DocuSign: Not Buying Despite Attractive Valuation

Summary

- DocuSign has shown solid financial performance with a 33% CAGR in revenue, but long-term estimates suggest a deceleration in growth.

- The stock is attractively valued with a potential upside, but risks include competition from tech giants and potential security issues.

- Given the potential risks, the author gives DocuSign a neutral rating and does not recommend investing in the stock.

Userba011d64_201/iStock via Getty Images

Investment thesis

DocuSign (NASDAQ:DOCU) delivered solid financial performance over several years with a stellar above 30% topline growth. Profitability metrics have been also expanding significantly during the past eight years horizon. On the other hand, long-term consensus estimates suggest that the topline CAGR will decelerate below double digits over the next five years. Valuation looks attractive but if compare upside potential to risks, I believe DOCU stock is not worth investing.

Company information

DocuSign is a software company mostly known for its electronic signature offerings to customers, where the company is recognized as the global leader. Besides e-signatures, the company's products address broader agreement workflows and digital transformation. DOCU's software is cloud-powered and the pricing comes in tiers ranging from $10 per user per month for the “personal” tier, $25 per user per month for “standard,” and $40 per user per month for “business pro.” According to the company's latest 10-K report, DocuSign's platform is used by over 1.3 million customers and more than a billion users in over 180 countries. The company estimates its total addressable market to be approximately $50 billion.

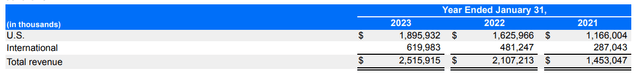

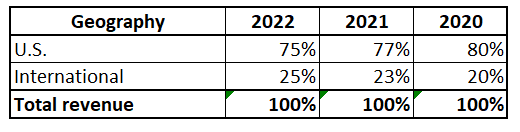

The company's fiscal year ends January 31 and operates in one segment. DOCU disaggregates its sales by geographic area, with the U.S. representing a vast portion. Though, over the last three years we can see a trend of International sales gaining more share out of total.

Author's calculations

Financials

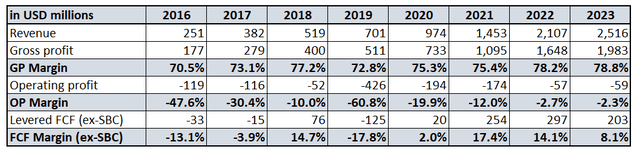

DocuSign went public in April 2018; therefore, we have only financials available for the last eight years for my long-term analysis. The company's revenue grew at a stellar 33% CAGR over time. Gross margin expanded from 70% to 90%. Operating profit was still negative last fiscal year, but the operating margin improved significantly as the business scaled. DOCU generates positive free cash flow [FCF] even with deducting stock-based compensation [SBC].

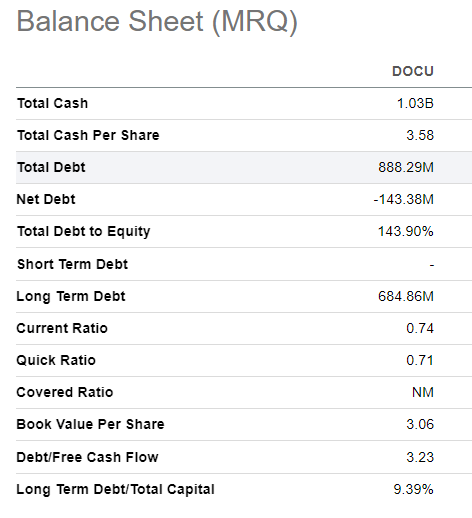

The company's balance sheet looks sound with a net cash position, though liquidity ratios are below one. The company's debt-to-equity [D/E] ratio might seem high, but DOCU is in a modest net cash position, so I do not consider a substantial D/E ratio to mean a high risk for the business. Moreover, the company is not burning cash, so I expect the balance sheet to improve as the business scales up.

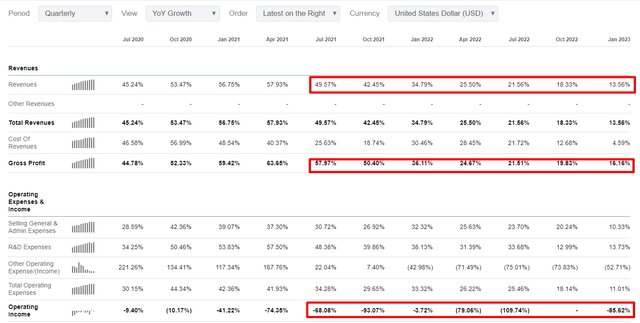

Seeking Alpha

I don't like that revenue has been decelerating consistently during seven straight quarters. Operating profit also deteriorated during the same period. On the other hand, the revenue cost grew slower than the top line, meaning that the gross margin expanded.

DOCU is expected to announce the upcoming quarter's earnings on June 8. Consensus estimates expect quarterly revenue to be at approximately $642 million, which is lower sequentially. It means that YoY growth is expected at about 9%, meaning the trend of revenue deceleration will continue.

Overall, I believe that DOCU is in a solid financial position. Still, we have to admit that revenue growth demonstrated massive deceleration during several quarters and is expected to decelerate even further.

