DIAX: DJIA Exposure With An Overwrite Strategy

Summary

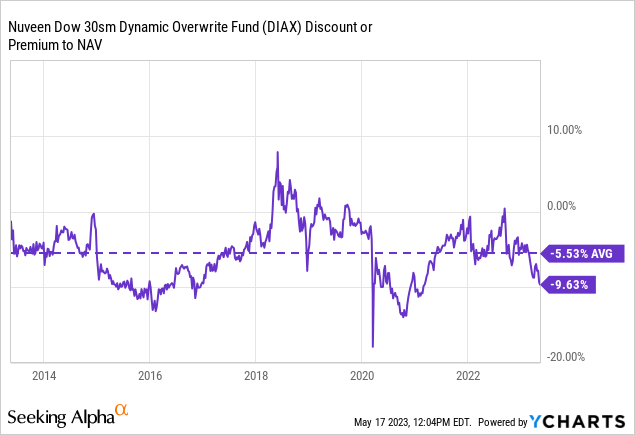

- Nuveen Dow 30 Dynamic Overwrite Fund (DIAX) is trading at a larger discount compared to its historical level, potentially indicating an attractive opportunity.

- The fund aims to offer regular distributions with less volatility than the Dow Jones Industrial Average (DJIA) by investing in an equity portfolio and selling call options.

- However, the fund's odd positioning of writing index calls on indexes that they aren't replicating in their underlying portfolio presents a potential risk.

- This idea was discussed in more depth with members of my private investing community, CEF/ETF Income Laboratory. Learn More »

champc

Written by Nick Ackerman, co-produced by Stanford Chemist. This article was originally published to members of the CEF/ETF Income Laboratory on May 17th, 2023.

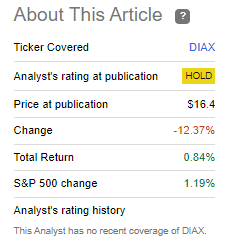

Nuveen Dow 30 Dynamic Overwrite Fund (NYSE:DIAX) is a name I last touched on over two years ago when it was trading at a large discount. Since then, the discount narrowed, and it wasn't brought up until more recently. To catch my attention was the fund going to a relatively larger discount compared to its own historical level once again.

A discount on its own isn't necessarily a good determining factor if a fund is attractive or not. Generally speaking, looking for discounts that are wider than usual can indicate something is worth looking into further for a potential opportunity. Conversely, a discount/premium that is running higher than a fund's historical range can often indicate a name worth potentially selling.

Since our last update, the fund's performance has been relatively flat on a total return basis.

DIAX Performance Since Prior Update (Seeking Alpha)

The fund road the highs through the end of 2021 like the broader market did, only to see more muted results in 2022. However, unlike the S&P 500 and Nasdaq, which were bogged down severely by growth names, the Dow Jones Industrial Average held up relatively better. Of course, we know so far in 2023 the opposite has been true. The DJIA has been the laggard with growth rebounding.

The Basics

- 1-Year Z-score: -2.25

- Discount: -9.63%

- Distribution Yield: 7.99%

- Expense Ratio: 0.93%

- Leverage: N/A

- Managed Assets: $590.525 million

- Structure: Perpetual

DIAX's investment objective is "to offer regular distributions through a strategy that seeks attractive total returns with less volatility than the Dow Jones Industrial Average (DJIA or "Dow 30")..." In an attempt to achieve this objective, the fund will invest "in an equity portfolio that seeks to substantially replicate the price movements of the DJIA, as well as selling call options on 35-75% of the notional value of the Fund's equity portfolio (with a 55% long-term target) in an effort to enhance the Fund's risk-adjusted returns." As of their last report, the fund was overwritten by 50%.

Overall, it's quite a simple strategy and isn't anything too exotic. There is no leverage to add to volatility - which would seemingly make sense as they are looking to tamp down on the overall volatility. The fund is also a fair size, which generally provides enough liquidity for retail investors. At the same time, like most option-writing funds, the fund's expense ratio is also quite competitive in the closed-end fund space.

