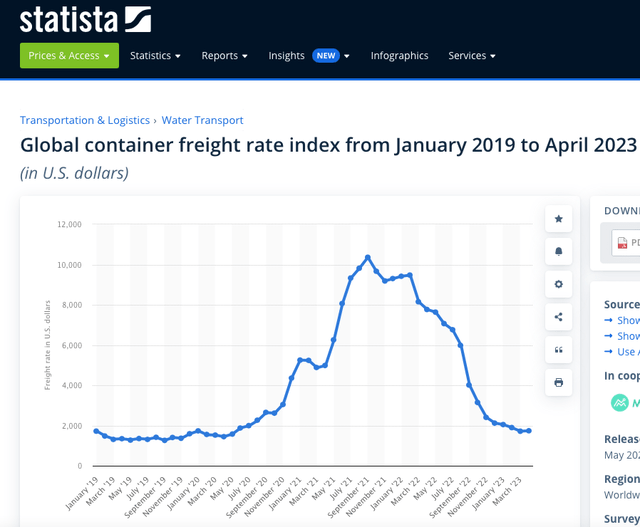

On February 1, 2021, ZIM Integrated Shipping Services Ltd. (ZIM) went public. The company priced its IPO at $15 per share. As luck would have it, the timing couldn't have been better, as the combination of record Covid stimulus, gummed up supply chains, labor shortages (at ports), and purged inventories which was quickly followed by inventory stockpiling (to get ahead of the messed up supply chains and stimulus induced demand), led to the perfect storm. I would argue, this was a once in a 100 years event, but investors/speculators lost sight of that fact. Shipping is one of the worst businesses, over the full life of the cycle, so there were few new builds and the velocity of global ships slowed dramatically, which created a short term imbalance of supply and demand. Ocean container rates surged from $1,200 to $10,000. Lo and behold, on St. Patrick's Day 2022, ZIM shares traded as high as $91.23. Despite paying $38.42 in cumulative dividends, since its February 1, 2021 IPO, from that St. Paddy's Day peak, to yesterday, ZIM shares are down 48% (including dividends).

Seeking Alpha

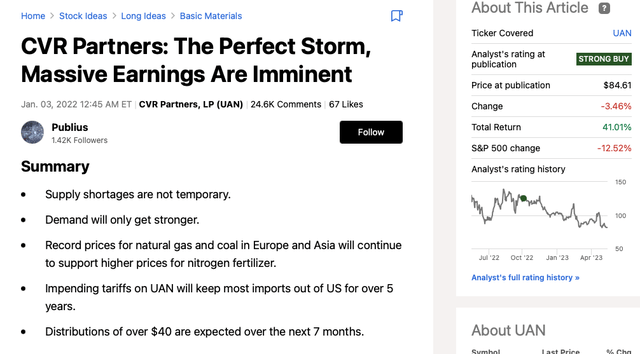

Moving along, as a proxy for euphoria, on January 3, 2022, Publius wrote an article on CVR Partners, LP (UAN). Get this - there have been 24,600 comments!

Seeking Alpha

For perspective and to be crystal clear, Publius has done some great work and is a very good analyst. My only point is that when there are that many comments, generally speaking, everyone already bought the stock and you're in the late innings. There isn't anyone left to buy the stock, as everyone and their brother along with their goldfish named Lucile already own it.

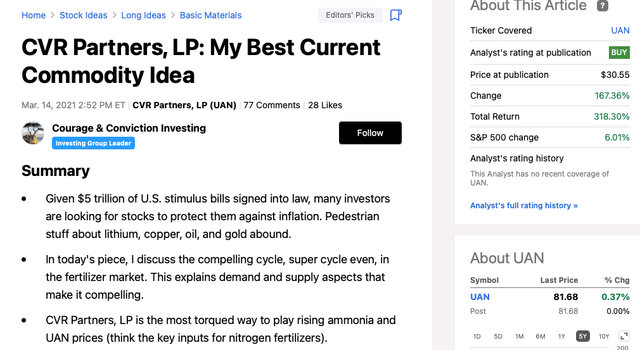

Incidentally, back on March 14, 2021, I wrote up UAN. Units were then trading at $30.55. That same day, a few hours later, as it happens, Publius also wrote a bullish piece and shared a different perspective and different bullish thesis.

