Templeton Dragon Fund: Cautious As Chinese Economy To Lose Momentum Later In 2023

Summary

- The Templeton Dragon Fund invests in Chinese companies for long-term capital appreciation, with a focus on growth companies.

- The fund has underperformed recently, with concerns about China's economic recovery and sustainability of consumer demand.

- The fund's discount to NAV is around 15%, but recent management changes and fee reductions may not be enough to close the gap.

Igor Kutyaev

Templeton Dragon Fund overview

The Templeton Dragon Fund (NYSE:TDF) invests for long-term capital appreciation by having at least 45% of its total assets in equity securities of Chinese companies. It has the flexibility to either invest in companies listed on the exchanges in mainland China, or other exchanges for example Hong Kong, Taiwan or elsewhere. The objective is that they own companies that are expected to benefit from the growth in the Chinese economy.

In theory the flexibility of the fund in terms of different exchanges it can access should increase its ability to add value, but evidence of success is lacking. In recent years they have had a bias towards “growth” companies and sticking to mainland China listed shares. I would expect that to continue, although one should keep an eye on a recent portfolio manager change at TDF.

The fund has a very long history going back to 1994, which helps the since inception performance figures look respectable. Given how portfolio managers can change, not sure we can conclude much from the since inception numbers noted below.

It has been a tough decade of performance for the fund but admittedly the same can be said for the benchmarks it compares itself with. It displays with its own performance record the returns of the MSCI China All Shares Index. You can refer here if you want a broad overview of the stock indices in China.

The fund size is currently approximately $360 million. The expense ratio is listed at 1.37% according to data as at the end of 2022. A very recently announced fee decrease should see this come down by circa 15bps in the near future.

Despite the distribution history showing some sizeable payments, TDF is not one for closed end fund investors looking for a consistent income stream. That should be clear when viewing the performance table above, seeing their 10-year number is only marginally positive.

China reopening growth to fade later in 2023

From November last year financial markets became relieved that China would be pivoting away from their “zero-Covid” policies. Logically, that could unleash plenty of pent-up demand from domestic consumers who had boosted their savings during lockdown. I shall address that thematic shortly, but we also must acknowledge that playing the China reopening trade is still very much vulnerable to global demand.

On that front, since Chinese equities bottomed out in October last year, we have seen plenty more rate hikes from the Fed and economic leading indicators worsening. Recession risks for China’s key global trading partners have been on the rise.

China’s economic data released this month worried economists, particularly form JPMorgan and Barclays who as a result cut their 2023 GDP forecasts. What is concerning is that growth fading may relate both to global and domestic factors. Also, what is concerning for Chinese equities in particular is that getting some sort of policy response to address this is far from certain.

To quote directly from the above article as it relates to demand, “big downside surprises in industrial production, retail sales, real estate investment, and youth employment confirm weakening demand amid deepening property woes,” Barclays wrote.

Yet, with China themselves putting a 5% target on growth earlier in the year, it may not be wise to get hopes up too much for policy stimulus. After all JPMorgan and Barclays, who cut their growth forecasts as just mentioned, still have forecasts of 5.9% and 5.3% respectively.

China pent-up demand in 2023, but for how long?

It did make some sense to be bullish about the pent-up demand potential with China’s re-opening late last year. There were signs in the data that Chinese consumers naturally built up their savings.

Bloomberg

This was a good catalyst to look forward to for those trying to pick the bottom in Chinese equities late last year. Caution is required however in regard to how long any rundown in savings may act as a tailwind.

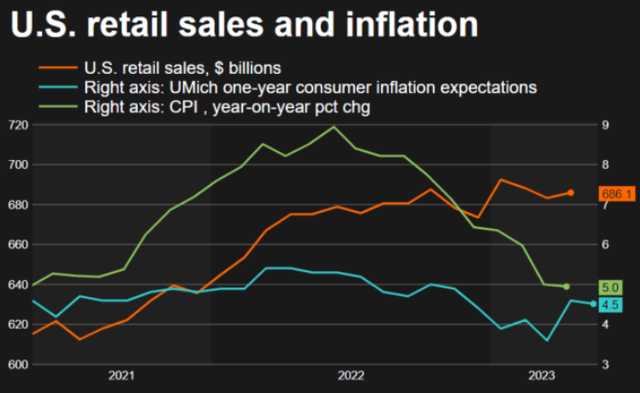

In the US for example, there was a noticeable boost in retail sales when consumers started “living with covid” later in 2021. This positive sentiment continued with retail sales in the beginning of 2022. The trend occurred after a huge spike in their savings rate when covid fears were at their highest and consumers often stuck at home.

