Yum! Brands: Sumptuous Fundamentals Giving Hearty Returns But Overvalued

Summary

- Yum! Brands, Inc. has demonstrated solid market positioning and operational efficiency, sustaining its expansion despite inflationary challenges.

- The company's financial positioning remains sound, with stable cash inflows supporting operating capacity and capital returns.

- Investment returns have always been high and attractive.

- However, the current stock price is high for its fundamentals, limiting its upside potential, and the recommendation is to hold.

tupungato/iStock Editorial via Getty Images

In the past year, inflation has strained the finances of millions of households and businesses. The consumer discretionary sector was one of the first to feel its impact. And QSRs like Yum! Brands, Inc. (NYSE: YUM) was no exception. Nevertheless, its pricing strategy and operational efficiency helped sustain its expansion. Its well-balanced revenues and margins showed its solid market positioning. Now that inflation has relaxed, YUM may see increased flexibility in its volume and pricing. But it must not be too complacent, given the elevated interest rates. Its financial positioning remains sound. But its high borrowing levels may increase its risk exposure. Despite this, its stable cash inflows sustain its operating capacity and capital returns. Dividends remain well-covered with decent yields. Investment returns are enticing, given the consistency between company earnings and stock price movements. Yet, the current price is quite high for its fundamentals, limiting its upside potential.

Company Performance

It’s been quite a while since I first covered Yum! Brands, Inc. Since then, it has remained on my watchlist. Its stellar performance and financial positioning show it can sustain itself amidst market volatility. Its strategic operations show it can stabilize growth and viability to consistently generate returns. Unsurprisingly, the company started the year with impeccable results.

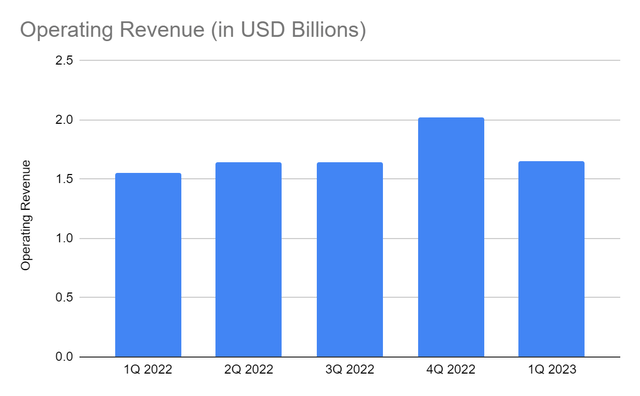

In 1Q 2023, the operating revenue reached $1.65 billion, a 6.45% year-over-year increase. It may only be a single-digit increase, but we must account for its complete exit from Russia. Also, inflationary headwinds stayed challenging for the company. Thankfully, it sustained its revenue growth amidst a rugged market landscape. The demand for its well-established brands was evident as its owned and franchise partners saw higher spending on its products. If we exclude the impact of its withdrawal from Russia, revenue growth would have been 13%. Its solid performance was primarily driven by its same-store sales increase. There were various factors that drove its growth.

Operating Revenue (MarketWatch)

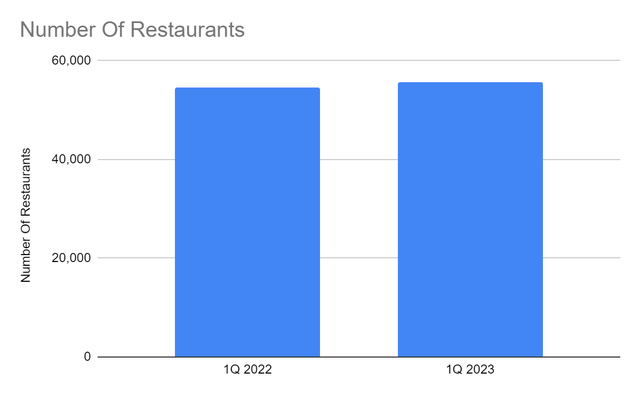

First, the company kept expanding amidst market headwinds. As of 1Q 2023, it had 55,683 restaurants versus 54,580 in 1Q 2022. This move was still timely and relevant as QSR spending rose by 2.2% at the start of 2023. Its brand popularity was helpful to maintain its solid customer base amidst the fierce competition. In fact, YUM’s market standing remained solid as three of its restaurants were part of the top ten fast food restaurants by brand value. KFC placed third, while Pizza Hut placed sixth, and Taco Bell placed tenth. It was no wonder YUM attracted and catered to more customers as its market presence increased.

