Sell Alert: 2 REITs Getting Risky

Summary

- I am bullish on some REITs, but not all of them.

- Some REITs are overpriced. Others are risky.

- We highlight two REITs that we have sold in recent years.

- High Yield Landlord members get exclusive access to our real-world portfolio. See all our investments here »

Lemon_tm

Generally speaking, we are bullish on real estate investment trusts, or REITs (VNQ), at High Yield Landlord.

Many would probably describe us as "cheerleaders" of the REIT sector because we regularly post articles on our favorite REIT opportunities.

I have personally invested about 50% of my net worth in them. I don't know what else could be a better indicator of the fact that I am very bullish about REITs.

However, that does not mean that I am bullish on every REIT.

In fact, over the past year, we have sold over 10 REIT positions that had either reached our fair value target or lost appeal due to growing risks.

In today's article, we will highlight two examples that we have sold in order to reinvest in other better opportunities:

Welltower Inc. (WELL)

We recently sold our stake in Welltower because our capital is limited and it was not the best use of it anymore.

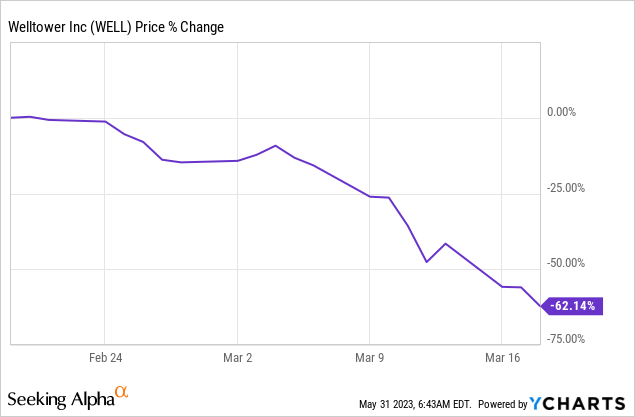

We initiated our Welltower Inc. position during the early days of the pandemic when its share price was heavily discounted. Back then, the market was very concerned about the prospects of senior housing communities, and that had caused WELL's share price to crash:

The low valuation made it very attractive...

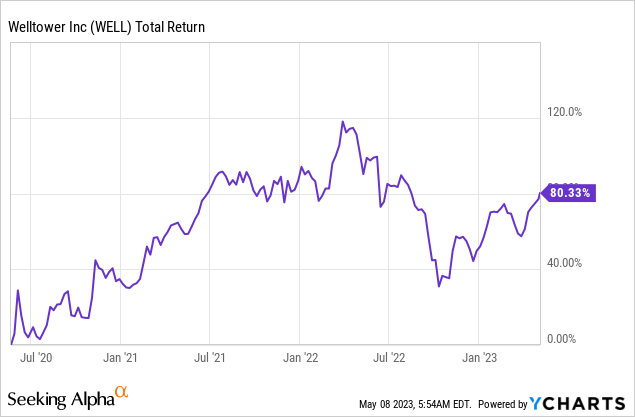

But since then, we have recovered from the pandemic, the market narrative has changed, and WELL's valuation has nicely recovered:

YCharts

Today, Welltower is priced at 22x FFO, or funds from operations, which is reflective of its blue-chip characteristics. The company enjoys strong growth prospects right now because its senior housing assets are still recovering from the pandemic, but it appears that the market has already priced in most of that growth.

Moreover, the company also owns a lot of medical office buildings, and most REITs that own such properties are today priced at much lower valuations. The leader in this space, Healthcare Realty Trust Incorporated (HR), is priced at just 12x FFO at the moment.

As a result, the risk-to-reward is now a lot less compelling than it used to be, at least relatively speaking.

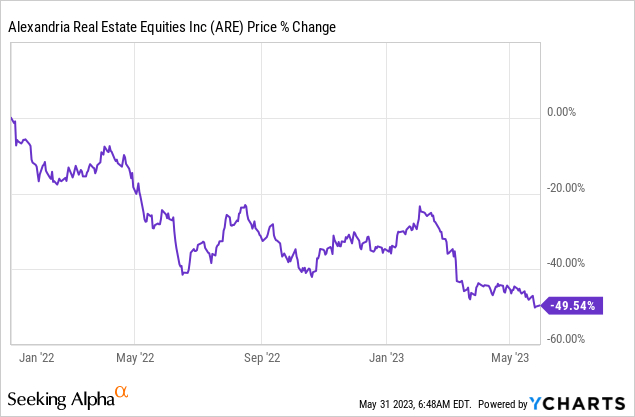

At the same time, some other REITs have become a lot more opportunistic. As an example, Alexandria Real Estate Equities, Inc. (ARE), the leader in life science properties, has seen its share price cut in half over the past year even as its cash flow kept on rising:

The market appears to have mistakenly grouped it with "office REITs" due to the similar physical appearance of life science buildings, but their fundamentals are actually a lot stronger.