A Look At DIAX's Portfolio, Odd Positioning

With the fund's strategy of writing calls against both index and underlying positions, they utilize a more flexible strategy. The different weightings they can target also introduce more flexibility to the fund. Having a higher overwrite would indicate a more bearish stance on the DJIA. The reason is that the fund could limit some of the upside should the index start to rally.

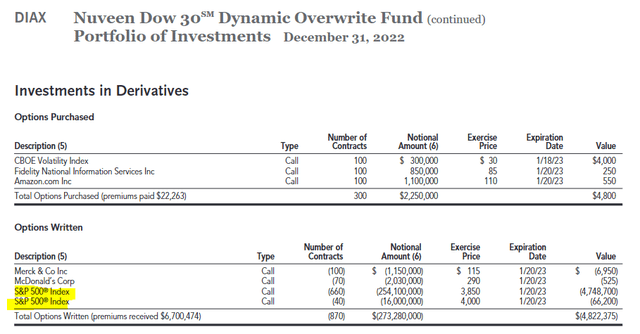

Interestingly, instead of just writing calls, this fund is also purchasing some calls too. That isn't something that most CEFs do regularly. In addition to that oddity, the fund also has chosen not to write calls against the DJIA index. Instead, in their last report, they had written against the S&P 500.

DIAX Options Positioning (Nuveen)

I view this as a potential risk and a negative for the fund. The reason is that an index can't really be owned outright. Therefore, they are always essentially writing naked options that are cash settled. While that is the case against any index writing, other funds implement holdings that would offset these moves.

For example, Eaton Vance Tax-Managed Buy-Write Opportunities Fund (ETV) writes calls against the S&P 500 and Nasdaq Indexes. However, the underlying portfolio of ETV is also heavily skewed with the holdings in those indexes.

In this case, DIAX is holding DJIA stocks while writing against a different index. While these indexes do tend to correlate over periods of time, there have been significant shifts in the last year and a half that clearly showed a divergence in performance. During the bear market of 2022 this wasn't too much of a problem; the S&P 500 Index was underperforming the DJIA.

However, for 2023 it has been the opposite. So now the fund is likely losing on the S&P 500 Index that they wrote calls against, while DJIA value-oriented names have been languishing this year, resulting in pressure on the fund.

This isn't a one-off either, just in the last report or the last couple. I checked back in several other historical reports, and besides the S&P 500 Index showing up, they've also used the Nasdaq 100 and Russell 2000 Indexes.

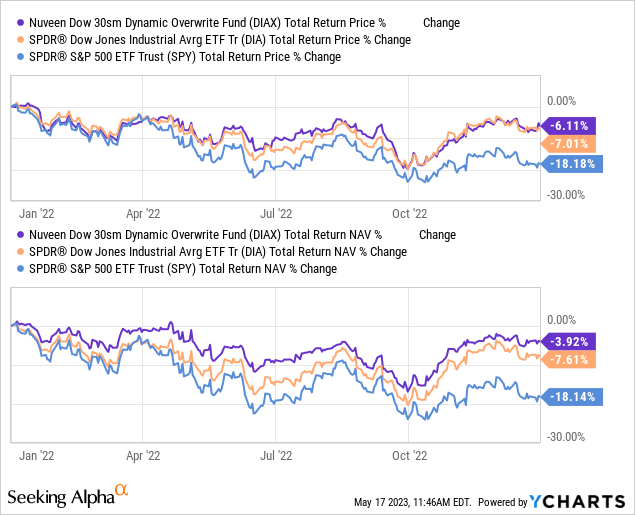

If this is hard to follow, I'll try to show what is going on visually in terms of performance. Below we can see 2022 performance with DIAX up against (DIA) and (SPY), representing the DJIA and S&P 500 Indexes, respectively.

Ycharts

2022 shows us exactly what we expect. On a total NAV return basis, DIAX has outperformed the other indexes. It's a call-writing fund, so naturally, as a slightly defensive strategy, we generally see this.

However, while the DIA has been languishing this year, DIAX should have had a good chance of outperforming again as the fund collects premiums when DIA does not.

Instead, we see that on a total NAV return basis, DIAX is underperforming. Clearly, it certainly isn't anything significant; higher expenses can also play a role. That said, if they are still utilizing written calls on the S&P 500 Index, that would be pressuring the fund, too, as that index is doing much better this year.