Seeking Alpha

Since March 2021, CVR Partners has been a home run and has paid $32.75 in cumulative dividends, since August 2022.

Lo and behold, on April 25, 2022, UAN units closed at $149.75. I literally missed the all-time high tick, of $179.74, set on April 20, 2022, by five days!

I could share twenty different stock charts, of commodity stocks, and the vast majority of them will be down 25% to 40%, to upward of 80%, from their recent peaks (for down 80%, see Intrepid Potash, Inc. (IPI)).

What Can We Learn From This?

This biggest and most important lesson I'm trying to share is that the crowd is usually wrong. In the market, there is the smart money and then everyone else. Over my career, I've learned the most serious money is made as a contrarian and buying good businesses, at good valuations, or mediocre businesses at really low valuations. Believe it or not, buying a business that goes from really bad to 'ok' can be one of the most lucrative ways to generate monster returns. That said, this is very much an art. You have to synthesize the business, its industry, and where you are in the cycle. And then lastly understand the valuation.

When it comes to commodities, the serious money is made buying trough earnings at the start of a turn in the cycle. Generally speaking, catching an inflection point where a market moves from oversupplied to balance or from evenly supplied, but there is a big uptick in demand, is the idea. That said, commodities are almost always boom and bust. That is why they look so cheap on an earnings or cash flow basis at the top of the cycle. The market is constantly trying to workout normalized EBITDA or EPS and what multiple investors should pay for those cash flows.

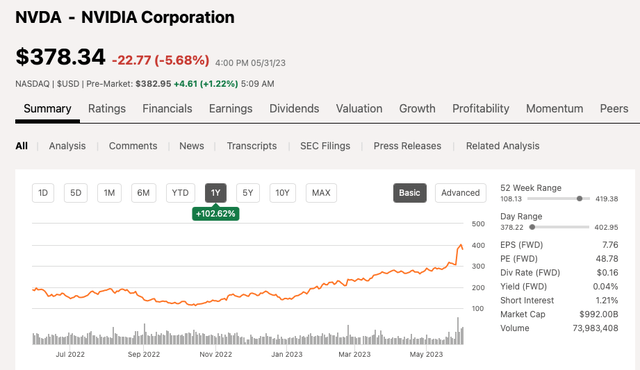

Fast forward to today, and perhaps a bit off topic, one might make a case that the media has fueled a massive bubble in AI. Let's face it, NVIDIA Corporation (NVDA) is a great company. However, a trillion dollar market capitalization seems extreme regardless of your 2028 EBITDA assumptions. Is NVDA worth $378? Maybe, but I have no idea how to value it.

Seeking Alpha

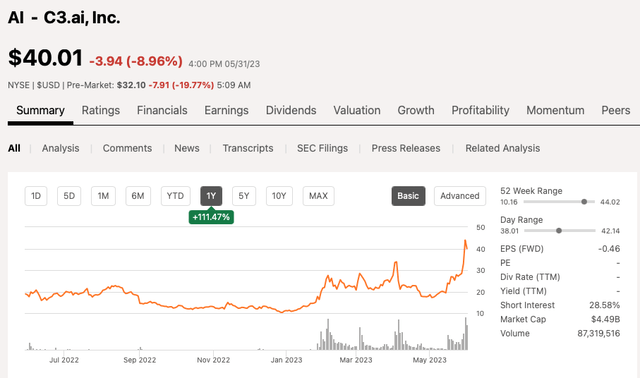

Moreover, there are a lot of very low quality companies, such as C3.ai, Inc. (AI) that have moved from $10 to $44, simply riding the coattails of this hype and media obsession.

