BNO: The ETF To Consider With The OPEC Meeting On The Horizon

Summary

- Crude oil prices are expected to remain above $60 to $70 per barrel in 2023, supported by the ongoing war in Ukraine, U.S. energy policy, and the impact of Saudi Arabia and Russia on world supplies.

- OPEC+ is likely to pursue output quotas that ensure the U.S. Department of Energy does not have the chance to buy crude oil at its target prices, further supporting higher prices.

- The United States Brent Oil Fund, LP ETF provides exposure to Brent crude oil prices, which are expected to experience the most volatility due to their sensitivity to events in Europe and the Middle East.

- Looking for more investing ideas like this one? Get them exclusively at Hecht Commodity Report. Learn More »

Timon Schneider

While the U.S. administration continues to support alternative and renewable energy production and consumption, crude oil remains the energy commodity that powers the world. With over one-third of the world's population in China and India, the most populous countries have yet to join the U.S. and Europe in climate change initiatives. Moreover, while the number of electric vehicles ("EVs") is rising, gasoline remains the fuel that powers most U.S. and European automobiles.

On June 1, nearby July NYMEX WTI crude oil futures (CL1.COM) were at the $70.65 per barrel level, and August Brent crude oil futures were trading around $75 per barrel. Prices have come down after trading above $130 per barrel in early 2022, but the odds favor the upside after the significant correction. The United States Brent Oil Fund, LP ETF (NYSEARCA:BNO) tracks Brent crude oil prices.

Brent and WTI crude oil are the world benchmarks

While crude oil has many qualities and locations worldwide, Brent, and West Texas Intermediate are the benchmark prices. Brent pricing is the standard for crude oil produced in Europe, Africa, Russia, and the Middle East, while WTI reflects U.S. and North American crude oil production.

Brent is trading at a premium to WTI crude oil, with both above the $70 per barrel level on June 1, 2023.

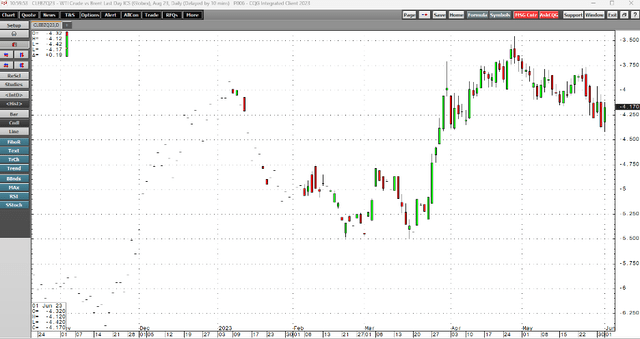

Chart of the Brent Premium over WTI Futures (CQG)

The chart highlights the $4.17 per barrel premium for the Brent over WTI benchmark crude oil for August delivery. Brent has consistently commanded a premium to WTI since 2016.

OPEC+ meets on June 4

OPEC members will meet at the cartel's biannual gathering in Vienna, Austria, on June 4. Saudi Arabia is the leading cartel member. Over the past years, Russia has cooperated with production quotas to balance the global supply and demand favorably for world producers. Production policy has been a function of decisions from Riyadh and blessings from Moscow. In April, Saudi Arabia surprised the oil market when it cut production. On May 23, the Saudi Oil Minister warned oil market speculators of another surprise, saying:

"Speculators, like in any market they are there to stay, I keep advising them that they will be ouching, they did ouch in April, I don't have to show my cards I'm not a poker player... but I would just tell them watch out."

The following factors favor another OPEC+ production cut to boost prices:

- Saudi Arabia requires Brent prices above $80 per barrel to balance its domestic budget.

- Russian oil revenues support its ongoing war effort in Ukraine.

- U.S. energy policy under the Biden administration has increased the cartel's pricing power.

- Weakness in the Chinese economy will likely cause OPEC+ to consider another output decline at the June 4 meeting.

- Tensions between Washington, DC, and Moscow/Riyadh favor higher oil prices.

Oil prices spiked higher in April after Saudi Arabia and OPEC trimmed production. The Saudi Oil Minister has prepared the market for a repeat performance on June 4.

While all signs point to a production cut, a disagreement between Russia and Saudi Arabia over Russia's cooperation with OPEC policy could potentially cause the Saudis to flood the market with petroleum to teach Moscow a lesson. However, tensions between Riyadh and Moscow are not likely in the current environment.

