SoFi Technologies: Supreme Court Decision, Student Loan Repercussions

Summary

- As an important Supreme Court decision looms, shares of SoFi Technologies, Inc. seem artificially low.

- We review SoFi’s business and the effects of fear (from the student loan situation, combined with recent banking sector distress caused by rapidly rising interest rates) on SoFi's current valuation.

- After discussing specific risks in more detail, we conclude with our strong opinion on investing in SoFi (and a few additional top ideas, as well).

- Looking for a helping hand in the market? Members of Big Dividends PLUS get exclusive ideas and guidance to navigate any climate. Learn More »

White House Press Secretary Karine Jean-Pierre Holds Daily Briefing Anna Moneymaker/Getty Images News

SoFi Technologies, Inc. (NASDAQ:SOFI) recently sued the Biden Administration, arguing there is no legal authority to continue student loan forbearance. Within the next few weeks, the Supreme Court is widely expected to rule against the Biden Administration's student loan forgiveness program, which will likely end forbearance within 60 days. In this report, we review SoFi's business and the effects of fear (from the student loan situation, combined with recent banking sector distress caused by rapidly rising interest rates) on the company's current valuation. After discussing specific risks in more detail, we conclude with our strong opinion on investing in SoFi.

SoFi

About: SoFi Technologies, Inc. (SOFI)

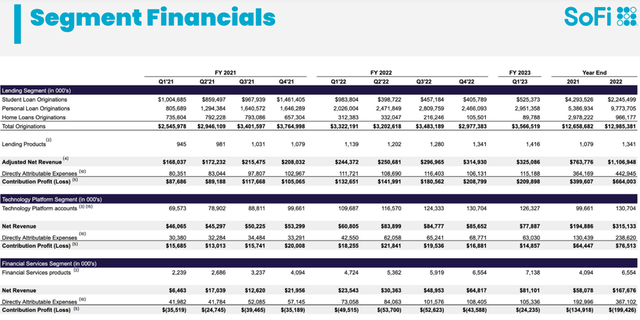

SoFi is an online financial services company and bank that targets younger, high-income customers. It divides its business into three segments (Lending, Technology Platform and Financial Services), but lending generates the overwhelming majority of the company's revenues, as you can see in the following graphic.

Known originally for originating loans for students at "elite" universities, you can see in the table above that within the "Lending Segment" student loan originations have slowed, while personal loan originations have accelerated. This is consistent with the current operating environment, as forbearance on federal student loans has hurt SoFi's private student loan business (private loans have not been eligible for forbearance or forgiveness, but federal loans have) and consistent with the company's long-term strategy to become a holistic solution for customers' financial needs by offering many financial products, creating cross-selling opportunities and thereby reducing customer acquisition costs.

Importantly, only recently has SoFi become an actual chartered bank (through its acquisition of Golden Pacific Bancorp in February 2022), and this will continue to help SoFi better serve customers (more on this later).

Looming Supreme Court Decision:

As mentioned, in March, SoFi sued the Biden Administration to stop student loan forbearance by the government. SoFi is a private loan originator, and competes with government (federal) loans. As such, private student loans have not been eligible for student loan forbearance that began during the pandemic. Further, private student loans have been excluded from the Biden Administration's efforts to forgive up to $20,000 in student loans per borrower. According to the lawsuit:

"In essence, SoFi is being forced to compete with loans with 0% interest rates and for which any ongoing repayment of the principal is entirely optional."

In fact, SoFi provides refinancing for federal student loans, and claims it has lost $200 million in the recent student loan freeze that has been in place since the start of the pandemic.

One key point to keep in mind is the difference between forbearance and forgiveness. SoFi is suing to stop forbearance (i.e., the freeze on payments and interest on federal student loans that has been in place since the start of the pandemic) and forgiveness (the case now in front of the Supreme Court to decide if the Biden Administration's plans to forgive up to $20,000 of federal student loans is even legal). However, if Biden loses at the Supreme Court (in a decision that is expected to be released within the next few weeks) then forbearance may become a moot point (because it is expected to end within 60 days of the supreme court decision anyway).

For example, according to Education Secretary Miguel Cardona, repayment will be resuming after the Supreme Court issues a decision, regardless of what that decision is:

"We recognize that during the pandemic that was very difficult for borrowers. And we are committed to making sure that once the decision is made, that we're going to resume payments for 60 days after, but no later than June 30."

So from SoFi's standpoint, the federal loan forbearance program (that has cost them millions), will likely be ending soon, but they're still suing the Biden Administration in an attempt to make absolutely certain that it does end (because Biden does have a few alternative options, albeit very unlikely).

Most likely, however, student loan payments (and interest charges) will resume 60 days following the Supreme Court decision, so those with loans outstanding should be ready.

