ZIM Integrated: Trading At 70% Discount To Tangible Book Value

Summary

- ZIM Integrated Shipping Services' stock price has dropped significantly due to weak financial results as a result of dropped container freight rates, making it a potential buy for value investors.

- The company's fundamentals have improved, with increased gross profit margin, EBITDA margin, and tangible book value per share; however, the short-term container market outlook remains weak.

- As inflation rates decrease and interest rates are cut, the demand for container vessels may increase, leading to a potential improvement in ZIM's stock price in the long term.

- As the P/B ratio analysis works for ZIM, the stock's price to tangible book value of $41 must not be ignored.

Tryaging

Yes, ZIM Integrated Shipping Services (NYSE:ZIM) reported weak 1Q 2023 financial results. However, as container freight rates dropped to low levels (even though it is still higher than the pre-pandemic levels), an impaired financial result was partly expected. But, as the stock’s price dropped significantly right after the company reported its 1Q 2023 financial results, we can conclude that investors didn’t expect ZIM’s quarterly loss to be as high as it really was.

Yet, the container market outlook is not strong, and I don’t expect ZIM’s average freight rate in 2Q 2023 to improve. In fact, ZIM’s 2Q 2023 financial results can be weaker than in 1Q 2023. The consensus estimate indicates that ZIM is going to report a 2Q 2023 loss of 92 cents per share. But, if you are a value investor who wants to buy stocks at a low price compared to their high value, ZIM is on the table.

Now, the stock’s price is down 80% YoY and is trading at about a 70% discount to its tangible book value per share. It is very risky to evaluate a stock just based on its P/B ratio. However, if you consider the long-term market outlook, and the company's fundamentals, the P/B ratio might work well. In the case of ZIM, the price to tangible book value per share of 0.3x is something that I can't ignore. As inflation rates get close to more normal levels by the end of 2023, allowing monetary authorities to cut interest rates, the demand for container vessels can increase. ZIM is trading at a 70% discount to its tangible book value per share, and once the container shipping market starts improving, ZIM stock price could jump. If you are a short term-investor, forget about ZIM. However, if you are a value investor, ZIM might be the right stock to consider. The stock is a buy.

Financials and P/B ratio

The company’s financial results show that compared with 28 months ago (the IPO), the company’s fundamentals improved significantly. ZIM’s gross profit margin increased from 29% in 2020 to 62.07 in 2022. Also, its EBITDA margin increased from 26% in 2019 to 50% in 2022. In 2020, ZIM’s operating cash flow, capital expenditure, and free cash flow were $881 million, $43 million, and $838 million, respectively. In 2022, the company’s operating cash flow, capital expenditure, and free cash flow increased to $6,110 million, $646 million, and $5,764 million, respectively.

In 2023, ZIM’s results will not be even close to its 2022 strong results. However, due to its strong results in 2021 and 2022, ZIM’s total equity and total debt-to-equity ratio increased from $267 million and 6.86x in December 2020 to $5082 million and 0.91x in March 2023. The company’s tangible book value per share increased from $2 in December 2020 to $42 in March 2023. Nonetheless, ZIM’s current stock price is very close to its IPO price. Thus, if you are a value investor, you may want to consider ZIM at its current price of around $13. The irony here is that the stock’s price may even decrease further, even to below its IPO price. However, a further decrease just makes the stock more opportunistic, unless something terrible happens to the company’s management.

The price-to-book value analysis (P/B) works for ZIM as the company has high tangible equity and a normal debt-to-equity ratio which significantly improved in the past few years. Usually, when internal problems such as management and debt problems lead to a low price-to-book value ratio, it is not wise to consider the corresponding stock a buy based on the low P/B ratio. However, ZIM’s weakening financial results that has caused the stock’s price to drop in the past year, are simply linked to plunged freight rates. Container freight rates dropped mainly for two reasons: the global economic headwinds due to high inflation and interest rates which led to lower imports of goods and destocking, and the easing of port congestions which led to higher capacities. While the positive effect of port congestion on freight rates is not expected to happen again, a better economic condition can increase the demand for container ships, pushing freight rates up.

Container freight rates

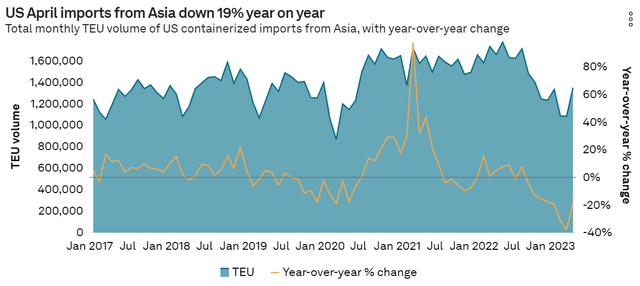

Freight rates in the 2023-2024 contracts are significantly lower than the previous year. For example, in 2023, the initial freight-all-kinds (FAK) rates, which are the rates that float with the spot market, are on average between $1350 to $1500 per FUE to the West Coast (compared with $6000 to $8000 in 2022) and $2350 to $2500 per FEU to the East Coast (compared with $8000 to $1000 in 2022). As a result of high inflation rates and high interest rates, U.S. containerized imports from Asia started decreasing in the second half of 2022. U.S. April imports from Asia totaled 1.35 million TEUs, down 19% YoY (see Figure 1). However, we could also see that U.S. containerized imports in April 2023 were higher than in March 2023, which is a good sign for the container market.