Ycharts

Essentially, they're running an unhedged portfolio. This isn't typically how these funds are managed with options strategies. Additionally, to be fair, that was their positioning at the end of 2022. It could be and is very likely that this has been altered since.

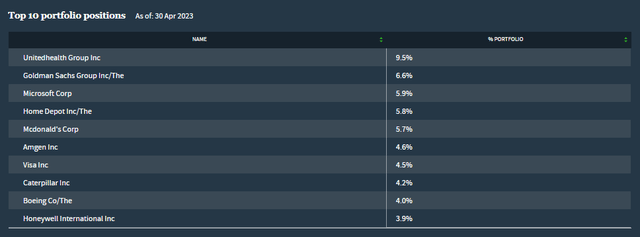

A quick look at the top holdings shows weightings to the more value-oriented names associated with the DJIA. This would be expected, given the fund's investment strategy. However, that means that besides Microsoft (MSFT) and UnitedHealth Group (UNH), they aren't carrying overlapping top holdings with the S&P 500 Index. Also, they list 40 holdings, so some positions they've incorporated that aren't included in the DJIA.

DIAX Top Ten Holdings (Nuveen)

Attractive Discount

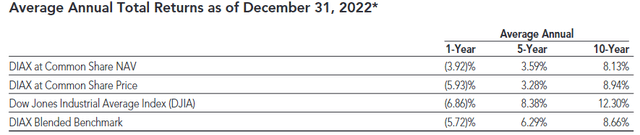

All that being said, the fund's historical performance has shown that they've been competitive with its blended benchmark. Thanks to a bull market in most of the last decade, DIAX would have underperformed the DJIA head-to-head. Naturally, we can see that the fund performed better in last year's bear market, as we already highlighted in the graph above.

DIAX Annualized Performance Through December 2022 (Nuveen)

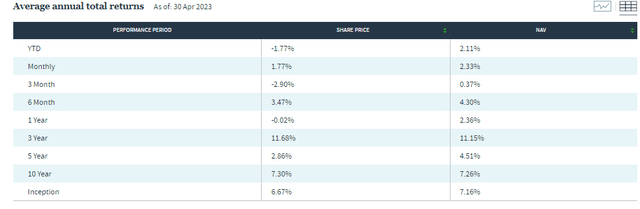

They share the results in their annual report, so unfortunately, it is dated, but it can still help provide some context. Their website provides more recent performance results but doesn't include the benchmark performance.

DIAX Annualized Performance (Nuveen)

Should the market remain flattish, a call-writing strategy can be a fairly strong consideration because it's one way to generate returns while the market is flat. Capital gains are also important to support the fund's distribution. Additionally, with the fund's current discount, it looks like it is presenting a potential opportunity for investors. If there is some discount contraction back to its historical average, that could potentially boost an investor's results.

Ycharts

Attractive Quarterly Distribution

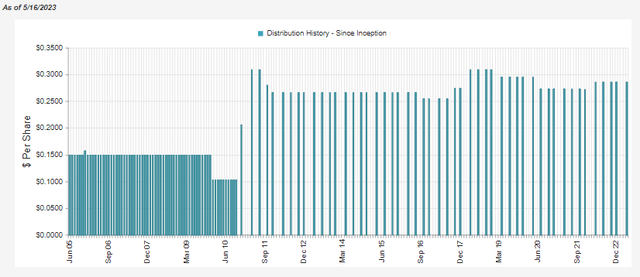

The fund has a quarterly distribution, but it was a monthly payout at one time. Monthly distributions are generally more attractive to income-oriented investors, but overall the payout schedule shouldn't matter too much.

Additionally, the fund has adjusted its distribution quite a few times over the years. That's another thing income investors tend to shun, even if this is standard for index ETFs. Which is essentially at the core of what DIAX is, with some active levers due to its option overlay strategy.

