It Doesn't Matter If Warren Buffett Doesn't Want To Buy Occidental Petroleum

Summary

- Berkshire Hathaway Inc. (Warren Buffett) has announced they don't want to own all of Occidental Petroleum Corporation. They clearly have a price at which they're a buyer, though.

- In addition to Buffett, Occidental Petroleum's own repurchase of their shares makes for two very large customers in the market, both very interested at current prices.

- Occidental Petroleum Corporation has some highly profitable operations, making it a valuable long-term investment.

- The Retirement Forum members get exclusive access to our real-world portfolio. See all our investments here »

Brandon Bell

On May 6, Berkshire Hathaway Inc.'s (BRK.A) (BRK.B) de-facto decision maker Warren Buffett stated:

"We wouldn't know what to do with it," he said, adding that he's confident in OXY's (NYSE:OXY) management.

"We may or may not own more" of the stock in the future, he said.

In the several days following, the company's share price dropped 6%. We have to admit we were surprised, we've discussed before our view of how Berkshire Hathaway could comfortably afford the company, and how OXY would be a great addition. Not knowing what to do with it might also be true of plenty of other companies in the portfolio, just let the management keep running it.

Berkshire Hathaway

However, Buffett is true to his word. Berkshire Hathaway has kept investing. The company recently acquired another 4.66 million shares for $273 million over the past week. That's an average price of just under $58.6 / share. As we've shown time and time again, Berkshire Hathaway loves these lower prices and it's regularly bought at <$60 / share.

The company now owns ~222 million shares of Occidental Petroleum Corporation. The company has just over 900 million shares outstanding. Berkshire Hathaway also has $9.35 billion in preferred equity that, when Occidental Petroleum's shareholder returns are high, have mandatory redemption at a 10% premium. They pay an 8% coupon in the meantime.

Lastly, the company has $5 billion in warrants at $59.62 each. That's a dilutive effect with share prices above that level, and it's clear where Buffett feels fair value is. Given that the warrants represent just under 84 million shares, purchasing those would take the company to a 31% equity stake from its 25% level.

It's also worth noting that the company's "feel bad for shareholders" June 2020 warrants total just under 104 million shares at a $22 / share breakeven. That'll provide $2.2 billion in cash, but is substantially dilutive at the current share price. No easy way around that without a massive decline equivalent to COVID-19.

Occidental Petroleum Financials

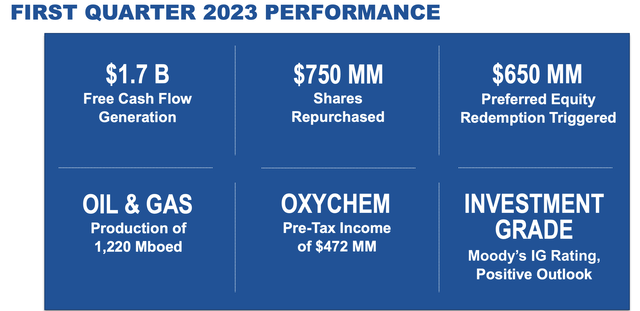

It's worth noting that this doesn't count Occidental Petroleum's own aggressive share repurchase program. In Q1 2023, the company repurchased almost 13 million shares, or a rate of almost 6% of its annualized float rate. The company was held back by needing to match repurchases w/ redemptions for the preferred equity.

Occidental Petroleum Investor Presentation

However, the company's free cash flow ("FCF"), which can be nearly entirely used for share repurchases, given the company's debt has hit its targets, is enough for the company to repurchase 13% of its shares on an annualized basis. That, combined with Berkshire Hathaway's slow repurchases, could rapidly increase Berkshire Hathaway's equity holdings.

The company's $40 WTI breakeven for its capital program + dividends, versus current WTI prices of almost $70 / barrel, will support substantial FCF from the company's 110 million barrels of quarterly production.

OPEC+

It's been just under two months since OPEC+ announced surprise production cuts of just under 1.2 million barrels / day. Since then Russia v. Saudi Arabia tensions, the two largest players of OPEC+, have seen tensions increase as Russia dumps cheap crude onto the market. India, for example, has rapidly ramped up Russian imports to replace Saudi Arabia.

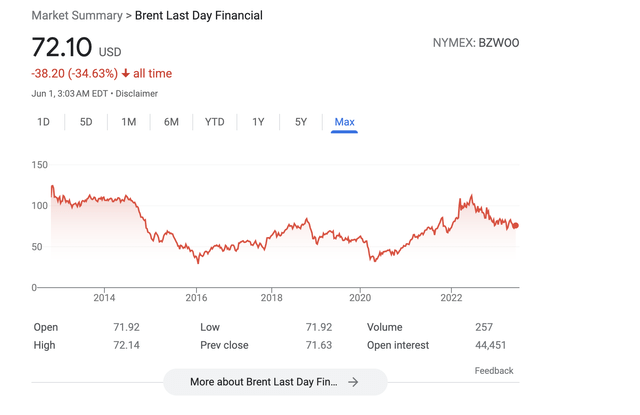

Historically, current prices are low.

