SMH ETF: The Nvidia Effect And De-Risking Of The Supply Chain

Summary

- The VanEck Semiconductor ETF should benefit from Japan's increasing role in "silicon geopolitics," which I believe helps justify its higher valuations compared to the Nasdaq.

- Japan's involvement in the chip supply chain, such as Micron's investment in Hiroshima and TSMC's second plant in Japan, reduces country concentration risks and supports a more sustainable, de-risked chip industry.

- I see a price target of $150 as plausible, considering increased demand for AI-related chips and the potential for a larger total market size than initially forecasted by the World Semiconductor Trade Statistics.

- I also consider the Nvidia effect on its way to sustainably becoming a $1 trillion company.

- The risks are illustrated by Warren Buffett divesting his stake away from the Taiwanese foundry giant.

SweetBunFactory

As critical ingredients for the manufacturing of electronic devices which get fitted in everything from washing machines and cars to fighter jets, semiconductors have always been the subject of close attention.

In this regard, the VanEck Semiconductor ETF (NASDAQ:SMH) provides exposure to a portfolio of stocks whose main businesses revolve around chips, right from design to manufacturing, and by considering the main holdings, this thesis aims to show that Japan is becoming a major contributor in removing away the risks from Taiwan, thereby justifying the fund's higher valuations.

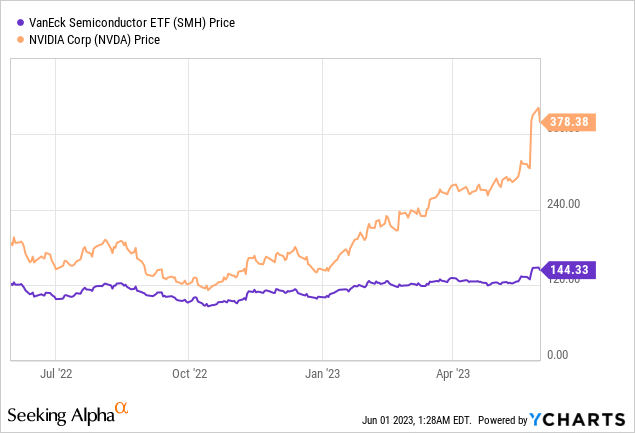

First, after surging by more than 15% in a matter of days as shown in the chart below, and reaching a high of $144-$145, driven primarily by Nvidia (NASDAQ:NVDA), I assess whether SMH's top holding can drive it even higher.

The Nvidia Driver

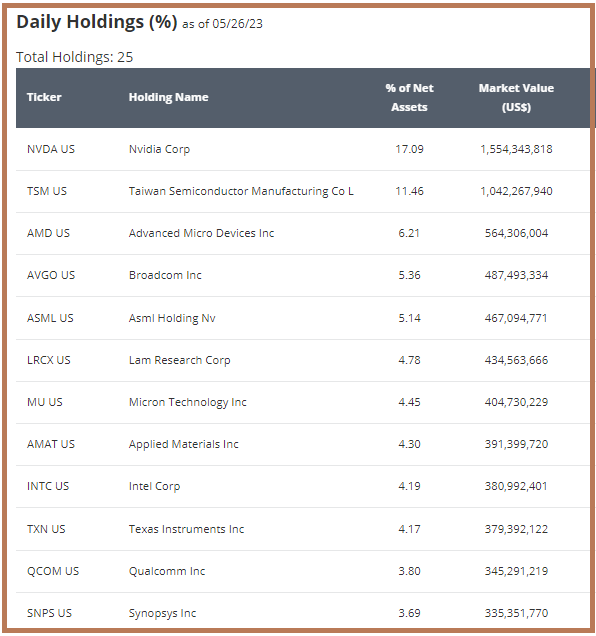

Nvidia is SMH’s top holding and accounted for 17.09% of the ETF’s overall weight on May 26 or a market value of $1.5 billion. Since the company appreciated by 30%, it contributed about $0.45 billion to the fund's market value in a matter of days which is significant. Thus, replacing its top holding (which was Taiwan Semiconductor Company (TSM) in 2022) with Nvidia has proven fruitful.

www.vaneck.com

Looking across the ETF space, the iShares Semiconductor ETF (SOXX) top holding is also Nvidia but it only constitutes 11.56% of the ETF. Both charge fees equivalent to 0.35%, but the VanEck fund has higher assets under management of $9.28 billion despite being incepted ten years later in 2011.