For the last 12 months or so, however, the trend in retail sales has flattened right out as we can see below.

Refinitiv Datastream via reuters.com

Obviously, consumers are feeling it from rate hikes and inflation in the US. Part of the story might however also lie with a lack of confidence in where the global economy is headed in the medium term. Given the current global growth outlook it shouldn’t surprise if Chinese consumers similarly tighten their belts later in the year.

Whilst China’s surge in their savings rate in 2022 was clearly pandemic related, we can’t ignore the five-year trend of the Chinese increasing their savings. This could be in part structural with concerns of their aging population a factor.

Are Chinese stocks cheap?

Prospective investors in TDF should pay attention to the “growth” bias the manager tends to have and whether that suits their own investment style and portfolio.

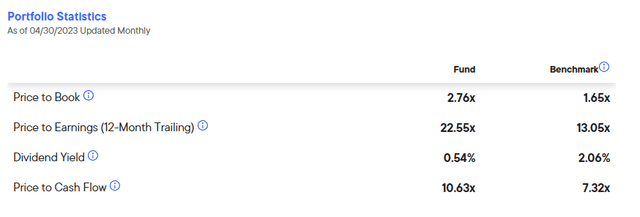

Below is a table of the valuation portfolio statistics as at end of April which does demonstrate the manger is looking for higher growth investments. The trailing P/E of the benchmark appears reasonable value given earnings should recover in the re-opening phase.

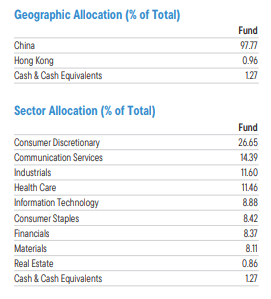

Notably though the Templeton Dragon Fund’s average trailing P/E ratios of stocks held is clearly higher than the benchmark. This gives me some reservations about whether this is the ideal fund to get exposure to a potential bounce back in China’s stock market. That being said, they are overweight consumer discretionary and underweight in the more traditional “value” sectors such as financials & materials which offers some explanation to this.

In terms of stock weights, they also have overweight positions in the likes of Tencent and Alibaba. Whilst these usually trade on higher trailing P/E ratios than the benchmark, they perhaps offer more upside potential. Recently there is increasing commentary about investors being able to get exposure to the AI investing theme via China’s internet giants.

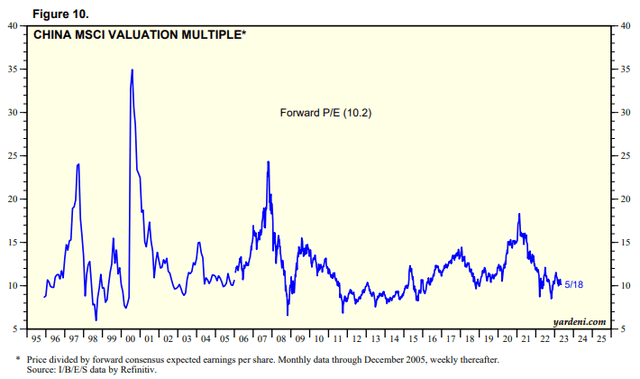

If you prefer to look where Chinese stocks sit in terms of forward P/E ratios here is a very long-term picture.

One of course expects a decent relative discount for various uncertainties that comes with investing in China, and it is evident we get that to some extent here.

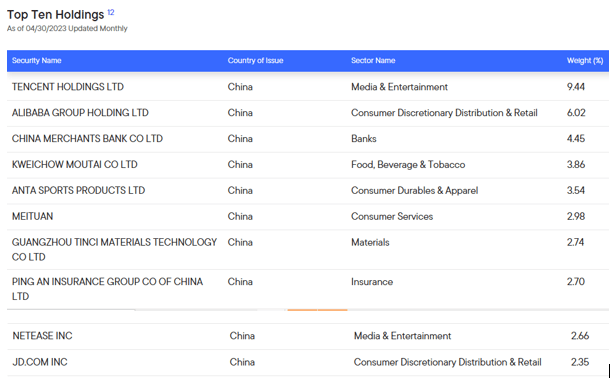

Templeton Dragon Fund holdings and sector exposures

Looking at the fund’s recent top ten holdings and sector exposures also gives some indication of the manager looking for growth. The heavyweights in Tencent and Alibaba feature prominently as they have done for many years now in the Templeton Dragon Fund. In sectors where more traditional “value” stocks often sit in such as financials and materials, TDF tend to have modest exposures.

franklintempleton.com

franklintempleton.com Factsheet as at March 31, 2023

China stock market catalysts, what is next?

