BrightSpire Capital: Office Loans Have The Market Exiting, I'm Entering (Slowly)

Summary

- BrightSpire Capital is benefiting from higher interest rates, but economic stress may cause some loans to default, particularly in the office property sector.

- I believe the market has priced in a complete write-off of the office part of the portfolio, providing a large margin of safety for investors.

- BRSP is rated a "BUY" at $5.92 per share, but investors should be cautious about the sustainability of the current dividend.

gerenme/iStock via Getty Images

Dear readers/followers,

Those that have been following me for a while know that I don't have a large exposure to mortgage REITs. I currently only hold two positions, one in Blackstone Mortgage Trust (BXMT) which I covered in my article here and one in Granite Point Mortgage Trust (GPMT) covered here. Those articles cover my thoughts for each company as well as my methodology for evaluating mortgage REITs in detail so I encourage you to check them out.

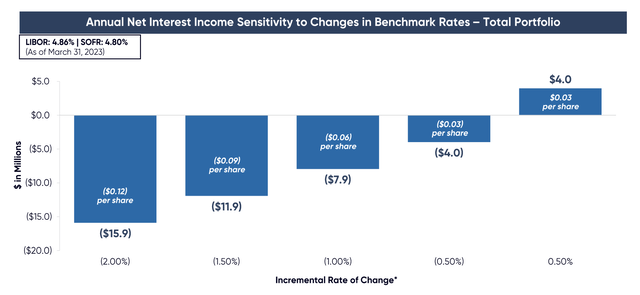

We're living through an interesting time for mortgage REITs. We have high interest rates which significantly increase revenues as they enable REITs to charge higher interest on their floating rate loan portfolio. BrightSpire Capital (NYSE:BRSP) which I'll cover today has nearly 100% of their outstanding loans floating rate based either on SOFR or one-month LIBOR. This means that their net interest income and consequently earnings are very sensitive to changes in interest rates. The company estimates that a further 50 bps increase in rates will add $0.03 per share in net interest income, while a decline in rates would hurt their earnings.

At the same time though, as we already know, there has to be someone on the other side paying this higher interest. The higher the interest, the higher the risk that the borrower will default on their payments, especially at a time when property values (especially office) have taken a significant hit. At some point, a borrower may decide to simply hand over the keys to the building which was pledged as collateral. This indeed is the main risk that mortgage REITs are facing today and as a result, their valuations have plummeted. If we are to invest in BRSP we have to evaluate the risk of such defaults occurring, assume how much the company would be able to recover from its collateral in case of default (i.e. how much it could sell the properties for) and determine whether the current valuation justifies these risks.

Basics

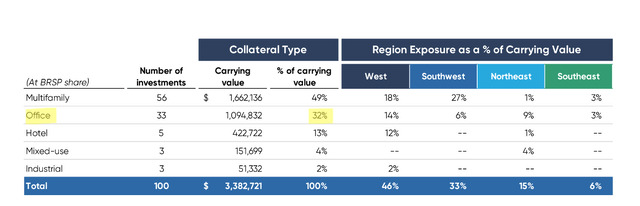

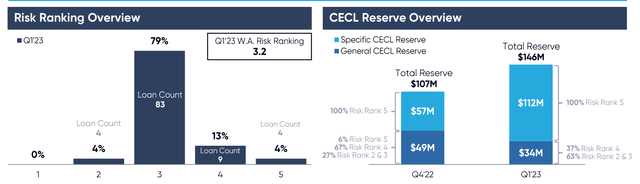

But first some basics. BRSP's loan book totals about $3.4 Billion and consists of 49% of multifamily, 32% office and 13% hotels. What we're really interested in is the office part of the portfolio, which is the riskiest. The office portfolio is spread across the country, but is quite heavily concentrated towards the coasts, especially in the west. The loan portfolio has a weighted average remaining term of 3 years and is 97% floating rate. The weighted average risk rating stands at 3.2 with 4 loans 5-rated and 9 loan 4-rated.

Risk profile

The weighted average risk rating stands at 3.2 with four loans 5-rated and nine loans 4-rated. Just as peers have done, BRSP has increased their CECL reserve quite significantly over the past few quarters in anticipation of some defaults. As of Q1 2023, the reserve stood at $146 Million ($1.13 per share). There is a loan specific reserve which cover 100% of 5-rated loans and a general reserve which covers an additional 1% of all loans. As a result of the increase in CECL reserves, the book value per share decreased to $11.74 (still double the current share price).

