United States Cellular: Things Can Get Even Worse

Summary

- US Cellular's strategy is not working, with rate and volume metrics deteriorating and financials not supporting the level of 5G investment needed.

- The stock price is high, even with a potential buyout, and investors should sell current holdings and avoid the stock.

- Upside potential is limited, with the best-case scenario being a buyout with a bidding war resulting in a premium on the current valuation.

coffeekai

United States Cellular Corporation (NYSE:USM) is the fourth largest US wireless provider, providing wireless services to customers in 21 states. Despite the stock falling over 50% in the last year, I believe that US Cellular is still overvalued, with downside risk significantly outweighing upside potential.

Their well-articulated but poorly executed strategy isn't working in the market, with rate and volume metrics deteriorating. In addition, the financials and weak balance sheet do not support the level of 5G investment needed to keep up with Verizon (NYSE: VZ), AT&T (NYSE: T), and T-Mobile (NASDAQ: TMUS). I feel the most likely scenario is a buyout for spectrum, but with elevated valuation multiples, even in this scenario, shareholders would likely come out below the current price.

Their Strategy Isn't Working

Coming into 2023, US Cellular put forward a strategy to focus on growth and expand the return on capital. This sounded great after a poor performance in 2022, with revenue stagnant and operating income going backward.

Unfortunately, in Q1 2023 earnings, we saw that the strategy isn't working on any front except the relatively small fixed wireless space. Looking at the post-paid space, ARPU was essentially stagnant, going from $50.60 to $50.66 despite high inflation. ARPA went backward from $130.97 to $130.77. On the volume side, gross and net additions fell after recovering slightly in Q4 2022.

Post-Paid Metrics (investors.uscellular.com)

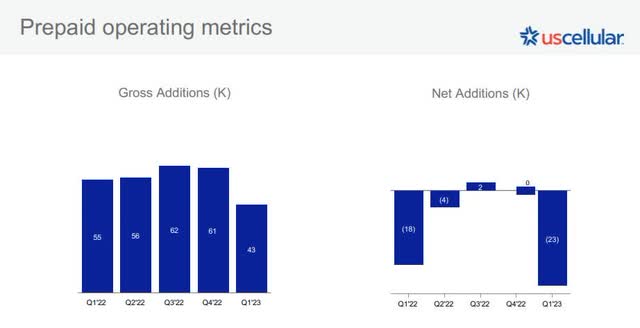

Looking at the pre-paid space, every metric deteriorated. ARPU was down from $33.34 to $33.19, churn increased from 4.11% to 4.63%, and net additions fell off a cliff.

Pre-Paid Metrics (investors.uscellular.com)

Growth in tower revenue also decelerated significantly to $0.3M quarter-over-quarter. The only bright spot was fixed wireless, although this business is too small and growing too slowly to offset the mobile decline.

In the Q1 2023 earnings call (remember that US Cellular and Telephone and Data Systems share a call), management seemed oblivious to the loss of momentum quarter-over-quarter. Their talking points were focused on year-over-year growth and customer mix. In a subscription-based business, I firmly believe momentum is more critical than year-over-year results. With rate and volume growth decelerating (or going backward), financials will quickly follow.

Financials Don't Support 5G Investment

In order to drive growth and stay competitive, US Cellular has been making significant investments in 5G. The 5G investment has required increased capital spend, but more impactfully, it has required billions in new spectrum licenses. The last auction alone cost $580 million for 380 mid-band spectrum licenses. In a 2021 auction, they spent another $1.5 billion for 254 licenses.

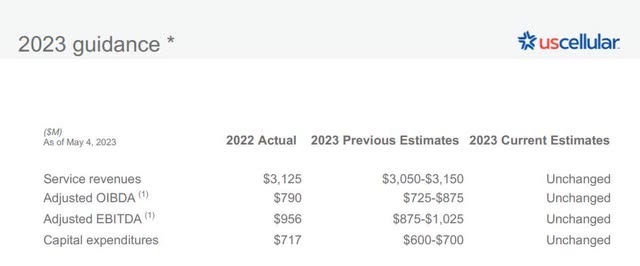

Investing in 5G makes sense if you can afford it and if you use it to drive growth. US Cellular couldn't afford the purchase, financing all of its spectrum holdings with long-term debt. Remember that the last time the business generated positive free cash flow was in 2018. The business is also not driving growth. Operating income went backward from 2021 to 2022 with stagnant revenue and higher costs. Earnings guidance paints a negative picture for 2023, with service revenue, AEBITDA, and AOIBDA all likely to go backward year-over-year. As a side note, I always get nervous about a business when every line item in their guidance is an adjusted metric.

2023 Earnings Guidance (investors.uscellular.com)

Stock Price Is High, Even With A Buyout

Based on the current momentum, I believe the financials will continue to deteriorate, and US Cellular will be sold to another telecom for parts (Spectrum). The company is barely breakeven, and the level of capital investment required to maintain the current customer base is not affordable. In this scenario, I think a likely purchase price would be the value of spectrum holdings (currently $4.7 billion), less long-term debt (currently $3.3 billion). At $1.4 billion, this would be slightly higher than the current market cap of $1.3 billion. However, if financials continue to deteriorate, the debt load would likely increase, pushing the buyout value at or below the current market cap.

Valuations tell a similar story: if not overvalued entirely, the stock is at the high end of a valuation. Forward P/E is elevated at 86% above the sector and 21% above the 5-year average. EV/EBIT has elevated an eyebrow-raising 311% above the sector and 27% above the historical average.

In addition to financials and the valuation, Quant ratings are flashing red with an overall growth grade of D-.

Upside Potential

In my opinion, the best-case scenario is a buyout where more than one telecom is interested in US Cellular's spectrum. Then, a bidding war could result in a premium being paid on the current valuation. Since the stock does not pay a dividend to provide a return while waiting, the upside potential is limited, with no end to the wait in sight.

Alternatively, management's strategy could gain traction. To revisit my thesis, I would be looking for rate and volume to stabilize the wireless business, and tower revenue growth to accelerate back to 2021/2022 levels. For me to feel better about the stock, the company needs to begin leveraging its newly acquired 5G assets and generating cash to clean up the balance sheet.

Verdict

I feel the stock price is high, even with a potential buyout on the horizon, and I believe investors should sell current holdings and steer clear of the stock. The business has not generated positive free cash flows since 2018, and operating income is declining year-over-year. Revenue growth is stagnant, and costs are rising. Furthermore, management’s guidance paints a negative picture for 2023, with all metrics likely to go backward.

Despite the high likelihood of a buyout, I don't believe shareholders would be rewarded for their efforts unless something changes in the core business and the balance sheet improves.

This article was written by

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.