XLV: The Powerhouse ETF Driving Health And Wealth

Summary

- XLV is a well-diversified healthcare ETF with a low expense ratio and a decent dividend yield.

- The ETF comes with anti-cyclical characteristics, strong long-term dividend growth, and a high likelihood of long-term outperformance.

- While XLV is currently underperforming the market, I believe that XLV has become an attractive long-term investment at current prices.

Phiwath Jittamas

Introduction

It's time to do something we haven't done in a while: discussing an ETF. In this case, we'll discuss an ETF you may be familiar with. The Health Care Select Sector SPDR Fund (NYSEARCA:XLV) is one of the most prominent healthcare ETFs on the market and a benchmark I often use when comparing single stocks in that sector.

However, XLV is more than just a useful benchmark. It is a highly diversified ETF with a low expense ratio, a dividend yield in line with the market, high historical dividend growth, and a high likelihood of low-volatility outperformance on a long-term basis.

One could even make the case that XLV is somewhat boring, which is what makes it such a great investment tool. On top of that, the ETF is supported by long-term secular tailwinds like an aging population.

Furthermore, healthcare is currently underperforming, as the market has shifted its focus from value to growth stocks. I expect that to change and consider healthcare to be attractively valued.

Now, let me give you the details!

My Complicated Relationship With ETFs

First, let me elaborate on my complicated relationships with ETFs.

I rarely discuss ETFs, as I'm a stock picker. Also, I'm not a fan of discussing investments that result in a financial benefit of a third party. After all, ETFs come with expense ratios, which means a part of investors' investments ends up in the pockets of fund managers. They obviously need to cover costs, but sometimes expense ratios are elevated. I prefer not to engage in investments that indirectly benefit third parties - especially if I share my views with a large audience (like on Seeking Alpha).

Also, I believe that certain ETF providers have become too powerful. While ETF providers (asset managers) cannot use their power in favor of personal goals, the risks are rising that they could indirectly use their power.

While I don't have the latest numbers, Vanguard (to name one of the big guys) owned 7% of all US equities in 2019. It's undoubtedly higher in 2023 than it was back then.

However, buying ETFs makes so much sense. Buying ETFs is the easiest way for investors to get diversified exposure. It's an easy, safe, and low-maintenance way of deploying capital. I often make the case that inexperienced investors should only buy ETFs while focusing on the things they are good at. Inexperienced investors shouldn't waste money stock picking, not until they learn the skills that could end up making them a lot more money in the future.

That's where XLV comes in.

XLV Is A High-Quality Healthcare ETF

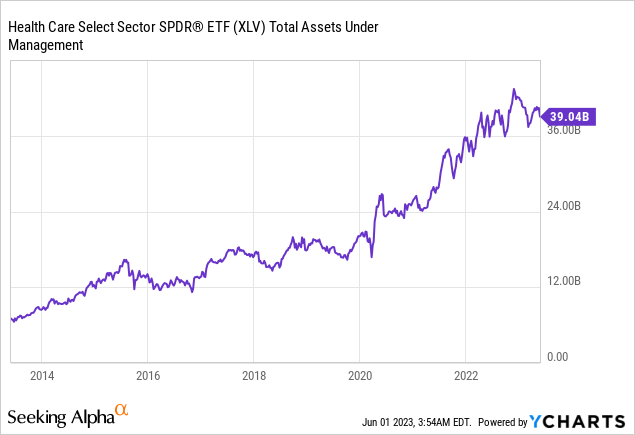

XLV is as no-nonsense as it gets. The company is the biggest and oldest healthcare ETF. Incepted in December 1998, the ETF has total assets under management of $39 billion, which makes it more than twice as big as its biggest peer.

The assets under management growth of this ETF has been nothing short of impressive. In 2017, AUM was roughly $12 billion.

The steep surge in assets is no surprise, as XLV offers one of the best ways to buy diversified healthcare exposure.

XLV, which is owned by State Street (STT), aims to:

- Provide investment results that correspond to the price and yield performance of the Health Care Select Sector Index.

- Represent the healthcare sector of the S&P 500 Index.