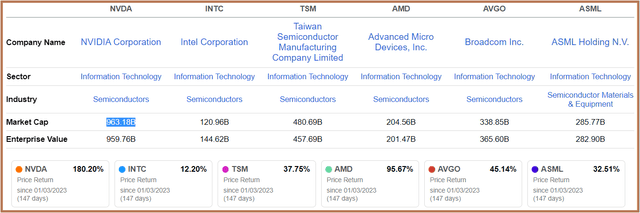

Interestingly, Nvidia’s market cap of over $950 billion is eight times larger than Intel (NASDAQ:INTC) (table below) which is an integrated device manufacturer (that both designs and produces chips), and two times larger than TSMC which is the world’s largest foundry. Considering that Nvidia is just a designer which only a few years back used to produce gaming graphic processors, you can easily gauge the importance of its AI chips used by Microsoft to drive ChatGPT’s algorithms. Interestingly, investors' enthusiasm around Nvidia also helped pushed other stocks for example TSMC, to which it outsources the manufacturing of its chips.

Now, the question is whether Nvidia can achieve the $1 trillion market cap in turn propelling SMH higher. I believe that this will not be the case, at least in a sustainable manner. The reason is that major cloud service providers are engulfing (purchasing) so many AI chips from Nvidia, which resulted in the second quarter of fiscal 2024 revenue guidance being boosted from $7.18 billion to around $11 billion. This means some time will be needed by cloud companies like Microsoft (NASDAQ:MSFT) and SaaS plays like Salesforce (CRM) to digest those chips namely by using Generative AI to deliver on actual customer requirements.

Moreover, contrary to the way the market seems to be pricing Nvidia, it does not have a monopoly status when it comes to intelligent processors as companies like Intel already have less known but competitive products which in some cases have been demonstrated to be faster than Nvidia's GPUs (graphic processing units). Other competitors may also emerge just like Advanced Micro Devices (NASDAQ:AMD) which as a GPU specialist, can rapidly reorient its RYZEN 7000 AI-based technology to deliver the ChatGPT effect.

Thus, it is unlikely for Nvidia alone to drive further upside, but the fact that the ETF also holds its competitors implies that SMH will benefit in case they also see more demand. The Fund should also profit from more joint demand reaching TSMC. For instance, while its share price should fluctuate with Nvidia's stock, I believe SMH's share price should still be less volatile as it will be cushioned to some extent by its exposure to the main contenders in the chip industry all under one roof unless there is a general softness in demand.

The Risks and Japan's Role in "Silicon Geopolitics"

Staying with Nvidia, we should not forget that only in January this year, for its fourth quarter 2023 earnings results, revenues were down by 21% from a year ago mainly due to a big drop in PC demand with some concerns also expressed for its Datacenter segment. This was in turn caused by both high inflation and borrowing costs rippling through corporate IT budgets. Going forward, when faced with hard-to-make choices, it is more likely for the CIO (Chief Information Officer) to stick to operational IT spending which by the way already includes analytics for some corporations, instead of nice-to-have ChatGPT style chatbots.

Therefore, in case the economy gets worse in the wake of the banking crisis triggering lenders to be more careful with corporate lending, do expect some softness in demand for Generative AI especially given that whether it is Microsoft or Salesforce, they already have existing AI tools for predictive analytics purposes. Therefore, it is likely for their customers to ask questions as to the concrete benefits they can benefit from Generative AI before making purchase decisions, in turn implying less demand for chips.

Moreover, investors' enthusiasm for AI seems to have already made its way into valuations with the VanEck ETF exhibiting a price-to-sales ratio of 4.78x which is higher than the Nasdaq-tracking Invesco QQQ’s 3.75x by more than 25%. For this matter, based purely on a valuation basis, one can argue that SMH is overpriced, but, I remain optimistic, because of Japan's increasingly important role in "silicon geopolitics".