Number Of Restaurants (YUM 1Q)

Second, its business model worked to its advantage. It’s true that franchises can be risky in a volatile market. Higher revenues mean higher franchise fees, and vice versa. The same may apply to the company, given the elevated prices and persistent recession fears. Even so, it can be helpful for YUM since it has already established its brands. Aside from expansion to increase market presence, it also capitalizes on brand loyalty and popularity. With that, its franchised restaurants may continue generating revenues. Additionally, having franchisees means having secure revenue streams. These are easier to manage without having to burn much cash and incur high costs to build them. The direct impact of inflation will be directed on franchise fees, not on costs and expenses. And by the looks of it, the company stays fruitful since franchise revenues and contributions rose by 8%. Also, we must understand that its business model is a combination of franchisees and company-owned restaurants. As such, it relies both on itself and the franchisees.

Third, its pricing strategy helped maintain a solid customer base. Despite the elevated prices, inflation has already relaxed in 1Q 2023, landing at 5%. With lower inflation, it became easier for the company to adjust its pricing strategy to maintain its production and sales volume. Also, lower inflation meant higher confidence, leading to higher spending on consumer discretionaries like restaurants. It also became more straightforward to increase its customer reach. Digital transformation allows virtual transactions. Online apps and third party food delivery services became a staple for many as hybrid work became prevalent. It was consistent with the increased food deliveries versus cooking at home.

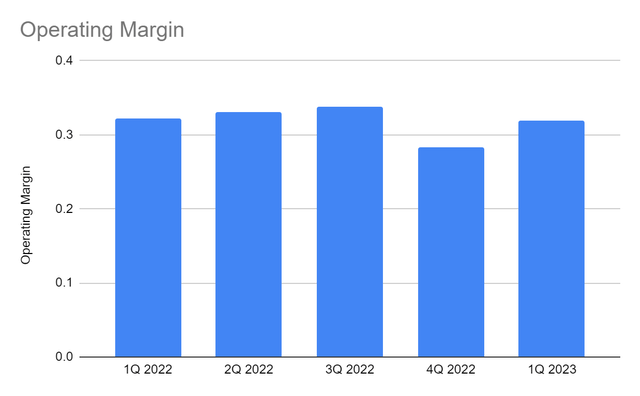

But what made Yum! Brands, Inc. solid was its operational efficiency. The year-over-year increase in operating costs and expenses remained relatively flatter. Also, the operating leverage of the company increased from 24% to 25%. Indeed, the percentage of fixed costs to the total costs increased. It showed better management of variable costs, which was suitable in a volatile economy. It also indicates a higher business certainty with managing its raw materials and other inventories. With that, the operating margin remained stable at 32%. The actual operating income increased from $499 million to $527 million. The increase in revenues offset the increase in costs and expenses. YUM stayed viable and derived more returns while expanding.

Operating Margin (MarketWatch)