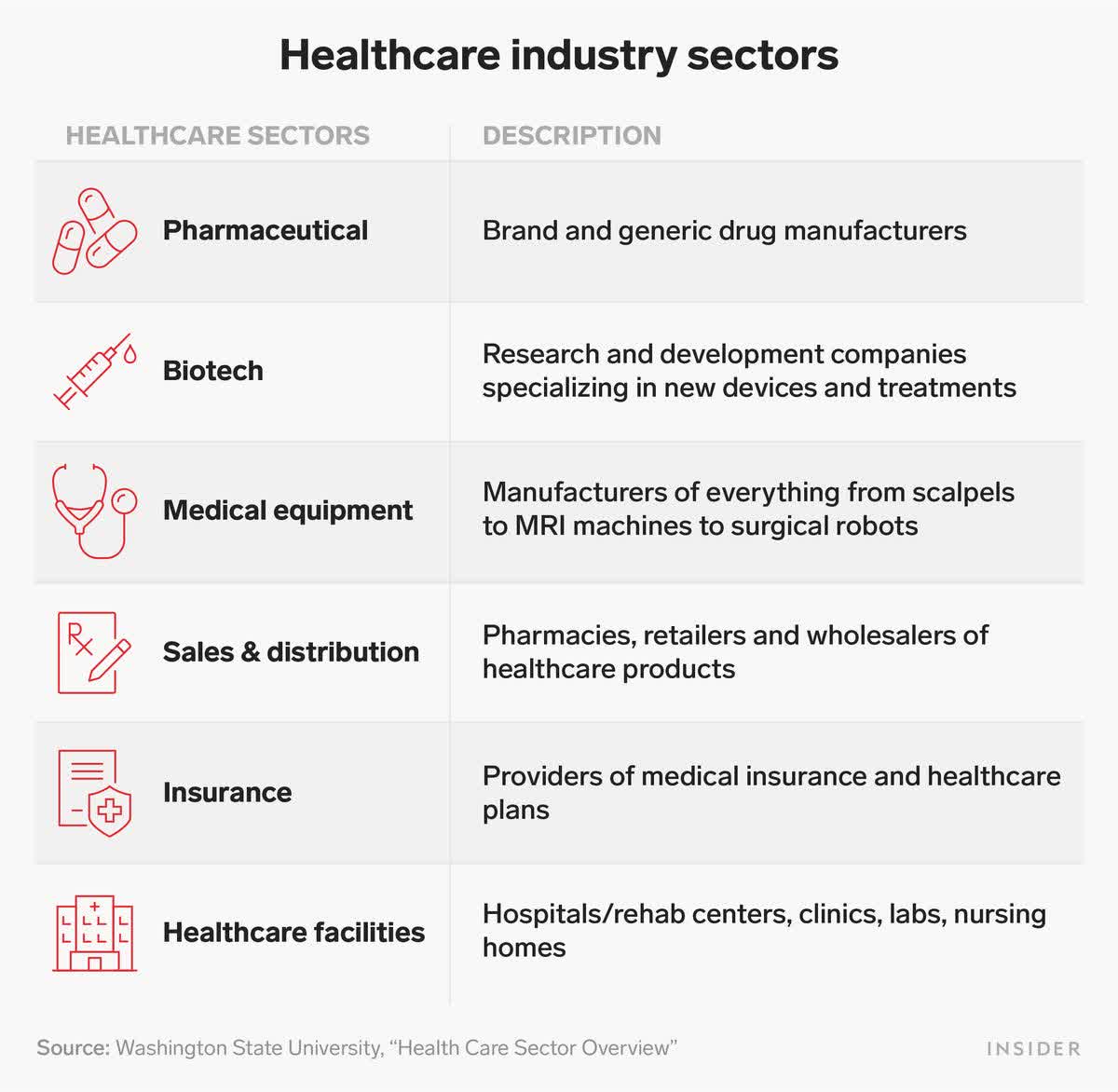

- Cover pharmaceuticals, healthcare equipment and supplies, care providers, biotechnology, life sciences tools, and healthcare technology industries.

Thanks to the passive nature and size of this ETF, the expense ratio is just 0.10%. While this is above most expense ratios of S&P 500 ETFs, it's very competitive for a sector-focused ETF.

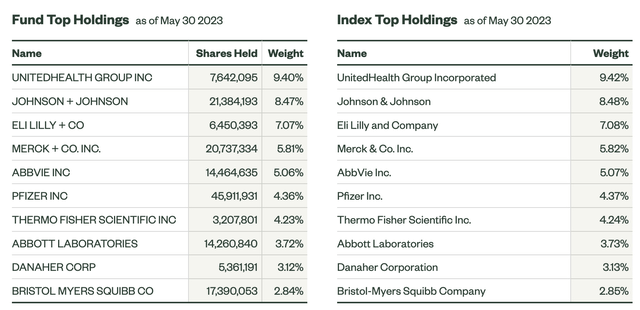

In this case, XLV has 65 holdings. The weighted average market cap is $192 billion, which shows that XLV is mainly a play on large healthcare giants.

