SoFi Stock: The Momentum May Not Last Long

Summary

- SoFi stock has been on a tear this month after disappointing investors for the most part since 2021.

- The resumption of student loan repayments is seen as a growth catalyst, but a closer look at relevant macroeconomic data suggests investors should curb their enthusiasm.

- SoFi's diversification efforts are commendable, but the company is missing an all-important earnings catalyst.

- Looking for a helping hand in the market? Members of Beat Billions get exclusive ideas and guidance to navigate any climate. Learn More »

Justin Sullivan

SoFi Technologies Inc (NASDAQ:SOFI), a prominent digital financial services company, has emerged as a leading online platform for personal finance since its establishment in 2011. Catering to younger, high-income customers, SoFi offers a diverse range of products and services, including student and auto loan refinancing, mortgages, personal loans, credit cards, investment products, and banking services. Divided into three segments - Lending, Technology Platform, and Financial Services - SoFi primarily generates revenue from its lending activities. Recent developments in the financial services sector landscape, including rising interest rates, have brought significant challenges for the company.

After hitting a high of around $23 in 2021, SoFi stock plummeted to $4.40 last December. So far this year, SOFI stock is up 54%, and we saw a 30% increase in the company's market value in the last five trading days aided by the improving sentiment toward SoFi amid the expected end of the pause on the repayments of federal student loans. As a financial services company with a strong student debt refinancing business, it seems almost natural for SoFi to benefit from such a decision. That being said, a closer look at the prospects for SoFi suggests investors should curb their enthusiasm for the time being.

Growth Catalyst: Student Loan Refinancing Potential

In light of a tentative agreement to lift the debt ceiling and avoid a catastrophic default, SoFi has witnessed a surge in its stock price. The agreement brings positive news for the banking sector and the economy at large, with one provision proving particularly advantageous for SoFi. The agreement stipulates the end of the pause in student loan repayments, which has been in effect since early 2020. Loan repayments might start as early as August.

Initially established by President Trump and subsequently extended by President Biden, the payment pause aimed to provide relief to borrowers during challenging economic circumstances. President Trump used his executive authority to initiate the payment pause for all government-held federal student loans in March 2020, a move that Congress later codified through the CARES Act. Originally intended to last for six months, the relief was extended multiple times under the HEROES Act of 2003. This act empowers the Education Department to modify federal student loan programs in response to national emergencies. President Biden's recent extension of the payment pause was prompted by legal challenges to his proposed student loan forgiveness plan, which could potentially eliminate up to $20,000 in federal student loan debt for qualifying borrowers. A federal court issued a nationwide injunction, blocking the program just a month after its launch. The Supreme Court is currently considering the case, with an opinion expected in the coming months.

SoFi Technologies also filed a lawsuit against the Biden administration, arguing that there is no legal authority to continue the student loan forbearance. Unlike federal loans, private student loans were not eligible for the pandemic-related forbearance program or the proposed loan forgiveness. The company contends that the eighth extension of the payment pause exceeds the authority granted under the HEROES Act and did not follow the proper "notice-and-comment" procedures. SoFi projects potential losses of $30 million if the pause were to continue through August. SoFi's lawsuit demands the overturning of the pause and proposes that borrowers ineligible for loan forgiveness should be required to resume payments. The Supreme Court is anticipated to rule against the Biden administration's forgiveness program, which would likely result in the termination of the forbearance within 60 days. If SoFi succeeds in its lawsuit, the Biden administration may be unable to extend the pause further, leading to an earlier end to the payment pause than originally planned.

