EIC: 0% Returns Since Inception, Here Are Two Alternatives For The Next Two Years

Summary

- Eagle Point Income Company Inc. has trailed its benchmark and delivered 0% total returns since inception.

- Over the next two years, we think the fund can deliver returns in line with the CS leveraged loan index i.e. 5-6%.

- With an upcoming recession now a virtual certainty, we look as to how we can beat this expected return with less risk.

- I do much more than just articles at Conservative Income Portfolio: Members get access to model portfolios, regular updates, a chat room, and more. Learn More »

Igor Kutyaev

Eagle Point Income Co Inc (NYSE:EIC) has not given you any returns since inception. What started out as a "conservative" take on collateralized loan obligations has lost out to Treasury bills. What happened here and where does this fund go next? We take a look at this and see if you have a mean reversion setup or whether you should hit the bid.

The Returns

You will find a few different numbers for returns on this fund. While all of them are bad, we want to show you how they are calculated so investors understand where the differences come from. The easiest number to access is the one on the company website. Note that this is for April 30, 2023 and we are about one month behind today.

EIC Website

This one is done reinvesting all distributions, but the twist here versus metrics found on other sites is that the distributions are reinvested at a discount. To the best of our knowledge, all other automatic calculators assume distribution at the market price. Since EIC generally has traded a premium, those sites will understate the total return. Hence the company's presentation is the very best outcome one can get with distributions reinvested.

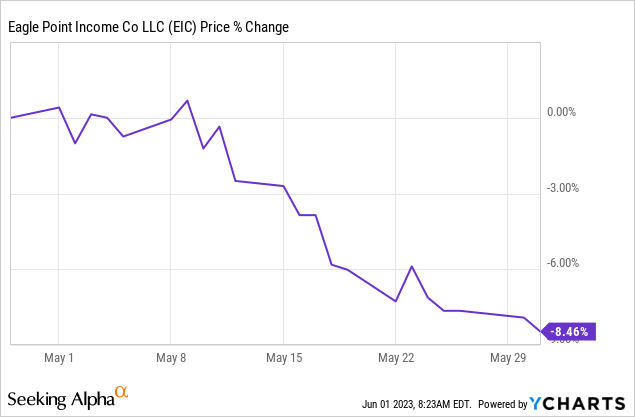

That outcome shows 8.27% since IPO. Of course that outcome takes a $14.78 closing price. EIC is down since April 30, 2023 falling by 8.46%.

We did get one distribution since then, but this is about as close to a 0% total return as you can get over 46 months (inception July 2019).

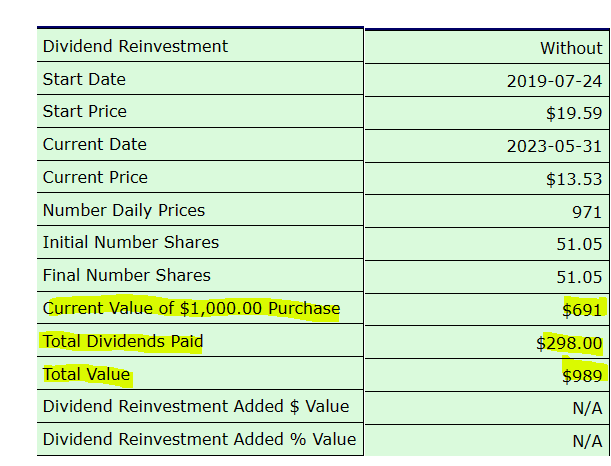

Many funds in this space have dramatically different returns depending on whether you had reinvested the distributions or not. Interestingly, this is one of those cases where if we investors consumed the distributions, then the total return is almost identical. Buy Upside calculates this as about 0% total since inception.

Buy Upside

Your Returns

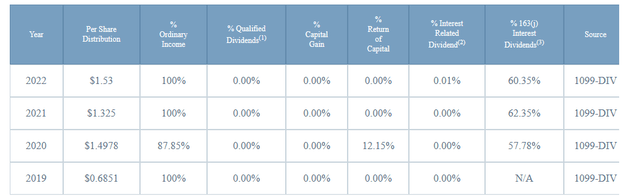

If you had this in a taxable account, your total returns would drop significantly from the 0% shown above. The bulk of the distributions have come as ordinary income and taxes would really reach deep into your pocket, even if you reinvested the income.

EIC Website

What Happened?

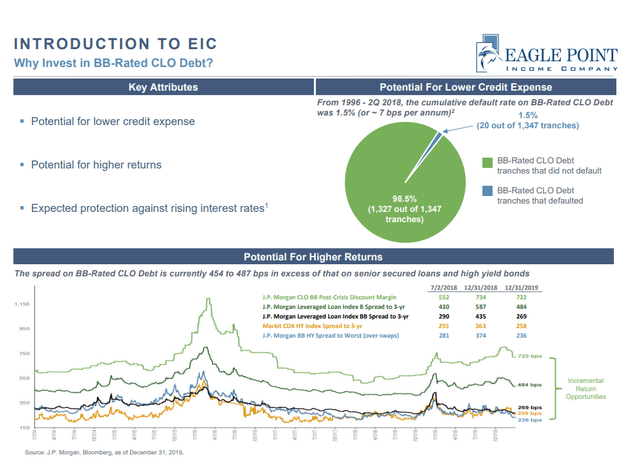

EIC started off in 2019 and was designed to give you exposure to BB rated CLOs. Note that this slide is from their 2019 presentation.

