XPeng: Struggling, But A Big Opportunity Still Exists

Summary

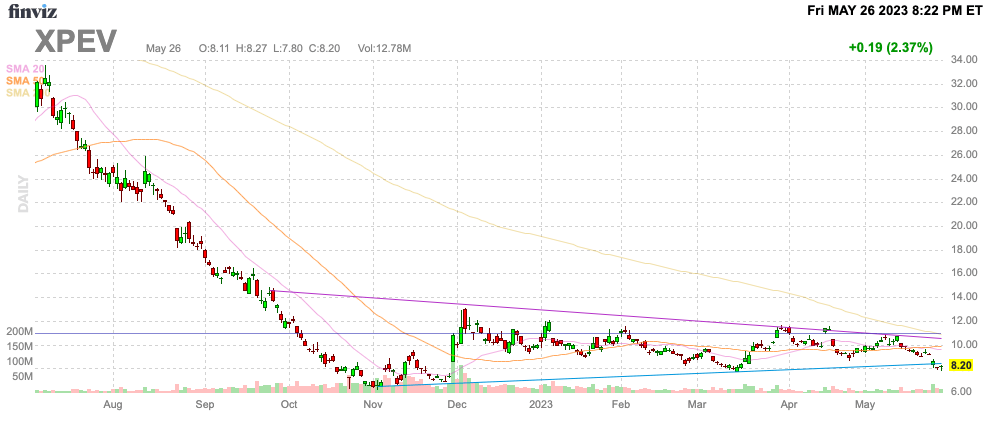

- XPeng trades at all-time lows despite substantial opportunities in the Chinese EV market.

- The EV company has struggled to re-launch the business, but XPeng forecasts vehicle deliveries to double in Q3 to 15,000 per month.

- The stock is cheap, trading at just above cash value, while sales could quickly jump above a $6 billion annual rate.

- Looking for more investing ideas like this one? Get them exclusively at Out Fox The Street. Learn More »

Robert Way

The Chinese reopening has not taken hold as most expected. On top of this general lack of a major economic tailwind, XPeng (NYSE:XPEV) has struggled to regain sales momentum. The Chinese EV manufacturer continues building a technology-led platform primed for future growth. My investment thesis remains Bullish of an inflection point ahead, but investor patience is likely to wear off with such volatile delivery numbers and the lack of consistent progress.

Source: Finviz

Another Weak Month

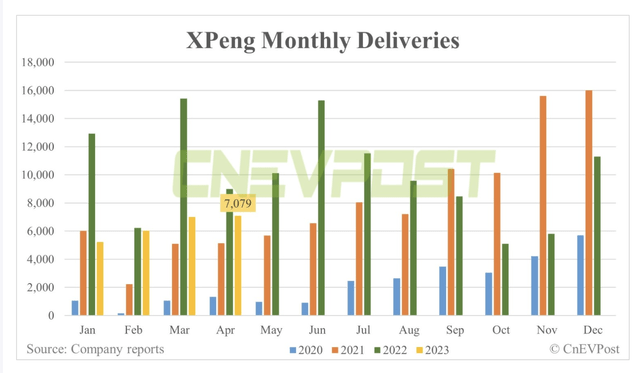

For April, XPeng reported monthly deliveries of only 7,079 vehicles. The Chinese EV manufacturer has grown vehicle deliveries sequentially this year, but sales are still down dramatically from comparative 2022 levels and even below the late 2021 sales.

Source: CnEVPost

XPeng has had several quarters where monthly vehicle delivers have topped 15,000, but the April total was over 50% below the peak levels. The CEO continues to promise and inflection point in sales, but the data is constantly pushed out.

The biggest concern is that XPeng, along with other Chinese EV OEMs, are constantly launching new vehicles. The company is now ramping sales on the flagship sedan P7i and recently unveiled the new SUV G6. One has to wonder whether Chinese consumers are constantly confused by new EV models and taking longer to make decisions after buying far more XPeng EVs during the Covid lockdowns.