Seeking Alpha

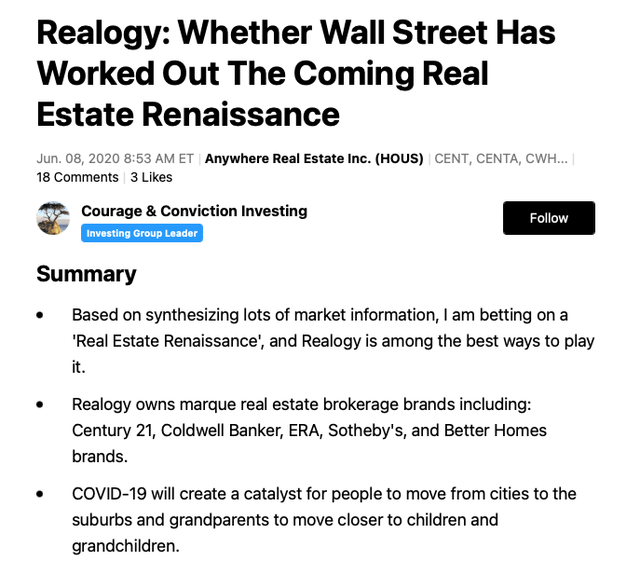

Putting It All Together

I make very few macro calls, as I'm just a simple small cap value investor. Therefore, when I write a macro piece, it is because I have something to say. Keep in mind, my other big macro call, was calling the 'Real Estate Renaissance' back on June 8, 2020. Lo and behold, I worked this out three to six months before many of the best and most highly paid minds, on all of Wall Street. This was a very lucrative observation, but with the benefit of hindsight, candidly, I only captured a piece of the potential profit bonanza, as this thesis played out perfectly.

Seeking Alpha

That said, and as I mentioned earlier, making macro calls is generally very difficult. Therefore, given the difficulty level, it is important to avoid being the boy that cried wolf. The idea is to synthesize companies, industries, and be aware of the external / macro forces. Again, though, I'm in the business of generating alpha and not spending fifty hours per work at this craft, to write red herring headlines and capture page views. The goal here, and this hasn't changed, is to generate alpha and share good ideas.

In closing, more often than not, when it comes to commodities, it is boom and bust cycles. We had a super cycle driven largely by Covid. We know now that the war in Ukraine marked the peak of fear around commodities shortages and scarcity. As interest rates have climbed markedly and supply chains have gotten much better. Put those two powerful forces together and you get this commodity price crash. Adam Smith's invisible hand of capitalism is very powerful and operators within the commodity space compete in a highly fragmented marketplace. Therefore, producers respond to incentives and when prices are high, either end customers substitute or producers find a way to bring more supply online, albeit with a lag.

If there is only one takeaway from this piece, it is to avoid the madness of the crowds. I would argue the serious money is selectively/artfully made playing contrarian and not buying in the 7th or 8th inning of a monster move and hoping to sell in the bottom of the 9th inning.

