Artificial Intelligence: A 126-Year-Old Case About Bicycles Illustrates Why Rampant Speculation Is Troubling

Summary

- AI optimism has driven significant gains in the technology sector, but the market's behavior suggests a potential speculative bubble.

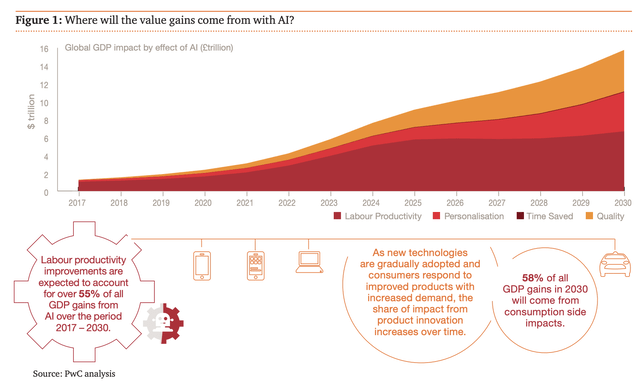

- The potential impact of AI on the global economy is massive, with PwC estimating a $15.7 trillion increase in global GDP by 2030.

- Investors should focus on quality companies with reasonable valuations and significant AI potential, such as Microsoft, Meta Platforms, and Amazon.

- Looking for a helping hand in the market? Members of Crude Value Insights get exclusive ideas and guidance to navigate any climate. Learn More »

Shutthiphong Chandaeng

So far, 2023 is looking to be a fantastic year for investors in the technology sector. Shares in this space have been juiced up for a couple of reasons. But undoubtedly the most significant contributor to the rise has been optimism centered around AI artificial intelligence. With the advent of ChatGPT, investors and the companies that they own shares in have become of the view that a new era for industry is coming. I have no doubt in my mind that there's a lot of opportunity in this space. But at the same time, investors would be wise to tread very cautiously. There will be some companies that benefit massively from AI, but recent action in the market is making this look like a bubble that could come back to bite investors who are hopeful for a brighter future.

The bullish case for AI

The size of the opportunity involving AI depends on who exactly you ask. But pretty much every credible source is of the opinion that it could have a significant positive impact on the global economy. Consider, for instance a report issued by PricewaterhouseCoopers. According to the report, from the beginning of the development of AI solutions through 2017, the positive impact on global GDP was around $2 trillion. By 2030, this number could grow to $15.7 trillion. Of this, about $6.6 trillion will likely come from increased productivity that AI and enables. But the lions share, about $9.1 trillion, will come from consumption side effects.

PwC

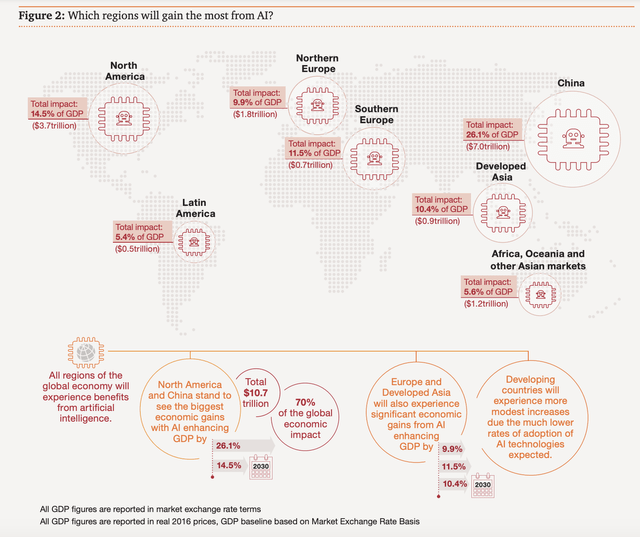

Much of the productivity side of the equation will involve product enhancements, as opposed to new developments. And these should help drive greater consumer demand than what we would otherwise experience. Geographically, PwC believes that North America will benefit by about $3.7 trillion from AI. But the region that should experience the greatest upside will be Asia. Specifically, the total impact for China alone will be around $7 trillion.