Valuation:

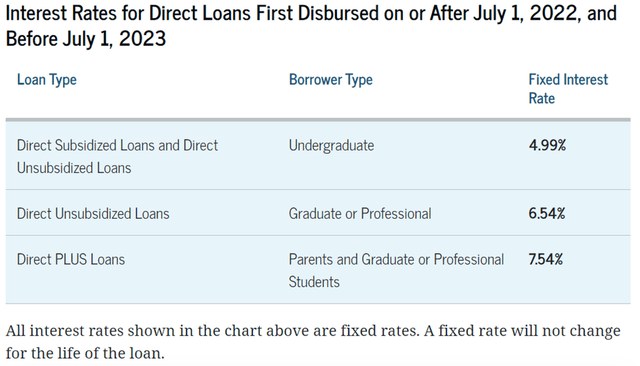

A positive ruling (for SoFi) in the upcoming Supreme Court decision would be good news for the business (and it may also help reduce the market fear that have been keeping the share price so low relative to its potential long-term value). However, it is important for investors to realize that SoFi's business has been expanding beyond student loans in recent years (a good thing), so (because of the current interest rate environment) a positive Supreme Court decision won't necessarily drive an immediate rush of business to SoFi (because as rates have risen, SoFi's refinancing rates are not necessarily any better than Federal Student Loan rates, which are set annually.

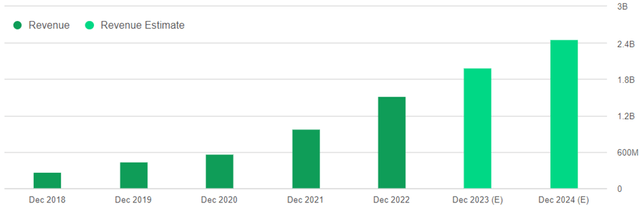

And while it is a very good thing that SoFi's non-student loan revenue and overall business have been growing rapidly (see total revenue chart below), the company is still not yet profitable.

SoFi expects to achieve GAAP profitability in 2023 (an important milestone), which could also provide a significant lift to the shares.

Also, a big part of the reason revenues have recently grown significantly is because interest rates are higher. As rates have gone up, SoFi now earns a higher net interest margin on its loans (a very good thing). Further still, the long-term total addressable market (for continuing high growth) remains very large (and the company continues to expand its product offerings).

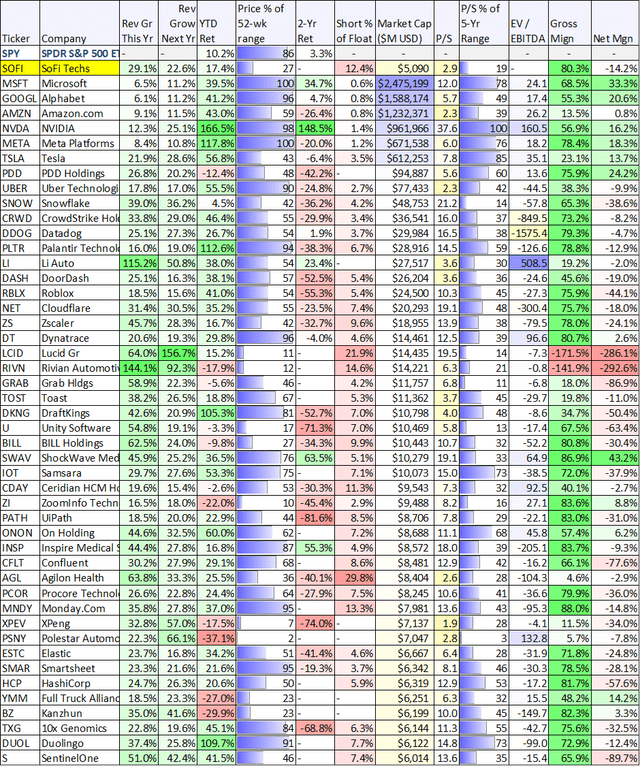

Further still, SoFi currently trades at around 2.9 times revenue, which is extremely low for a company with such a high revenue growth rate (see table below). Nonetheless, high short interest (recently 12.4%) has added to fear and helped to keep the share price low and valuation low (as compared to other high growth stocks, as shown in the following table).

(MSFT) (GOOG, GOOGL) (AAPL) (AMZN) (NVDA) (META) (TSLA) (SNOW)

Note: An extended (and downloadable) version of the above table is available here: Top 10 Growth Stocks, Ranked.

According to a recent note from Morningstar equity analyst Michael Miller, SoFi is worth $14 per share (and has 62% upside):

Our fair value estimate for SoFi is $14 per share. Our model assumes that student loan forbearance lasts through 2023 as the politics surrounding the program remains a key point of uncertainty. We also project for personal loan origination volume growth to slow from its breakneck pace in 2022, as SoFi has benefited from strong consumer loan growth industrywide. That said, SoFi is a beneficiary of rising interest rates and record credit card balances as credit card refinance remains one of the core use cases for personal loans.