EIC 2019 Presentation

Across most measures, the default rate for CLOs was pretty low in the last four years. You can see the data for 2021 below.

Corporate defaults in 2021 were unlikely to drag much on CLO performance, given half of the corporate entities that defaulted in 2021 were rated within the lowest rating levels, 'CCC+' and lower, at which CLO managers tend to limit their credit exposures. Meanwhile, the 'B' category (which is much more broadly held within CLOs) showed a default rate of just 0.52%, considerably lower than its long-term weighted average of 3.18%.

Source: S&P Global

In fact the same article has a picture of CLO defaults versus other forms of debt and goes to show that even during 2020, the results were quite good for this asset class.

S&P Global

So whatever EIC delivered, we cannot blame it on lower rated CLOs in general.

There are two reasons here that could explain the performance.

1) The fund generally had bad picks relative to the index.

2) The pricing of its CLOs is abnormally depressed and offers substantial room for recovery.

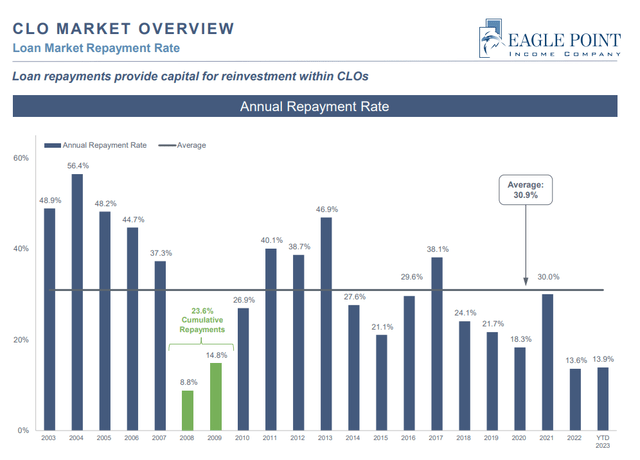

If you ask the bulls, it is always the case that any CLO fund or mortgage REIT that delivers really poor returns is facing abnormally bad pricing. It is always sunny in Philadelphia and it is always a good time to buy. We are skeptical of this explanation here for two reasons. The first being that these funds hold CLOs that have relatively short durations (they pay out quickly). If you own a CLO maturing in four years, at the end of four years you have a final outcome. There is zero room for pricing "being off" at that time point. An extension of that is that pricing cannot be too far away from the truth when the fund is holding relatively short duration debt and has pretty substantial prepayments every year.

EIC Q1-2023 Presentation

So the disappointment from the fund comes from bad picks and the CLO asset class delivering less than advertised.

