FNGS: Time To Sell The Magnificent Seven

Summary

- The 'magnificent seven' tech stocks, including Apple, Microsoft, Google, Amazon, Tesla, Meta, and Nvidia, have significantly outperformed the market in 2023, with the MicroSectors FANG+™ Exchange Traded Notes up over 63%.

- The concentration of market gains in these few names indicates an unhealthy market.

- Investors should consider selling FNGS now, as poor market breadth and elevated interest rates could lead to a risk-off move in the near future.

Orbon Alija

Thesis

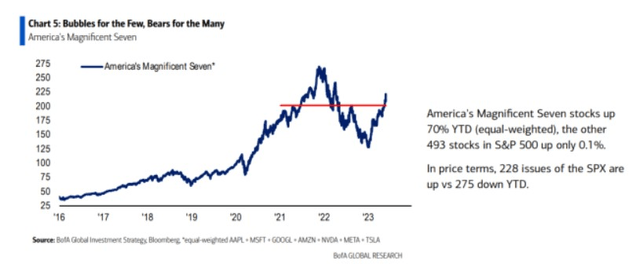

It has been quite the year so far in 2023. With Mike Wilson continuously warning us regarding a Q1 market sell-off, a lot of market participants positioned themselves short, only to watch theta bleed out of their put positions. Conversely, beaten down tech names and highly shorted stocks outperformed. And then there is the 'magnificent seven', which just blew everybody out of the water:

Performance (Refinitiv)

The 'magnificent seven' moniker refers to an adjusted FAANG cohort, namely to Apple, Microsoft, Google, Amazon, Tesla, Meta and Nvidia. These names are up an astounding 70% year to date, on an equal weight basis:

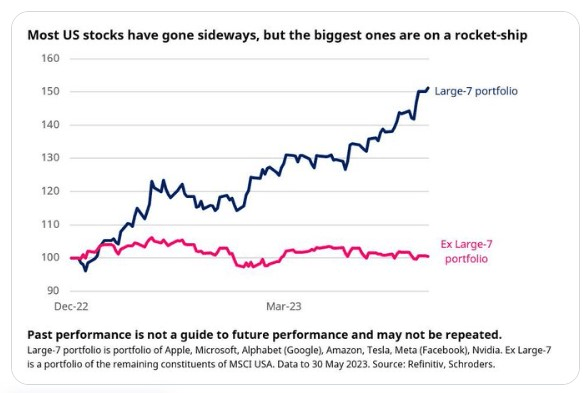

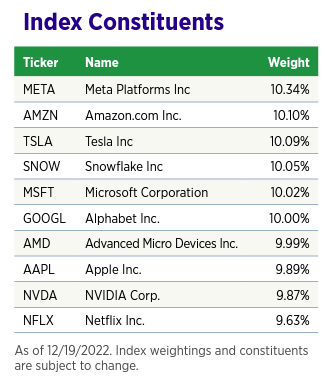

The shocking aspect is that they represent the only niche of the S&P 500 that has gone up, the rest of the index being fairly flat on the year. The MicroSectors FANG+™ Exchange Traded Notes (NYSEARCA:FNGS) which we covered before here, gives you exposure to the mentioned names:

Holdings (Fund Fact Sheet)

It should come as no surprise that FNGS is up over 63% this year, and has represented the trade to be done in 2023. We entirely agree that these are not signs of a healthy market when all the breadth is concentrated in a very few names, and that is why we think it is a good time to sell FNGS now, but it has been an incredible ride. Every year there are one or two market themes that end up making most of the money for investors. In 2022 those themes were higher rates and higher energy prices. In 2023 the theme has been tech mega caps.

Where do we go from here

FNGS is a great instrument to use when going long mega cap technology names. It has worked astoundingly so far in 2023, but we think this trade is about to end. There is only so much that mega caps can do, especially when their P/E ratios are going through the roof again. A healthy market is characterized by breadth, with investors spreading their cash to a multitude of names and industries and with earnings in expansionary mode.

We are having a bit of the opposite this year. Earnings are stagnant or contracting, and investors are playing defense via the mega caps. It is not sustainable long term, and we do not see this as a structural bull market. At the end of the day higher rates are here, and they will stay elevated for longer than the market thinks. Inflation needs to be addressed structurally, and that takes time.

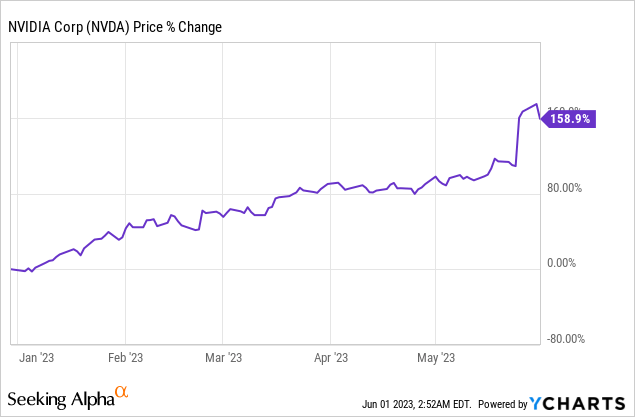

We just had another push higher driven by the artificial intelligence theme which we covered here, and the related semiconductors sector. NVDA has been the poster child for AI benefits, just killing all short sellers this year:

We feel this move is coming close to being exhausted, and there is only so much that seven stocks can do for the entire market.

ETN Structure

We have mentioned this before in our prior article, but worth re-emphasizing that FNGS is an exchange traded note, and not an ETF. An investor in FNGS will run the credit risk posed by Bank of Montreal, and in the very remote case of a restructuring will be a creditor to the estate. The financials crisis this year has so far been limited to regional banks, which do not have a large presence in the capital markets, but investors should understand fully the risk and rewards of the products they are trading.

Conclusion

FNGS is an exchange traded note. The fund gives investors equal weighted exposure to the 10 largest technology and consumer discretionary equities (basically the FAANG cohort plus a couple of additions). This trade has worked out very well in 2023, with FNGS being up over 63%. The 'defensive' trade this year has been tech mega caps rather than utilities or healthcare. When we take out the largest 7 stocks from the S&P 500, we get a fairly flat performance, which is indicative of very poor market breadth. We do not think this is sustainable long term, and that FNGS will come back to earth during the next market risk-off move. Timing is quasi impossible in the markets, but any investor long this name should take their 63% gain off the table and Sell FNGS now.

This article was written by

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.