Valuation

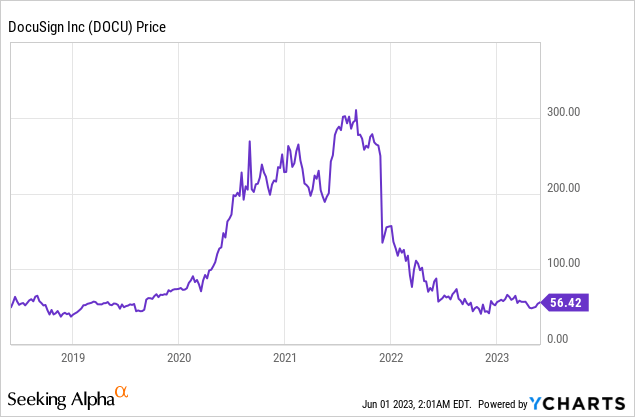

Since all-time highs were reached during the summer of 2021, DOCU stock price crashed almost sixfold.

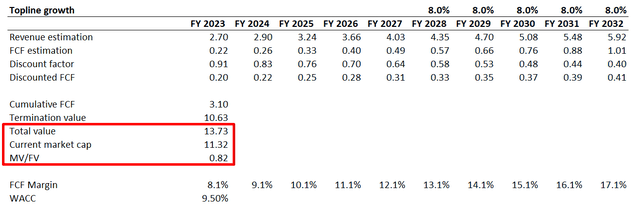

Given the company's growth prospects, I want to assess whether such a massive selloff has been fair. The best tool to value a growth company like DOCU is the approach called discounted cash flow [DCF]. I use 9.5% for the discount rate, which is an estimation from valueinvesting.io slightly rounded up. Earnings consensus estimates project about 8% revenue CAGR up to FY 2027, and for my DCF I expand this growth rate for the whole next decade. I use 8.1% for FY 2023 FCF margin, which DOCU demonstrated in FY 2022 if we deduct SBC. I expect the FCF margin to expand by one percentage point yearly as the company's business scales up.

Incorporating all the above assumptions into the DCF template returns me a fair market cap of about $13.7 billion, about 20% higher than the current market cap. Therefore, I think the current stock price is attractive, especially given the assumptions, which I consider very conservative.

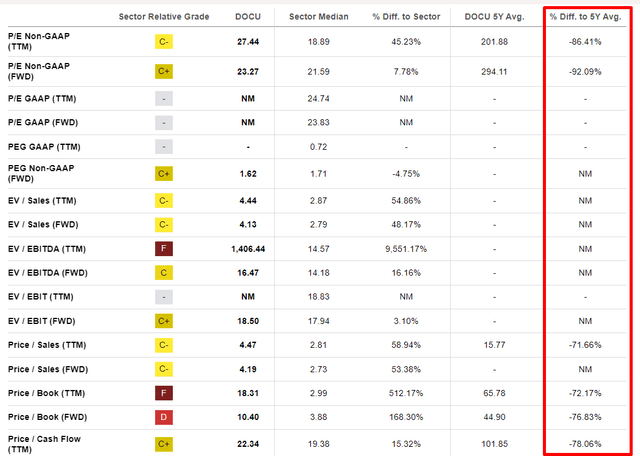

Seeking Alpha Quant valuation rating of DOCU is relatively low due to very high multiples if compared to the sector median. While peer comparison of valuation ratios is sound for value companies, I do not use it for growth companies. Instead, I compare it to 5-year averages, and DOCU is trading significantly cheaper than historical metrics.

To summarize this part, the stock is attractively valued with a substantial upside. Potential investors should be aware that the level of uncertainty regarding underlying assumptions is very high. We also should assess the upside potential compared to the risks of investing in DOCU stock.

Risks to consider

As a growth company, DOCU's share price heavily depends on future earnings projections. In case the company demonstrates signs of decelerating revenue or fails to improve FCF margins, as I expect, it will adversely affect the stock price. On the other hand, my assumptions are relatively conservative, especially given the massive total addressable market for the company.

Signing documents is a solemn task, and if DocuSign's platform or its competitors are compromised for fake signatures or something like that, it will severely harm the overall electronic signature solutions' reputation. Fake signatures or other types of manipulations with documents might lead to the financial loss of clients, and therefore there is a risk of potential litigation and fines.

There is also a high risk that electronic signatures can become just a feature integrated into technological behemoth products. Adobe (ADBE) allows users to sign documents within the Acrobat software. Apple's (AAPL) iOS also allows you to sign documents from your iPhone without any additional software. Giants like Microsoft (MSFT) or Google (GOOG) (GOOGL) also have more than enough resources to introduce e-signature features to their office productivity solutions. I understand that DocuSign's offerings are beyond just e-signatures, but all other features can also be relatively easily introduced by technological giants, in my opinion. I see this as a substantial long-term risk for DOCU's business.

Bottom line

I consider potential risks to outweigh the upside potential. Over the long term, there is a high risk that technological giants will introduce e-signature solutions to their offerings, making DocuSign an unnecessary additional cost to customers. Over the short term, I might be wrong, but as a long-term investor, I prefer to look at secular trends and risks. Therefore, I give DOCU stock a neutral rating.

This article was written by

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.