MoneyLion: What Will It Take For Shares To Trade At Their Intrinsic Value?

Summary

- MoneyLion's common shares are experiencing a cycle of decline despite strong revenue growth and a large cash balance.

- Fiscal 2023 first-quarter revenue increased by 34.4% year-over-year, driven by 1.3 million customer additions.

- The company is aiming to diversify its product offering through third-party products. These formed 73% of its product mix as of the end of the first quarter.

AerialPerspective Works

MoneyLion (NYSE:ML) is perplexing, stuck in a relentless cycle of decline since it went public even against strong revenue growth rates and a large cash and equivalents balance. This cycle of decline has led to a 1-for-30 reverse stock split to prevent delisting and has subjected the future performance of the New York-based fintech company to a great deal of angst and uncertainty. What's the way forward? Bears, who form the 5.6% short interest, would say avoid and move on. Bulls would highlight a price to trailing 12-month sales multiple of 0.25x, around 88% lower than its sector median.

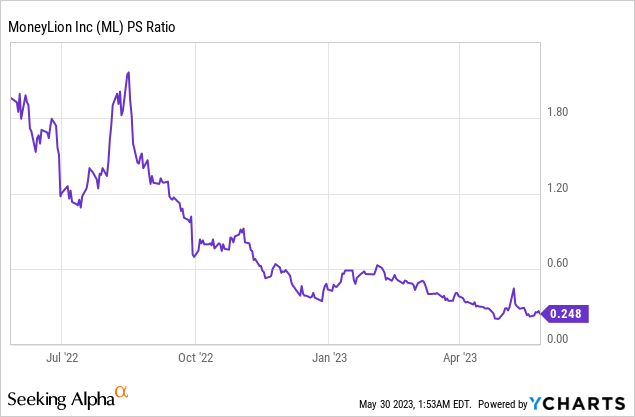

To be clear, MoneyLion is valued at a quarter of every dollar of revenue it earns, down from a year ago when every dollar of revenue was valued at a 1.8x premium. The price-to-sales multiple captures the market perception and broader sentiment toward a company. Critically, the current multiple infers a level of financial distress or negative year-over-year sales that are simply not being reflected by MoneyLion's current financials. MoneyLion's fiscal 2023 first-quarter revenue came in at $93.67 million, a 34.4% increase over its year-ago comp and a beat by $6.79 million on consensus estimates.

What Is MoneyLion's Intrinsic Value?

MoneyLion currently trades on a $96 million market cap, roughly equivalent to its first-quarter revenue. Growth was driven by 1.3 million in customer adds to bring total customers to 7.8 million as of the end of the quarter, up 102% over the year-ago comp. Year-over-year customer additions actually saw growth accelerate sequentially by around 500 basis points. The fintech saw 1.8 million products consumed during the first quarter. This meant total products of 14.7 million, a growth of 63% over the year-ago comp with total originations growing by 24% year-over-year to $506 million.

MoneyLion Fiscal 2023 First Quarter Presentation

Crucially, the first quarter formed a watershed from a profitability perspective. MoneyLion saw gross profit come in at $51.7 million, a 28% jump over the year-ago quarter against gross profit margins of 58%. Further, adjusted EBITDA came in at $7.3 million, MoneyLion's first ever positive adjusted EBITDA quarter. The fintech is firing on all cylinders, with new products being added to develop and expand on its flywheel and increase the LTV of its customers.

MoneyLion Fiscal 2023 First Quarter Presentation

This flywheel is increasingly being driven by third-party products which formed 73% of the company's product mix as of the end of the first quarter. This has come on the back of the company's acquisition of Even Financial, an embedded finance marketplace. MoneyLion's aim is to diversify its product offering to deepen the value its customers derive from its platform. This should embed stickiness and loyalty against what's a crowded market for neobanking.

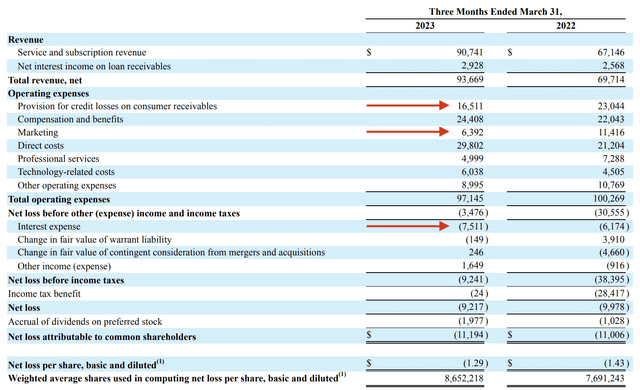

MoneyLion Fiscal 2023 First Quarter 10-Q

Further, the company's provision for credit losses on consumer receivables was $16.5 million, down around $6.5 million from the year-ago comp. At around 3.2% of first-quarter originations, it came in far below the low end of the company's target range of 4% to 6%. This is with the company prioritizing originations to their most credit-worthy customers whilst still chasing growth within the context of making sustained profits. So what's MoneyLion's intrinsic value? Bears would be right to state that revenue growth has slowed. However, this has been countered by a marked improvement in profitability. Forward guidance shows this is set to continue. It's hard to state what the exact value should be, but the current sales multiple against triple-digit customer growth, adjusted EBITDA profitability, and a diversifying product offering seems abnormal.

2023 And Beyond

MoneyLion is guiding for second-quarter revenue to come in at $95 to $100 million, outperforming consensus estimates of $91.48 million at the low end. Gross profit margin is set to come in at 54% to 58% with adjusted EBITDA of between $1 million to $8 million. The company ended the first quarter with cash and equivalents of $111 million, roughly 115.6% of its market cap, albeit offset by total debt of $217 million as of the end of the first quarter. This drove quarterly interest expenses of $7.5 million, up from $6.2 million in the year-ago quarter.

That MoneyLion has been able to maintain its high pace of customer additions despite its marketing expenses falling by $5 million year-over-year to $6.4 million is a vote of confidence in the value customers derive from its platform. The fintech company has been swept up by the risk-off sentiment of the stock market over the last two years as it enters a new period set to be marked by profitability against continued growth. I don't expect sentiment towards the company to improve in the near term even against its presently strong financials, but the time will eventually come.

Editor's Note: This article covers one or more microcap stocks. Please be aware of the risks associated with these stocks.

This article was written by

Analyst’s Disclosure: I/we have a beneficial long position in the shares of ML either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.