PwC

But beware the bubble

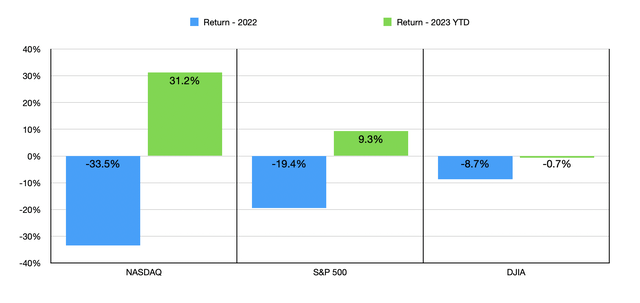

This revelation has investors incredibly excited. If these prognostications come to fruition, then there's no denying that there will be parties that benefit tremendously. As a result of this, the investment community, always trying to get ahead of the curve, has been instrumental in pushing up the Nasdaq, with gains of the Nasdaq coming out to roughly 24.5% so far this year. The Nasdaq-100, which keeps track of the 101 securities from 100 different companies that represent the largest holdings in the index, is up an even more impressive 31.2%. By comparison, the S&P 500 is up a modest but still impressive 9.3%, while the Dow Jones Industrial Average has actually declined by 0.7%.

Author

This significant return disparity was the first thing that made me think we might be experiencing a speculative bubble. But just because one index outperforms another does not mean that we are in bubble territory. In fact, there's one good argument, besides the opportunity that AI offers, that those who are critical of my stance can legitimately point to. And this is that much of the recent increase in price for the Nasdaq may actually just be a recovery from what we saw last year. In 2022, the Nasdaq plunged 33.5%. By comparison, the S&P 500 was down 19.4%, while the Dow Jones Industrial Average saw a decline of only 8.7%. The fact of the matter is that the economy remains incredibly robust and, in an environment where further interest rate increases are unlikely, growth-oriented companies like those that populate the Nasdaq, would make for more appealing opportunities than they would during more painful times.

Author

*With data from here and here.

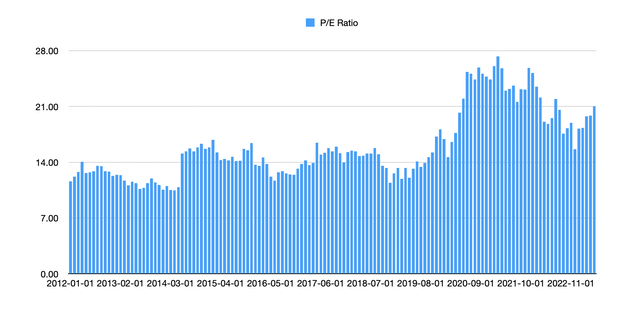

The only problem with this defense is that the roughly $4.48 trillion of additional value added just to the Nasdaq-100 companies alone this year has been instrumental in pushing the price to earnings ratio of the Nasdaq as a whole at rather lofty levels. In the chart above, you can see the price to earnings ratio of the Nasdaq from the beginning of 2012 through May of this year. What we seem to be experiencing with the Nasdaq right now is not a recovery so much as it's a re-inflating of the hefty multiples that were experienced during the COVID-19 pandemic. The price to earnings ratio for the index seems to have been around 10 to 15 prior to the pandemic. And right now, it is a very lofty 21.

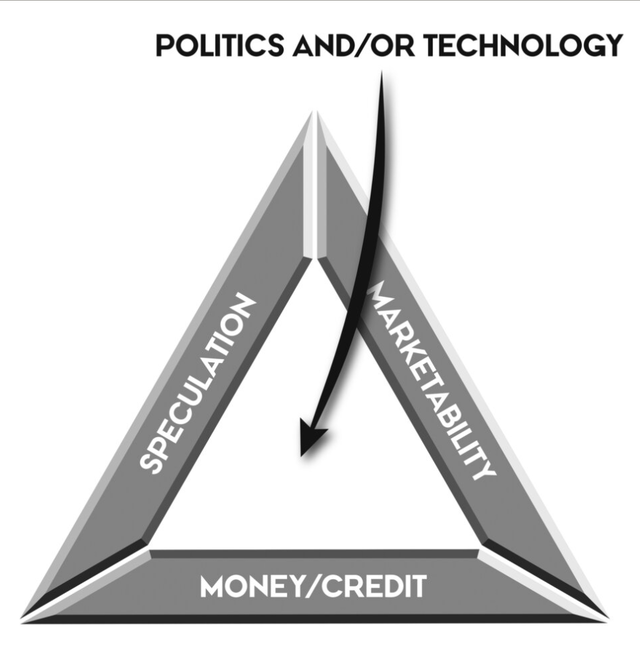

One of the really good books that I read last year is called Boom and Bust by William Quinn and John D. Turner. In that book, one of the topics discussed is what is referred to as the Bubble Triangle. Through their research on bubbles over time, the authors pointed out two primary catalysts for the creation of a bubble. One of these is political. The other is technology. And in order for either of these to create a bubble, you must have three different attributes.