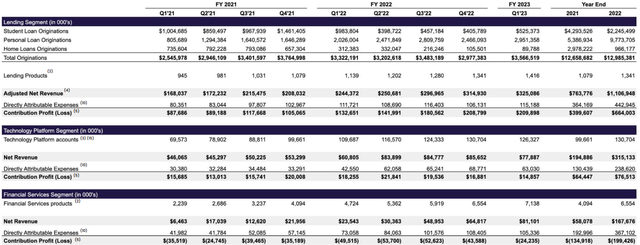

While the pause did not impact private student loans, SoFi provides refinancing services for federal student loans and experienced a significant impact from the student loan payment pause. The company claims to have incurred a loss of $200 million during the repayment freeze, leading to a collapse in its student-loan origination business. For the first quarter of this year, SoFi reported $525 million in student loan volume, a sharp decline from the $2.4 billion recorded in the fourth quarter of 2019, just before the onset of the pandemic. However, as the resumption of student loan payments draws near, SoFi expects a revival in its business, as student loan refinancing represents a substantial portion of its operations.

Exhibit 1: SoFi segment financials

Earnings presentation

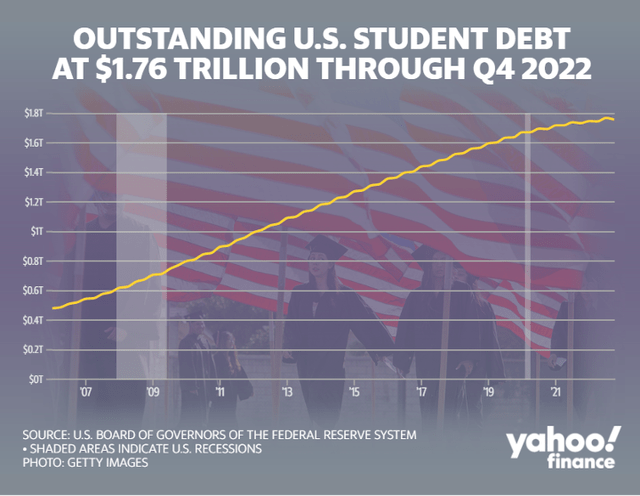

The imminent restart of student loan payments is poised to catalyze growth for SoFi. The outstanding student loan debt in the United States, amounting to a staggering $1.7 trillion, presents a vast potential for refinancing. With a customer base of 5.66 million members, SoFi is well-positioned to capitalize on the opportunities to cross-sell student loan products in the upcoming quarters. Historically, student loan refinancing has been SoFi's primary focus, but the payment pause significantly impacted this business, forcing the company to look for new revenue streams. However, as payments are set to resume, SoFi envisions substantial growth in this domain.

Exhibit 2: Outstanding U.S. student debt as of 2022

Yahoo Finance

The resumption of government student loan repayments, following over three years of suspension, presents a favorable landscape for SoFi to revive and expand its student loan refinancing business. The company's legal actions against the government shed light on the detrimental impact of the pause on its refinancing operations. While the debt-ceiling agreement reinstates government student loan repayments, it does not address President Biden's student loan forgiveness plan, which is awaiting a Supreme Court ruling expected by the end of June. Nonetheless, SoFi remains focused on the opportunities presented by the resumption of payments, aiming to thrive in the student loan refinancing market.

Most Borrowers Are Unlikely to Qualify for SoFi Services

Although the end of the repayment pause might be near, SoFi has been subject to criticism and skepticism. The Education Department questioned the motives behind SoFi's lawsuit stating that:

This lawsuit is an attempt by a multi-billion-dollar company to prioritize its profits over the financial well-being of 45 million borrowers, who may face significant harm as they are forced back into repayment. The payment pause is within legal bounds, as is our intention to provide one-time debt relief to the most vulnerable borrowers who are at high risk of delinquency and default upon resuming payments.