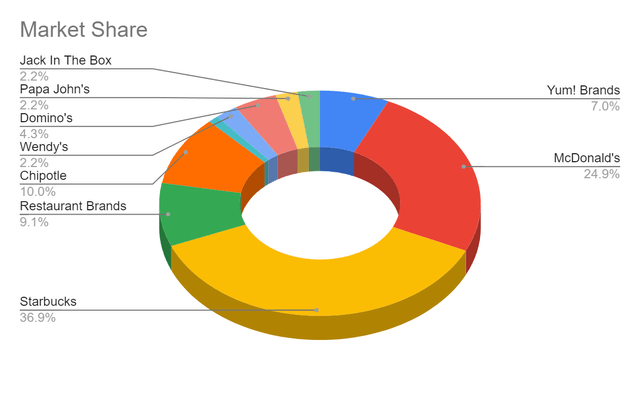

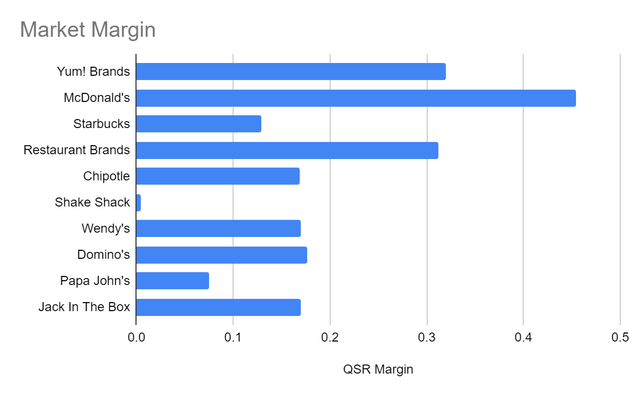

With regard to its peers, Yum! remains in a secure market positioning. Market share may not be accurate since we will only focus on its close peers. Its market share reached 7%, flat from 1Q 2022. It seemed to be underperforming since its revenue growth was lower than the peer average of 14%. Yet, it was more efficient than most of its peers. Its operating margin ranked second after McDonald’s (MCD) with 45%. It was higher than the peer average of 20%. Also, the company had one of the best variable cost management. Its operating leverage also ranked second from Restaurant Brands (QSR) with 38%. But it was way higher than the peer average of 17%.

This year, Yum! may see similar challenges as the overall consumer spending remains lower than in 2022. It must also watch out for the potential recession, which may affect its performance. But with the improvement in inflation, the company may manage its operations better. There are opportunities it can seize as it expands, given the current changes in the QSR market. We will discuss more of these in the following section.

How Yum! Brands, Inc. May Stay Secure This Year

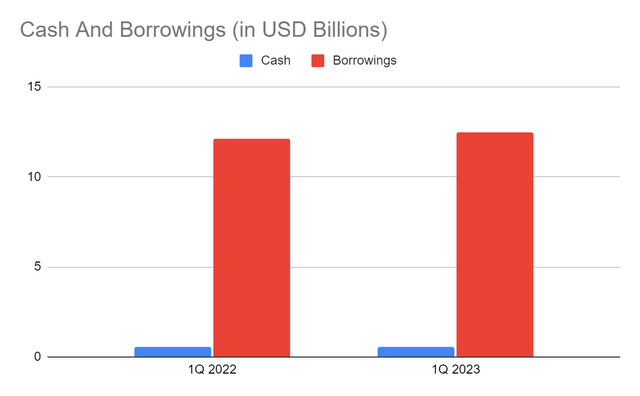

Yum! Brands, Inc. may have stayed solid at the start of the year. But it must not be too complacent, given the interest rate hikes. It has a heavy reliance on borrowings, which are way higher than the total assets. With that, higher rates may lead to higher borrowing costs or interest expenses. Also, it may further impact the liquidity of the company since it already has a negative book value. The consolation is that interest rate hikes have become flatter recently.