Appendix

Crude Oil ($98 to $68): -30%

Seeking Alpha

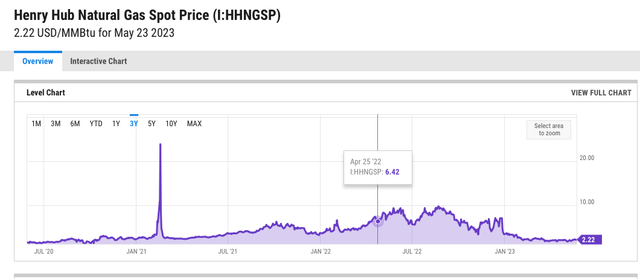

Spot Natural Gas ($6.42 MMBtu to $2.22): -65%

Y Charts

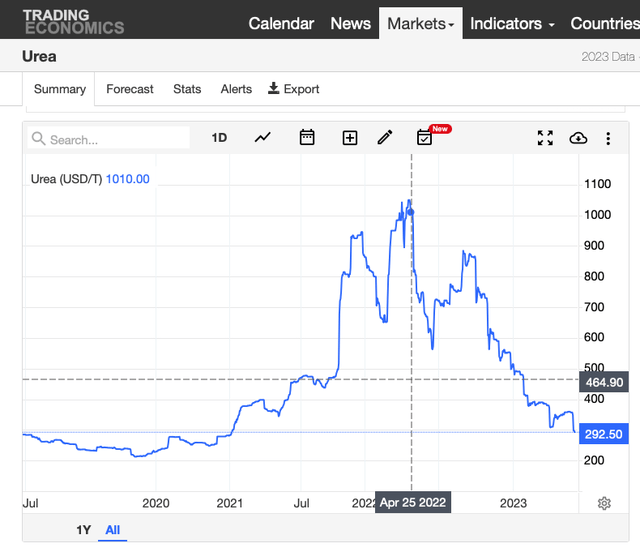

UREA ($1,010 per ton to $293 per ton): -71%

Trading Economics

Global Container Freight Index ($7,768 to $1,740): -78%

statista

Steel Rebar ($5,052 CNY/T to $3,551 CNY/T): -30%

Trading Economics

Corn Futures ($813.50 to $598.25): -26%

Google Finance

Wheat Futures ($1,056 to $599.50): -43%

Google Finance

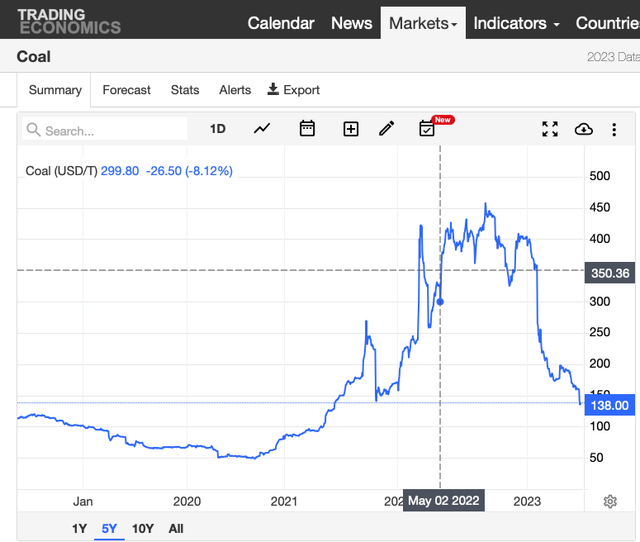

Seaborne Thermal Coal (NewCastle Futures) ($350 per ton to $138 per ton): -61%

Trading Economics

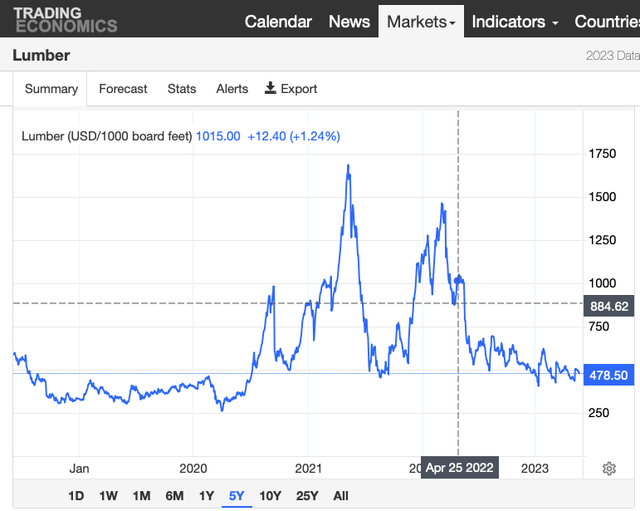

Lumber ($885 to $479): -46%

Trading Economics

Second Wind Capital is a value oriented investment service with a strong recent track record of exceptional outperformance. The focus is mostly small cap value and special situation equities. From January 1, 2020 - December 31, 2022, the flagship account has compounded at 43.7% per year.

This article was written by

I actively invest my own capital and for a few family members.

Favorite quotes:

“When you are inspired by some great purpose, some extraordinary project, all your thoughts break their bonds: Your mind transcends limitations, your consciousness expands in every direction, and you find yourself in a new, great and wonderful world. Dormant forces, faculties and talents become alive, and you discover yourself to be a greater person by far than you ever dreamed yourself to be.” (Author - Patanjali)

“Tentative efforts lead to tentative outcomes. Therefore, give yourself fully to your endeavors. Decide to construct your character through excellent actions and determine to pay the price of a worthy goal. The trials you encounter will introduce you to your strengths. Remain steadfast...and one day you will build something that endures: something worthy of your potential.” (Author - Epictetus)

"Hope sees the invisible, feels the intangible, and achieves the impossible." (Author - Unknown)

"When I stand before God at the end of my life, I would hope that I would not have a single bit of talent left, and could say, 'I used everything you gave me." (Author - Erma Bombeck)

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.