C3.ai: Soft Guidance Belies AI Hype

Summary

- C3.ai's stock reacted negatively to the Q4 earnings release, as the company's performance cannot fulfill investor expectations.

- C3.ai's switch to a consumption pricing model is yet to show significant evidence of accelerating customer acquisitions.

- C3.ai now trades on similar multiples to best-in-class software companies. This situation is unlikely to persist for any length of time.

da-kuk

C3.ai's (NYSE:AI) stock reacted negatively to the Q4 earnings release, with the reality of the company's situation temporarily overwhelming investor fantasies. The company is not alone here though. The recent surge in growth stocks in general comes against deteriorating fundamentals, and a number of prominent SaaS stocks have also declined significantly on earnings releases.

C3.ai

C3.ai unsurprisingly hasn't seen a significant revenue bump from the recent increase in interest in AI. C3.ai has no unique AI capabilities. Rather, it is more of a consulting organization that helps customers implement scalable machine learning driven applications, primarily in areas like predictive analytics for operations.

C3.ai's CEO essentially admits that it is a consulting company in the following quote:

We're in the solution business and I would say the other people are in the piece parts and tools businesses. - Tom Siebel

Developing applications for customers can be a lengthy and expensive process. For example, a project with the San Mateo County Sheriff's Office reportedly had a one-year timeline for deployment.

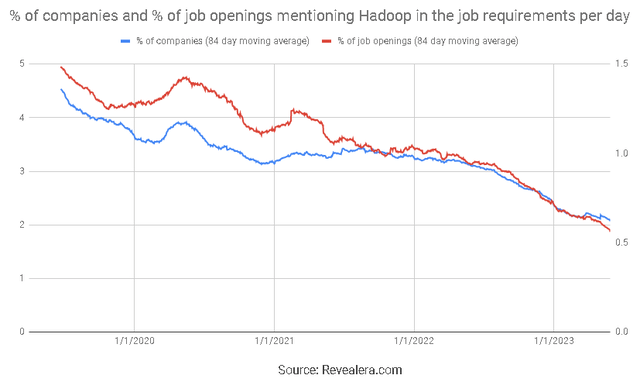

C3.ai has existed for a long time, and after several early pivots, is focused on providing scalable infrastructure for analytics. This was a problem at one point, as big data infrastructure like Hadoop was beyond the capabilities of most organizations. C3.ai has in many ways become obsolete before gaining traction though, with a range of more user friendly infrastructure solutions now available.

Figure 1: Job Openings Mentioning Hadoop in the Job Requirements (source: Revealera.com)

C3.ai believes that the market is increasingly demanding turnkey solutions rather than development tools, supporting this position with the fact that 83% of its bookings come from application sales. While there will always be organizations that demand turnkey solutions, it is not clear the market is tilting in any particular direction. For example, there are analytics platforms that are larger and growing faster than C3.ai.

It is easy to be critical of C3.ai given the recent run up in share price, but it should be recognized that the company has genuine problems. Short sellers may be positioned to benefit from a decline in the stock price, but they have highlighted real issues with the company.

A recent Bloomberg article points out a lot of the same issues that others have, including:

- Micromanagement

- Difficulty signing new customers despite the company's small customer base and the connections of the CEO

- Demonstration of unfinished products in presentations as if they were ready for the market

- For the 12 month period ending in March, C3.ai's employee departure rate was roughly 31%

- Counting different divisions of the same parent company as separate customers

- Baker Hughes (BKR) has reduced its ownership stake and the CEO no longer sits on C3.ai's board, despite being the source of a large portion of C3.ai's revenue

Generative AI

C3.ai's Generative AI solution was released to the market in Q4. This is an enterprise search product that appears to combine a traditional indexing approach with LLMs. C3.ai is touting the fact that its solution can provide traceable, deterministic and consistent answers. In addition it has the access controls and security protocols necessary for an enterprise product.

Snowflake (SNOW) recently announced that it intends to acquire the search company Neeva. Neeva has approximately 40 employees and has also been working on generative AI powered search. The stated reason for the acquisition is to enable users and application developers to build rich search and conversational experiences. Neeva will also allow non-technical users to utilize Snowflake.

The popularity of ChatGPT has brought more attention to the space, but there are issues that must be addressed to provide a viable enterprise search product. Neeva combines LLMs with traditional search approaches and is able to do attributional results. This is important in an enterprise setting were precise results are important.