Its largest holding is UnitedHealth (UNH), which accounts for 9.4% of the fund's assets. Its top ten positions account for 54% of total assets.

SPDR - State Street

When looking at the industry allocation below, we see that the fund has invested in all key sectors except for healthcare real estate. Among these sectors, pharmaceuticals emerge as the largest, constituting a significant 31% of the fund's assets. As for healthcare providers and equipment suppliers, they both account for approximately 20%-21% of the fund's overall investments.

This diversification is key, as each healthcare industry comes with unique risks (and opportunities).

Business Insider

For example, biotech stocks are essentially a play on interest rates. Lower rates make funding biotech stocks more attractive. Higher rates are toxic. Also, biotech comes with pipeline and approval risks, although these risks are minimized by ETF diversification.

Insurance companies often depend on factors like the value of stocks and bonds in their massive investment portfolios. Pharma companies are prone to regulations and pricing issues.

Hence, unless investors are healthcare experts, it does make sense to go with an ETF - even if investors do have general investment expertise.

XLV Comes With Dividend Growth & Outperformance

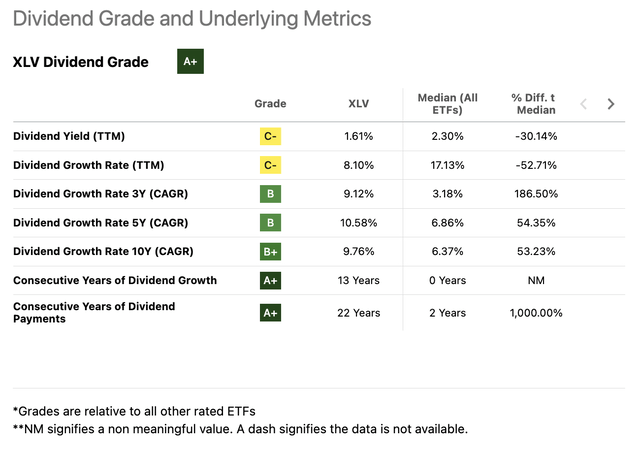

The XLV ETF currently yields 1.6%. This is in line with the S&P 500.

This is not a high yield, and I'm not going to pretend that XLV is an income play.

However, this yield is backed by high and consistent dividend growth. Using Seeking Alpha numbers, we see that XLV is one of the most consistent dividend growers. The ETF has hiked its dividend for 13 consecutive years. Over the past five years, the average annual dividend growth was 10.6%. The three-year average was 9.1%.

Seeking Alpha

Needless to say, SPDR (State Street) doesn't decide what the dividend looks like. That's up to the companies in its fund.

So, here's the dividend history of the ten largest holdings, accounting for slightly more than half of the ETFs assets:

Furthermore, healthcare comes with historical outperformance.

This is based on a number of reasons.

- Healthcare companies are (often) anti-cyclical, which means they are not highly impacted by recessions. While issues like interest rates are still important, consumer weakness and related problems during recessions do not have a major impact on most healthcare companies. This protects the company's downside. Hence, as I often say, downside protection is a key to long-term outperformance.