Boom and Bust

The first of these, which the authors refer to as the oxygen for the boom, is marketability. They even state that publicly traded companies are incredibly marketable, more so than most other assets, because they can be easily traded. And in a massive global market, it's easy to find buyers and sellers of securities. The fuel for the bubble is money and credit. Over the past several years, easy money and access to credit have been the name of the game. Admittedly, this picture has gotten a bit worse over the past two years because of inflationary pressures and rising interest rates aimed at combating inflation. However, the prospect that the Federal Reserve may no longer increase interest rates from here and could be planning interest rate cuts beginning next year could definitely improve the outlook when it comes to the money and credit picture. And the third component to the bubble triangle is speculation. I don't think I have to explain that there's now a tremendous amount of speculation regarding AI.

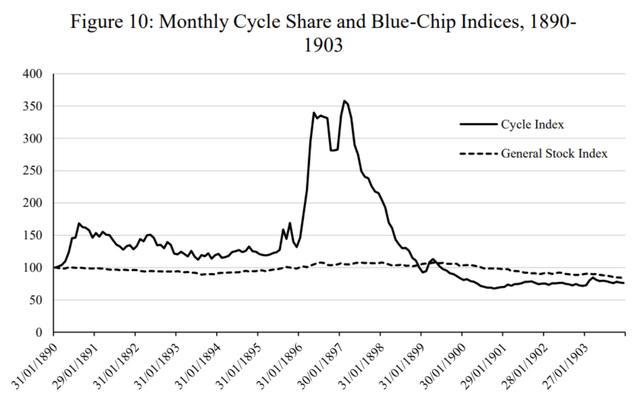

Throughout their book, the authors touch on many different examples of bubbles that ultimately burst. But one of my favorite to touch on, because of how unknown it is to even the general investment community, is the British bicycle mania. Throughout the 1880s and early 1890s, the bicycle industry in Britain grew at a rather steady pace. From 1889 to 1895, for instance, in Birmingham, the number of bicycle manufacturers grew from 72 to 177. Other parts of the country also saw rather significant increases. This growth was driven by multiple factors. But most notably was the introduction of new technologies that made the bike more accessible and easier to use. One of the most notable examples of this is the pneumatic tire that was produced in 1888 that allowed for bikes to offer a much smoother ride than they did previously.

Investor Amnesia and Boom and Bust

Optimism surrounding the bicycle led to a massive inflow of money into the industry. In the first quarter of 1895, 17 publicly-traded companies were founded in Britain that were focused on the bicycle in some capacity. Collectively, their capitalization came out to roughly 357,500 pounds. A little over a year later, in the second quarter of 1896, an impressive 94 bicycle companies were established, with 13.8 million pounds being invested in them combined. From the first quarter of 1895 through the second quarter of 1897, a total of 671 bicycle-related businesses ended up of being established, with total nominal capital infused in them coming out to 43 million pounds. Adjusted for inflation today, that would be about 4.5 billion pounds.

Investor Amnesia and Boom and Bust

As you can imagine, the bubble did not last. By December of 1897, an index that kept track of the value of bicycle companies had fallen 40% compared to what it was nine months earlier. Corporate consolidations and bankruptcies caused a massive decline in the number of bicycle related firms that were on the public market. This is not to say that something good did not come from this. The significant amount of capital that had been invested into the space caused a surge of innovation. In 1890, for instance, there were only 595 bicycle related patents issued in Britain. For 1896 alone, there were a reported 4,269 patents issued.

The reason why I bring this up is to show not only that these kind of speculative upswings are very common, but also to show that there could be some winners that come from this big move into AI. In fact, I would go so far as to argue that there absolutely will be some big winners. But when you look at recent pricing action, it seems almost as though the market is randomly guessing which businesses might succeed and which ones should be invested into.

While researching for this article, I downloaded data for the 100 companies that comprise the Nasdaq-100. And 73 of these reported share price increases so far this year, with an average increase so far of 26%. Some of these are names that probably do make sense to be bullish on. For starters, the biggest winner so far this year is Nvidia (NVDA). As of this writing, its stock is up 165.1% this year, with the company recently joining the $1 trillion club. I'm no expert on semiconductors, so it's not up to me to decide whether or not this particular business makes sense. But I trust that other analysts are correct in saying that the company stands to benefit tremendously from AI.