There are also existing enterprise search vendors, like Elastic (ESTC), that have incorporated LLMs into their search products. The utility of LLMs in enterprise search is somewhat unclear and the relative strength of different vendor solutions is also unknown. Given C3.ai's sudden pivot to this market, it is unlikely that its solution is on par with pure play search companies.

Competition

C3.ai faces competition at both the application and infrastructure level, with Palantir (PLTR) perhaps being the closest competitor. The market is undergoing a shift in competitive dynamics at the moment though due to generative AI. Some competitors offer low-code / no-code tools and are now introducing generative AI to guide users through machine learning workflows, undermining C3.ai's position as a solution provider.

Alteryx (AYX) is capitalizing on the hype around generative AI with the launch of AiDIN. AiDIN builds on Alteryx's low-code foundation and aims to empower business users. AiDIN appears to be positioned as something of a coordination layer that helps guide users through the analytics lifecycle, ensuring that accurate insights into business problems are generated. This could potentially make Alteryx easier to use, increasing adoption and the value of the service for customers.

Microsoft (MSFT) is also taking a similar approach in this area, and its distribution footprint makes it a formidable competitor. Fabric is an end-to-end analytics platform that integrates data and tools. At this stage it is not really clear to what extent Fabric represents genuine product innovation versus a marketing rebrand though, as it appears to be largely based on the integration of existing tools, like Azure Data Factory, Azure Synapse Analytics, and Power BI.

Figure 2: Microsoft Fabric (source: Microsoft)

Microsoft plans on leveraging generative AI to help business users extract insights from data. This includes integrating Copilot into the service so that users can create data pipelines, generate code, build machine learning models, and visualize results using conversational language.

Palantir believes that its platform has the frameworks, infrastructure, and software needed to capitalize on the opportunity provided by LLMs. It is leveraging this opportunity through the introduction of its Artificial Intelligence Platform (AIP). AIP empowers organizations to activate large language models safely and securely. It appears to be something of a coordination layer, connecting users with Foundry services and data. Palantir is focused on rapidly gaining mindshare with AIP, making it difficult for others to enter the market.

Financial Analysis

Somewhat bizarrely, C3.ai felt the need to pre-announce a 1.8% revenue beat. This beat is immaterial and could be considered disappointing given this should be an unprecedented demand environment. In the release, C3.ai stated that the business environment is more active than at any point in the company's history and is accelerating. Despite this, the company is only guiding to 15% revenue growth in the coming financial year. Growth is likely to be weighted to the back half of the year though. Pilots are generally 2 quarters long and as a result, C3.ai expects that it will really begin impacting revenue in Q3 and Q4.

C3.ai closed 43 deals during the quarter, including 19 pilots that were initiated during Q4 and the company's sales pipeline more than doubled YoY. C3.ai changed its customer reporting methodology in the fourth quarter as it felt the previous approach wasn't accurately reflecting the underlying business. Customer engagement increased from 247 to 287 in the fourth quarter, compared to customer count under the previous methodology going from 236 to 244.

The switch to a consumption pricing model was supposed to open C3.ai up to smaller organizations and accelerate customer acquisitions. So far there is limited evidence that this is occurring though. C3.ai counts separate divisions within the one organization as separate customers, so it is not really clear how many actual individual customers the company has. Some recent deals are obviously existing customers moving over to the consumption pricing model though.

C3.ai is targeting non-GAAP profitability by the end of FY2024, although this would likely mean that GAAP operating profit margins would still be below -50%. Margins are poor as the company has an R&D heavy business model and continues to invest aggressively in sales and marketing. At some point the company will need to demonstrate better margins or higher growth though.

Valuation

C3.ai's stock is now trading on similar multiples to best-in-class software companies that have far better growth and profitability profiles. This is all on the back of hype around generative AI, and despite the widely recognized problems with C3.ai's business.

The stock is likely to approach single-digits again at some point in the next 1-2 years as investors are forced to recognize C3.ai for it is. It is obvious where C3.ai's stock is going, the real question is the path it will take to get there. The stock has been moving higher because investors are buying, not because the fundamentals of the company justify the move, but there is no reason that this situation can't continue in the near term.

Figure 3: C3.ai Relative Valuation (source: Created by author using data from Seeking Alpha)

This article was written by

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.