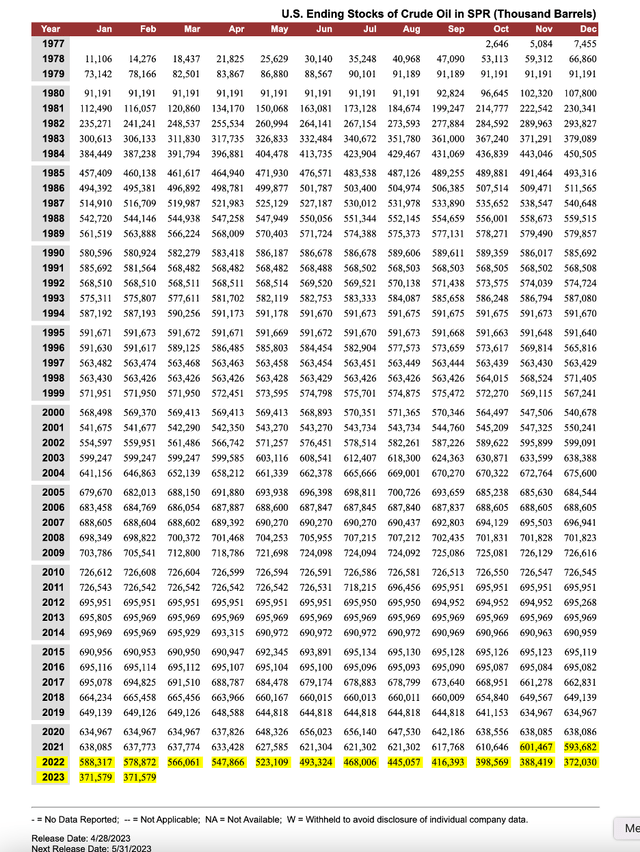

The U.S. SPR is at its lowest level since September 1983

According to Oilprice.com, the U.S. Strategic Petroleum Reserve stood at 355.4 million barrels for the week ending on May 26, 2023. The SPR was at the lowest level since August 1983, in nearly four decades.

The chart shows the significant decline in the U.S. SPR, which stood at over 600 million barrels in November 2021 and has dropped over 40% as of May 26, 2023.

In 2022, crude oil prices rose to over $130 per barrel, the highest level since 2008, while gasoline and distillate fuels rose to record prices. The war in Ukraine caused significant supply concerns, lifting prices. The Biden administration sold unprecedented crude oil from the U.S. SPR to keep a lid on traditional fuel prices. However, the sales have caused the SPR to drop to a four-decade low.

A $60 to $70 floor

The average SPR sales price was around $96 per barrel. In October 2022, the administration issued a FACT SHEET, stating:

"The administration intends to repurchase crude oil for the SPR when prices are at or below about $67 - $72 per barrel, adding to global demand when prices are around that range."

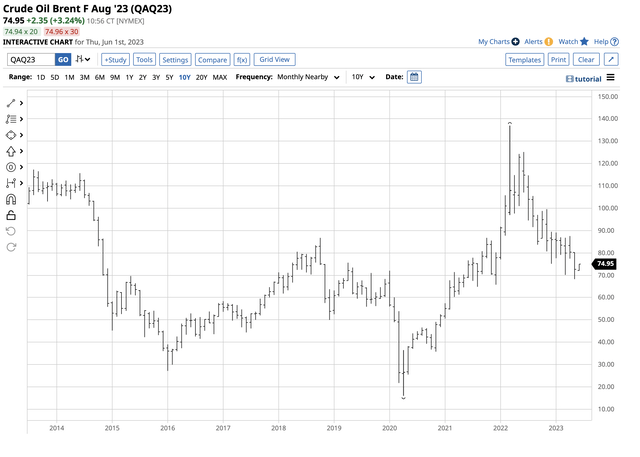

Ten-Year Chart of ICE Brent Crude Oil Futures (Barchart)

The ten-year Brent crude oil futures chart shows the crude oil benchmark that trades at a premium to U.S. WTI futures fell below $72 per barrel in March and May 2023. At $75 on June 1, Brent futures were back above the U.S. DoE's target buying price, with WTI futures within the range at below $71 per barrel.

On May 15, 2023, the U.S. Department of Energy announced plans for a three-million-barrel SPR purchase of sour crude oil in June. The DoE revealed that the average SPR sale price is $95 per barrel.

OPEC+'s mission is to reach the highest possible oil price that balances worldwide supply and demand fundamentals. The cartel's policy determines the fundamentals, making it a chicken-and-egg situation that favors higher prices.

Time will tell if the Biden administration gets another chance to buy crude oil below the $72 level, or if it will look back at March and May as a missed opportunity. Riyadh and Moscow will likely pursue output quotas that ensure the DoE does not have the chance to buy at its target prices.

BNO is the ETF product that follows Brent crude oil futures

I believe $60 to $70 per barrel is the bottom for crude oil prices in 2023. The ongoing war in Ukraine, U.S. energy policy, and Saudi Arabia and Russia's Impact on world supplies support higher prices over the coming months. Moreover, economic recovery in China could turbocharge upside price action in Brent and WTI crude oil futures. Since Brent prices are the most sensitive to events in Europe and the Middle East, we could see the most volatility in the Brent benchmark, which reflects two-thirds of the world's production and consumption.

The most direct route for a risk position in Brent crude oil is via the futures and futures options on the Intercontinental Exchange. Those seeking Brent crude oil exposure without venturing into the ICE futures and futures options markets can employ the U.S. Brent Oil ETF product.