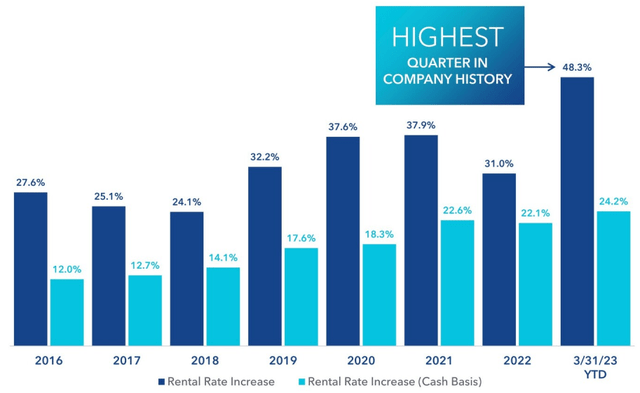

ARE's rents are today growing at the fastest pace ever because there is a lot of demand for lab space in the post-covid world, but the supply of high-quality space is limited:

We would have rather have our capital invested in a REIT like ARE at 13x FFO than in WELL at 22x FFO and for this reason, we sold our position in WELL, locking our gain, and reinvested the proceeds elsewhere.

Omega Healthcare Investors, Inc. (OHI)

While WELL earned us a nice gain, we also occasionally suffer losses, and OHI is an example of that.

We invested in the company in March of 2021 because we thought that the end of the pandemic was approaching and we expected the profitability of its skilled nursing tenants to rapidly improve, allowing them to pay their rent in full and on time.

Omega Healthcare

But shortly after, it became clear to us that our OHI thesis had weakened. New variants kept emerging one after the other, labor costs surged in the healthcare sector, stimulus from the government was drying up, and it put OHI's tenants at even greater risk.

We felt that at any given time some tenants could stop paying rent and so we end up selling our position at a small loss.

Shortly after, OHI reported that some of its tenants had stopped paying rent, and to this day, it is still struggling with rent collections because nearly 30% of its rents come from tenants that aren't profitable.

Moreover, its average rent coverage (EBITDAR coverage, excluding CARES Act support) is today only at 1.09 times.

That's very low and it leaves very little room for error.

I think that it shows that the skilled nursing sector is suffering significant problems that go beyond the pandemic and it may require some significant rent cuts to resolve them.

One of OHI's closest peers, Sabra Health Care REIT, Inc. (SBRA), granted a 30% rent reduction to its biggest tenant a year ago.

Sabra Health Care

We think that similar rent cuts are likely if OHI wants its tenants to survive, and if we are correct, then OHI's dividend is also likely to be cut.

OHI may seem cheap due to its high 9% dividend yield, but this dividend yield is not sustainable and the company is shooting itself in the foot by stubbornly trying to maintain it. The CEO was open about the poor dividend coverage in their latest conference call.

If you ignore the high yield, which is really just a mirage to attract yield-chasing investors, the company is actually priced at a 10% premium to NAV.

Most companies facing OHI's struggles typically trade at large discounts to NAV. We think that the company could face more downside and a dividend cut. But even if we are wrong and OHI manages to maintain the dividend, we think that the risk-to-reward is poor at the moment.

Bottom Line

REITs make up a huge portion of my portfolio. I am very bullish on a number of them.

However, it is important to remember that there are over 200 REITs out there, and just because I own ~20 of them does not mean that I am bullish on the remaining 180.

It is very important to be selective in today's environment, and that explains why we invest in only 1 out of 10 REITs on average at High Yield Landlord.

Join 2,500+ Subscribers...

At Just ~1/3 Of The Regular Rate!

We want to give you the opportunity to try High Yield Landlord at a much lower price, so you can see if it's a good fit for you. We are the largest and best-rated real estate investing group on Seeking Alpha with a perfect 5/5 rating from 500+ reviews and our members happily pay $79 per month.

For a limited time, you can join us at a significantly reduced rate and we are also giving you a 2-week free trial so you have everything to gain and nothing to lose.

This article was written by

Jussi Askola is a former private equity real estate investor with experience working for a +$250 million investment firm in Dallas, Texas; and performing property acquisition in Germany. Today, he is the author of "High Yield Landlord” - the #1 ranked real estate service on Seeking Alpha. Join us for a 2-week free trial and get access to all my highest conviction investment ideas. Click here to learn more!

Jussi is also the President of Leonberg Capital - a value-oriented investment boutique specializing in mispriced real estate securities often trading at high discounts to NAV and excessive yields. In addition to having passed all CFA exams, Jussi holds a BSc in Real Estate Finance from University Nürtingen-Geislingen (Germany) and a BSc in Property Management from University of South Wales (UK). He has authored award-winning academic papers on REIT investing, been featured on numerous financial media outlets, has over 50,000 followers on SeekingAlpha, and built relationships with many top REIT executives.

DISCLAIMER: Jussi Askola is not a Registered Investment Advisor or Financial Planner. The information in his articles and his comments on SeekingAlpha.com or elsewhere is provided for information purposes only. Do your own research or seek the advice of a qualified professional. You are responsible for your own investment decisions. High Yield Landlord is managed by Leonberg Capital.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of ARE; HR either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.