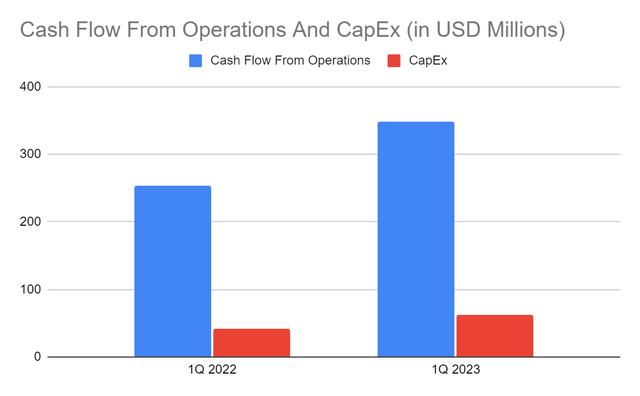

Moreover, only 3% of borrowings have current maturities. Its cash levels are still stable and enough to cover its current borrowings. The good thing is that the company earns more than enough to cover its maturing borrowings. As a result, it does not have to burn cash to pay borrowings. For instance, its EBITDA of $552 million in 1Q 2023 was enough to cover current borrowings of $398 million. The difference is also adequate to cover capital returns. We can confirm it in the Cash Flow Statement, given the Cash Flow From Operations of $349 million versus CapEx of $62 million. It was impressive since YUM paid over $100 million accounts payable. Most importantly, it led to an FCF of $287 million or an FCF/Sales Ratio of 17%, showing that YUM turned a substantial portion of revenues into cash. The financial positioning remains decent, so the company maintains the balance between viability and sustainability.

Cash And Equivalents And Borrowings (YUM 1Q)

Cash Flow From Operations And CapEx (YUM 1Q)

Other opportunities are evident in the market. Inflation is now 4.9%, a 46% difference from the 2022 peak. If it continues, consumer and borrower confidence may increase. Yum! may have better pricing flexibility to attract more customers and revenue. It is logical and consistent with studies estimating global QSRs will have a market value of over $900 billion in 2027. In the US, QSR spending may increase consistently with Americans spending $1,200 on average. Even better, it can stabilize costs and expenses better to generate adequate returns.

Stock Price Assessment

The stock price of Yum! Brands, Inc. has increased substantially over the years. There were corrections and pullbacks in 2020 and 2022, but the uptrend was prominent. At $131.51, it is 12% higher than last year’s value. It is also impressive as it keeps increasing from the stock price in my previous coverage. However, it does not seem to be a good entry point. The stock price appears quite high for its fundamentals. Despite this, the PE Ratio of 30.54x exudes optimism, given the NASDAQ estimated EPS of $5.05 that gives a target price of $154.22. Meanwhile, the EV/EBITDA Model shows that the stock price is still fairly valued, but risks are quite evident. It gives a target price of ($48.16 EV - $11.92 Net Debt) / 280,000,000 shares = $129.43.

On a lighter note, Yum! is a secure dividend stock, given its consistently increasing payments. Its yields of 1.89% are decent versus the S&P 500 average of 1.55%. These are also well-covered, given the Dividend Payout Ratio of 55%. Most importantly, investment returns are exciting. We can confirm it using the cumulative EPS and average stock price increases since 2019. The cumulative EPS of $17.91 and the stock price gains of $27.96 give returns of 156%. Given this, the $1 increase in EPS gives a $1.56 increase in the stock price. To assess the stock price better, we will use the DCF Model.

FCFF $1,503,720,000

Cash $555,000,000

Outstanding Borrowings $398,000.000

Perpetual Growth Rate 4.8%

WACC 9.2% Common Shares Outstanding $280,000,000

Stock Price $131.51

Derived Value $121.74

The derived value adheres to the supposition of a potential undervaluation. There may be a 7% downside in the next 12-18 months. Despite this, we can see that my target price has increased by 13% from my previous coverage. It confirms the stronger fundamentals of YUM. The only problem is that the stock price is still higher than the intrinsic value of the company.

Bottom line

Yum! Brands, Inc. is an excellent company with well-balanced growth and viability. Its solid market standing allows it to increase its operating capacity while generating returns. Also, it has sound fundamentals despite having high borrowing levels. Its adequate earnings cover its maturing borrowings to avoid burning cash. Cash levels are also stable, showing decent liquidity. Moreover, it has impressive investment returns with its consistent dividend payments and share repurchases. Stock price increases have been reasonable relative to company earnings. The only thing that hinders me is the current stock price. YUM is an exciting stock, but one may have to wait for a better entry point before making a position. The recommendation, for now, is that Yum! Brands, Inc. stock is a hold.

This article was written by

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.