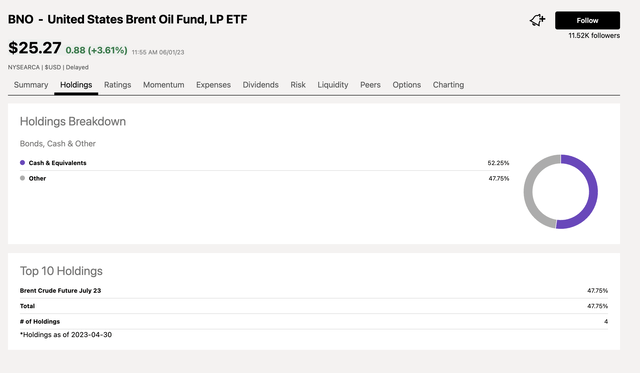

At $25.28 per share on June 1, BNO had over $186 million in assets under management. BNO trades over 618,000 shares daily and charges a 1.00% management fee. BNO's fund summary states:

Fund Profile for the BNO ETF Product (Seeking Alpha)

The most recent top holdings include:

Top Holdings of the BNO ETF Product (Seeking Alpha)

As the chart shows, BNO holds Brent crude oil futures.

The most recent rally in the nearby ICE Brent crude oil futures contract was from $68.20 on May 4 to $78.66 on May 24, 2023, a 15.3% increase.

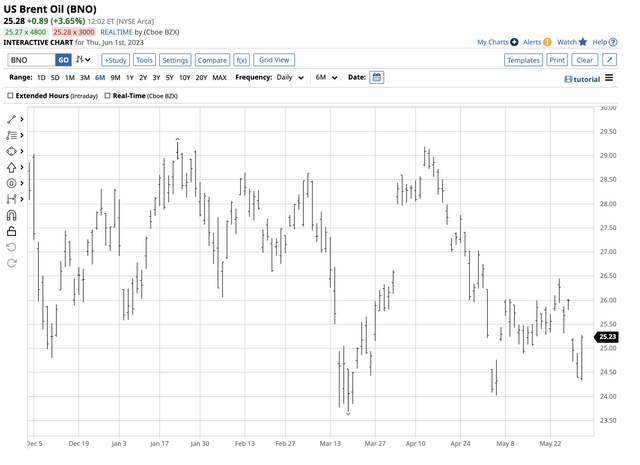

Chart of the BNO ETF Product (Barchart)

The chart illustrates BNO's rally from $24.02 to $26.45 per share, or a 10.1% rise over the period. BNO only trades during hours when the U.S. stock market operates, while Brent crude oil trades around the clock. Therefore, BNO can miss highs or lows when the U.S. stock market is not operating.

I favor crude oil on price weakness and believe that OPEC's pricing power and the U.S. plans to replace the SPR sales will create a floor around the $60 to $70 per barrel level. Risk-reward favors the upside, and United States Brent Oil Fund, LP ETF is a product that provides exposure to Brent, the world's leading crude oil benchmark and grade OPEC controls.

The Hecht Commodity Report is one of the most comprehensive commodities reports available today from a top-ranked author in commodities, forex, and precious metals. My weekly report covers the market movements of over 29 different commodities and provides bullish, bearish, and neutral calls; directional trading recommendations, and actionable ideas for traders. I am offering a free trial and discount for new subscribers for a limited time.

This article was written by

Andy spent nearly 35 years on Wall Street, including two decades on the trading desk of Phillip Brothers, which became Salomon Brothers and ultimately part of Citigroup.

Over the past two decades, he has researched, structured and executed some of the largest trades ever made, involving massive quantities of precious metals and bulk commodities.Andy understands the market in a way many traders can’t imagine. He’s booked vessels, armored cars, and trains to transport and store a broad range of commodities. And he’s worked directly with The United Nations and the legendary trading group Phibro.

Today, Andy remains in close contact with sources around the world and his network of traders.

“I have a vast Rolodex of information in my head… so many bull and bear markets. When something happens, I don’t have to think. I just react. History does tend to repeat itself over and over.”

His friends and mentors include highly regarded energy and precious metals traders, supply line specialists and international shipping companies that give him vast insight into the market.

Andy’s writing and analysis are on many market-based websites including CQG. Andy lectures at colleges and Universities. He also contributes to Traders Magazine. He consults for companies involved in producing and consuming commodities. Andy’s first book How to Make Money with Commodities, published by McGraw-Hill was released in 2013 and has received excellent reviews. Andy held a Series 3 and Series 30 license from the National Futures Association and a collaborator and strategist with hedge funds. Andy is the commodity expert for the website about.com and blogs on his own site dynamiccommodities.com. He is a frequent contributor on Stock News- https://stocknews.com/authors/?author=andrew-hecht

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

The author always has positions in commodities markets in futures, options, ETF/ETN products, and commodity equities. These long and short positions tend to change on an intraday basis.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.