I Am Still Not Bullish On Dollar General After Q1 Results

Summary

- Dollar General Corporation Q1 earnings results showed a decline in diluted EPS and operating margin due to increasing SG&A expenses.

- Gloomy economic outlook and shift in sales mix towards consumables may affect the company's profitability in the near term.

- Despite a more reasonable valuation after a 20% dive, I maintain a neutral rating on Dollar General stock due to potential margin compression and uncertain macroeconomic conditions.

Smile

Picking Dollar General Corporation (NYSE:DG) as a safe haven for a potential recession does not play well in 2023.

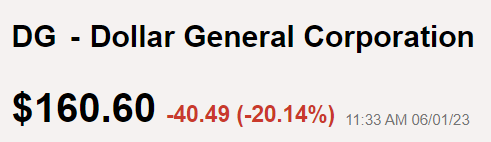

I raised my concern about DG stock in February due to a shift in sales mix, increasing production cost, and surging inventories. Shares have been down over 10% since then. Worse, the discount retailer was down almost 20% after releasing its Q1 2024 earnings result due to its disappointing guidance for 2023.

Seeking Alpha

In this article, I will reiterate my neutral rating on DG based on three reasons:

- Gloomy economic outlook speeds up the shift in sales mix

- Margin compression is still a concern

- Valuation is more reasonable after a 20% dive.

A Fair Earnings Result Amid Tough Economic Backdrop

As DG reported its FQ1 earnings result, its management team is confident about its ability to grow in the coming years, although short-term turbulence shall hurt DG’s top line and bottom line.

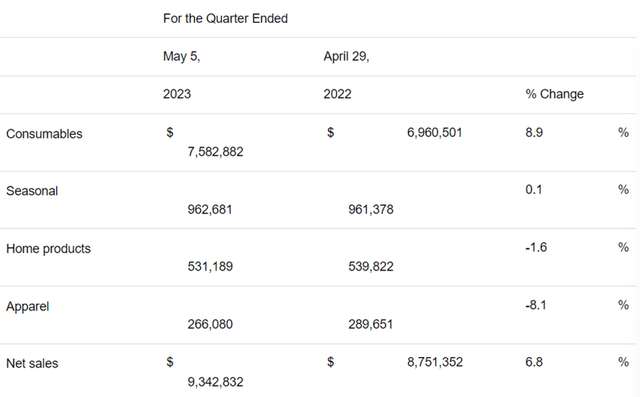

Dollar General’s net sales rose 6.8% (YoY) to $9.3 billion, driven by new stores’ contribution and growing same-store sales. Same-store sales were up slightly at 1.6% (YoY) as customer traffic declined, offsetting the growth from transaction amount. Diluted EPS dropped 2.9% (YoY) to $2.34, driven primarily by increasing SG&A expenses. Operating margin thus declined by 60 basis points to 7.93%.

And the company’s organic growth fell short of its peers.

Company | Comparable Sales |

BJ's Wholesale Club Holdings, Inc. (BJ) | 5.7% |

Dollar Tree, Inc. (DLTR) | 3.4% |

Dollar General | 1.6% |

Overall, DG delivered a fair earnings result to kick-start its financial year. In fact, the company’s ability to grow its gross margin is not an easy task as customers are shifting away from high-margin products. Also, its strength over the long term by expanding its portfolio and higher-margin businesses can’t be overlooked. However, it will be challenging to maintain DG’s profitability in the near term.

Here’s why.

1. Gloomy Economic Outlook Speed Up The Shift In Sales Mix

Sales in the consumables category tend to have lower gross margins than consumer discretionary products. Examples of consumables include paper and cleaning products, packaged food, snacks, etc.

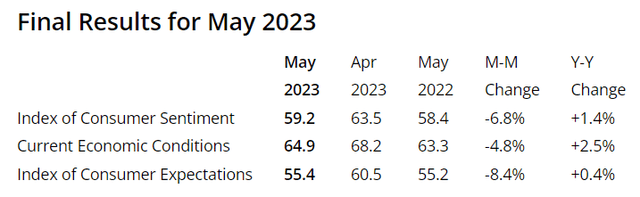

The University of Michigan Consumer Sentiment Index shows that U.S. consumers are still worried about the economy and thus intend to save money for the potential recession. The Index plummeted by 6.8% in May 2023 from April 2023.

The lack of spending incentives usually leads to a gradual shift in consumption behaviour. In the latest financial quarter, sales of consumables jumped by 8.9% from last year, while discretionary segments like home products and apparel fell 1.6% and 8.1%, respectively.

Consumables represented 81.2% of net sales in the latest financial quarter, from 79.5% last year (about 170 basis points) and 76.7% in 2021 (about 450 basis points).

2. Margin Compression Is Still A Concern

Although DG’s gross margin improved by 34 basis points, I am still concerned about potential margin compression, which will hurt its profitability.

A shift in the sales mix I mentioned above is one huge threat to margin expansion. As Dollar Tree reflected lately:

We are experiencing near-term margin pressures from the macro factors impacting sales mix and elevated shrink.

The inventory level continued its upward trend after surging by 28.4% in 2022. Total merchandise inventories were $7.3 billion, an 14.7% (YoY) increase on a per-store basis despite the US Manufacturing PMI hovering at around 50 from February to April.

Still, it is worth noting that excessive inventories may require the management team to mark down to clearance prices, exerting more pressure on the margins.

Valuation

The company issued guidance that its 2023 diluted EPS will be in the range of an approximate 8% decline to flat, compared to its previous expectation of growth of approximately 4% to 6%.

DG is a popular defensive stock pick that should be well-positioned to navigate challenging times. Thus, this disappointing guidance leading the stock to plummet by 20% (trading at $161 on mid-trading day) is shocking.

But the valuation is more reasonable after the dive.

The stock has a 5-year average forward P/E ratio of 20.62. The below summary tabulated my bullish, neutral and bearish case, assuming the stock returns to its 5-year average.

Bullish Case | Neutral Case | Bearish Case | |

EPS (FY 2023) | $10.61 (=TTM) | $10.68 * (1-8%) =$9.826 | $10.68 * (1-16%) =$8.97 |

Fair Value | $218.8 | $202.6 | $185 |

Implied Growth | 36% | 26% | 15% |

Previous lessons and technical analysis taught me not to catch a falling knife, especially when the macroeconomic atmosphere is uncertain and a potential recession approaches. The worst may be yet to come.

The growth of Dollar General Corporation is highly dependent on new store expansion, which requires high capital investment. The current high-interest rate environment does not favor the company raising capital. It is a risky move to continue its aggressive expansion plan amid a recessionary environment.

Thus, although the valuation has significantly improved from the last time I wrote, I will still rate Dollar General Corporation “HOLD.”

Please feel free to leave a comment below to share your view.

This article was written by

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

I am not a professional investment advisor. No information in this publication is intended as investment advice to buy/sell. The past performance data shown is not a guarantee of future results.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.