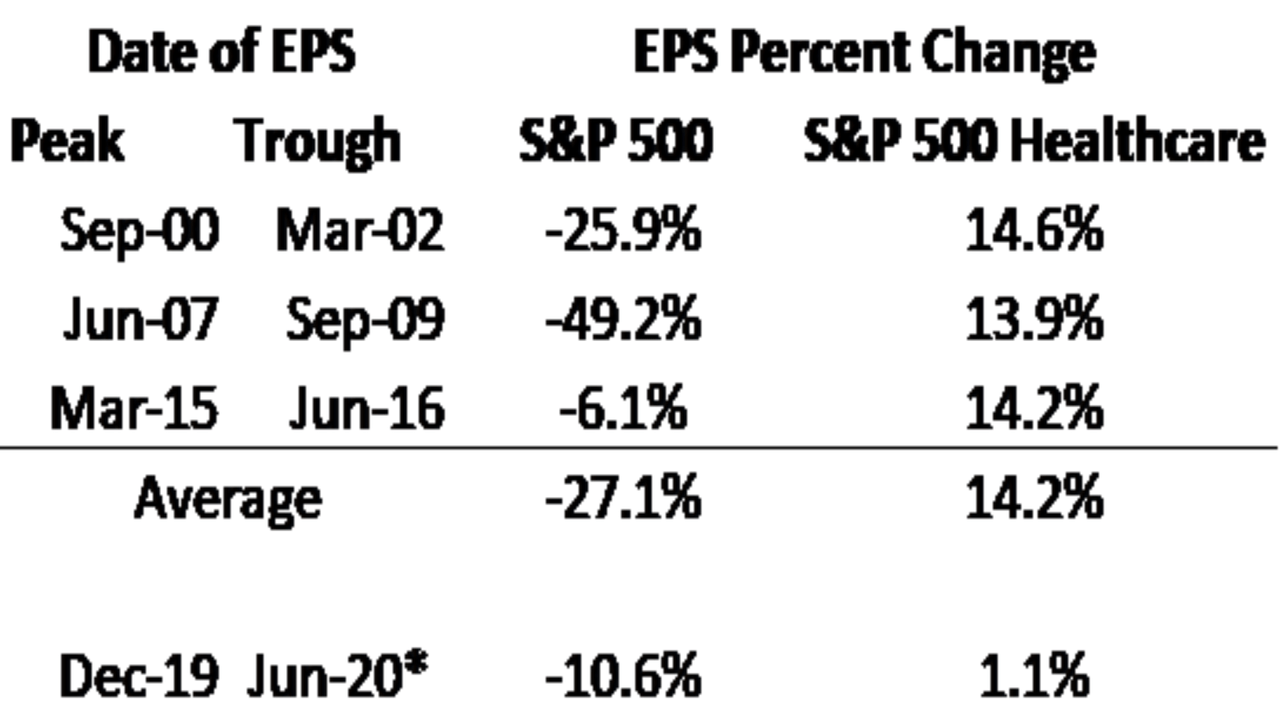

Bloomberg

- Healthcare companies have pricing power, which helps to protect investors against (high) inflation.

- Healthcare companies tend to benefit from strong secular growth.

Related to secular growth, Invesco found that healthcare is driven by five strong tailwinds.

- Strong earnings growth: Healthcare sector profits have grown faster than the overall market.

- Aging population: The increasing number of elderly individuals drives demand for healthcare services.

- National security importance: The pandemic has highlighted healthcare's role in economic stability and defense.

- Medtech innovation: Technological advancements in healthcare offer growth opportunities.

- Resilience in downturns: Healthcare earnings tend to hold up better during economic contractions.

Since 2000, the US population over 65 years of age has grown 62%, which equates to a 2.5% annualized compounded rate. Over the next 10 years, the US Census Bureau projects the population over 65 rising another 30%, which equals a 2.6% annualized compounded rate.3 Older populations are likely to spend more on health care as their bodies mature, and medical care is needed to maintain their well-being.

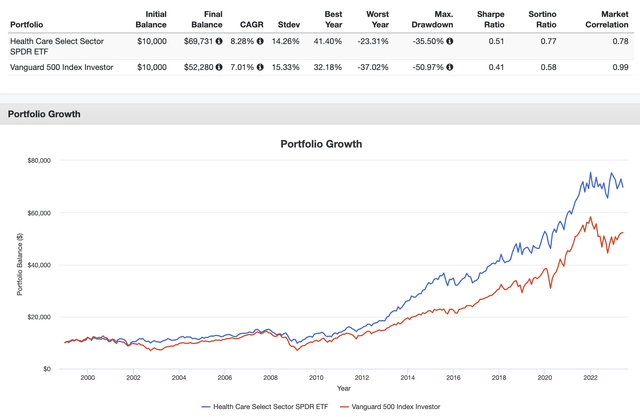

All of this is confirmed by the actual numbers. Since its 1998 inception, XLV has returned 8.3% per year. This has beaten the S&P 500's 7.0% return by a significant margin. Moreover, the standard deviation of 14.3% during this period is lower. The max drawdown of this ETF was 35%. Also, the market correlation is just 78%.

Portfolio Visualizer

With that in mind, XLV doesn't always outperform the market. Over the past three years, XLV has returned 9.1% per year. While that's a great return, the S&P 500 returned 12.8%.

