How Does Chunghwa Telecom Stack Up Against Asian Peers?

Summary

- Chunghwa Telecom's Q1 2023 results show revenue growth of 5.7% YoY and net income growth of 6.4% YoY.

- The company's balance sheet remains strong, but free cash flow decreased by 12%.

- Compared to its Asian peers, China Mobile appears more attractive based on fundamentals, while Chunghwa Telecom maintains a Hold stance.

Blackstation Chunghwa Telecom's logo (Chunghwa Telecom)

Investment thesis

In our previous article on Taiwan's telecom company Chunghwa Telecom (NYSE:CHT), we concluded that despite it being a well-managed company, we so far have preferred to own China Mobile (OTCPK:CHLKF) and Singtel (OTCPK:SGAPY).

Now that CHT have come out with their Q1 2023 results it is a good time to check if our preference still stands.

Comparison with its Asian peers

Let us start by going through the numbers for CHT.

On their top line, they grew their revenue by 5.7% Y-o-Y from NT$ 51.3 billion in Q1 of 2022 to NT$54.21 billion in the last quarter. As guidance, NT$54.21 billion equates to approximately USD1.8 billion.

Their net income grew even more Y-o-Y by 6.4% from NT$9.06 billion to NT$9.64 billion.

EPS was NT$1.24 in Q1 of 2023.

With the share trading at a price of NT$126 per share, we still get a high P/E of 101.6. In March this year, we complained about their high P/E. At that time, it was 25. However, we shall not put too much emphasis on a quarterly P/E. We will look at this on a yearly basis when we compare it with its peers.

Management has guided for a net income for FY 2023 to be in the range of NT$34.6 billion to 36.1 billion.

We know that cash flow trumps earnings.

Here, CHT had a less favorable quarter, as their free cash flow actually decreased by 12% from NT$6.6 billion to NT$5.8 billion. Sometimes this can be explained by higher capex requirements, but for CHT this was only NT$0.19 billion higher.

In times like these, we want to make sure the company we consider owning has a strong balance sheet. CHT do tick off that box.

Their debt ratio, defined as the ratio of total debt to total assets, was lowered by 6.7% Q-o-Q to a ratio of 23%.

Now, let us look at how it stacks up against some of its Asian peers, and the companies that we do have a stake in. We want to start by looking at the ROE.

Comparison of ROE over a 5-year period (SA)

Here we see that CHT is doing similarly well over a 5-year period. Now let us compare their P/E on a GAAP basis.

Comparison P/E on GAAP basis (SA)

The one company that truly stands out is China Mobile with a P/E below 10.

Last but not least, we compare the Price/Tangible Book Value.

Comparison of Price to Tangible Book Value (SA)

Again, here China Mobile really shines.

We have made a compilation where we also look at other fundamentals, like debt to equity and dividend yield as well.

Compilation of fundamentals (Data from SA, Yahoo Finance & companies. Compilation by TIH)

Risks and Conclusion

Last time around, we gave CHT a Hold stance.

We have pointed out in our earlier thesis about the geo-political risks for CHT and our opinion that their growth potential is somewhat limited as we cannot see them venturing abroad.

Bear in mind that SingTel generates as much as 78% of its profits from countries outside its home market. This is something we do not see happening to CHT.

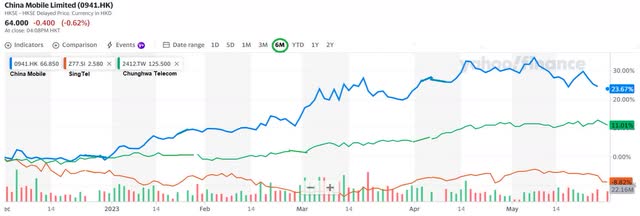

When we look purely at fundamentals, it is still China Mobile that looks the most attractive. This has been noticed not only by us but by the market in general. It has seen quite a big improvement in the share price over the last six months, compared to CHT and SGAPY.

China Mobile share price development compared to CHT and SGAPY (Yahoo Finance)

We maintain our Hold stance for CHT.

Editor's Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

This article was written by

Analyst’s Disclosure: I/we have a beneficial long position in the shares of SGAPY, CHL either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

We are long SingTel in Singapore and China Mobile in HK.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.