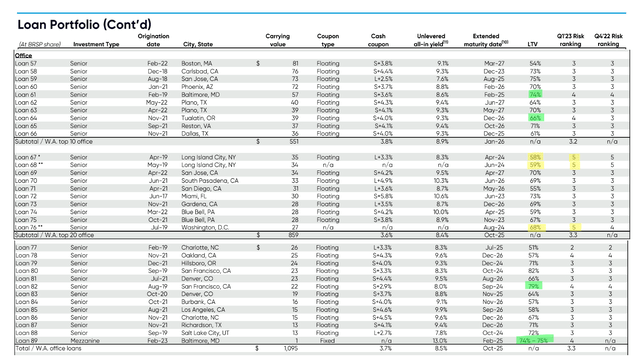

Looking at their entire office loan book, there are some troubled properties for sure. In particular, two properties in Long Island were marked for sale in Q1, but as the failure of New York based Signature Bank disrupted that process, these have now been placed on non-accrual status with a specific CECL reserve against them. A third and last 5-rated office loan is on a property in Washington D.C. which has just 51% occupancy and with federal government employees not returning to work and known lease expirations in late 2023, BRSP has begun the foreclosure process and plans to convert the property to residential use upon foreclosure.

The thing is though, that there is already a specific CECL reserve against all 5-rated loans so we can easily assume that they're written down to zero with no recovery whatsoever. What we really want to focus is their 4-rated loans with high LTV (in green below). I identified four loans that have LTV of 60%+ (in some cases as high as 79%). With office value falling hard, these are in my opinion at high risk of eventually being classified as 5-rated. Still, their proportion is not very high.

Valuation

So really it all comes down to the discount to book value which currently stands at around 50%. Does that mean that half the portfolio could default with no recoveries and we'd still be fine? Unfortunately no. The company has leverage of about 2.2x with total liabilities at $3 Billion and equity reported at $1.35 Billion. Using the same methodology as in my article on GPMT I can calculate that the market is pricing in a total write-down of 25% of loans or about two thirds of all office loans. And of course, if those loans default, the REIT will still get its collateral and will recover at least a part of the capital so in reality, if we assume a recovery rate of about 30%, the market has effectively written off the entire office loan portfolio.

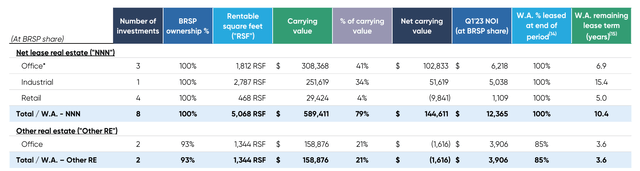

And when we consider that in addition to loans, the company also owns a small net lease portfolio, worth about $800 Million, the implied margin of safety increases further. The net lease portfolio which consists of 62% of office and 34% of retail. The portfolio has a decent occupancy and a 9 year WAULT.

Risk of default

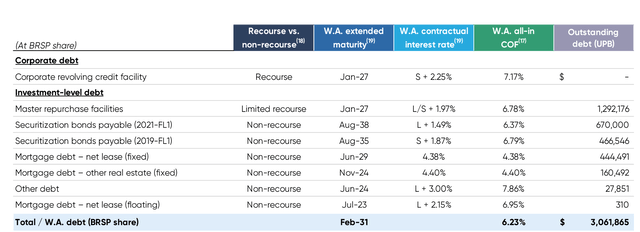

Since I believe the market has effectively written off the entire office portfolio, the risks have largely been priced in and it should only be a question of time until things stabilize and the valuation closes at least part of the gap to BV in my view. What we need to keep in mind though is that the company first has to survive to reach the light on the other side of the tunnel. The only thing that could realistically bankrupt a mortgage REIT would be their inability to repay/refinance their debt. The first thing they'll have to pay is of course interest which happens to be $186 Million per year (6.23% on $3 Billion of debt). The net lease portfolio covers about $60 Million of this. The rest can easily be paid by cash which the company has over $300 Million of. So it's quite clear that even if BRSP doesn't collect another dime from their outstanding loans, they will easily be able to cover interest on their debt.

But what about maturities? In short, there are some, in 2023 and 2024, but they are relatively small and non-recourse, which means that they cannot bankrupt BrightSpire. The only recourse debt is not due until January 2027 which gives the company plenty of time to recover.

Conclusion

To conclude, BrightSpire is in a similar position to Granite Point, which I covered in my previous mortgage REIT article. The company is benefiting from higher rates by being able to generate higher net interest income, but at the same time the economic stress is going to cause some loans to default. No one knows how bad things will get, but assuming the market has priced in a complete write-off of the office part of the portfolio, the margin of safety sure seems large. I rate BRSP as a "BUY" here at $5.92 per share, but will only add shares slowly. We have to recognize that we cannot time a bottom and that the price could go much lower over the rest of this year, but several years from now I'm quite certain we'll be happy we bought at least some shares at these levels.

In the meantime, the company will pay investors dividends, which now stand at $0.20 per quarter (yield of 13.5%). In Q1 the dividend was covered by adjusted distributable earnings of $0.27 per share, but frankly with the uncertainty ahead, I'm not sure if the company can sustain this dividend, which is why I haven't really included it in my calculations. Of course, a dividend cut would most likely lead to a further decline in stock price, which could represent an opportunity to double down on the stock in my opinion.

This article was written by

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, but may initiate a beneficial Long position through a purchase of the stock, or the purchase of call options or similar derivatives in BRSP over the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.