Portfolio Visualizer

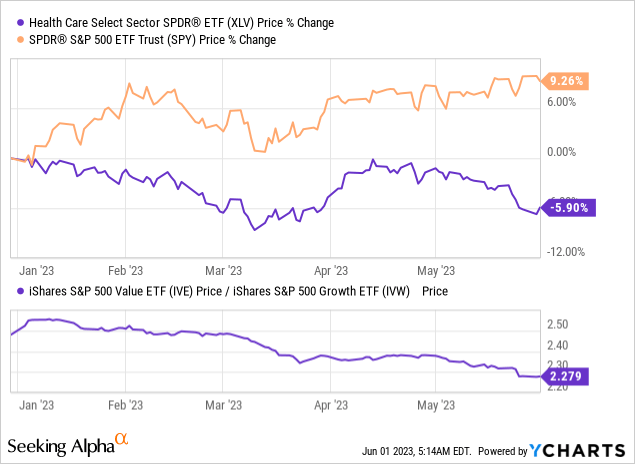

So far this year, healthcare stocks are down 5.9%. The market is up 9.3%, driven by growth stocks. The lower part of the chart below shows that value stocks have consistently underperformed growth stocks.

Excluding dividends, the relative performance of XLV has dropped towards the lower bound of the longer-term range.

Hence, this year, I started buying healthcare stocks more aggressively.

So far this year, I added to Danaher (DHR), which is a major supplier of healthcare equipment, and AbbVie (ABBV), a biotech giant that suffered due to a patent loss.

I'm also considering buying Abbott Laboratories (ABT).

While it is impossible to say whether healthcare stocks have bottomed, I started to like the valuation of most of XLV's holdings, which includes the relative underperformance.

I believe that XLV offers buying opportunities for long-term investors.

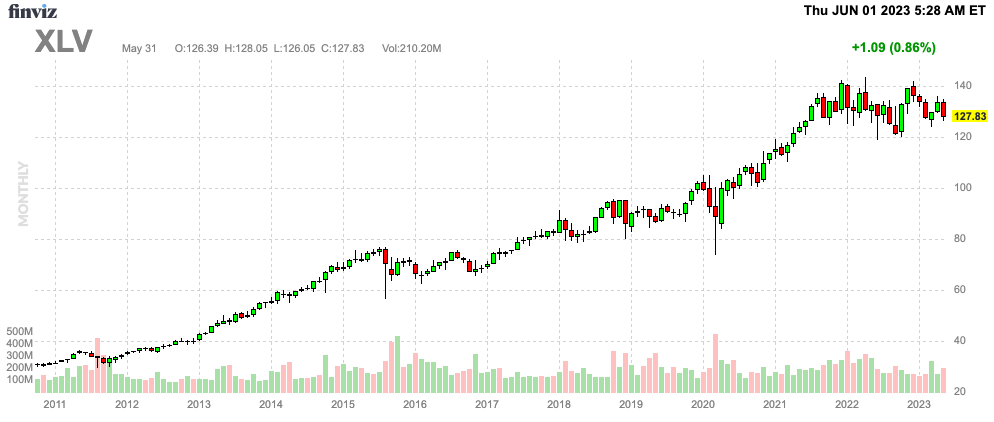

FINVIZ

While XLV might remain rangebound for the time being, I expect that lower interest rates in 2024 (and maybe beyond) can trigger a breakout above $140, followed by more upside.

Takeaway

The Health Care Select Sector SPDR Fund is an outstanding healthcare ETF that provides diversified exposure to the sector. Despite my reservations about ETFs, XLV's benefits are hard to ignore. It offers a low expense ratio of 0.10% and is supported by long-term secular tailwinds such as an aging population.

XLV's assets under management have grown impressively, and it holds a strong position in the market.

XLV's dividend growth is consistent, with a 13-year track record of increasing dividends. While it may not be a high-yield investment, the dividend growth has averaged 10.6% over the past five years.

Healthcare companies have historically outperformed due to their anti-cyclical nature, pricing power, and strong secular growth is driven by factors like an aging population and technological advancements.

Although XLV hasn't outperformed the market in recent years, the current underperformance presents buying opportunities, especially considering the attractive valuations of its holdings. While the ETF's performance may remain rangebound for now, a potential breakout above $140 could be triggered by lower interest rates in the future.

Overall, XLV is a solid choice for long-term investors seeking exposure to the healthcare sector.

This article was written by

Analyst’s Disclosure: I/we have a beneficial long position in the shares of DHR, ABBV either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.