Figure 1 – US April imports from Asia

www.joc.com

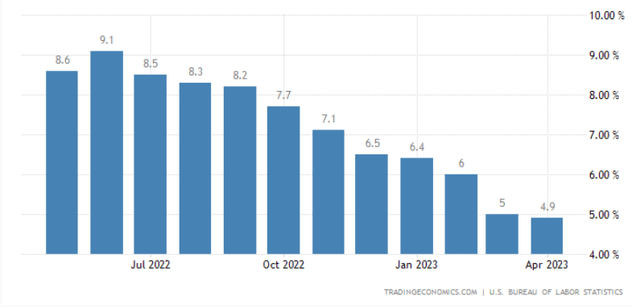

According to Figure 2, U.S. annual inflation rate in April was lower than the previous months, and with the current trend, it seems that the inflation has been tamed and we could the Federal Reserve getting close to its target by the end of 2023. Also, USD depreciated against the Chinese Yuan from October 2022 to January 2023. However, in the past months, USD appreciated against Yuan, meaning that imports of goods from China are now cheaper for the United States. Also, it means that exports from China to the United States are now more profitable for Chinese exporters. All of these mean that the demand for container ships is supported.

On the other hand, the Fed still doesn’t have any plan to start cutting interest rates in the following months yet, and there even might be another rate hike. In the first quarter of 2024, Federal Reserve may start decreasing the interest rates. Lower interest rates after reaching the inflation target of around 2.0% can help the U.S. economy to improve. As a result, U.S. imports of goods can increase to higher levels, strengthening the demand for container vessels. According to Figure 3, United States import prices decreased in the past few months (However, it is still higher than the 5-year, 10-year, and 25-year mean).

Figure 2 – U.S. inflation rate

tradingeconomics.com

Figure 3 – United States import prices

tradingeconomics.com

Choosing the entry point

According to IMF’s April 2023 report, the world economic growth in 2024 is expected to be 3.0%, compared with 2.8% in 2023. Based on the current market conditions and the economic outlook, it is not reasonable to expect container freight rates to start increasing in a significant way until 2024. Container freight rates may decrease further in the second half of 2023.

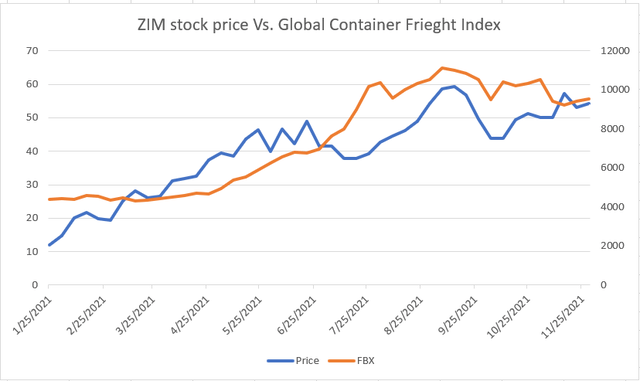

It would be great if you could buy ZIM at its current price (around $13 per share) six months later when container freight rates can start increasing. But the problem is that you can’t. According to Figure 4, while ZIM stock price increased by 283% from $12 on 25 January 2021 to $46 on 25 May 2021, the global container freight index increased just by 34%. On the other hand, when the global container freight index increased by 75% from 25 May 2021 to 2 August 2021, ZIM stock price decreased by 9%. I’m not saying that ZIM’s stock price is not linked to container freight rates. I’m just saying that despite the significant current correlation between ZIM stock price and container freight rates, we cannot determine the buy and sell points simply regarding the changes in the container freight rates. I expect a few months before container freight rates start increasing, ZIM’s stock price starts climbing as Mr. Market predicts the booming of the container market in advance.

Also, you should consider the fact that some investors with huge amounts of money have access to information about the container market before retail investors. They can determine their entry and exit points much easier than retail investors. As retail investors do not have access to that first-hand information, they should build their strategy according to the long-term market outlook and the stock’s intrinsic value. When it comes to ZIM, I expect the container market to improve as inflation rates decrease further, allowing money authorities to cut interest rates. We cannot be sure when it exactly happens. It can happen in 3 months, 6 months, or a year.

Figure 4 – ZIM stock price (left axis) Vs. global container freight index (right axis)

Author (based on Yahoo Finance and Freightos data)

End Note

ZIM’s 1Q 2023 financial results were weak and the company’s 2Q 2023 results are expected to impair further. Also, container freight rates can continue decreasing in the following months, and until 2024, there might be no significant good sign for the container shipping market. However, the current market condition is expected to change and as ZIM is now trading at a 70% discount to its tangible book value per share, the stock is a buy for value investors who build their strategy based on the long-term trends and the fundamental position of the stock.

This article was written by

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.