Outlook

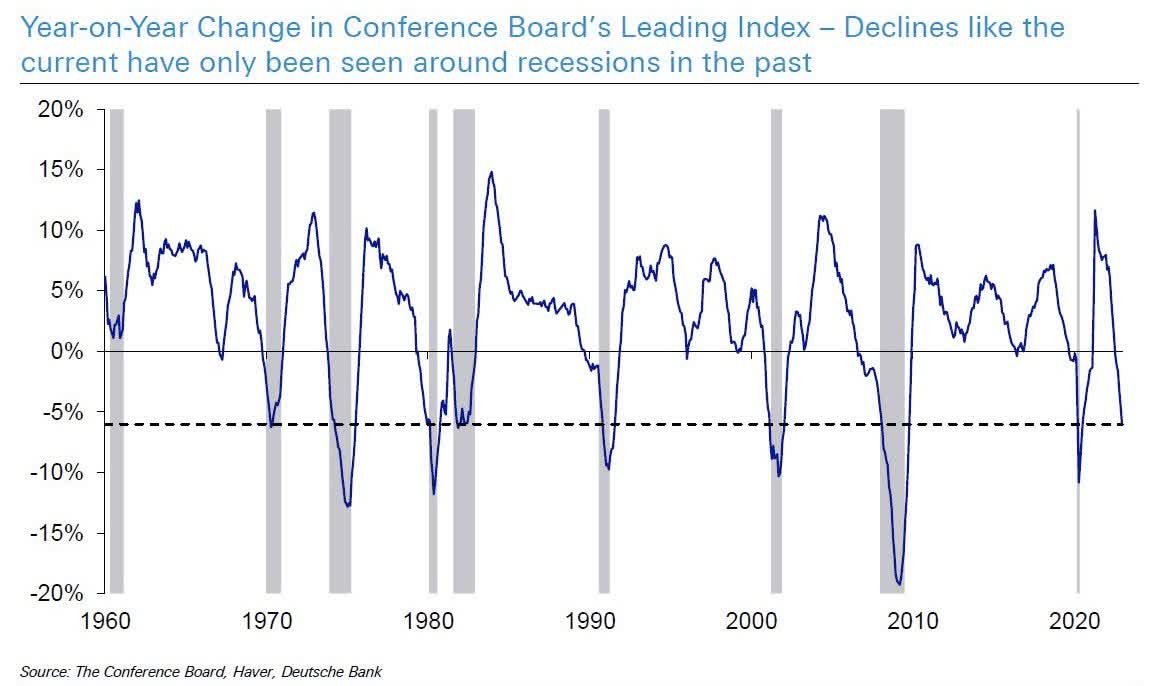

The hard data continues to support a recession having started or being awfully close. GDI (an alternate measure similar to GDP) contracted in Q4-2022 and Q1-2023. LEI's have been contracting for several months in a row.

Deutsche Bank

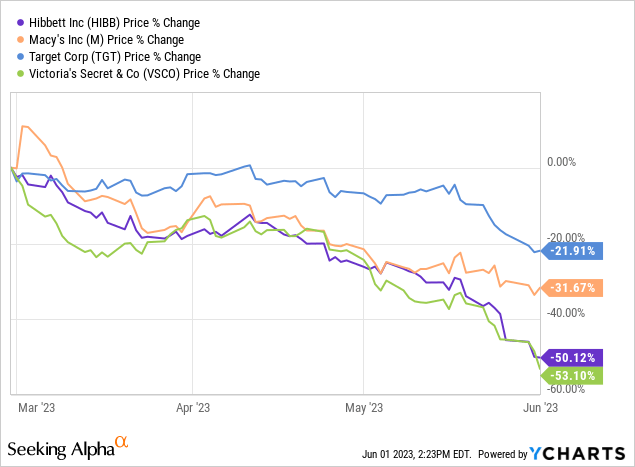

Chicago PMI printed at 40.4, which has not happened outside of a recession. Most retailers have been reducing guidance extremely briskly. Victoria's Secret (VSCO) for example changed their 2023 sales guidance in one quarter from up 6-8% to down 2-4%. Their Q4-2022 results were in early March so they had one quarter pretty much in the bag when they guided for 6-8% up. We have a lot of retailers fitting this profile.

This fits with the economy falling off the cliff in Q2 which we are hearing about in multiple reports. We don't think high yield debt is properly pricing in the risks and the same goes for CLOs and the funds associated. For EIC we think 5% annual total returns are probable given the asset class over the next two years. So more NAV declines that partially offset the income.

Alternatives

One place where investors can get good yields with lower risk are in the preferred shares of these same CLO funds. Eagle Point Credit Company Inc - 6.75% PRF PERPETUAL USD 25 (ECC.PD) belonging to sister company Eagle Point Credit (ECC) has an 8.44% yield currently. There are safety nets in place for Closed end funds and they have to maintain an enhanced asset coverage for the preferred shares and baby bonds at all times. We will wager that this yield outperforms the total return on EIC as well as ECC from here.

Another alternative would be shop for quality bonds that punch above their weight class. Since we are sticking with the credit theme, Owl Rock Capital (ORCC) is one that comes out ahead in our screening. Near term bonds such as the one maturing on July 22 2025, offer 7.5% yield to Maturity. These are investment grade bonds which yield far more than the average two-year investment-grade bond. Obviously the market sees some relatively higher risks, but with ORCC's liquidity profile and backing of parent Blue Owl Capital Inc. (OWL), we think the bonds should be bulletproof.

Please note that this is not financial advice. It may seem like it, sound like it, but surprisingly, it is not. Investors are expected to do their own due diligence and consult with a professional who knows their objectives and constraints.

Editor's Note: This article covers one or more microcap stocks. Please be aware of the risks associated with these stocks.

Are you looking for Real Yields which reduce portfolio volatility? Conservative Income Portfolio targets the best value stocks with the highest margins of safety. The volatility of these investments is further lowered using the best priced options. Our Enhanced Equity Income Solutions Portfolio is designed to reduce volatility while generating 7-9% yields.

Give us a try and as a bonus check out our Fixed Income Portfolios.

Explore our method & why options may be right for your retirement goals.

This article was written by

Conservative Income Portfolio is designed for investors who want reliable income with the lowest volatility.

High Valuations have distorted the investing landscape and investors are poised for exceptionally low forward returns. Using cash secured puts and covered calls to harvest income off value income stocks is the best way forward. We "lock-in" high yields when volatility is high and capture multiple years of dividends in advance to reach the goal of producing 7-9% yields with the lowest volatility.

Preferred Stock Trader is Comanager of Conservative Income Portfolio and shares research and resources with author. He manages our fixed income side looking for opportunistic investments with 12% plus potential returns.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of ECC.PD either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.