The collapse in 2015-early-2016 was the end of an era, as cheap shale pushed supply too high. Prices bounced up quickly from early-2016 lows and looked good through 2018 especially. 2019 was weak and COVID-19 quickly collapsed the markets. From there, prices recovered, bolstered by Russia's invasion of Ukraine and the potential loss of supply.

However, they've quickly tapered back down, and $70 / barrel is much less interesting to large parts of the market, including OPEC+. Russia, unfortunately, has a contrarian interest. Price caps against the country due to its invasion, mean that high prices are less important than volume. We expect this to lead to additional tensions.

Occidental Petroleum Future

The company's future involves both its valuable assets and strong shareholder returns as the Anadarko Petroleum acquisition pays off.

Occidental Petroleum Investor Presentation

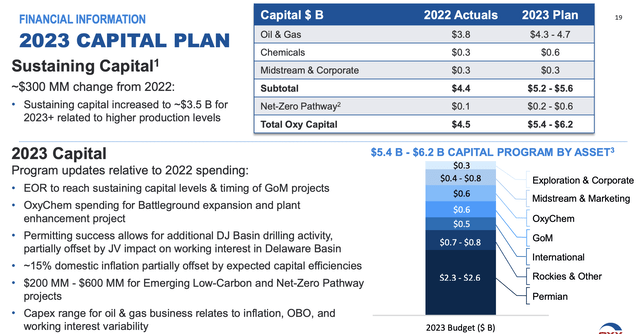

The company's sustaining capital as increased as a result of the company's higher production. The company's long-term sustaining capital is ~$3.5 billion, a level that the company can comfortably afford. The company's plan is $5.8 billion in total capital spending of which $4.5 billion is its upstream assets. The extra $1 billion will help to sustain long-term production strength.

The company's capital efficiencies will help with inflation. The company's annualized FCF is $6.8 billion per the 1Q. It can maintain high FCF even in a tough market. That should enable strong shareholder returns through repurchases. The company's debt has it its target and in the backup it has a dividend yield of more than 1%.

Thesis Risk

The largest risk to our thesis is crude oil prices. Occidental Petroleum Corporation is highly profitable and can continue to pay its dividends at $40 WTI. But the story changes as oil prices drop. Prices have been weak and a weak reopening from China combined with general market weakness can hurt the company. As a result, we recommend investors pay close attention to crude prices.

Conclusion

Berkshire Hathaway has announced they don't want to fully purchase Occidental Petroleum Corporation, but they remain a massive buyer of the stock. Occidental Petroleum is perhaps the only larger buyer out there in the market, with an aggressive repurchase program of its own OXY shares. The company can comfortably afford that, given its massive FCF.

The company is negatively impacted in direct shareholder returns by an obligation to direct half of shareholder returns to repurchases of Berkshire Hathaway's preferred equity. However, given the 8% yield on that, that still pans out. The company's forced 1Q 2023 repurchases will save it $50 million annually going forward.

Long term, Occidental Petroleum Corporation is a valuable investment. Let us know your thoughts in the comments below.

You Only Get 1 Chance To Retire, Join The #1 Retirement Service

The Retirement Forum provides actionable ideals, a high-yield safe retirement portfolio, and macroeconomic outlooks, all to help you maximize your capital and your income. We search the entire market to help you maximize returns.

Recommendations from a top 0.2% TipRanks author!

Retirement is complicated and you only get once chance to do it right. Don't miss out because you didn't know what was out there.

We provide:

- Model portfolios to generate high retirement cash flow.

- Deep-dive actionable research.

- Recommendation spreadsheets and option strategies.

This article was written by

#1 ranked author by returns:

https://www.tipranks.com/experts/bloggers/the-value-portfolio

The Value Portfolio focuses on deep analysis of a variety of companies across a variety of sectors looking for alpha wherever it is to maximize reader returns.

Legal Disclaimer (please read before subscribing to any services):

Any related contributions to Seeking Alpha, or elsewhere on the web, are to be construed as personal opinion only and do NOT constitute investment advice. An investor should always conduct personal due diligence before initiating a position. Provided articles and comments should NEVER be construed as official business recommendations. In efforts to keep full transparency, related positions will be disclosed at the end of each article to the maximum extent practicable. The majority of trades are reported live on Twitter, but this cannot be guaranteed due to technical constraints.

My premium service is a research and opinion subscription. No personalized investment advice will ever be given. I am not registered as an investment adviser, nor do I have any plans to pursue this path. No statements should be construed as anything but opinion, and the liability of all investment decisions reside with the individual. Investors should always do their own due diligence and fact check all research prior to making any investment decisions. Any direct engagements with readers should always be viewed as hypothetical examples or simple exchanges of opinion as nothing is ever classified as “advice” in any sense of the word.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of OXY either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.