The second biggest mover so far this year has been Facebook parent Meta Platforms (META). Now this is a company I do know and understand. After seeing the stock drop about 72% last year, I picked up a good chunk of it for my own portfolio. I nearly doubled my money on it before selling out earlier this year. Though to be honest, I wish I had held on a bit longer. So far, the stock is up 112% in 2023. There definitely is an AI angle when it comes to world's largest social network. Plus the stock already was cheap heading into the year because of the fact that the market completely misunderstood the business when it pushed the stock lower last year. The third largest mover during this time was Tesla (TSLA), which was also pushed down significantly last year as investors in the company and market watchers became concerned about the ability of Elon Musk to properly guide the company while also handling Twitter and other operations.

I could go on down the list and point out to specific examples of why any of these companies deserved to see an increase, whether it was connected to AI or not. But when you dig in, you do start to see some more questionable movers. One that really stuck out to me was Apple (AAPL). I have been a devout Apple user since buying my first laptop back in 2008. I remain a loyal customer of the company to this day. But I noticed that the stock is up 42% this year. This is in spite of the fact that operating cash flow in the first six months of this fiscal year is down 16.6% compared to what it was the same time last year. Revenue has fallen 4.2%, while every major revenue category for the company, with the exception of those related to the iPad and the services the company sells, have fallen year over year. This is not to say that the business cannot benefit from AI. By incorporating AI solutions into its products and services, Apple can make its offerings more appealing than they have been in the past. But given the very nature of the company, any sort of AI adoption will likely either involve cutting down operational costs or providing only incremental improvements to its devices.

Another head scratcher to me is Palantir Technologies (PLTR). Although not a member of the Nasdaq-100, the company has skyrocketed this year, with shares up 130.2% as investors digest management's comments regarding the role that AI will play into the company moving forward. The company has even launched its own AI offering that it calls AIP. For businesses, it offers customers the ability to use large language models or other AI systems in their own internal networks. It offers high-quality real-time visualization of all assets within an organization, and it empowers customers to set the ground rules of who can see what data within an organization. They also have similar offerings for the defense sector.

This is great to see, and it's admittedly still early in the AI race. But this also is the same company that saw its share price plunge nearly 65% last year after significantly overpromising and underdelivering when it came to growth prospects. And while the company has increased guidance for the current fiscal year, shares of the business we're already trading at a forward price to adjusted operating cash flow multiple of 39.5 and at a forward EV to EBITDA multiple of 34.2 when I last wrote about the firm in early May of this year. Since then, the stock has rocketed higher by 59.5%, with most of that upside attributable to optimism around AI.

Takeaway

In the long run, I'm a big believer that AI will have a lot of value for companies, investors, and consumers alike. I believe that there will be some companies that do incredibly well during this time. But the recent actions that I have seen in the market, both with some individual firms and with the market more broadly, makes me concerned about a speculative bubble. This also happens to be occurring at a time when the broader economy might see a pullback because of the impact that Federal Reserve policies have had and will have on combating inflation. And in that kind of environment, you don't want to be invested in expensive, speculative businesses. In terms of how I think investors should approach this in general, I would urge caution. Trying to pick the winners is difficult. But for those who do make investments based on AI specifically, I would argue that the quality companies that are trading at reasonable levels and that have significant potential for AI, but that don't need it in order to succeed, will be the best ones to focus on. Examples of this would include firms such as Microsoft (MSFT), Meta Platforms, Amazon (AMZN), and more.

Crude Value Insights offers you an investing service and community focused on oil and natural gas. We focus on cash flow and the companies that generate it, leading to value and growth prospects with real potential.

Subscribers get to use a 50+ stock model account, in-depth cash flow analyses of E&P firms, and live chat discussion of the sector.

Sign up today for your two-week free trial and get a new lease on oil & gas!

This article was written by

Daniel is an avid and active professional investor. He runs Crude Value Insights, a value-oriented newsletter aimed at analyzing the cash flows and assessing the value of companies in the oil and gas space. His primary focus is on finding businesses that are trading at a significant discount to their intrinsic value by employing a combination of Benjamin Graham's investment philosophy and a contrarian approach to the market and the securities therein.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.