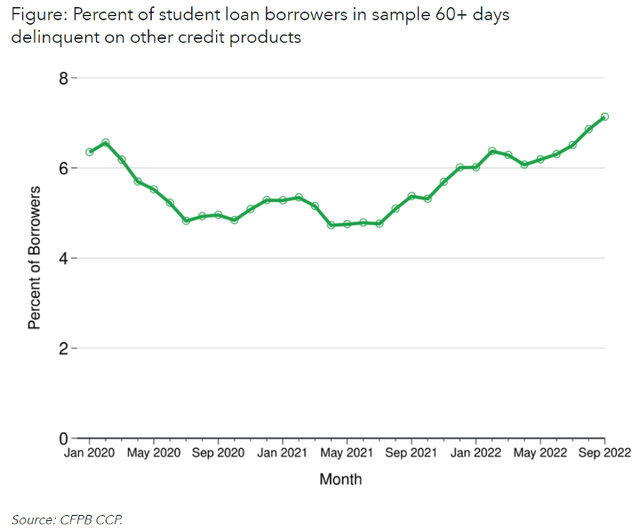

Several research studies prove these points. For example, research from the Consumer Financial Protection Bureau shows that as of September 2022, 7.1% of student loan borrowers were behind on their other debts, an increase from 6.2% before the pandemic. This data, along with surveys and credit bureau information, provides insight into the number of borrowers who will face hardship when payments restart.

Exhibit 3: Percent of student loan borrowers who are behind other debt repayments

Consumer Financial Protection Bureau

At the end of 2019, approximately 17% of federally managed student loans in repayment status were delinquent, representing around 3.31 million borrowers with payments past due for more than 30 days. A substantial portion of these borrowers is expected to continue facing financial difficulties when repayments resume in 2023. Additionally, among the 2.7 million borrowers whose loans were in forbearance status at the beginning of 2020, many may struggle with repayment due to medical or financial challenges.

According to the findings of a 2022 New York Fed Survey of Consumer Expectations, borrowers who had paused student loan payments predicted a 16.1% risk of delinquency if payments were to resume in a month. Additionally, falling behind on federal student loans can trigger various financial consequences, as revealed by research conducted by The Pew Charitable Trusts. More than 80% of borrowers who experienced default reported facing additional repercussions. The most common impact was a decline in their credit score (62%), followed by collection fees (47%) and loss of eligibility for future federal financial aid (37%). Other consequences included wage garnishment, suspension of professional licenses, and offsets of Social Security or tax refunds.

These financial consequences, particularly low credit scores, can make it more challenging for borrowers to obtain other types of credit that are crucial to their financial well-being. Pew Research, which surveyed 1,609 respondents who had defaulted on a federal student loan, highlights these wide-ranging effects of default on borrowers' lives.

Advocates argue that SoFi's lawsuit is driven by a profit-oriented agenda, prioritizing corporate interests over the well-being of borrowers. They point out that most borrowers benefiting from the payment pause wouldn't qualify for SoFi's services due to the credit checks required by private lenders.

Further, consumer optimism regarding the labor market has waned, as indicated by a recent report from Reuters. The proportion of individuals perceiving jobs as "plentiful" has reached its lowest level since April 2021, while the percentage of those perceiving jobs as "hard to get" has risen to a six-month high. This shift in sentiment is reflected in the survey's labor market differential, a measure derived from respondents' perspectives on job availability. The labor market differential fell to 31, its lowest point since April 2021, down from 36.9 in April. This decline suggests a loosening labor market, aligning with the correlation to the unemployment rate reported by the U.S. Labor Department.

Jeffrey Roach, the chief economist at LPL Financial in North Carolina, warns of a slowdown in job growth cautioning that the new job report may unveil emerging vulnerabilities in the labor market. The evolving dynamics in consumer confidence and the labor market signify a need for cautious observation, as signs of cracks in the employment landscape may begin to surface, potentially impacting the loan repayment capacity of Americans.

Overall, the expected end of the student loan repayment pause may not benefit SoFi as initially predicted due to the waning consumer confidence in the economy and the ongoing credit repayment difficulties that will be faced by SoFi's target customer cohort.