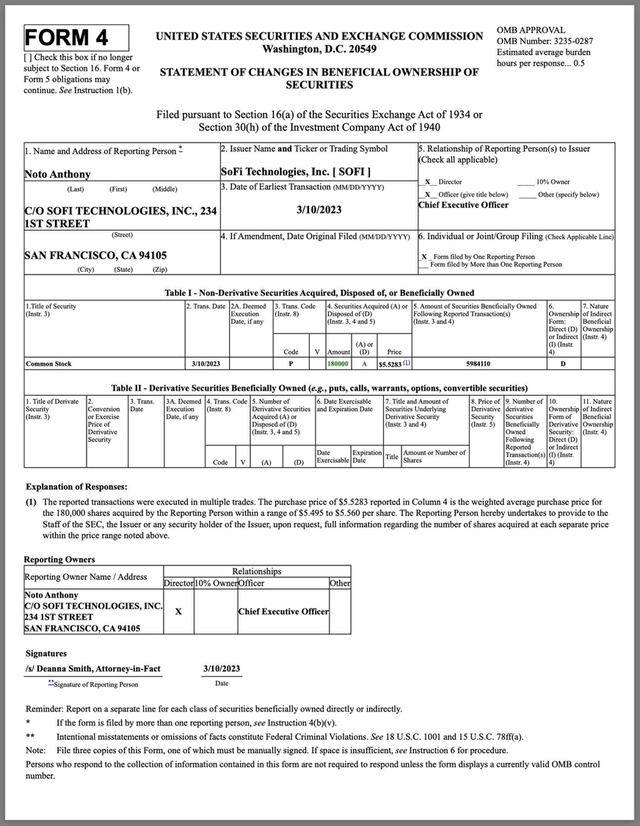

Further still, insiders have been purchasing shares of SOFI. For example, CEO Anthony Noto recently notified the SEC of nearly $1 million worth of share purchases.

Risks:

Despite SoFi's rapidly growing business, the company does face a variety of risk factors. These include an adverse decision from the Supreme Court, and/or the Biden Administration may also seek further federal student loan forbearance (although this seems unlikely).

Banking Sector Distress: Fear from the recent banking sector distress is likely another reason why the share price of SoFi has remained artificially low, in our opinion. And the recent string of regional bank failures may incentivize regulators to impose further restrictions and costs on banks (remember, SoFi does now have a bank charter). However, more likely this fear has kept the price low, thereby creating a more attractive entry point for disciplined long-term investors.

Interest Rates are another risk factor for SoFi. Most recently, rising interest rates have helped SoFi increase revenue (from improved net interest margin), but rising rates also decreases the market value of bank assets (as rates rise, bond prices fall) thereby creating additional risks if SoFi were to need to access capital or "mark assets to market." However, according to Dan Dolev, managing director at Mizuho Securities:

Dolev said the argument regarding a potential CECL [current expected credit losses] provision is not a possibility as regulators don't allow switching between fair market value and cost accounting.

Long-Term Strategy Execution: Another risk is simply whether SoFi can execute on its long-term strategy to become a one-stop financial services shop for young high-income customers and thereby achieve the economies of scope (i.e., lower customer acquisition costs) that it is targeting. Growth continues to accelerate rapidly as the company moves towards profitability, but it is to be determined just how high operating margins can eventually go.

Conclusion:

As business continues to improve, negative sentiment is keeping the SoFi Technologies, Inc. share price artificially low. However, sentiment could turn positive quickly if the upcoming Supreme Court decision is favorable for SoFi Technologies, Inc., and if the company continues to track towards GAAP profitability this year. As such, we've ranked SoFi #12 (as the lone "contrarian growth stock") in our new free top ideas report. And if you are a long-term growth investor, SoFi Technologies, Inc. shares are absolutely worth considering for a spot in your portfolio.

Further, if you are interested in more investment ideas, consider a subscription to "Big Dividends PLUS," where you'll get access to the current top-idea holdings in our two income-focused portfolio, plus a lot more. We're currently offering 40% Off all new annual subscriptions.

This article was written by

Use code SA25 for 25% Off all new memberships at blueharbinger.com. Our flagship membership service at blueharbinger.com covers top growth stocks and high-income opportunities. Our Seeking Alpha service, Big Dividends PLUS, has been launched specifically to serve the needs of high-income investors.

- - - - - - -Information presented is for educational purposes only and does not intend to make an offer or solicitation for the sale or purchase of any specific securities, investments, or investment strategies. Investments involve risk and, unless otherwise stated, are not guaranteed. Be sure to first consult with a qualified financial adviser and/or tax professional before implementing any strategy discussed herein. Past performance is not indicative of future performance.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of SOFI either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it. I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.