For this purpose, the chip supply chain is a complex one with lots of volatility risks as seen by Micron’s (MU) downside after China branded its memory chips as posing cybersecurity risks. By the way, the chip manufacturer forms part of SMH's holdings, constituting 4.45% of its overall weight. Along the same lines, some will remember that Nvidia's stock was also grappled by volatility in August last year after the U.S. Department of Commerce barred it from exporting its most sophisticated chips to China.

De-Risking the Chip Supply Chain

However, these volatility episodes pale when compared to country concentration risks as most of the high-end chips used in smartphones are produced in Taiwan which is only about 2,000 kilometers off the Chinese coast. Worst, the advanced chips for driving ChatGPT algorithms may be designed by Nvidia but are produced by TSMC whose majority production capacity is located on the island as I had elaborated in a thesis in January this year entitled "Avoid TSMC In Favor Of United Microelectronics Due To The Elevated Threat Level". Coincidentally, only a few weeks later, or in February, Warren Buffett divested his entire stake in TSMC.

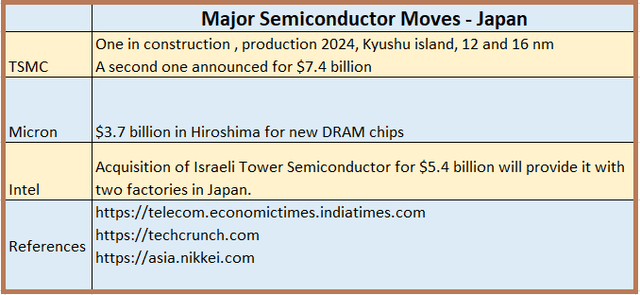

Since then there have been some developments with Japan looking to play a major role in the chip supply chain as seen with Micron's recent $3.6 billion investment to produce next-generation memory chips in its existing plant in Hiroshima. This move benefits from Japanese financial support and requires Extreme ultraviolet lithography ("EUV") machines produced by Europe's ASML (ASML).

These are essential in the foundry process and currently have to be brought all the way to Taiwan, something seen as a threat by America as denying China advanced chips can achieve its intended objective only if the Asian country is unable to lay its hands on the very equipment which manufactures these. In addition, in an effort to mitigate country risks, TSMC has announced a second plant in Japan as per the table below which summarizes only some of the concrete moves involving SMH's holdings.

Table Built using data from (www.seekingalpha.com)

Now, even before Japan, America has been encouraging more foundry-related activities on its soil. In this case, the United States CHIPS Act has played a positive role with several big industry players including TSMC, Intel, and Micron announcing initiatives or expansions in the U.S. However, it is also important to look at the cost factor. In this case, the cost of living in Japan being lower than in the U.S. implies lower operational expenses and maximizes the chances of a more sustainable de-risked chip industry.

Conclusion

Therefore, inclusive of heavy-weight Japan which is also the world's third richest country by GDP, the risk-reward ratio is gradually becoming more favorable for semiconductor investments. Moreover, as a subset of the tech sector which holds chip stocks or the very ingredients that power AI applications, SMH's higher valuations compared to the Nasdaq are justifiable in my opinion.

To come to a target price for SMH, I use data from the WSTS or World Semiconductor Trade Statistics.

Now, in November last year, the organization had anticipated the market to grow by 4.4% in 2022 to $580 billion and decline by 4.1% in 2023 to $557 billion. However, with an increase in demand for AI-related chips, and Nvidia alone forecasting about $4 billion of sales more than initially forecasted by analysts, this year's total market size should be more than the $557 billion mentioned by WSTS. Assuming, it is $580 billion, or the same as in 2022, for moderation purposes to take into account softer demand and high inventory levels seen by memory producers like Micron or Samsung Electronics (OTCPK:SSNLF), then there can be a 4% ((580-557)/557) increase in sales. This translates to a target of $150 (144.5 x 1.04) considering the current share price of $144.5.

Finally, this remains a moderate target, but, do expect volatility, and bear in mind that you may have to wait till the beginning of 2024 for a sustainable upside, driven by catalysts like TSMC producing its chips outside of Taiwan.

This article was written by

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

This is an investment thesis and is intended for informational purposes. Investors are kindly requested to do additional research before investing.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.