New releases of smart phones each year work with consumers replacing those phones every couple of years to prevent delayed purchases while waiting on the latest release. For a vehicle one might keep 5+ years, a buyer might wait months to obtain the latest release.

The big question remains whether XPeng can ramp up the G6 to meet targeted monthly sales targets of 2x to 3x that of its P7 predecessor sales. The vehicle launches during July using the new architecture platform and the CEO continued to push the positive sales narrative on the Q1'23 earnings call:

The G6 will be officially launched in June and begin mass deliveries in July accompanied by a fast ramp-up. We believe the G6 will emerge as one of the best selling models in China's NEV SUV market segment within the RMB 200,000 to RMB 300,000 price range.

As with a lot of Chinese companies, XPeng continues to advance autonomous driving technology in their EVs. The company recently obtained another test license for passenger-carrying autonomous driving tests with a plan to move towards all customers having access to the Guangzhou's Huangpu district. Such technology will definitely become a driving force for whichever EV manufacturer has the best offering.

XPeng guided to Q2'23 vehicle deliveries in the 21,000 to 22,000 range. The company delivered 18,230 vehicles during Q1 suggesting guidance forecast a 10% sequential increase in the quarter, but vehicle deliveries won't grow materially during the quarter from the April rate of 7,079.

The whole focus now is on the Q3 ramp of the production of the new G6 SUV and additional sales of the P7i sedan. On the Q1'23 earnings call, President Brian Gu confirmed aggressive sales targets for Q3/Q4:

...what we see most importantly is that the third and fourth quarters, we expect our growth will be significantly higher than the market growth, and also we believe that with the G6 deliveries starting in the third quarter, we would like to aim to achieve monthly deliveries over 15,000 vehicles per month in the third quarter as what are the targets, and then the fourth quarter, given the continuous growth and also additional model mix favorable changes, we think we can actually also target over 20,000 per month in the fourth quarter as our peak sales. These are our goals in the second half.

Still Got The Cash

XPeng ended Q1 with a massive cash balance of $5.0 billion. The company reported a Q1'23 loss of $320 million following a smaller loss during the prior year when sales were vastly higher.

The Chinese EV manufacturer has worked on improving efficiency this year, but sales are down substantially from 2022 levels hiding any efficiency gains in the process. The stock has held at the current levels due to the cash value nearly accounting for most of the current $7.1 billion market valuation.

XPeng is forecasting the type of vehicle deliveries in Q3 that would match or top the record revenue levels of $1.34 billion back in Q4'21. The stock traded in the $40s back in those days when the stock market was stronger, but XPeng would definitely recapture some of the hype from that period with sales doubling sequentially during the next quarter.

Takeaway

The key investor takeaway is that XPeng has struggled in the last year to warrant higher stock prices. The Chinese EV manufacturer still has the cash and market opportunity to hit financial targets that would warrant much higher stock prices. The new technology platform and ADAS functionality should lead to higher vehicle volumes in the 2H ,but XPeng still needs to prove the company can actually hit targets after struggling for a couple of years.

If you'd like to learn more about how to best position yourself in undervalued stocks mispriced by the market heading into a 2023 Fed pause, consider joining Out Fox The Street.

The service offers model portfolios, daily updates, trade alerts, and real-time chat. Sign up now for a risk-free, 2-week trial to start finding the next stock with the potential to generate excessive returns in the next few years without taking on the outsized risk of high-flying stocks.

This article was written by

Stone Fox Capital launched the Out Fox The Street MarketPlace service in August 2020.

Invest with Stone Fox Capital's model Net Payout Yields portfolio on Interactive Advisors as he makes real time trades. The site allows followers to duplicate the model portfolio in their own brokerage accounts. You can find the portfolio and more details here:

Net Payout Yields model

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

The information contained herein is for informational purposes only. Nothing in this article should be taken as a solicitation to purchase or sell securities. Before buying or selling any stock, you should do your own research and reach your own conclusion or consult a financial advisor. Investing includes risks, including loss of principal.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.