As panic set in with Chinese stocks in October last year, everywhere you looked there were negative headlines. In hindsight the catalysts for a bottom to be reached back then ended up simply being that the news flow could hardly get worse!

At the start of November last year, I was sympathetic to the view that Chinese equities could rally. I was discussing another China closed end fund back then and thinking that if all the negative news faded a little then Chinese stocks could do well. I mentioned it wouldn’t be surprising to see China-Taiwan relations take a backseat in the news, that China perhaps ends up re-opening in early 2023, and monetary policy is eased.

A powerful rally did take place from November through to the end of January, but it has then turned bearish. The CSI 300 Index rose approximately 20% in that short time frame, only to see this index correct by 10% since.

I have already discussed above the uncertain sustainability of China’s economic bounce back in 2023. In that context, this market reversal since February is not all that surprising.

Late last year a bottom was made in Chinese stocks in a large part due to extreme bearish sentiment at the time. Six months later I am now beginning to question where the next positive catalysts are going to come from.

Risks of investing in China may come to the forefront again

In the absence of many positive catalysts for Chinese equities in the back half of this year I am not tempted into adding exposure to the region right now.

In comparison to October last year, the negative news flow relating to China has moderated, but that could be a worrying sign for stock market investors. It may not take much to unnerve the market further. The usual reasons to worry about relating to China’s role in geopolitics are always lurking to make one hesitant in trying to capitalize on cheaper valuations there.

Aside from China related issues, the sizeable discount to NAV in the case of the Templeton Dragon Fund is also not of great temptation to me.

Templeton Dragon Fund discount to NAV

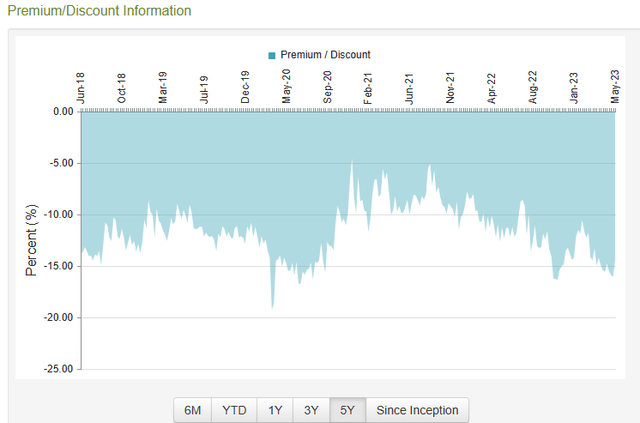

TDF is currently trading at a large discount to NAV of circa 15%, but that seems to be fairly typical for this closed end fund.

I do acknowledge that the discount is around the widest point of the range over the last five years as we can see from the chart above. I wonder, however, if the recent portfolio manager changes and small fee reduction has used up some of their tools already that were expected to help close the discount.

Whilst the fee reduction is welcome, it doesn’t excite me in the context of their performance history and neither does them changing portfolio managers twice in the last few years. Perhaps some of these changes sit well with City of London Investment Management Company, who are the largest shareholder. At times they have been aggressive in trying to get managers close the discount to NAV, but they also can be patient closed end fund investors. Back in 2018, City of London finally reached an agreement with the China Fund (NYSE:CHN) in a long running activism battle to try and close the discount with that fund.

In terms of the discount closing much in this situation it could also be a case of there not being much in the way of catalysts in the near term.

Conclusion

Chinese equities have disappointed since the end of January this year, but I would be cautious about buying here on weakness. The underperformance makes some sense in light of slowing global growth and the potential for the recovery in domestic consumer demand to fade.

Specifically, the Templeton Dragon Fund does not look a particularly compelling to gain exposure to the region anyway. It is difficult to weigh up whether you are getting value for the active management fees. Their historical record spans decades but recently we have had changes in management. They also have not been very active in the past in opportunistically switching between mainland China and other exchanges.

The discount to NAV is still quite wide and recent changes to the portfolio manager and modest fee reduction are likely small positive steps in the right direction. In the absence of many obvious positive catalysts though I would prefer to wait and see if this one continues to weaken further this year for a potential opportunity.

This article was written by

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.