DIAX Distribution History (CEFConnect)

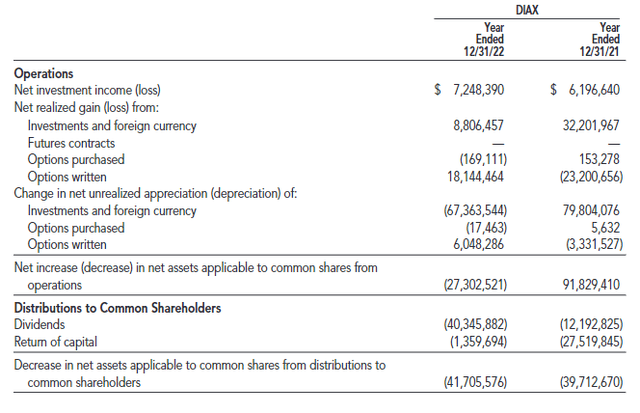

As I mentioned above, capital gains are important to fund the 7.99% distribution rate. That's nothing new or unusual for an equity fund. In this case, the last year's net investment income coverage came to 17.38%.

DIAX Annual Report (Nuveen)

To help cover that shortfall, we can see that they brought in another $18.144 million in realized gains from their written options. There was also $6.05 million in unrealized gains from their options written. Both realized, and unrealized options purchased resulted in losses. And finally, they were able to realize more than $8.8 million from their underlying portfolio positions.

The bad news is that despite all these gains, the big unrealized loss in the underlying portfolio would have counteracted that appreciation; therefore, why we saw negative results in the fund last year overall. Still, the losses would have been even more severe had it not been for the fund's options writing strategy. That's where we get the outperformance relative to the indexes we saw in 2022.

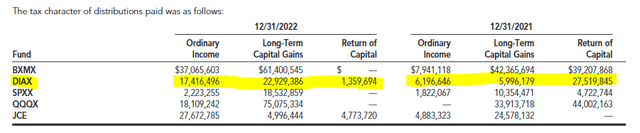

The tax classifications for the fund's distribution in the prior two years contained a little of every classification, ordinary income, long-term capital gains and return of capital. CEFs tend to change from year to year in their classifications, but a fund such as this can make it hard for an investor to choose between a taxable or tax-sheltered account.

DIAX Distribution Tax Classification (Nuveen)

The reason is that ROC can be beneficial as a way to defer taxes as it reduces an investor's cost basis. Eventually, they would have to potentially be paid as capital gains if the position is sold. Long-term capital gains can also be tax-friendly as they are taxed relatively lower than ordinary income. However, that very ordinary income that can fluctuate meaningfully could catch an investor off-guard and potentially push their tax obligations up more than expected.

Conclusion

The fund is trading at an attractive discount and offering a healthy distribution. Currently, the distribution rate on the NAV is reasonable, and thanks to that large discount, it means that investors collect an even higher rate. The caveat here is that, like most equity funds, they will rely significantly on capital gains to cover this distribution. If we remain under pressure in the overall market, it could be more difficult for DIAX to fund its distribution.

On the other hand, they also have an options writing strategy that can soften the blow and provide capital gains even if the market is flat. That could see any distribution cut put off for longer or potentially avoided. The fund also doesn't implement any leverage as most CEFs do.

The one thing that stood out as odd when looking at this fund is that they are writing index calls on indexes that they aren't replicating in their underlying portfolio. I think this presents a bit of a risk that should be noted. The trajectory of the three main indexes often has correlated, but the divergence - especially what we see in 2023 - could lead to potential losses. They lack being hedged due to a mismatch between their underlying portfolio and the index writing they are doing.

Profitable CEF and ETF income and arbitrage ideas

At the CEF/ETF Income Laboratory, we manage ~8%-yielding closed-end fund (CEF) and exchange-traded fund (ETF) portfolios to make income investing easy for you. Check out what our members have to say about our service.

At the CEF/ETF Income Laboratory, we manage ~8%-yielding closed-end fund (CEF) and exchange-traded fund (ETF) portfolios to make income investing easy for you. Check out what our members have to say about our service.

To see all that our exclusive membership has to offer, sign up for a free trial by clicking on the button below!

This article was written by

---------------------------------------------------------------------------------------------------------------

I provide my work regularly to CEF/ETF Income Laboratory with articles that have an exclusivity period, this is noted in such articles. CEF/ETF Income Laboratory is a Marketplace Service provided by Stanford Chemist, right here on Seeking Alpha.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of ETV, MSFT, UNH either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.