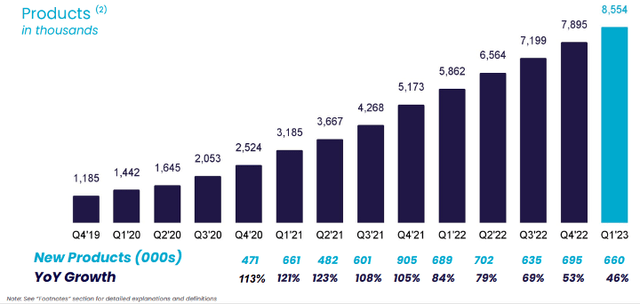

The Expansion Beyond Student Loans and Profitability

SoFi has been gradually expanding its business in recent years, venturing into various revenue streams to reduce reliance on a single product. While a favorable Supreme Court decision would be beneficial, the current interest rate environment may not immediately drive a surge in SoFi's business. Higher interest rates have diminished the advantage of SoFi's refinancing rates compared to the fixed rates of Federal Student Loans. Despite this, the company has experienced rapid growth in its non-student loan revenue and overall business. However, it is worth noting that SoFi has not yet achieved profitability. The company has projected to reach GAAP profitability in 2023, which could have a significant positive impact on its stock performance. Notably, in the first quarter, SoFi added 660,000 new products, bringing the total to 8.6 million, marking a 46% year-over-year increase.

Exhibit 4: SoFi products (thousands)

Earnings presentation

Additionally, on April 3, SoFi announced the acquisition of Wyndham Capital Mortgage, a prominent fintech mortgage lender, in an all-cash transaction. With this acquisition, SoFi aims to expand its suite of mortgage products, improve unit economics, and establish ownership of an intelligent and scalable platform that sets industry standards for a fully digital mortgage experience. This approach will reduce SoFi's reliance on third-party partners and processes in the future. Over the past two decades, Wyndham Capital has garnered a 98% satisfaction rating while assisting over 100,000 borrowers. SoFi's acquisition of Wyndham Capital will also enable potential homeowners to save time and money through transparent rates and a seamless application process. Further, SoFi plans to integrate Wyndham’s technology platform into its lending business, bolstering the home loans segment of the company's Financial Services Productivity Loop strategy.

By positioning itself as a comprehensive financial solutions provider and offering a diverse range of products, SoFi aims to leverage cross-selling opportunities, reduce customer acquisition costs, and carve out competitive advantages in the long run.

The Missing Earnings Catalyst

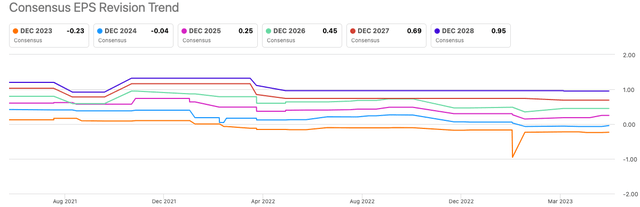

It is no secret that corporate earnings dictate long-term stock prices. Not just the profitability of a company, but certain earnings-related events can also have a meaningful impact on stock prices. We believe there is a strong relationship between long-term stock prices and earnings revisions. Unfortunately for SoFi, earnings revisions have gone nowhere in the last year or so, which is a red flag.

Exhibit 5: Earnings revisions trends

Seeking Alpha

In the absence of a meaningful turnaround in EPS revision trends, I believe SoFi stock will fail to build on the recent momentum behind its stock prices.

Takeaway

SoFi Technologies, the digital financial services company known for its innovative offerings, faces a changing landscape with the imminent restart of student loan payments and legal challenges to student loan forbearance. While the resumption of payments presents a growth opportunity for SoFi's student loan refinancing business, it also underscores the company's diversification efforts beyond student loans. The outcome of the Supreme Court decision regarding student loan forgiveness will further shape SoFi's prospects. As the company strives toward profitability and expands its product offerings, investors will have to closely monitor its performance and the ability to navigate challenging market conditions.

Unlock Alpha Returns With Our Comprehensive Investment Suite

Beat Billions offers a wide range of tools and resources to help you achieve superior investment returns. Our team of expert analysts uncovers undercovered and thinly followed stocks to supercharge your investment returns.

- Access our model portfolios and receive actionable ideas to build a successful portfolio.

- Join our community of like-minded investors and exchange ideas to maximize your investment potential.

- Keep track of the real-time activities of investing gurus.

Don't miss out on our launch discount - act now to secure your subscription and start supercharging your portfolio!

This article was written by

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.